Automated Payments

Note

Please contact your bank or ACH/AFT processing company to obtain the required information for setting up automated payments in NLS. Different organizations will have different requirements as to where certain information appears on the file. It is strongly recommended that the information entered in each of the fields in the NLS automated payments setup is verified with your bank and a payment on a single loan is tested before initiating automated payments on a wider scale.Note

For NLS versions prior to 5.5.1/5.6, Automated Payments is listed as ACH in Loan Setup.

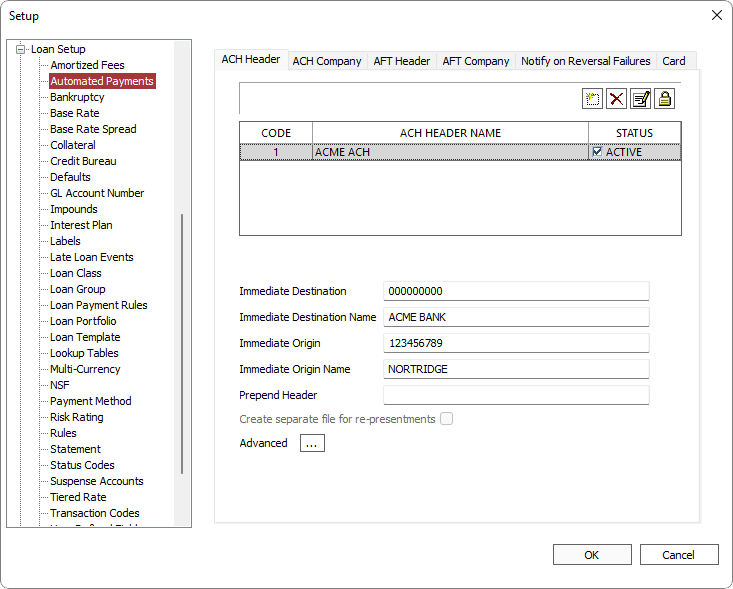

The global automated payment setup is in Setup > Loan Setup > Automated Payments. Automated payment data about your company is entered here.

You must add data for at least one ACH/AFT header and one ACH/AFT company. Additional headers are required only if:

- more than one Federal ID Number is used in your business or

- more than one bank or institution is to be used to process the automated payment

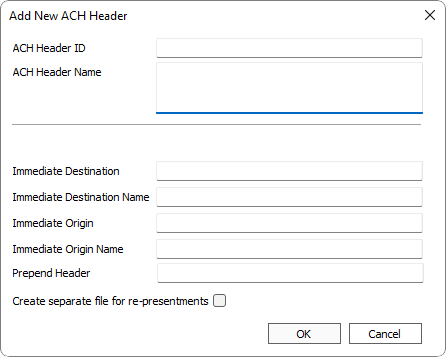

To add a new ACH Header, click  .

.

| Option | Description |

|---|---|

| ACH Header ID | A sequential, unique, number assigned by NLS to identify this particular ACH header code in the database. |

| ACH Header Name | Your name for this particular ACH Header code. This information does not appear in the ACH file. It is here to help you identify the ACH header code in NLS. |

|

Payment Method5.12-

|

Select from the available payment methods in NLS. The selected method will be the payment method used on the pending transactions created by the ACH, and subsequently will be the payment method on the payments that are posted by those pending transactions. The standard payment method of ACH will be selected by default. |

| Immediate Destination |

Identifies the party to which the file is being delivered. It contains the (ABA) Routing Number of the ACH Operator – TCB Services. Precede the routing number with a space.

Example If a bank's routing number is "012345678", a standard nine-digit code , enter " 012345678" with a <space> preceding the first digit for a total of 10 characters. |

| Immediate Destination Name | The name of the ACH, bank, or receiving point for which the ACH file is destined. Use the exact name as used or required by the receiving entity. |

| Immediate Origin |

The Immediate Origin field identifies the sender of the file. It can be the routing number of the ODFI – ABC Trust or your EIN (Employer Identification Number) from the IRS. Precede the number with a space.

Example If the EIN is "00-1234567", enter " 001234567" without the hyphen and with a <space> preceding the first digit. |

| Immediate Origin Name | The name of the ACH Operator or sending point (typically your company name) that is sending the file. This field has a maximum limit of 23 characters. |

| Prepend Header | This field is not a part of the NACHA specification and is optional. Additional information requested by banks can be entered here and will appear as the very first line on the ACH. Use only as directed by the ACH recipient. |

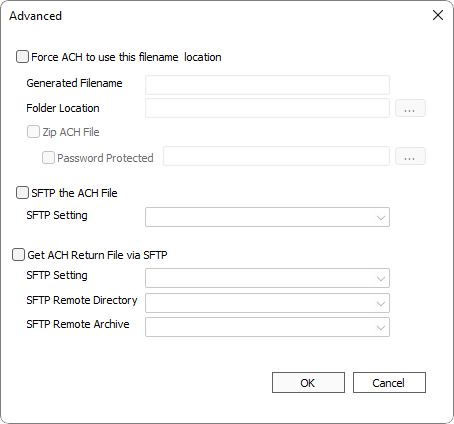

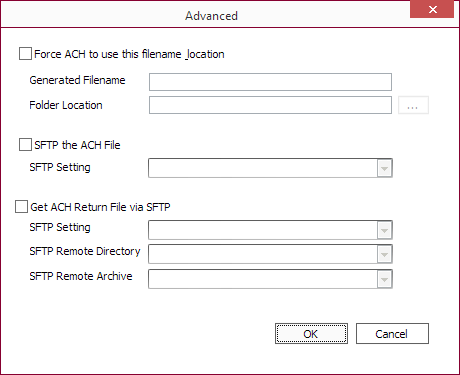

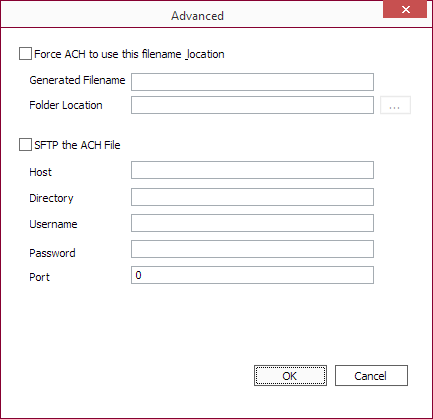

Advanced

Click Advanced  to open the Advanced dialog.

to open the Advanced dialog.

Force ACH to use the filename location

Sets the option to force ACH files to be saved to a specific location using a predetermined filename. When the option to Force ACH to use this filename & location is selected, the location and filename of the ACH file cannot be changed during the ACH creation process.

The filename can be configured to use a date/time stamp using variables.

| Variable | Description |

|---|---|

| %m | Month as decimal number (01 – 12) |

| %d | Day of month as decimal number (01 – 31) |

| %y | Year without century as decimal number (00 – 99) |

| %Y | Year with century as decimal number |

| %H | Hour in 24-hour format as decimal number (00 – 23) |

| %I | Hour in 12-hour format as decimal number (01 - 12) |

| %M | Minute as decimal number (00 – 59) |

| %S | Second as decimal number (00 – 59) |

Example

ACH%y%m%d-%H%M%S.txt would result in a filename ofACH170120-132301.txt if the file was saved on January 20, 2017 at 1:23:01 PM.

Zip ACH File

NLS 5.29 and later

When selected, the ACH file will be saved as a ZIP file. Select the Password Protected option and click  to enter the password that will be used to encrypt the zip file.

to enter the password that will be used to encrypt the zip file.

SFTP the ACH File

NLS 5.7 and later

Select this option to save the SFTP connection settings which will be used when making SFTP connections. Please obtain the necessary information needed to connect to the server from the financial institute processing your ACH file.

| Option | Description |

|---|---|

| Host | The hostname of the SFTP server which may be in domain/subdomain (sftp.example.com) format or as an IP address (10.0.0.0). The protocol (sftp://) is assumed and is not specified. |

| Directory | The directory on the SFTP server where the ACH file is to be saved. |

| Username | The user name to use to log in to the SFTP server. |

| Password | Password to use to log in using the specified user name. Password is stored encrypted. |

| Port | The port number used to connect to the SFTP server. Typically TCP port 22. |

Select an SFTP setting as configured in Setup > System > SFTP Settings.

Get ACH/AFT Return File via SFTP

NLS 5.16 and later

Select this option to retrieve the ACH/AFT return file via SFTP.

| Option | Description |

|---|---|

| SFTP Setting | SFTP setting to use as defined in Setup > System > SFTP Settings. |

| SFTP Remote Directory | The path to the directory on the SFTP server where the ACH/AFT return file resides. Directories are defined in Setup > System > SFTP Settings. |

| SFTP Remote Archive | The path to the directory on the SFTP server to where the ACH/AFT return files are to be moved to after processing has been completed. Files that are processed with errors are not moved. Directories are defined in Setup > System > SFTP Settings. Files may not be moved if the SFTP user does not have the appropriate permission. |

To automate the process of retrieving return files when new return files become available on the remote SFTP server, see the section on setting up the SFTP Listener.

