Card Payment Processing

To process an automated card payment (such as with credit cards), you must first have a payment gateway configured. If you have not already done this, see Payment Gateway in System Setup.

Once the payment gateway is configured, you must have it enabled in the Loan Group on the Servicing Options tab.

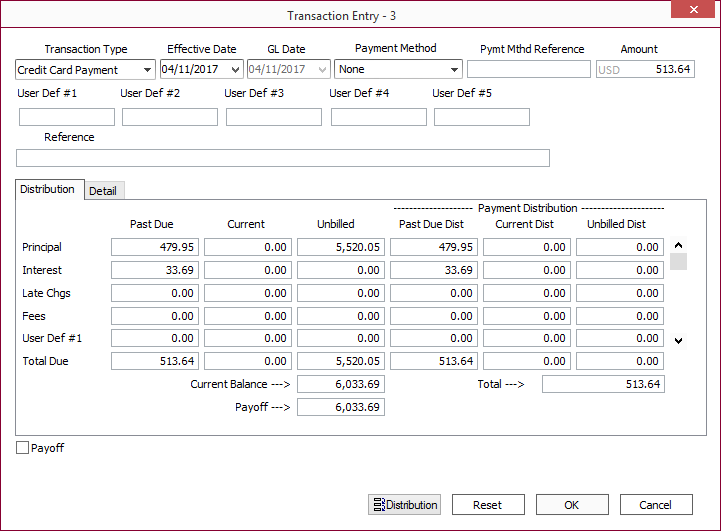

To enter a card type payment, begin by going to the transaction entry screen.

Select Credit Card Payment

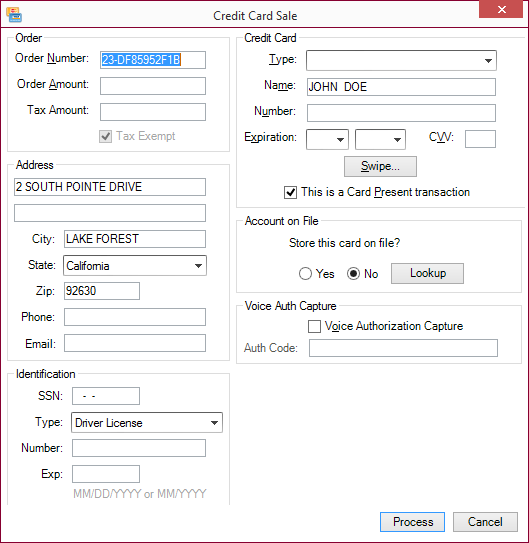

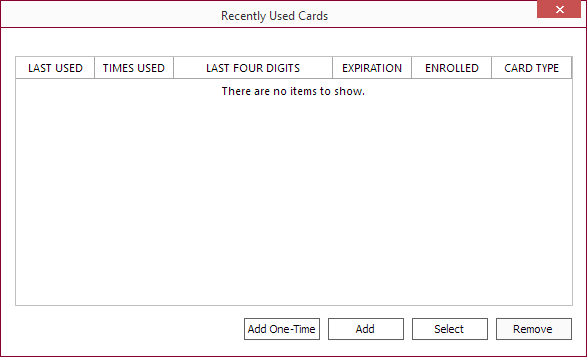

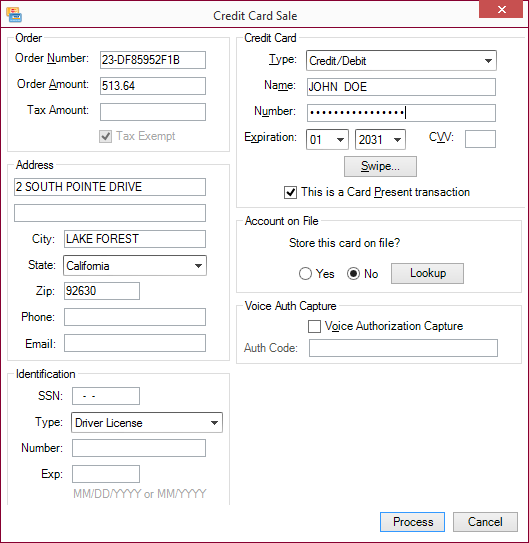

The dialog that appears to enter the card payment information will vary depending on the payment gateway associated with the loan group. If the Recently Used Cards dialog appears, click Add to access the web form for the associated payment gateway.

