Automated Payments Configuration

AFT support available in NLS 5.5.1 and later

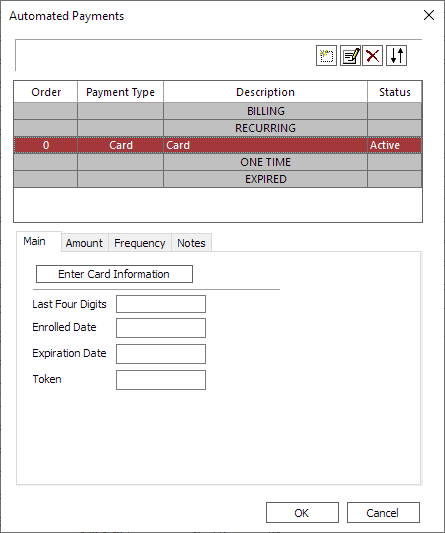

To configure a loan for an automated payment, query the loan and click  Automated Payments on the Home tab of the ribbon bar.

Automated Payments on the Home tab of the ribbon bar.

Add Add |

Add a new automated payment. |

Modify Modify |

Modify the selected automated payment. |

Delete Delete |

Delete the selected automated payment. |

Re-Sequence Re-Sequence |

Re-sequence the automated payments. |

ACH/AFT and Card

Click  to put in an order for an ACH

to put in an order for an ACH

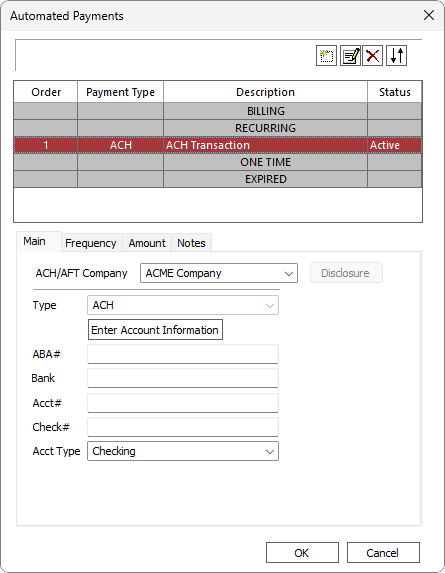

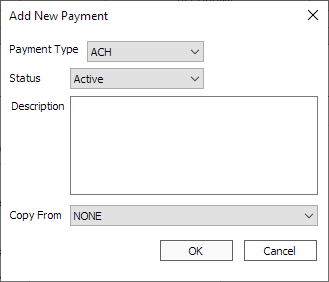

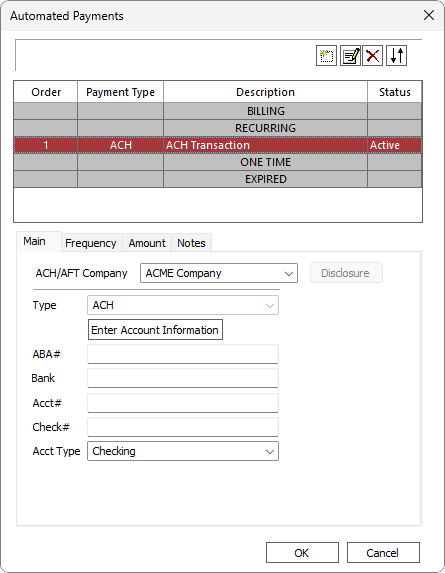

On the Add New Payment dialog, select ACH or Card as the Payment Type, set a status and enter a description. The default status is Active, but the payment order can also be Disabled or Expired.

To copy all the information as configured from an existing payment, select it from the Copy From drop down list. Otherwise leave this as NONE.