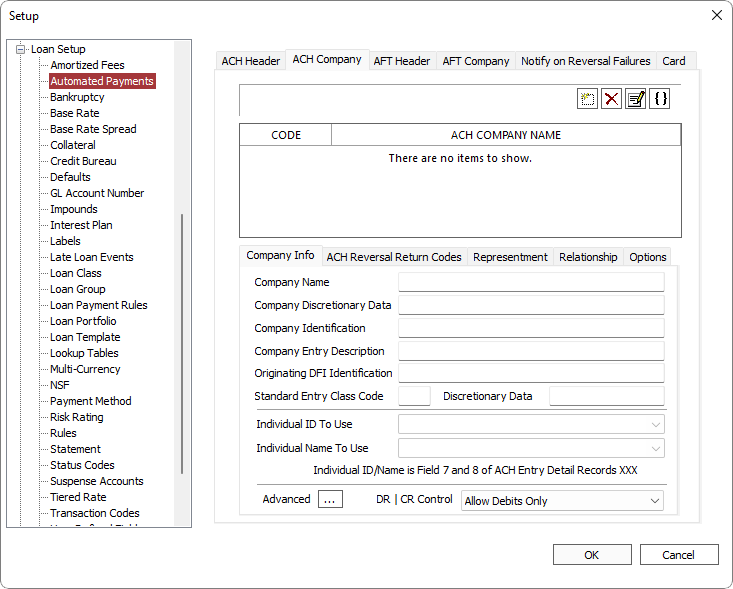

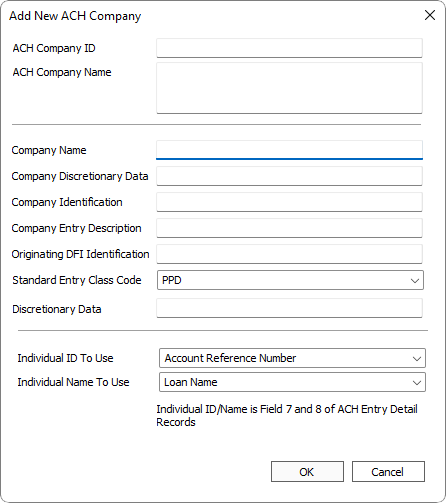

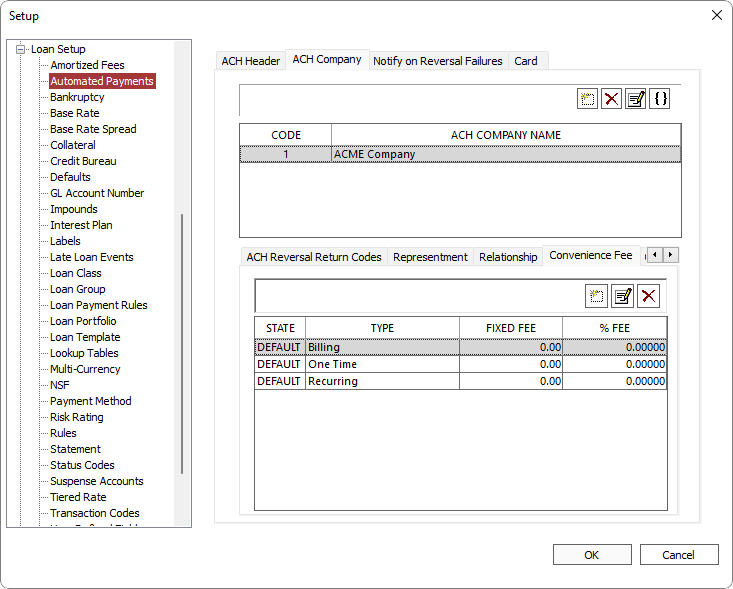

More than one ACH Company may be specified in NLS if you have divisions within your organization or may be servicing loans from another entity and wish to keep finances separate.

Click  to add a new ACH Company.

to add a new ACH Company.

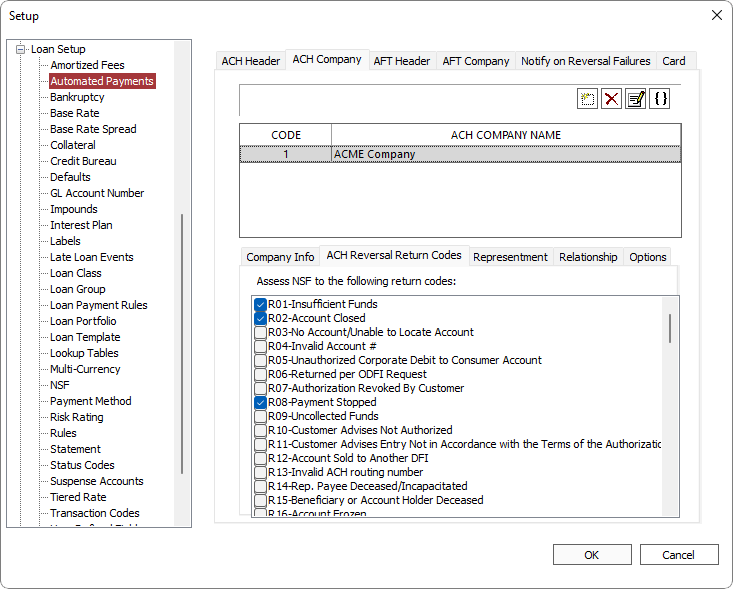

ACH Reversal Return Codes

If the bank sends an exception file, and that file is in the standard return format, the file may be imported. This will cause automatic reversal of the corresponding payments. Depending upon the reversal return code sent for the payment in question by the bank, NLS will automatically reverse the payment as an NSF or as a standard reversal. The determination of which reversal return codes constitute an NSF is made on the ACH Reversal Return Codes tab of the ACH Company setup.

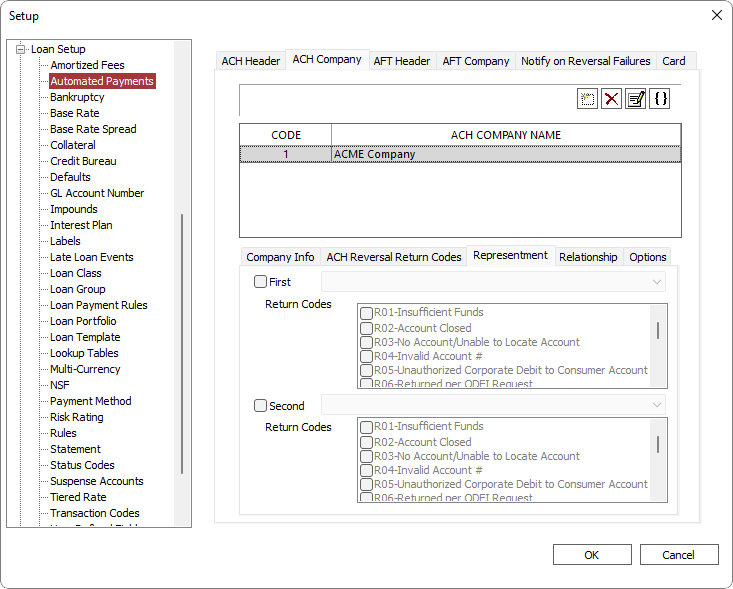

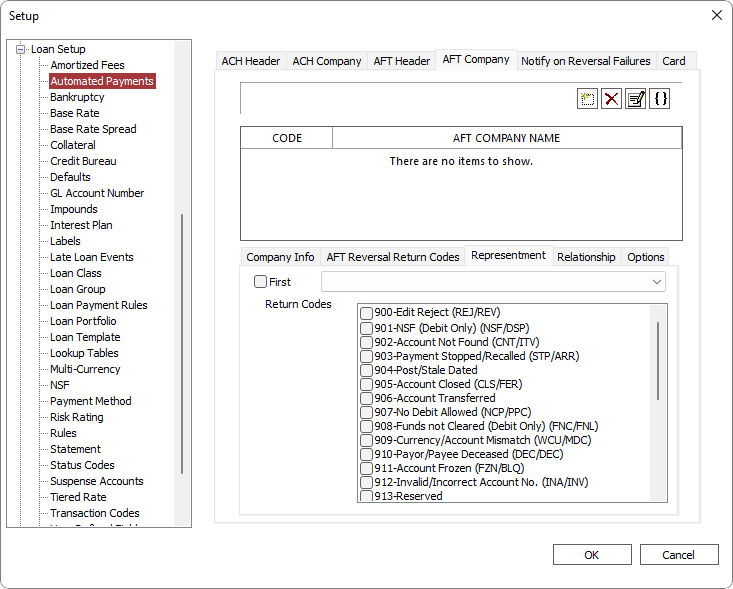

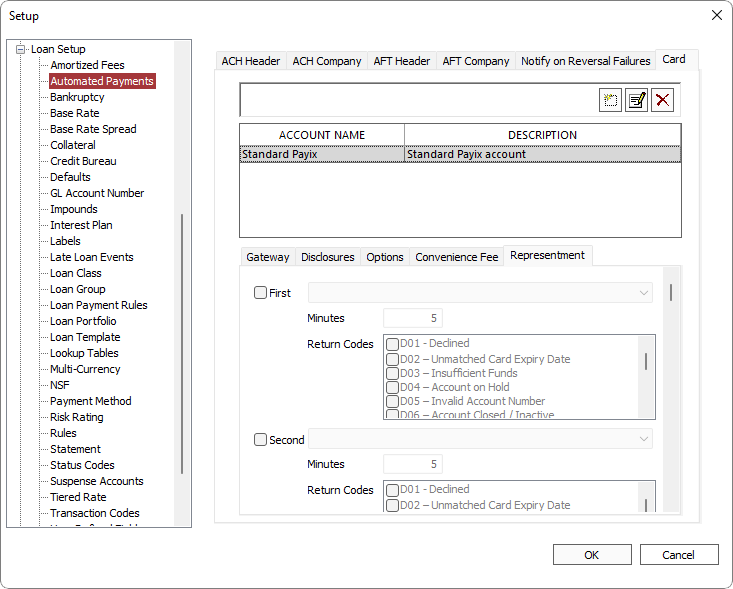

Representment

When an ACH transaction fails, the invalid transaction must be reversed and the transaction “re-presented” or re-sent at a later date. The representment feature in NLS automates this process.

Click File > Setup then expand Loan Setup and click ACH. Click the Company tab then the Representment tab.

NLS can attempt up to two re-presentment cycles. Select the First checkbox then choose from the drop down list, the number of days after the ACH is returned that the re-presentment should be made. Select all Return Codes that will trigger a re-presentment from the list.

Select the Second checkbox to set up a second re-presentment if needed.

Now, when a NACHA return file from a bank is imported into NLS, any invalid transaction matching the return codes will be reversed and a new ACH payment made on the specified number of day(s) after the return.