Fill out the fields as required by the payment gateway servicer. In the example shown, the fields are filled in with test data provided by the gateway servicer.

Click Process $xxx.xx.

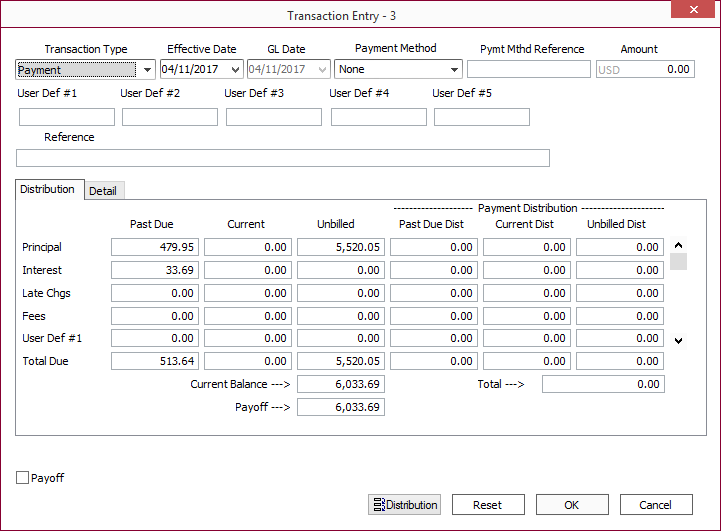

On the transaction entry screen, the Amount field is now locked down. It cannot be changed from the amount of the card payment transmission that has been approved by the gateway. Additionally, the Cancel button has been replaced with Void CC Payment. Now that a card payment has been sent to the gateway, it cannot be canceled. It must be completed (OK) or voided.

NLS 5.20 and later

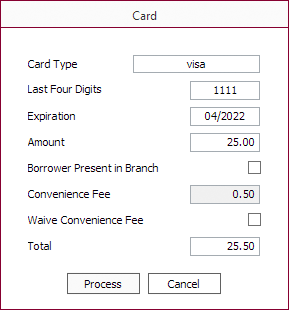

A convenience fee may be added to the transaction in the Convenience Fee field as configured in the convenience fee tab of the payment gateway setup.The convenience fee will be calculated automatically for the Amount entered.

The Borrower Present in Branch option is tied to the Don’t Assess in Branch option in the card convenience fee setup. When selected, no convenience fee will be assessed.

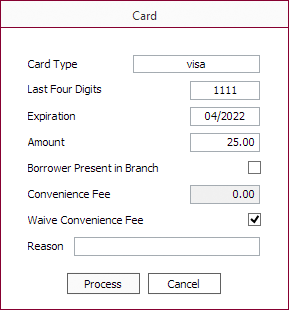

When Waive Convenience Fee is selected, no convenience fee will be assessed. Enter a reason for waiving the fee in the Reason field. If nothing is entered in the field, “Waived with no reason given” will be recorded by default.

Security privilege for the Waive Convenience Fee option is configured in Loan > Transaction Entry > Credit Card Payment and Loan > Quick Payment > Credit Card Payment.

Make any necessary modifications to your distribution as usual for a payment.

Click OK.

Payment Card Tokenization

When using Merchant Partners for payment card processing, all cards are tokenized (card information stored in Merchant Partners’ vault and a unique ID stored in NLS). This allows for re-using previous payment cards used on a loan without having to re-enter the card information.

A Card Selection Dialog will appear when a card transaction is entered on a loan. The dialog shows the date of last use, number of times used, last four digits of the card, and its expiration date. Double click the card on the list to retrieve the card information from Merchant Partners for use in the current transaction.

To remove the card so that it no longer appears on the list, click Remove.

Note

Expired cards are automatically removed from the list.