Impound Analysis

Introduction

Since it is beneficial to outline the steps in conducting an escrow analysis, as well as some of the servicer’s obligations under the Real Estate Settlement Procedures Act (RESPA) and options for having a borrower cure a shortage or deficiency, a general outline and discussion of these steps are provided.

RESPA and Regulation X

Section 10 of RESPA places limits on the amount a lender or servicer may require a mortgagor to keep in his or her escrow account to cover the payment of taxes, insurance, or other disbursements. This section also governs a servicer’s obligations with respect to providing an annual escrow account statement (i.e. escrow analysis) and notice, “not less than annually” of any shortage in the escrow account.

Initial and Annual Escrow Statements

Initial Statement

A servicer that establishes an escrow account in connection with a “federally related mortgage” must provide the borrower a statement that clearly itemizes the estimated taxes, insurance premiums, and other charges that are reasonably anticipated to be paid from the escrow account during the first 12 months after the escrow account is created. The statement must be provided to the borrower either at closing, or within 45 days after creation of the escrow account. If the initial statement is provided to the borrower at closing of the loan, the servicer may incorporate such a statement in the uniform settlement statement.

Annual Statement

A servicer that has established or continued an escrow account must provide the borrower with a statement at least once for each 12-month period (otherwise known as the “escrow account computation year”) during which the servicer maintains the escrow account that clearly itemizes:

- the amount of the borrower’s current monthly payment

- the portion of the monthly payment being placed in the escrow account

- the total amount paid into the escrow account during the period

- the total amount paid out of the escrow account during the period for taxes, insurance premiums, and other charges (as separately identified)

- the balance in the escrow account at the conclusion of the period

- an explanation of how any surplus is being handled by the servicer

- an explanation of how any shortage or deficiency is to be paid by the borrower

- if applicable, the reason(s) why the estimated low monthly balance was not reached, as indicated by noting differences between the most recent account history and last year’s projection.

The Regulation allows the servicer to provide or deliver the annual escrow statement to the borrower along with other statements or materials, including forms 1098, which is provided for federal income tax purposes.

Short Year Statements

A servicer may issue a short-year annual escrow account statement (“short-year statement”) to change one escrow account computation year to another. By using a short-year statement, a servicer may adjust its schedule for its entire portfolio or alter the escrow account computation year for the escrow account. The short-year statement has the effect of ending the “escrow account computation year” for the escrow account and establishing the beginning date of the new escrow account computation year. Therefore, the servicer must deliver the short-year statement to the borrower within 60 days from the end of the short year.

If a borrower pays off a mortgage during the escrow account computation year, the servicer is required to send a short-year statement to the borrower within 60 days after receiving the payoff funds.

Transfer of Servicing

If servicing of the loan is transferred and the new servicer changes the monthly payment amount of the accounting method used by the transferor (i.e. old servicer), then the new servicer must provide the borrower with an initial escrow account statement within 60 days of the date of servicing transfer. If the new servicer provides an initial escrow account statement upon the transfer of servicing, the new servicer must use the effective date of the transfer of servicing to establish the new escrow account computation year. On the other hand, if the new servicer retains the monthly payments and accounting method used by the old servicer, the new servicer may continue to use the escrow account computation year established by the old servicer or may choose to establish a different computation year using a short-year statement. At the completion of the escrow account computation year or any short year, the new servicer must perform an escrow analysis and provide the borrower with an annual escrow account statement. Regardless of whether the new servicer changes or retains the payment amount of accounting method used by the old servicer, upon the transfer of servicing, the transferor must provide a short year statement to the borrower within 60 days of the effective date of the transfer of servicing.

The Escrow Analysis

For purposes of Regulation X, an escrow analysis is the accounting that a servicer conducts in the form of a trial running balance for an escrow account to:

- Determine the appropriate target balances

- Compute the borrower’s monthly payments for the next escrow account computation year and any deposits needed to establish or maintain the account

- Determine whether shortages, surpluses, or deficiencies exist.

In general, there are five steps in completing an escrow analysis.

The numbers used in this example come from the HUD website

Step 1 - Anticipated Escrow Disbursements

The first step in the analysis is to list all of the anticipated disbursements that will be paid out of the escrow account over the next 12 months. The example assumes $1,200 for property taxes ($500 paid July 25 and $700 paid December 10) and $360 for Hazard Insurance on September 20.

| County Taxes | $1,200.00 |

| Homeowner’s Insurance | $360.00 |

| Total | $1,560.00 |

If the borrower has a payment for flood insurance, which is ordinarily paid every three years, the Regulation requires the servicer to project a trial balance over the three-year period.

If the servicer knows the charge for an escrow account item in the next computation year, then the servicer shall use that amount in estimating disbursement amounts. But if the charge is unknown to the servicer, the servicer may base the estimate on the preceding year’s charge, or the preceding year’s charge as modified by an amount not exceeding the most recent year’s change in the national Consumer Price Index for all urban consumers.