NLS 5.6 and later

ACH representment will not satisfy a promise to pay that was broken by the initial return.NLS 5.20 and later

When an ACH return code R02 or AFT return code 905 is received, all automated payments associated with the loan will be disabled and a representment will not occur.Relationship

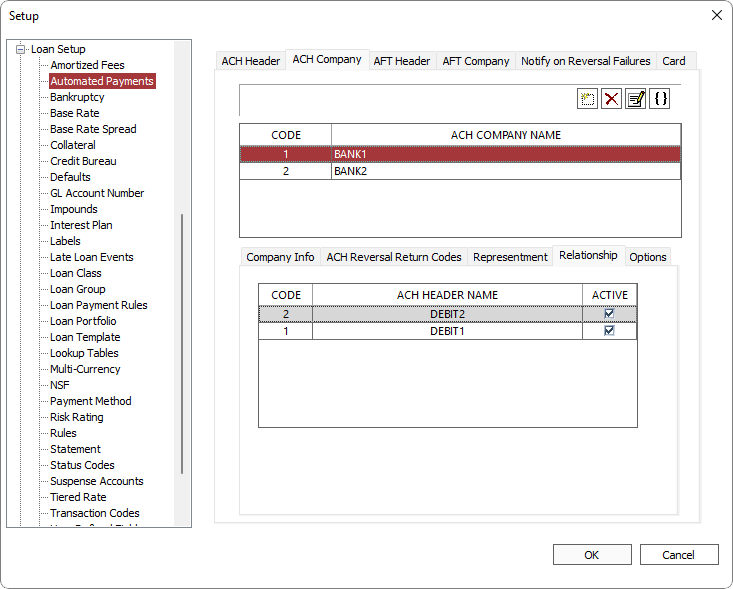

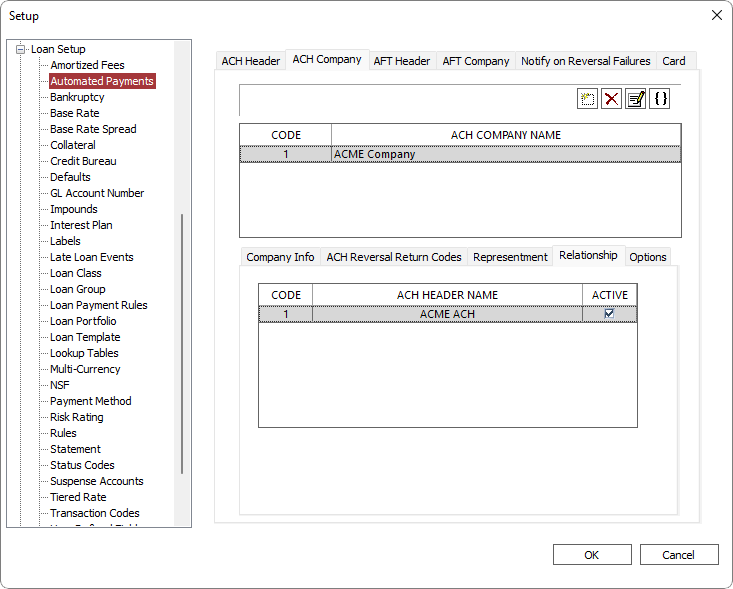

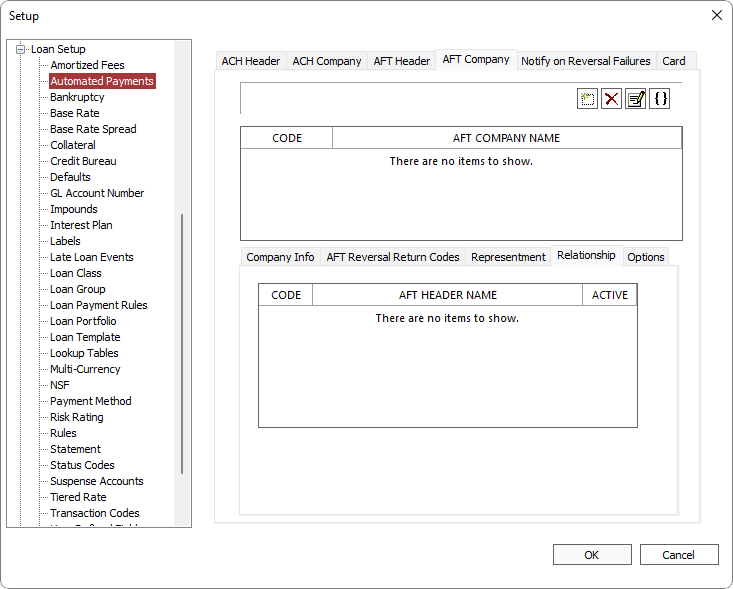

NLS 5.7 and later

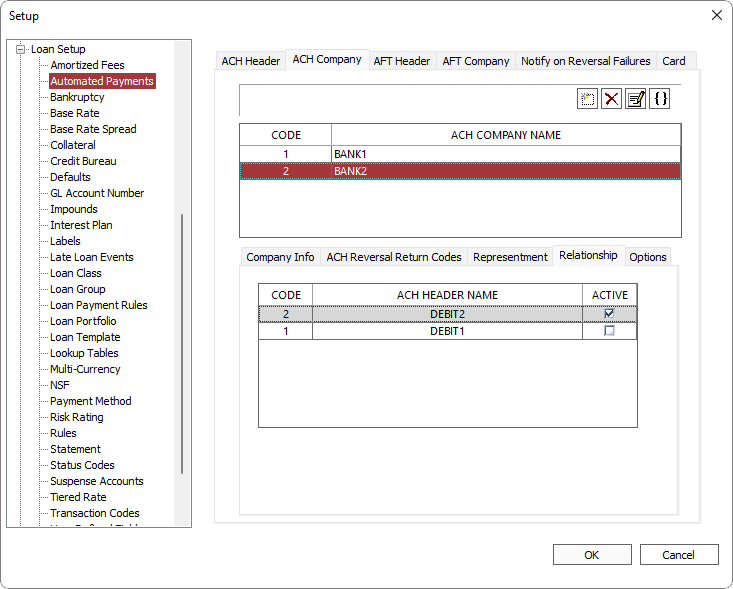

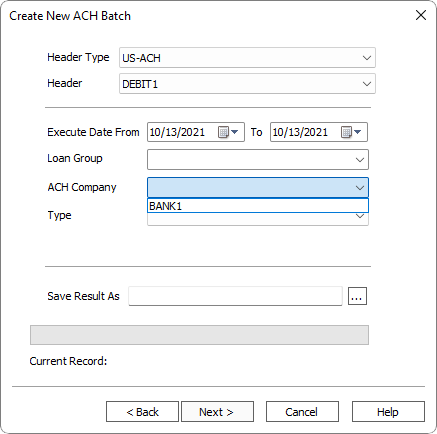

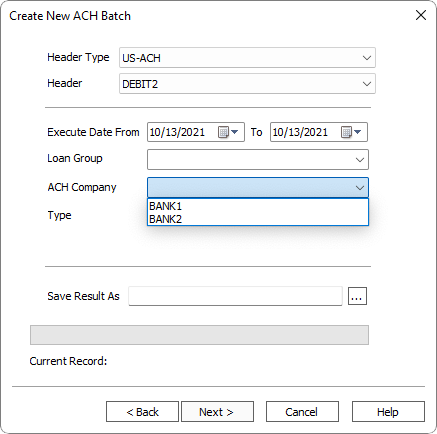

The Relationship tab allows for assigning relationships between the header and company. The ACH Company can be associated to one or more ACH Headers which will restrict which ACH Company will be available depending on the Header selection during the ACH Batch process creation.

Select Active for each header to associate it to the company. Only companies associated with the active headers will appear in the ACH Company selection when creating an ACH batch.

Example

If ACH Company named BANK1 has ACH Header named DEBIT1 and DEBIT2 set as Active in the Relationship tab, BANK1 will be available in the ACH Company selection when either DEBIT1 or DEBIT2 is selected as the Header during ACH batch creation.If ACH Company named BANK2 has ACH Header named DEBIT2 set as Active in the Relationship tab, BANK2 will only be available for ACH Company selection when DEBIT2 is selected as the Header during ACH batch creation.

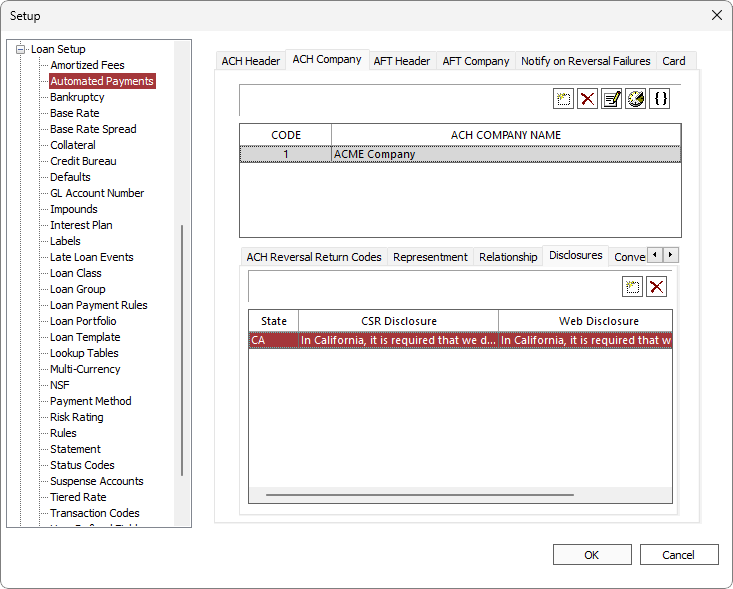

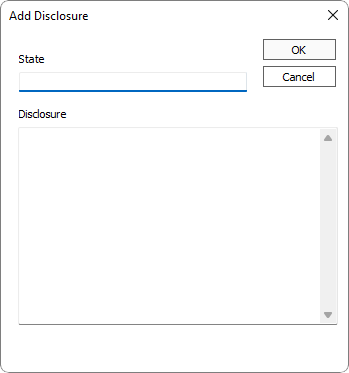

Disclosures

NLS 5.41 and later

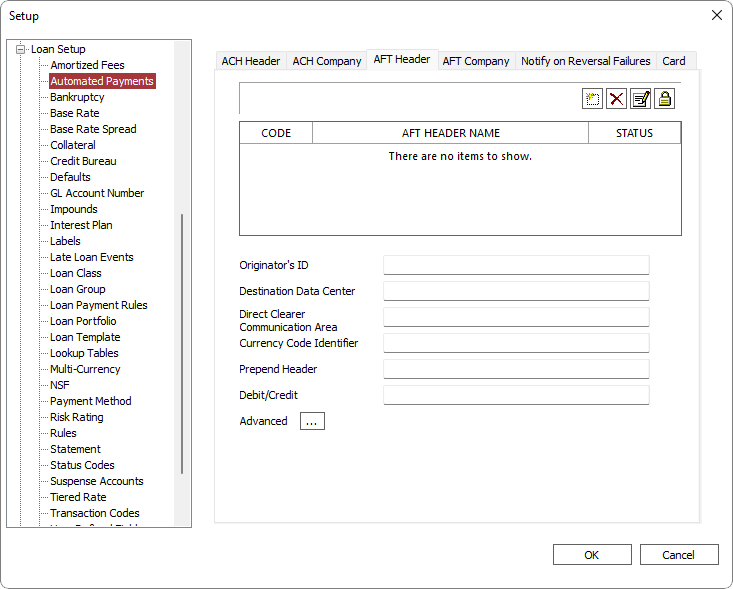

A disclosure statement may be configured to appear during a ACH transaction entry for which a convenience fee is applied. Disclosures are based on the address for which the convenience fee is based on as configured in the Convenience Fee tab. The DEFAULT disclosure will be used for any address that does not match any of the state specific disclosures.

