Setting Up Impound on a Loan

Four things must be in place before impounds may be configured on a loan:

- Transaction Codes for Impounds.

- Impound Codes.

- Contact Records for the entities to be paid by escrow.

- Vendor Accounts must be configured of those contacts.

To configure impounds on a loan, first query that loan. Select Impounds from Loan >  Impounds. Here you will have three choices:

Impounds. Here you will have three choices:

- Impounds

- Analyze Impounds

- CoreLogic Interface (formerly FARETS Interface)

Select the first option (Impounds)

Click Add  to add a new impound.

to add a new impound.

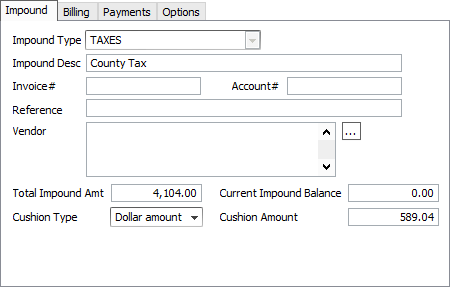

Select an impound type (from the list of impound codes that you had previously configured) and type a description for the impound.

The impound setup will then be configured on the following four tabs:

The impound tab contains general information related to the impound account.

| Impound Type | The impound type code is selected from a preconfigured drop down list. | |||

| Impound Desc | The description is entered here for reference and identification purposes. | |||

| Invoice # | This is the invoice number of the tax or insurance bill or other type of payment for which escrow is being held. If a vendor receives a check for escrow payments from multiple borrowers, a detailed report that will print with that check will include information on the breakdown of those funds, indicating the borrowers on whose behalf the payments are being made. The invoice and account numbers are included in this report. | |||

| Account # | This is the Account number for the tax account or insurance policy. | |||

| Reference | This is the impound reference. By setting the voucher reference in the trans code setup to “%R”, the impound reference will be assigned as the reference field for the vouchers generated by this impound, and subsequently the reference on the checks. | |||

| Vendor | This links to the specific vendor account for the payee of the impound (e.g. tax agency or insurance company). | |||

| Total Impound Amount | The total amount of money to be impounded. Because of billing cycles for taxes and insurance, these figures are generally adjusted annually, so the amount here is the bill for one year of taxes or a one year insurance policy. | |||

| Current Impound Balance | The current amount in impound for this particular account. This will generally be zero whenever an impound is set up, but often has a value in it when this screen is accessed on an existing impound. | |||

| Cushion Type |

Loan Servicers are allowed to impound extra funds to cover them in the event that the original impound amount becomes insufficient to actually cover the amount of the bills. Annual impound analysis procedures will be used to make sure that in subsequent years the cushion neither builds up nor becomes insufficient. Note Cushion type and amount is used in the impound analysis output.

|

|||

| Cushion Amount / Number of Periods / Cushion Percentage | This field is used with the cushion type field to define the actual amount of the cushion. |

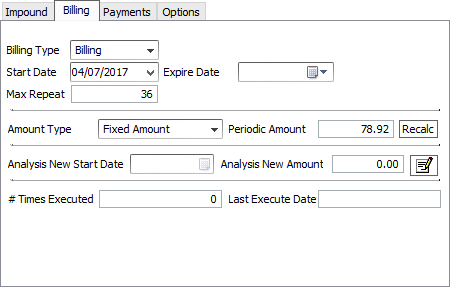

The billing tab of the impound setup contains all those settings which govern when impound shall be billed and how much impound billing shall be added on to the regular periodic billing.

| Billing Type | Controls the criteria for determining when the impound will be billed.

|

|||

| Start Date | The date of the first impound billing. | |||

| Expire Date | No impound billing will be assessed after the date set here. | |||

| Max Repeat | The maximum number of impound billings which may be billed. | |||

| Amount Type |

Determines how to calculate the billing amount for each impound payment.

|

|||

| Periodic Amount | Click Recalc to have the amount calculated automatically based on the Amount Type setting. | |||

| Analysis New Start Date | The start of the next period for the purpose of impound Analysis. Click  Modify to edit this field. Modify to edit this field. |

|||

| Analysis New Amount | Based on the Impound Analysis, the expected Periodic Payment Amount for the impound in the next period (year) after the analysis start date (i.e. what the Periodic Amount is expected to change to). Click  Modify to edit this field. Modify to edit this field. |

|||

| # Times Executed | The number of billings that have occurred thus far on this impound. | |||

| Last Execute Date | The date of the most recent impound billing. |

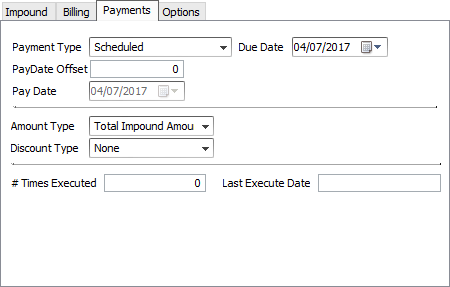

The Payments tab of Impound Setup holds the information and setting that dictate when a voucher shall be generated for the payment to the vendor.

| Payment Type |

This controls the determination for when the voucher should be generated.

|

|||||

| Due Date |

|

|||||

| PayDate Offset | The number of days (specified as a negative number between -180 and 0) prior to the due date at which the voucher will generate. This is to allow sufficient time for printing the voucher, mailing, and arrival at the vendor. | |||||

| Expire Date | A date after which no vouchers will be generated for this particular impound. | |||||

| Pay Date | The date the voucher is scheduled to be generated (Due date - Pay Date Offset) | |||||

| Period | For Periodic Payment Type only; the period will define the subsequent due dates with respect to the first due date. | |||||

| Number of Periods | Helps the Period to define the subsequent due dates. Example A regular due date of three times per year could be defined as Period: Months, Number of Periods: 4. |

|||||

| Max Repeat |

The Maximum number of vouchers that can be generated by this impound setup. |

|||||

| Amount Type |

Determines the amount of the Voucher to be generated.

|

|||||

| Discount Type |

Determines the type of discount applied to the payment.

|

|||||

| Times Executed | The number of vouchers that have been generated by this impound setup. | |||||

| Last Execute Date | The most recent date of voucher generation. |

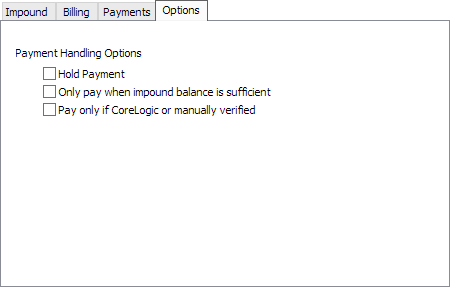

How a payment is to be handled is configured in the Options tab.

Payment Handling Options

| Hold Payment | When selected, payments will not be made. |

| Only pay when impound balance is sufficient | When selected, payments will be made only if the impound balance is greater than or equal to the payment amount. |

| Pay only if CoreLogic or manually verified | When selected, payments will be made only if CoreLogic is used or the Verified checkbox for a payment installment on the Payment tab is selected. |

Analysis Setup

See the section on Impound Codes for information on the options available.

The Next analysis date is the date on which the next impound analysis is to run. This date is updated automatically when an impound analysis is run. However, a date may be entered manually as needed.