Main Tab for ACH/AFT

On the Main tab, enter information for the customer’s checking account.

| ACH |

If you have configured multiple ACH |

| Type | Shows the type of automated transfer. |

|

Disclosure5.41+

|

Displays the disclosure as configured for the ACH/AFT company. |

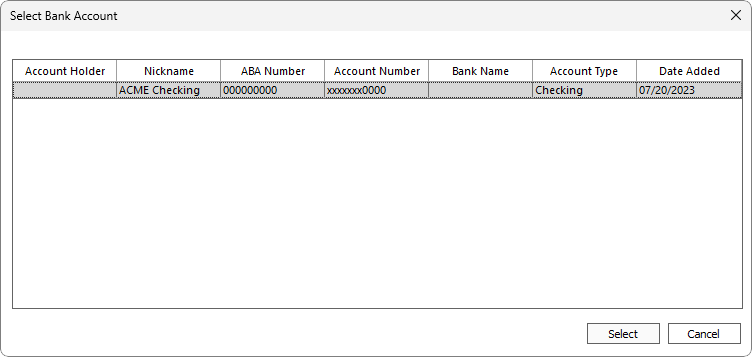

| Click to select from a list of bank accounts from the borrower's wallet. | |

| ABA# | The ABA number of the bank that has the checking account that is to be used for the automated draws. |

| Field will populate automatically when a valid ABA# is entered. | |

| Acct# | The account number of the checking account that is to be used for the automated draws. |

| Check# | Optional. The check number of the check that was voided by the customer in setting up the automated draw. All of the automated draws effectively go through with that check number, so the check must be voided by the customer and not used. |

| Acct Type | Either Checking or Savings. |

| Available when the ACH Company’s SEC code is set to Auto. | |

| EFT Type | This feature is not yet implemented. |

Main Tab for Card

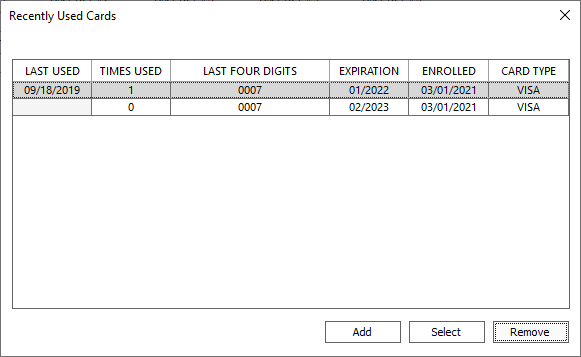

Click Enter Card Information to select a payment card to associate with this order.

Amount Tab

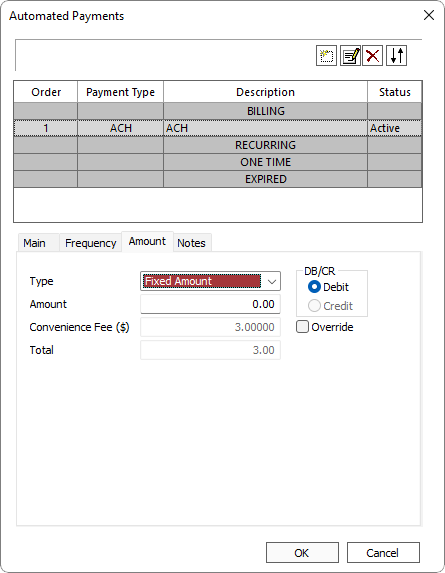

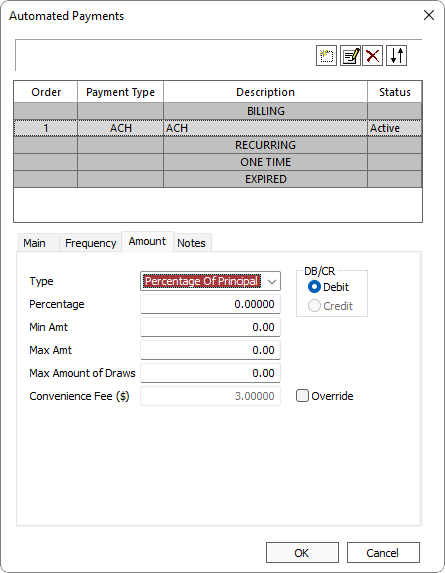

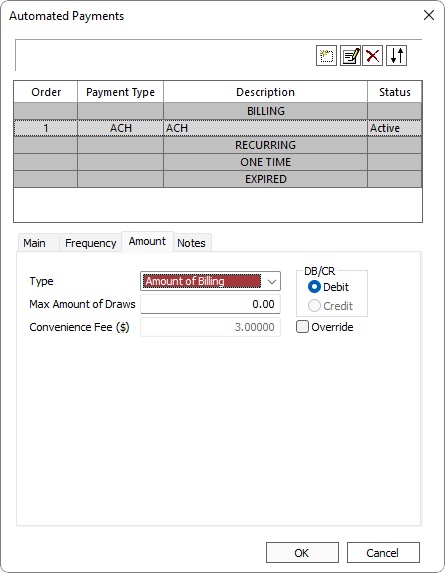

On the Amount tab, enter information about the transaction.

| Type |

Either a fixed amount, a percentage of the principal, or the amount scheduled to be billed.