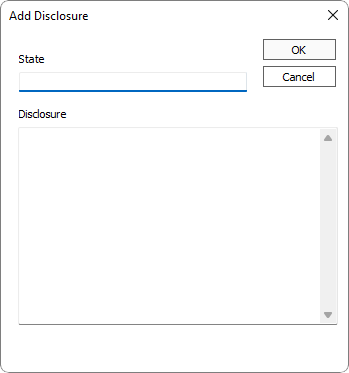

Click Add to add a new disclosure.

to add a new disclosure.

Enter the state postal code for the disclosure. Any given state can only have one set of disclosures.

Anything entered in the Disclosure field will be replicated in both the CSR and Web disclosure fields which may be edited individually later.

Click OK to finish adding a new disclosure.

Disclosures can be configured to be displayed regardless of an existence of a convenience fee by selecting the Always Display option to the right of the Web Disclosure column in the disclosures grid.

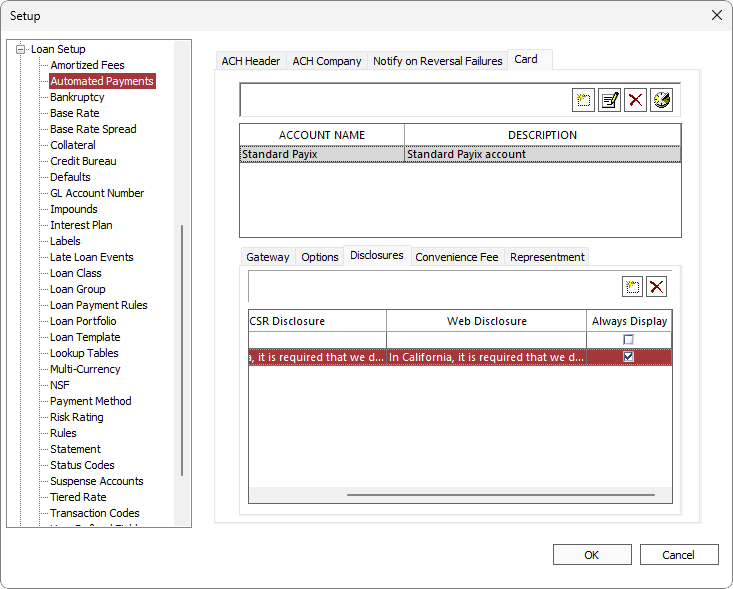

Convenience Fee

NLS 5.30 and later

The Convenience Fee tab allows for assessing fees on ACH transactions.

By default, three configurations for billing, one-time, and recurring type transactions are pre-configured with their fees and percentages set to 0. Click the corresponding Fixed Fee or % Fee cells to edit the values. Only one or the other may be set. If Fixed Fee is set to a value greater than zero, then % Fee cannot be set and vice versa.

Click  to add a new convenience fee which will be assessed only to transactions in a specific State. The convenience fee will be applied to a primary borrower's State of residence.

to add a new convenience fee which will be assessed only to transactions in a specific State. The convenience fee will be applied to a primary borrower's State of residence.

Enter the 2 or 3 letter abbreviation for the State to which this convenience fee will be associated.

Three additional rows, each for billing, one-time, and recurring types, will be created for which the fees may be configured.

Note

In order to update the Loan ACH records when changing the convenience fee settings, each ACH setup on each loan must be accessed either through XML import or through manually opening the Automated Payments dialog for the convenience fee amount to update.To do this most efficiently, we recommend running an XML that “updates” all relevant ACH records without explicitly changing any values. This will force each ACH to update its convenience fee to match the current settings, primary borrower’s state, and billing type.

XML

<NLS>

<LOAN UpdateFlag = "1" AcctRefno = "1">

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "1" />

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "2" />

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "3" />

...

</LOAN>

<LOAN UpdateFlag = "1" AcctRefno = "2">

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "101" />

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "102" />

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "103" />

...

</LOAN>

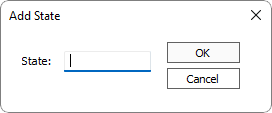

</NLS>Options

NLS 5.6 and later

The Options tab allows for setting rules exclusions.

| Option | Description | ||

|---|---|---|---|

| Continue drafts after Payoff | By default, ACH drafts end whenever a payoff transaction is executed. Selecting this option overrides that default. | ||

| Continue drafts after Maturity | By default, ACH drafts end upon the maturity date of the loan. If the mature loan is not paid off, it may be necessary for the drafts to continue. Selecting this option will allow drafts to continue after maturity. | ||

| Do not adjust draft down to loan balance on payoff | By default, whenever an ACH draft will result in a payoff that overpays the loan, the draft amount will be adjusted down to just payoff the loan, so that no refund is required. Selecting this option will override that default. | ||

| Draft scheduled payments (including impound) only | Only available when the frequency type is set to Billing. When selected, only scheduled payments are included in ACH drafts. |

||

|

Do not resubmit if resubmit is greater than payoff5.7.2+

|

When selected, ACH/AFT will not be resubmitted if the amount being resubmitted is greater than the payoff amount. | ||

|

Do not resubmit if customer revoked ACH/AFT5.7.2+

|

When selected, ACH/AFT will not be resubmitted if the ACH/AFT on a loan is in a disabled state. This option does not apply to one-time ACH/AFT payments.5.24+ |

||

|

Suspend resubmit if a resubmit was returned5.7.2+

|

When selected, ACH/AFT will not be resubmitted if the previous representment was returned unpaid. | ||

|

Do not resubmit if active PTP exists5.7.3+

|

When selected, ACH/AFT will not be resubmitted if there are any active PTP. | ||

|

Do not charge NSF fee when resubmit returns5.7.3+

|

When selected, a NSF fee will not be assessed if a representment is returned. | ||

|

Do not resubmit if conflict w/ scheduled ACH/AFT5.7.3+

|

When selected, a representment that is set to “Next Known Payday” will not occur if another ACH/AFT is scheduled for the same date. | ||

|

When selected, a representment will not occur if a payment in full is made prior to the ACH return being processed.

Note If the payment that suppressed the representment is reversed, the representment will not be reinstated. |

|||

| When selected, the current recurring ACH/AFT will be suspended after the specified number of consecutive returns are received. | |||

| When selected, the next pay date of the primary employer will be used for representments. For multiple designations of primary employers, the earliest next pay date will be used. | |||

| When selected, ACH with posting dates on or prior to the current date will be processed by NLS immediately after the generation of the NACHA file, affecting the loan’s balance. This option takes precedence over other constraints (e.g. if ACH is configure to not process on holidays, enabling this option will cause the ACH to be processed). | |||

| When selected, any One-Time ACHs that are set up in the XML or Automated Payments/Quick ACH dialogs will immediately execute their internal NLS transactions as long as they are payments (debit) made on the same-day (billing start date is the minimum possible date not in the past). Usage of past dates with the ACH - Allow Backdating option invalidates this option. Once executed, the One-Time ACH record cannot be modified nor can it be deleted immediately. To delete the One-Time ACH record, transaction associated with the ACH must first be reversed. |

|||

|

Delay allow same-day One-Time ACH5.35.27+

|

When selected, NLS automatically adds one day to the minimum start/NACHA-post date of all One-Time ACH/AFT executions.

|

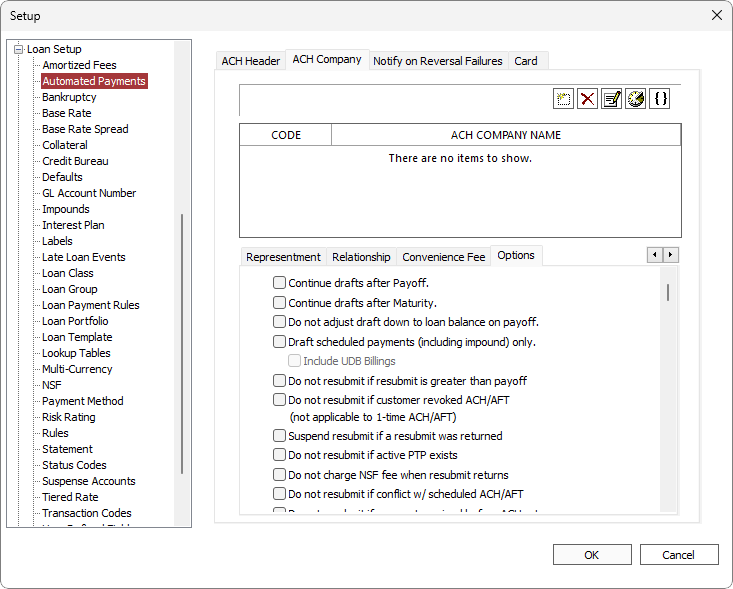

Macro

NLS 5.7.7 and later

A macro can be used to determine which ACH/AFT company is to be used for an automated payment for loans in specific loan groups or belonging to specific branches.