Step 2 - Calculating the Monthly Escrow Component

The second step in the analysis calls for the servicer to divide the total from Step 1 by 12 monthly payments ($1,560 divided by 12 = $130).

Step 3

The third step in the escrow analysis requires the servicer to create a trial running balance for the next 12 months, listing all payments into the escrow account and all payments out of the account, and when the anticipated disbursements above are expected to be paid.

| Payment | Disbursement | “Step 3 Balance” | |

|---|---|---|---|

| June | 0 | ||

| July | 130 | 500 | -370 |

| August | 130 | 0 | -240 |

| September | 130 | 360 | -470 |

| October | 130 | 0 | -340 |

| November | 130 | 0 | -210 |

| December | 130 | 700 | -780 |

| January | 130 | 0 | -650 |

| February | 130 | 0 | -520 |

| March | 130 | 0 | -390 |

| April | 130 | 0 | -260 |

| May | 130 | 0 | -130 |

| June | 130 | 0 | 0 |

Step 4

Step 4 requires the servicer to increase all of the monthly balances to bring the lowest point in the account (in the example, December -$780) up to zero. This is sometimes referred to as the theoretical low point. Usually the low point comes in the month where the property taxes have been paid.

| Payment | Disbursement | “Step 3 Balance” | “Step 4 Balance” | |

|---|---|---|---|---|

| June | 0 | 780 | ||

| July | 130 | 500 | -370 | 410 |

| August | 130 | 0 | -240 | 540 |

| September | 130 | 360 | -470 | 310 |

| October | 130 | 0 | -340 | 440 |

| November | 130 | 0 | -210 | 570 |

| December | 130 | 700 | -780 | 0 |

| January | 130 | 0 | -650 | 130 |

| February | 130 | 0 | -520 | 260 |

| March | 130 | 0 | -390 | 390 |

| April | 130 | 0 | -260 | 520 |

| May | 130 | 0 | -130 | 650 |

| June | 130 | 0 | 0 | 780 |

Step 5

Step 5 directs the servicer to add any cushion the lender requires to the monthly balances. The cushion may be a maximum of one-sixth of the total escrow charges anticipated over the next 12 months. The regulation provides that the servicer shall examine the loan documents to determine the applicable cushion and limitations for each escrow account. If the loan documents provide for lower cushion limits than under the Regulation, then the terms of the loan documents apply. Where the terms of any loan document allow greater payments to an escrow account than allowed by the Regulation, then the Regulation controls the applicable limits. Where the loan documents do not specifically establish an escrow account, whether a servicer may establish an escrow account for the loan is determined by state law. If the loan document is silent on the escrow account limits and a servicer establishes an escrow account under state law, then the limitations under the Regulation apply, unless state law provides for a lower amount. If the loan documents provide for escrow accounts up to the RESPA limits, then the servicer may require the maximum amounts consistent with the Regulation, unless an applicable state law sets a lower amount.

In the example provided: 1/6 of $1,560 = $260.00

| Payment | Disbursement | Balance | |

|---|---|---|---|

| June | 1040 | ||

| July | 130 | 500 | 670 |

| August | 130 | 0 | 800 |

| September | 130 | 360 | 570 |

| October | 130 | 0 | 700 |

| November | 130 | 0 | 830 |

| December | 130 | 700 | 260 |

| January | 130 | 0 | 390 |

| February | 130 | 0 | 520 |

| March | 130 | 0 | 650 |

| April | 130 | 0 | 780 |

| May | 130 | 0 | 910 |

| June | 130 | 0 | 1040 |

So, following the RESPA/HUD guidelines, the maximum the servicer could require in the escrow account at the point of analysis (June) is $1,040. This is then compared to the actual balance of the amount impounded to determine the presence of a Surplus, Shortage, or Deficiency.

Surpluses, Shortages, and Deficiencies

At this point, the servicer then compares the “required” amount (otherwise known as the “target balance”) to the actual account at the time the escrow analysis was being performed (in the example provided, the escrow analysis is being performed in the month of June). If the amount in the escrow account exceeds the required amount, then there is a “surplus” in the escrow account. Where the surplus is less than $50, the servicer may apply the surplus to reduce the amount of the escrow payment, or may choose to return the surplus to the borrower. If the surplus is more than $50, the servicer must return the surplus to the borrower within 30 days of performing the escrow analysis.

If the amount in the escrow account is positive, but less than the required amount, then there is an escrow shortage. If the amount of the escrow shortage is less than one month’s escrow payment, the servicer may ask the borrower to pay this shortage within 30 days, or the servicer may spread it out over 12 months. If the amount of the escrow shortage is greater than one month’s escrow payment, then the servicer must spread the shortage out over at least 12 months. A servicer may also do nothing and allow the shortage to exist.

If the amount in the escrow account not only falls below the required amount but is negative (i.e., where the servicer has had to use its own funds to make a disbursement), then there is an escrow deficiency. As with an escrow shortage, if the amount of the deficiency is less than one monthly escrow payment, the servicer may require the borrower to pay the deficiency within 30 days. However, if the amount of the deficiency is equal to or greater than one monthly escrow payment, the servicer may require the borrower to repay the amount over 2–12 months. A servicer also has the option to allow the deficiency to exist and do nothing to change it.