Note Amount of Billing can only be used when the Frequency Type is set to Billing. |

| Amount | Only exists if type is fixed. This is the amount to be drawn in the ACH |

| Max Amount of Draws | When the total amount of the ACH |

| Debit |

If selected, the ACH Note Deduction to the borrower's account. |

| Credit |

If selected, the ACH Note Deposit to the borrower's account. |

| Percentage | Only exists if type is set to percentage of principal. This is the percentage of the principal that will be drawn. |

| Min Amt | If the amount derived by the percentage is less than this amount, this amount will be used. Convenience fee is included in the determination of this amount. |

| Max Amt | If the amount derived by the percentage is greater than this amount, this amount will be used. Zero in this field represents no maximum amount. Convenience fee is included in the determination of this amount. |

| Max Amount of Draws | When the total amount of the ACH/AFT draws reaches this value, the ACH |

| Advance Trans Code | Available when set to Credit. Select the transaction code to be used on an advance. |

| Available when set to Debit. The convenience fee (fixed amount or percentage) as configured for the selected frequency type will be shown. Select Override to enter a value other than the configured value. The convenience fee is not counted towards a loan’s payoff. The convenience fee is not counted when checking for payments between a failed ACH and a representment. |

|

|

Total5.30+

|

Available when set to Debit and only for Fixed Amount type. Automatically calculated as Amount plus Convenience Fee. |

The Debit/Credit option availability will be determined by the user’s privilege as granted in the Loan > ACH Setup privilege settings.