Click  to enter a XML macro to be used to determine the ACH/AFT company. See Segmented GL Macro for additional info on XML macro syntax.

to enter a XML macro to be used to determine the ACH/AFT company. See Segmented GL Macro for additional info on XML macro syntax.

SAMPLE XML

<MACROS>

<MACRO> <!--MACRO Name is not required for ACH/AFT macro-->

<!--if Branch number is 11 then Automated Payment Company ID is 1-->

<CONDITION RESULT="1">

<BRANCHNO>11</BRANCHNO>

</CONDITION>

<!--if Branch number is 12 then Automated Payment Company ID is 2-->

<CONDITION RESULT="2">

<BRANCHNO>12</BRANCHNO>

</CONDITION>

</MACRO>

</MACROS>

The macro can be selected for use in Setup > Loan Group > Servicing Options and in  Branch Setup. Select {USE MACRO} from the ACH/AFT Company drop down list.

Branch Setup. Select {USE MACRO} from the ACH/AFT Company drop down list.

Figure - Loan Group setup with {USE MACRO} selected

The ACH/AFT Company drop down list in the Automated Payments dialog will be populated with the results of the macro.

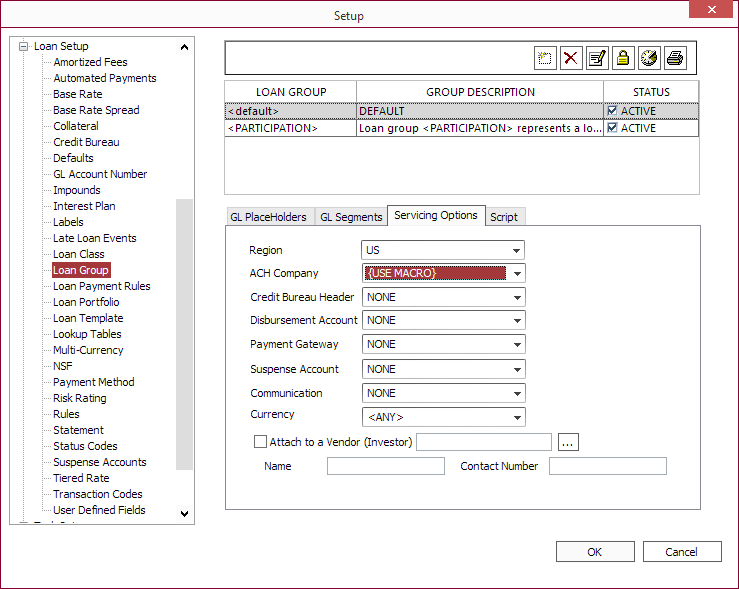

NLS 5.5.1 and later

NLS 5.20 and later

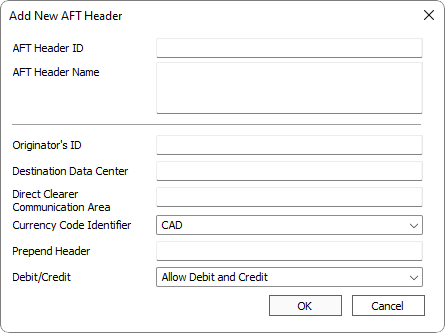

De-selecting the Active status option will disable the AFT Header and any automated payments configured with the header will not be processed.To add a new AFT Header, click  .

.

| Option | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AFT Header ID | A sequential, unique, number assigned by NLS to identify this particular AFT header code in the database. | ||||||||||||||||

| AFT Header Name | Your name for this particular AFT Header code. This information does not appear in the AFT file. It is here to help you identify the AFT header code in NLS. | ||||||||||||||||

| Originator's ID | Used to identify the originator. An invalid value will result in the AFT being rejected. | ||||||||||||||||

| Destination Data Center | Unique number identifying the Data Center to which the file is being delivered. | ||||||||||||||||

| Direct Clearer Communication Area | Optional. Leave blank unless instructed by the Direct Clearer. | ||||||||||||||||

| Currency Code Identifier | Use "CAD" for Canadian dollar. | ||||||||||||||||

| Prepend Header | This field is not a part of the CPA specification and is optional. Additional information requested by banks can be entered here and will appear as the very first line on the AFT. Use only as directed by the AFT recipient. | ||||||||||||||||

| Advanced |

Sets the option to force AFT files to be saved to a specific location using a predetermined filename. When Force ACH to use this filename & location is selected, the location and filename of the AFT file cannot be changed during the AFT creation process.

The filename can be configured to use a date/time stamp using variables.

Example AFT%y%m%d-%H%M%S.txt would result in a filename ofAFT170120-132301.txt if the file was saved on January 20, 2017 at 1:23:01 PM.

NLS 5.7.2 and later Select SFTP the AFT File to save the SFTP connection settings which will be used when making SFTP connections. |

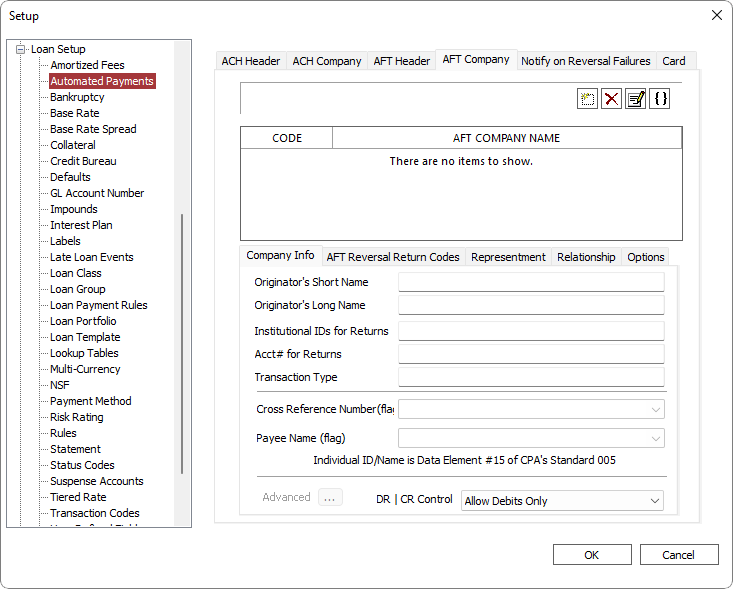

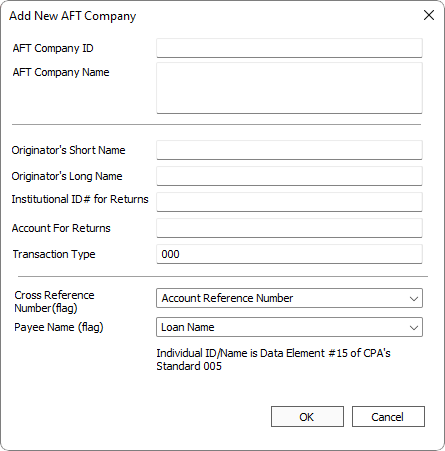

NLS 5.5.1 and later

More than one AFT Company may be specified in NLS if you have divisions within your organization or may be servicing loans from another entity and wish to keep finances separate.

Click  to add a new AFT Company.

to add a new AFT Company.

| Option | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AFT Company ID | A sequential, unique, number assigned by NLS to identify this particular AFT company code in the database. | ||||||||||||||||||||||||

| AFT Company Name | Your name for this particular AFT company code. This information does not appear in the AFT file. It is here to help you identify the AFT company code in NLS. | ||||||||||||||||||||||||

| Originator's Short Name | The name of the originator of the transaction. May be replaced by the Originator's Long Name when identifying the originator of the transaction to the payee/payor. | ||||||||||||||||||||||||

| Originator's Long Name | The name of the originator of the transaction. May be used to replace the Originator's Short Name when identifying the originator of the transaction to the payee/payor. | ||||||||||||||||||||||||

| Institutional IDs for Returns | The routing information of the institution branch or office to which items will be returned. | ||||||||||||||||||||||||

| Acct# for Returns | The Originating Direct Clearer's user's account number, if any, maintained at the branch/office identified by the Institutional ID Number for Returns. | ||||||||||||||||||||||||

| Transaction Type | Used to identify the type of payment. | ||||||||||||||||||||||||

| Cross Reference Number (flag) | Used to identify the transaction for your own reference (e.g. loan number, account reference number). | ||||||||||||||||||||||||

| Payee Name (flag) | The name of the account to be credited. | ||||||||||||||||||||||||

| DR | CR Control |

This option will prevent credits or debits from flowing into a file.

|

||||||||||||||||||||||||

| Advanced |

|

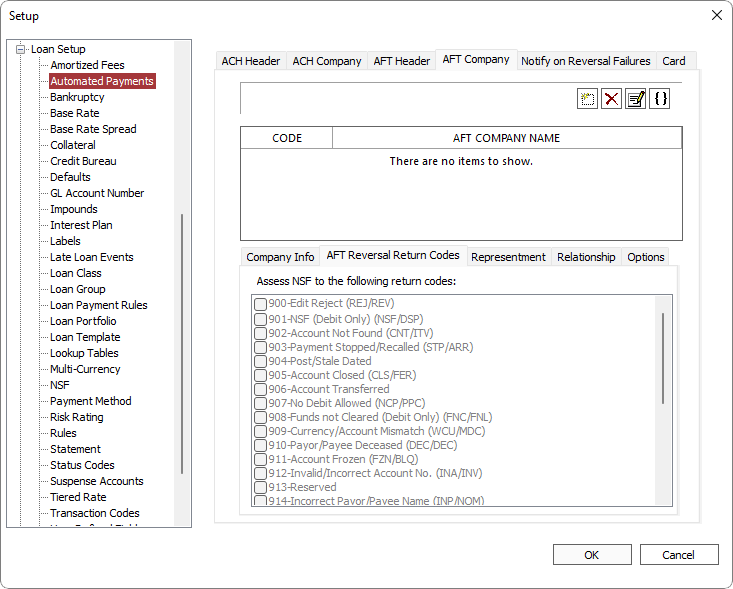

AFT Reversal Return Codes

If the bank sends an exception file, and that file is in the standard return format, the file may be imported. This will cause automatic reversal of the corresponding payments. Depending upon the reversal return code sent for the payment in question by the bank, NLS will automatically reverse the payment as an NSF or as a standard reversal. The determination of which reversal return codes constitute an NSF is made on the AFT Reversal Return Codes tab of the AFT Company setup.