Running the Analysis in NLS

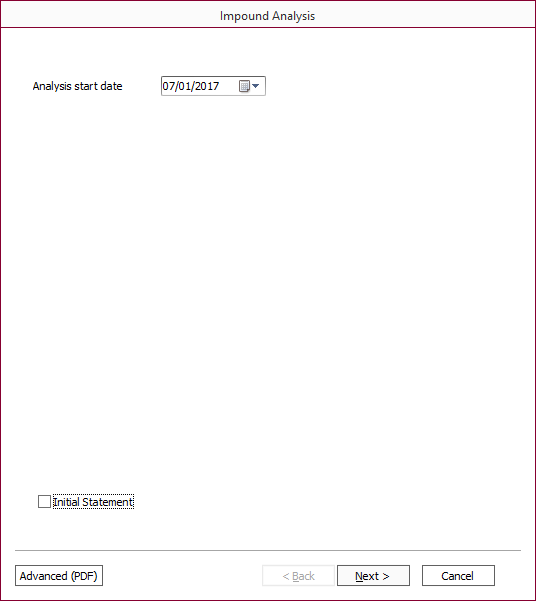

On any loan where impounds are configured, select Home > Impounds > Analyze Impounds.

Because of the RESPA requirement to deliver an analysis two months in advance of any change to the impounding amount, the analysis date will default to the start of the next month, plus two months, from the date upon which the impound is being run. Click Next >.

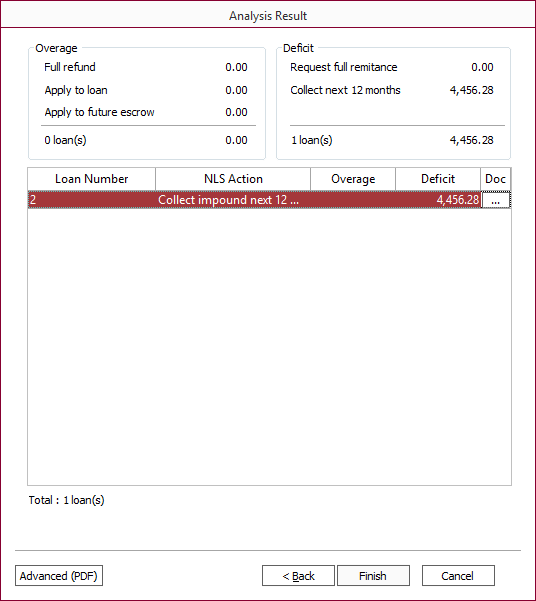

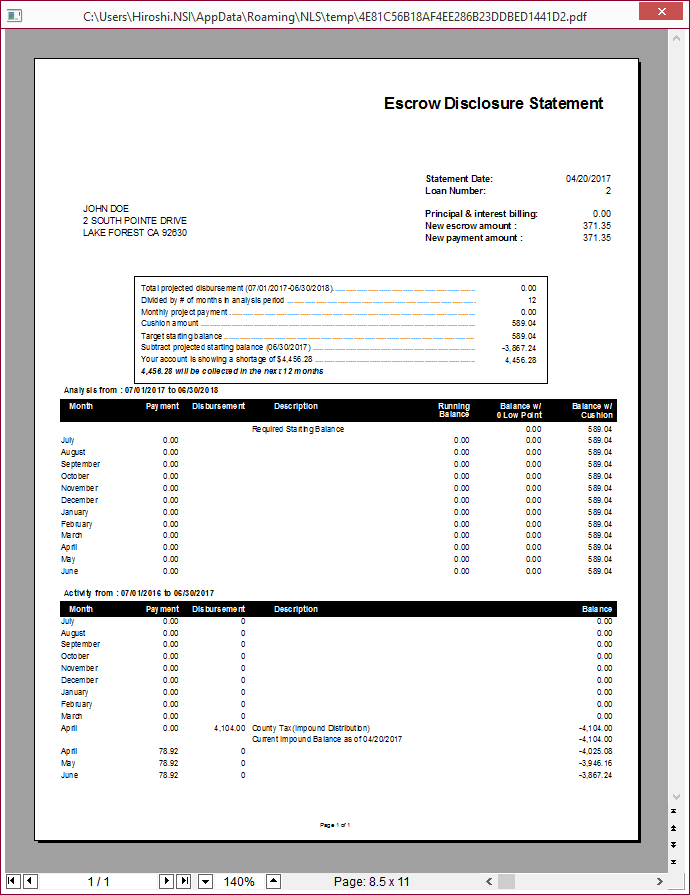

Click  in the Doc column to view the escrow disclosure statement.

in the Doc column to view the escrow disclosure statement.

Click Advanced (PDF) to add a logo and a separate statement address if needed.

Click Finish on the analysis form to send the statements to the printer.