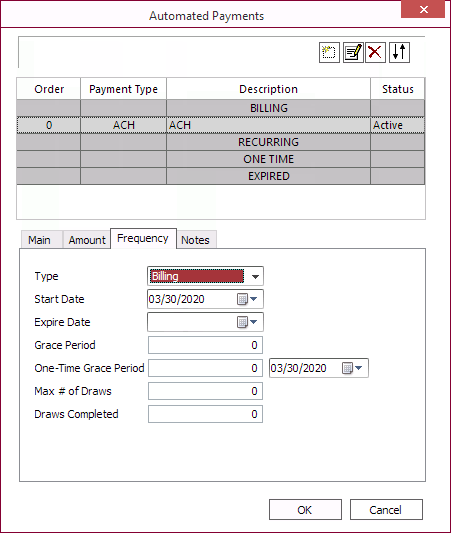

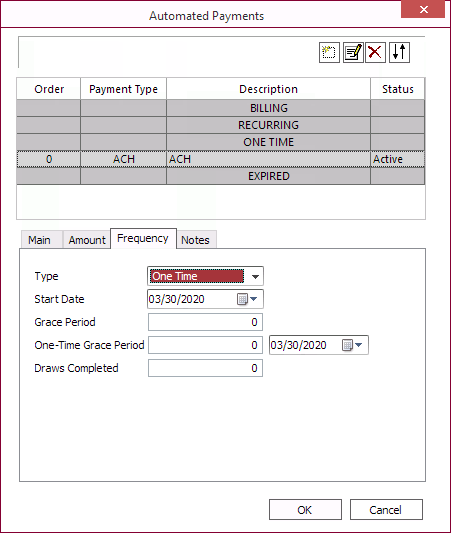

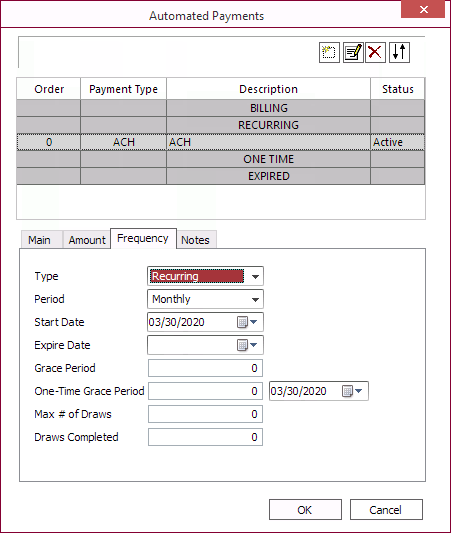

Frequency Tab

On the Frequency tab, configure under what conditions an ACH

| Type |

|

|||

| Period | For Recurring ACH |

|||

| Start Date | The date of the first ACH |

|||

| Next Date | The date of the next ACH |

|||

| Expire Date | If set, there will be no ACH |

|||

| Grace Period |

The Grace Period is added to the ACH Example ACH date is August 1st and Grace Period is set to 3. This ACH will appear on any NACHA file that includes August 4th and August 4th is the date that will appear on the NACHA file. The pending transaction which will be posted in NLS to process the payment will have an effective date of August 1st if the Effective Date is set to Due Date (default behavior). If the Effective Date is set to Post Date, it will reflect the August 4th date. In either case, the amount of the transaction will show in the Pending field on the main screen until accrual processing occurs on August 4th (the date of the actual draw). |

|||

|

Same as Grace Period but only applies to the next ACH/AFT and overrides Grace Period. Once the ACH/AFT is drawn, this will reset to 0.

The One-Time Grace Period may be entered as a number of days or by selecting a date within 20 days from the next ACH/AFT draw date using the date picker. Changing the value of one will be reflected in the other. |

||||

| Max # of Draws | When the count of total draws equals this number, there will be no further draws. | |||

| Draws Completed | A count of the number of draws that have already been done. |

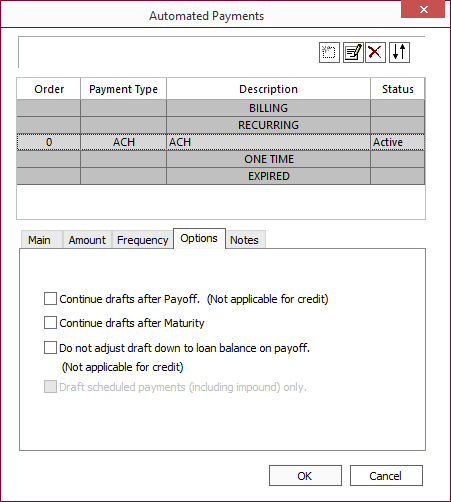

Options Tab

Note

Beginning with NLS 5.6, the Options tab has been moved to Setup > Loan Setup > Automated PaymentsThe Options tab allows for setting rules exclusions.

| Continue drafts after Payoff | By default, ACH drafts end whenever a payoff transaction is executed. Selecting this option overrides that default. |

| Continue drafts after Maturity | By default, ACH drafts end upon the maturity date of the loan. If the mature loan is not paid off, it may be necessary for the drafts to continue. Selecting this option will allow drafts to continue after maturity. |

| Do not adjust draft down to loan balance on payoff | By default, whenever an ACH draft will result in a payoff that overpays the loan, the draft amount will be adjusted down to just payoff the loan, so that no refund is required. Selecting this option will override that default. |

| Draft scheduled payments (including impound) only | Only available when the frequency type is set to Billing. Only scheduled payments are included in ACH drafts. |

Notes Tab

Any text that you would like to record about this particular customer’s ACH

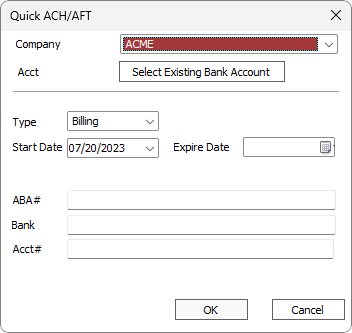

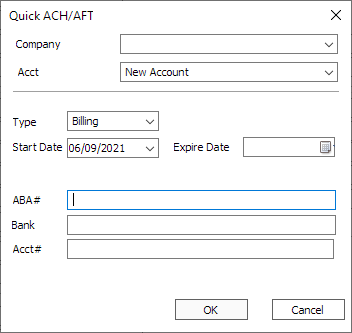

Quick ACH/AFT Setup

Quick ACH/AFT Setup

NLS 5.9 and later

AFT support available in NLS 5.27 and later

Query a loan and click  Quick ACH/AFT Setup to add an ACH/AFT to a loan with minimal configuration.