Representment

NLS 5.7.2 and later

To attempt a representment of an AFT, select First then choose from the drop down list, the number of days after the AFT is returned that the re-presentment should be made. Select all Return Codes that will trigger a re-presentment from the list.

When a AFT return file from a bank is imported into NLS, any invalid transaction matching the return codes will be reversed and a new AFT payment made on the specified number of day(s) after the return.

If Next Scheduled Due Date or Next Known Paydate is selected, a representment will not occur if more than 30 days have elapsed since the creation date specified in the reversal file.

Relationship

NLS 5.7 and later

The Relationship tab allows for assigning relationships between the header and company. The company can have multiple headers associated with it.

Select Active for each header to associate it to the company.

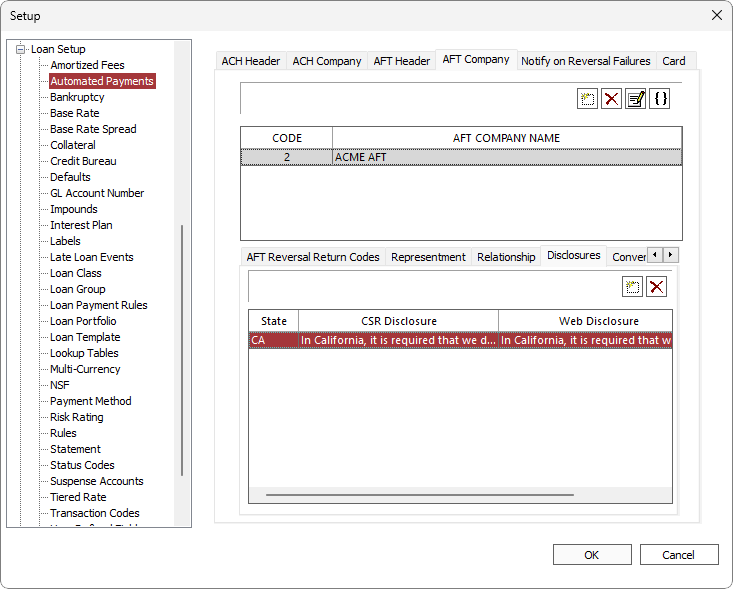

Disclosures

NLS 5.41 and later

A disclosure statement may be configured to appear during a AFT transaction entry for which a convenience fee is applied. Disclosures are based on the address for which the convenience fee is based on as configured in the Convenience Fee tab. The DEFAULT disclosure will be used for any address that does not match any of the state specific disclosures.

Click Add to add a new disclosure.

to add a new disclosure.

Enter the state postal code for the disclosure. Any given state can only have one set of disclosures.

Anything entered in the Disclosure field will be replicated in both the CSR and Web disclosure fields which may be edited individually later.

Click OK to finish adding a new disclosure.

Disclosures can be configured to be displayed regardless of an existence of a convenience fee by selecting the Always Display option to the right of the Web Disclosure column in the disclosures grid.

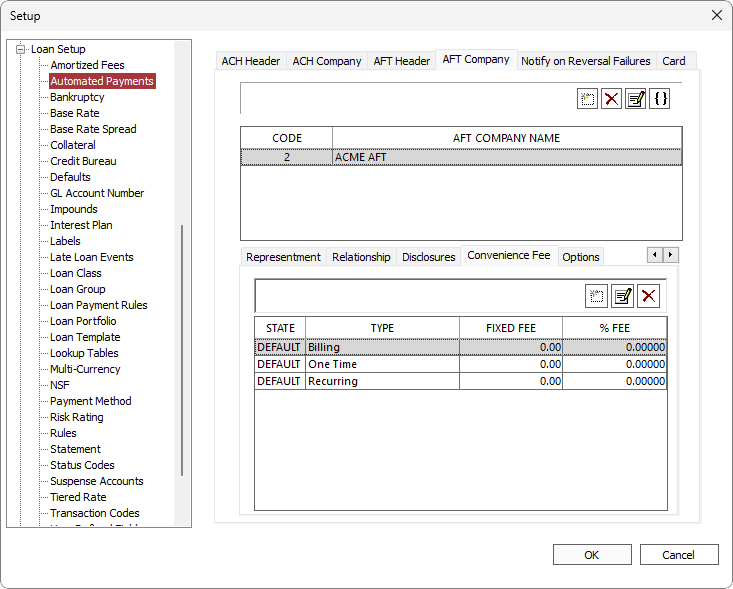

Convenience Fee

NLS 5.30 and later

The Convenience Fee tab allows for assessing fees on AFT transactions.

By default, three configurations for billing, one-time, and recurring type transactions are pre-configured with their fees and percentages set to 0. Click the corresponding Fixed Fee or % Fee cells to edit the values. Only one or the other may be set. If Fixed Fee is set to a value greater than zero, then % Fee cannot be set and vice versa.

Click  to add a new convenience fee which will be assessed only to transactions in a specific State. The convenience fee will be applied to a primary borrower's State of residence.

to add a new convenience fee which will be assessed only to transactions in a specific State. The convenience fee will be applied to a primary borrower's State of residence.

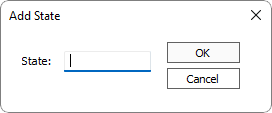

Enter the 2 or 3 letter abbreviation for the State to which this convenience fee will be associated.

Three additional rows, each for billing, one-time, and recurring types, will be created for which the fees may be configured.

Note

In order to update the Loan AFT records when changing the convenience fee settings, each AFT setup on each loan must be accessed either through XML import or through manually opening the Automated Payments dialog for the convenience fee amount to update.To do this most efficiently, we recommend running an XML that “updates” all relevant AFT records without explicitly changing any values. This will force each AFT to update its convenience fee to match the current settings, primary borrower’s state, and billing type.

XML

<NLS>

<LOAN UpdateFlag = "1" AcctRefno = "1">

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "1" />

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "2" />

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "3" />

...

</LOAN>

<LOAN UpdateFlag = "1" AcctRefno = "2">

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "101" />

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "102" />

<ACH Operation = "UPDATE" AutomatedPaymentCompanyID = "1" RowID = "103" />

...

</LOAN>

</NLS>Options

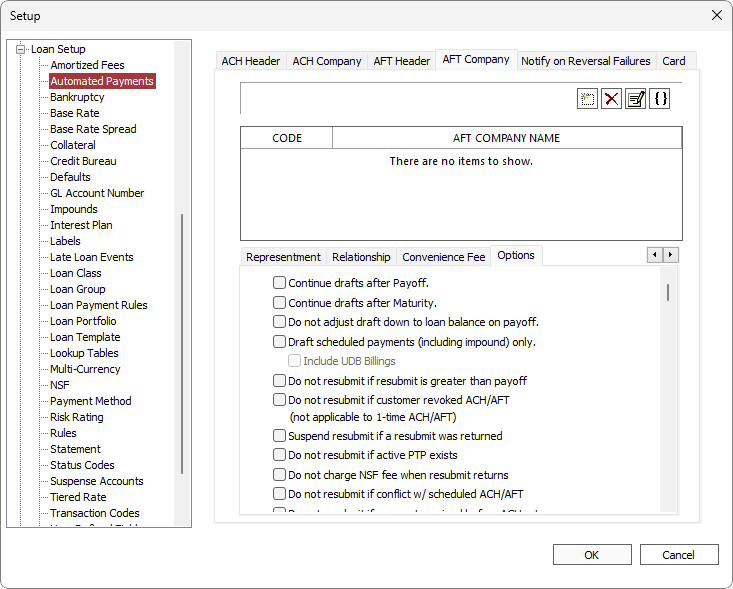

The Options tab allows for setting rules exclusions.

| Option | Description |

|---|---|

| Continue drafts after Payoff | By default, AFT drafts end whenever a payoff transaction is executed. Selecting this option overrides that default. |

| Continue drafts after Maturity | By default, AFT drafts end upon the maturity date of the loan. If the mature loan is not paid off, it may be necessary for the drafts to continue. Selecting this option will allow drafts to continue after maturity. |

| Do not adjust draft down to loan balance on payoff | By default, whenever an AFT draft will result in a payoff that overpays the loan, the draft amount will be adjusted down to just payoff the loan, so that no refund is required. Selecting this option will override that default. |

| Draft scheduled payments (including impound) only | Only available when the frequency type is set to Billing. Only scheduled payments are included in AFT drafts. Include UDB Billings – When selected, UDB billings will be included in AFT drafts.5.38+ |

|

Do not resubmit if resubmit is greater than payoff5.7.2+

|

When selected, ACH/AFT will not be resubmitted if the amount being resubmitted is greater than the payoff amount. |

|

Do not resubmit if customer revoked ACH/AFT5.7.2+

|

When selected, ACH/AFT will not be resubmitted if the ACH/AFT on a loan is in a disabled state. This option does not apply to one-time ACH/AFT payments.5.24+ |

|

Suspend resubmit if a resubmit was returned5.7.2+

|

When selected, ACH/AFT will not be resubmitted if the previous representment was returned unpaid. |

|

Do not resubmit if active PTP exists5.7.3+

|

When selected, ACH/AFT representments are disabled if an active or open PTP exists on the loan. |

|

Do not charge NSF fee when resubmit returns5.7.3+

|

When selected, loans whose ACH/AFT representments are returned will not be assessed a NSF fee. |

|

Do not resubmit if conflict w/ scheduled ACH/AFT5.7.3+

|

When selected, ACH/AFT will not be resubmitted if the representment is set to Next Know Paydate and an ACH/AFT is already schedule for the same date. |

|

When selected, a representment will not occur if a payment in full is made prior to the ACH return being processed.

Note If the payment that suppressed the representment is reversed, the representment will not be reinstated. |

|

|

When selected, a representment will not occur if a payment in full is made prior to the ACH return being processed.

Note If the payment that suppressed the representment is reversed, the representment will not be reinstated. |

|

| When selected, the current recurring ACH/AFT will be suspended after the specified number of consecutive returns are received. | |

| When selected, the next pay date of the primary employer will be used for representments. For multiple designations of primary employers, the earliest next pay date will be used. |

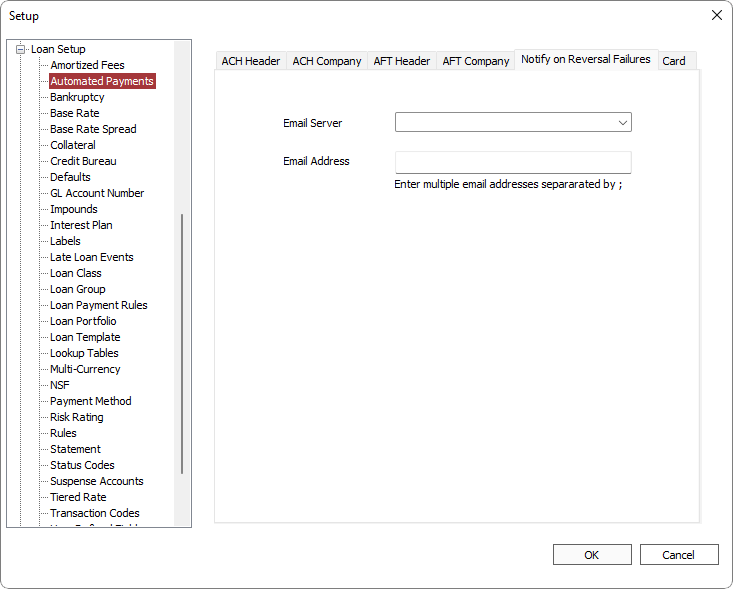

NLS 5.6 and later

When a bank sends an ACH/AFT exception file and that file is imported into NLS, an email listing all loans that failed their reversals can be sent to the specified Email Address.

Select an email server from those that has been configured in Setup > System > Communication.

NLS 5.20 and later

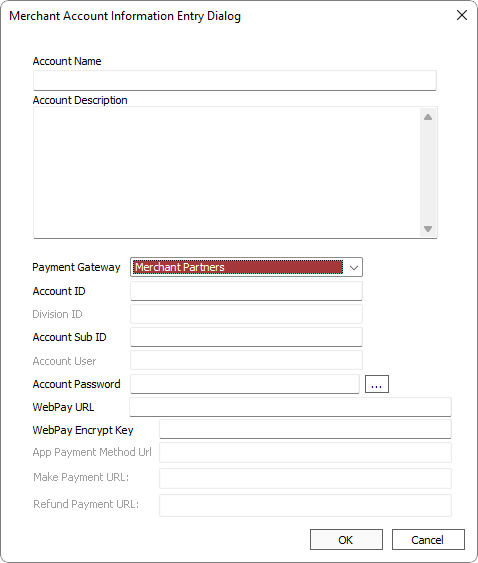

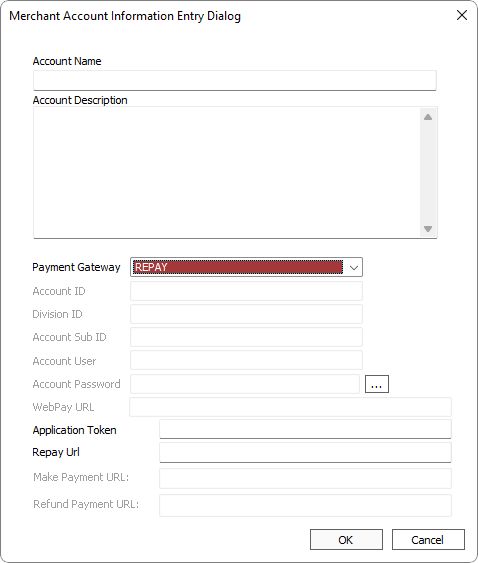

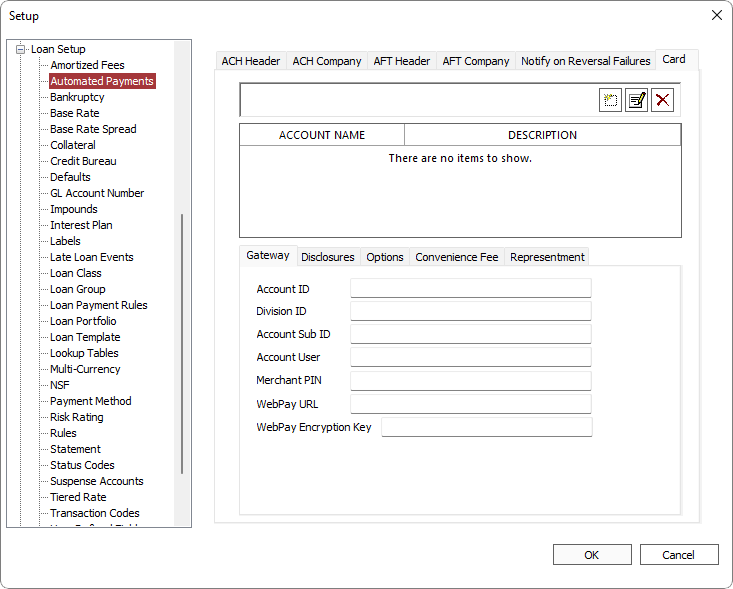

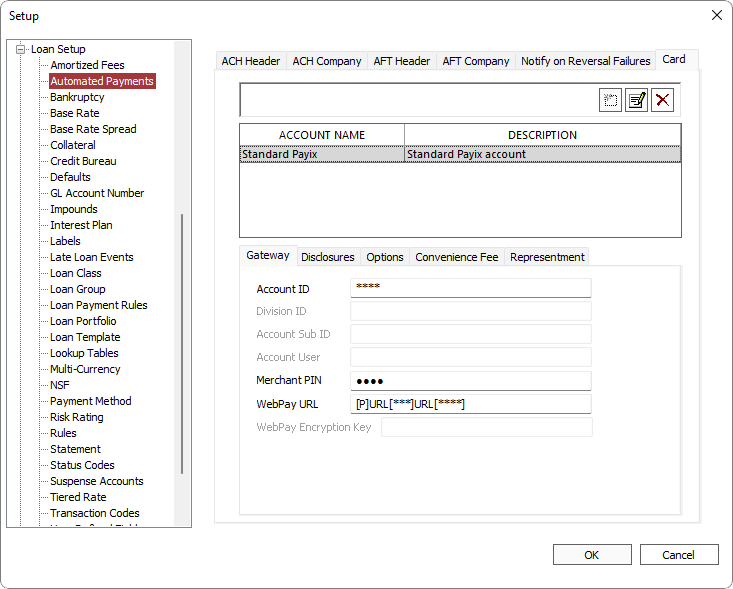

Before configuring the loan system to accept automated card payments, an account must be set up with Merchant Partners or REPAY (Payix is now REPAY). If you do not currently have an account, contact your Nortridge sales representative or email paymentprocessing@nortridge.com to get that process started.

Once your payment gateway account has been established, you will have the information necessary to fill out the card setup.

Gateway

Click Add to add a new account.

to add a new account.

Select the payment processing company from the Payment Gateway drop down list and fill out the information provided by the respective service providers.

Click  , next to the Account Password field, to enter your password.

, next to the Account Password field, to enter your password.

Note

The Subdomain {COMPANYNAME} field will be disabled during the initial steps of creating the payment gateway. The configuration must be saved first by clicking OK. After saving the configuration, click edit and the field will be enabled.

and the field will be enabled.This field will always appear blank when the entry dialog is opened but is not an indication that the previously entered value was not saved.

Click OK.

For information on how to link the gateway to the loan group, see Loan Setup: Loan Group.

For information on how to enter a credit card payment, see Transaction Entry: Card Processing.