Quick ACH/AFT Setup to add an ACH/AFT to a loan with minimal configuration.

| Company | Select the ACH/AFT Company to use from the drop down list. |

| Acct |

Previous accounts configured in the Automated Payments configuration will be listed in the drop down list showing the last four digits of the ABA# and Acct#.

Select New Account to enter a new account information.5.36- Click Select Existing Bank Account to select from a list of bank accounts from the borrower's wallet.5.37+

|

| Type | Select Billing, One Time, or Recurring from the drop down list. See the Frequency Tab section for information on the fields available for each type. |

Security for access to the Quick ACH/AFT dialog is configured in each user’s/group’s privilege setting under Loan > Quick ACH Setup.

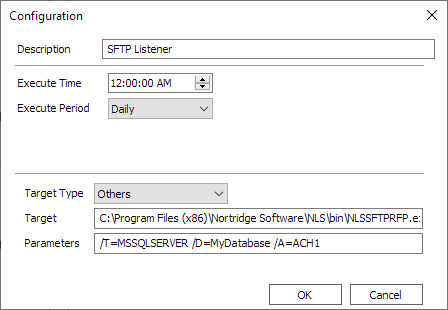

SFTP Listener

NLS 5.16 and later

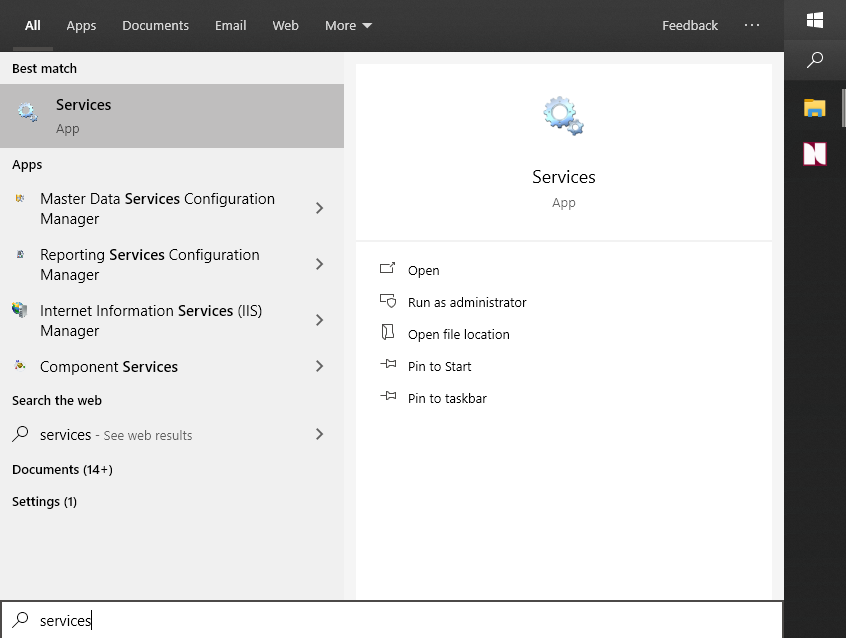

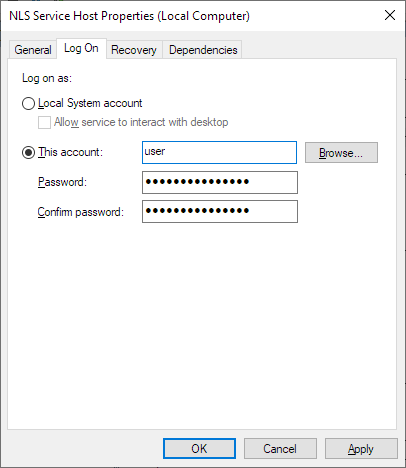

A helper application—NLSSFTPRFP.exe—can be used to monitor SFTP sites to listen for changes and to start the processing of ACH/AFT return files when new return files appear. To allow this service to connect to the database using your Windows credentials, the NLS Service Host must be configured as follows:

- Run the Services app by clicking on the search field in the Task Bar and type in services.

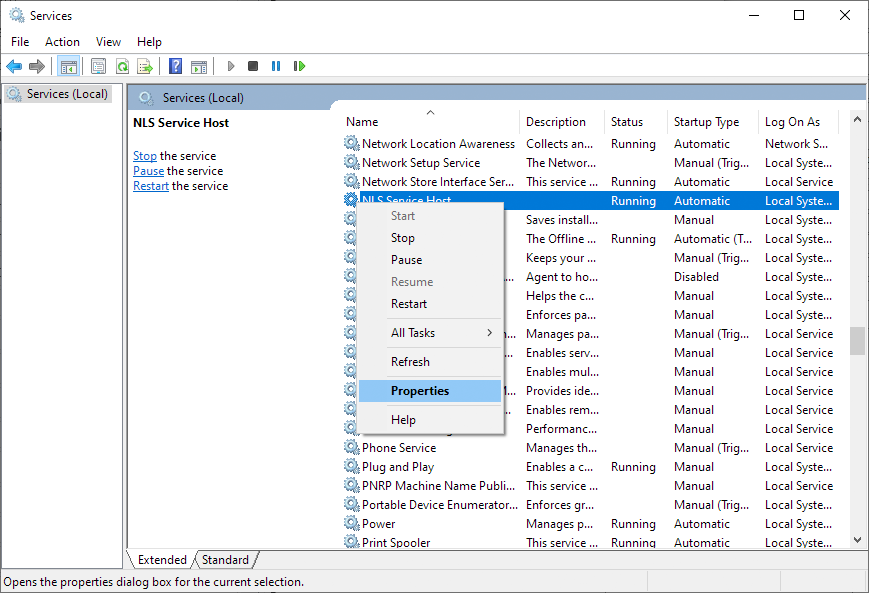

- Scroll down the list of services. Right click on NLS Service Host and select Properties.

- In the Log On tab click This account and enter your credentials used to log into your computer and click OK.

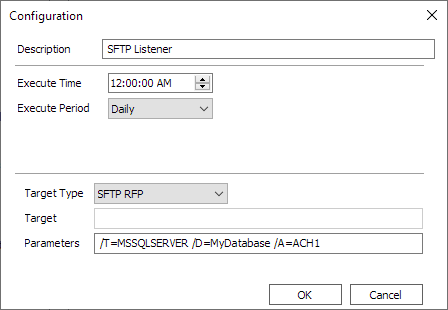

- In Setup > System > NLS Service, add a new configuration and set Target Type to Others. Specify the full path to the NLSSFTPRFP.exe file in the Target field and the parameters to use in the Parameter field.

NLS 5.26 and later

Select SFTP RFP from the Target Type drop down list. The target has been pre-configured to point to the default installation location of the NLSSFTPRFP.exe file.SFTP RFPOthers

The following parameters may be passed to NLSFFTPRFP.exe.

| Parameter | Notes |

|---|---|

| /T | Database type. MSSQL (also MSSQLSERVER) or ORACLE. Not required.5.26+ |

| /S | Server name. Not required.5.26+ |

| /D | Database name. Not required.5.26+ |

| /U | Username. Windows authentication is used if /U and /P are not specified. Not required.5.26+ |

| /P | Password. Windows authentication is used if /U and /P are not specified. Not required.5.26+ |

| /F | Path to a local directory where the remote files are temporarily saved. Local copies are deleted after processing. |

| /R | Remote directory. |

| /X | Remote archive. Path to remote directory to where post processed files are moved. Optional. |

| /K | Path to a local directory where the decrypted files are temporarily saved. Optional. If undefined, /F will be used. Local copies are deleted after processing. |

| /A | Use NLS ACH/AFT SFTP settings to connect. If defined, /I, /O, /N, or /C are not used. If the SFTP Name contains a space, use ID#. |

| /I | SFTP host. /O, /N, and /C are required. |

| /O | SFTP port number. /I, /N, and /C are required. |

| /N | SFTP username. /I, /O, and /C are required. |

| /C | SFTP password. /I, /O, and /N are required. |

| /H | ACH/AFT header to use. |

| /E | Do not delete temporary local files after processing. |