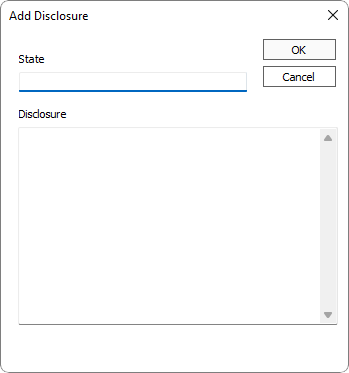

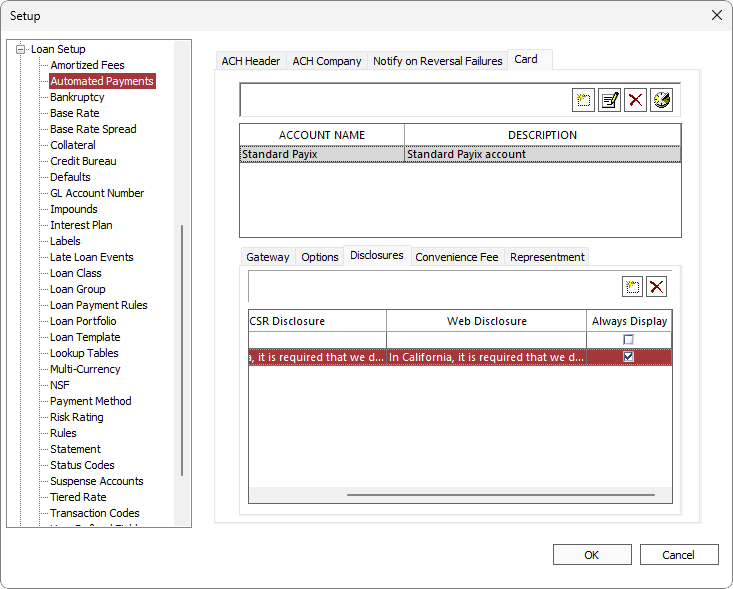

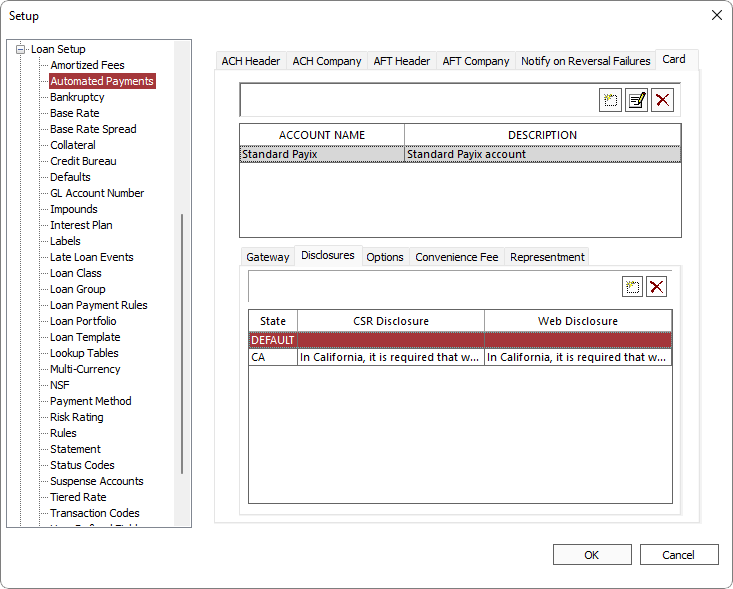

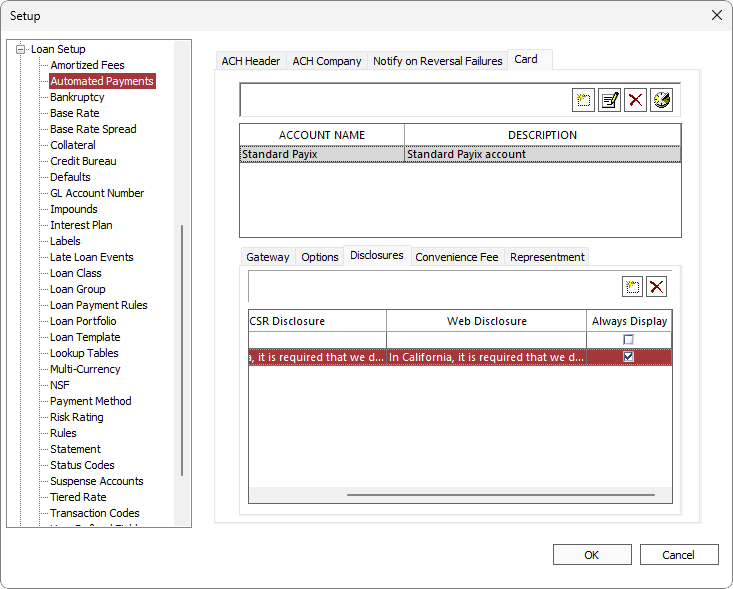

Disclosures

A disclosure statement may be configured to appear during a payment card transaction entry for which a convenience fee is applied. Disclosures are based on the address for which the convenience fee is based on as configured in the Convenience Fee tab. The DEFAULT disclosure will be used for any address that does not match any of the state specific disclosures.

Click Add to add a new disclosure.

to add a new disclosure.

Enter the state postal code for the disclosure. Any given state can only have one set of disclosures.

Anything entered in the Disclosure field will be replicated in both the CSR and Web disclosure fields which may be edited individually later.

Click OK to finish adding a new disclosure.

NLS 5.41 and later

Disclosures can be configured to be displayed regardless of an existence of a convenience fee by selecting the Always Display option to the right of the Web Disclosure column in the disclosures grid.

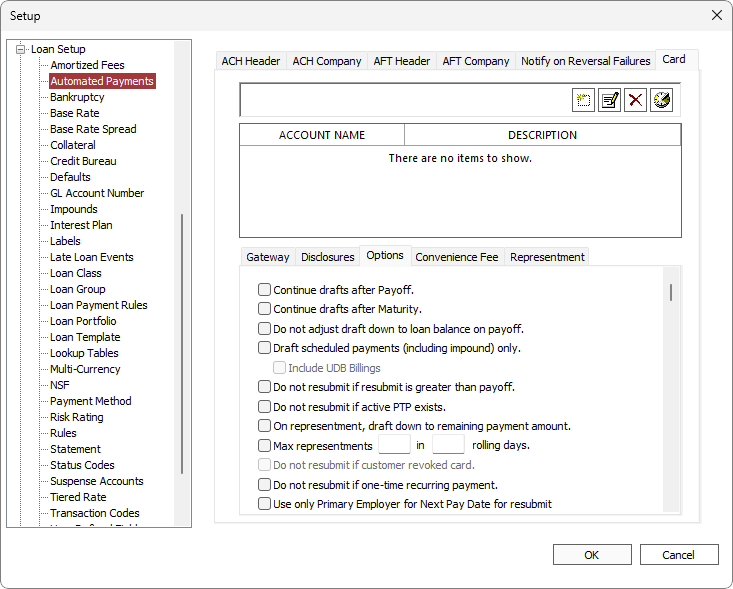

Options

| Option | Description | ||

|---|---|---|---|

| Continue drafts after Payoff | By default, card drafts end whenever a payoff transaction is executed. Selecting this option overrides that default. | ||

| Continue drafts after Maturity | By default, card drafts end upon the maturity date of the loan. If the mature loan is not paid off, it may be necessary for the drafts to continue. Selecting this option will allow drafts to continue after maturity. | ||

| Do not adjust draft down to loan balance on payoff | By default, whenever a card draft results in a payoff that overpays the loan, the draft amount will be adjusted down to just payoff the loan so that no refund is required. Selecting this option will override that default. | ||

| Draft scheduled payments (including impound) only | Only available when the frequency type is set to Billing. When selected, only scheduled payments are included in card drafts. Include UDB Billings – When selected, UDB billings will be included in card drafts.5.38+ |

||

| Do not resubmit if resubmit is greater than payoff | When selected, card payments will not be resubmitted if the amount being resubmitted is greater than the payoff amount. | ||

| Do not resubmit if active PTP exists | When selected, card payments will not be resubmitted if there are any active PTP. | ||

| On representment, draft down to remaining payment amount | When selected, a representment will only charge the remaining unpaid amount. | ||

| Max representments n in n rolling days | Limits the number of representments that can be made in the specified number of days. | ||

| Do not resubmit if customer revoked card | This feature is not yet implemented. | ||

| When selected, a card payment that is configured as a one-time recurring payment will not be represented if the initial card payment fails. | |||

| When selected, the next pay date of the primary employer will be used for representments. For multiple designations of primary employers, the earliest next pay date will be used. | |||

| Disallow | Do not accept the selected card brand. | ||

| Allow waiving of Convenience Fee | When selected, waiving of convenience fees may be accomplished by specifying a zero for the convenience fee. | ||

| Convenience Fee based on | Convenience fee will be based on the selected address. | ||

| Payment Amount | The allowable range of payment amount. | ||

|

Disable Card Payments Based on Return Status5.23-

|

Card payments will be disabled if a specified return status is received. | ||

Select how automated card payments are to be handled for individual card return codes:

|

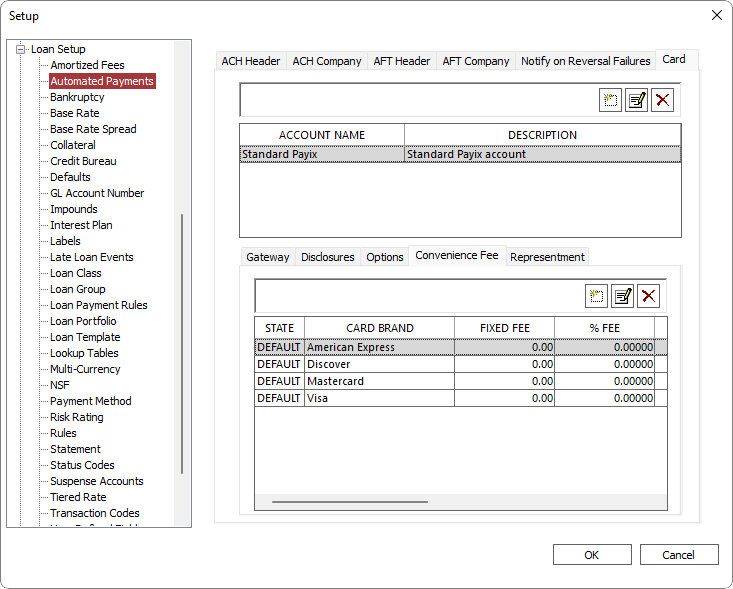

Convenience Fee

A convenience fee may be assessed on card transactions per state.

Click Add to add a new convenience fee and enter the state postal code. Any given state can only have one set of convenience fees.

to add a new convenience fee and enter the state postal code. Any given state can only have one set of convenience fees.

| Column | Description |

|---|---|

| State | The state to which the fees will be applied. The DEFAULT configuration will be used for all transactions that do not match a state configuration. |

| Card Brand | American Express, Discover, Mastercard, and Visa. |

| Fixed Fee | A fixed amount to be assessed. If this is specified, % Fee, Min Fee, and Max Fee are disabled. |

| % Fee | The percentage of the transaction to be assessed. If this is specified, Fixed Fee is disabled. |

| Min Fee | The minimum amount to be assessed when % Fee is specified. |

| Max Fee | The maximum amount that may be assessed when % Fee is specified. |

| Assess on Web | When selected, transactions made through the borrower portal will be assessed the specified fee. |

| Assess on CSR | When selected, transactions made through NLS will be assessed the specified fee. |

| Assess on Recurring | When selected, transactions that are recurring in nature will be assessed the specified fee. |

| When selected, transactions that are one-time payments will be assessed the specified fee. | |

| Don’t Assess in Branch | When selected, transactions in a branch are not assessed the specified fee. This option is particular to the state of Texas. |

Representment

A card transaction may be reattempted based on the parameters as configured in the Representment tab.

To attempt a representment of a card payment, select First then choose from the drop down list, when the next attempt should occur. Up to four representment attempts may be configured.

| Option | Description |

|---|---|

| Time from Return | Specify the number of minutes since the card was declined for the representment to occur. |

| Days from Return | Specify the number of days since the card was declined and the preferred time for the representment to occur. |

| Next Scheduled Due Date | Next attempt will occur on the next scheduled due date. Specify the preferred time for the representment to occur. |

| Next Known Pay Date | Next attempt will occur on the next known pay date. Specify the preferred time for the representment to occur. |

| Next attempt will occur on the first occurring next scheduled due date OR the next known pay date. |

Select all Return Codes that will trigger a representment from the list.