Status Codes

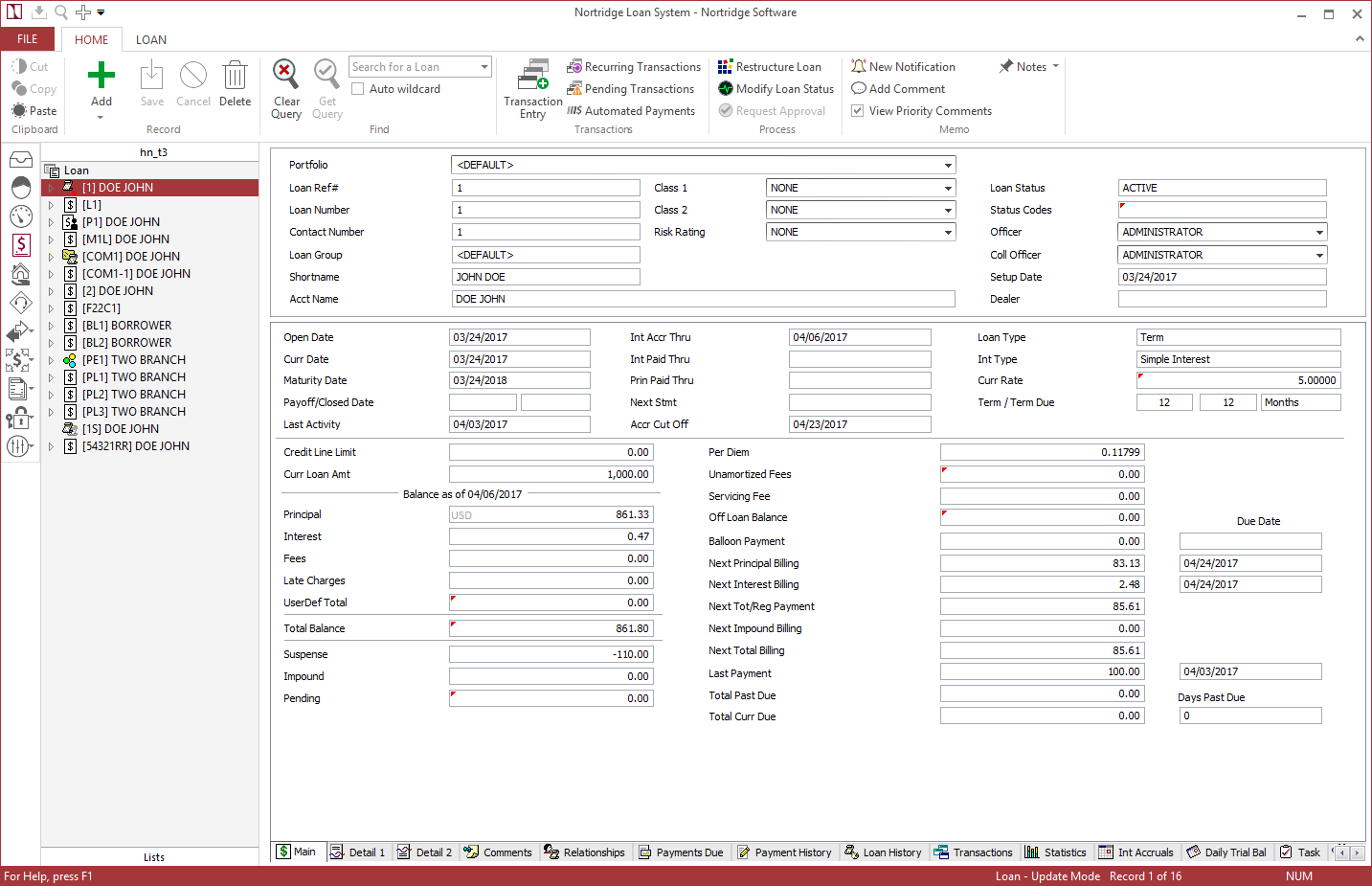

NLS has two fields that define the status of a loan. The first is Loan Status, which will always be assigned one of the following settings:

| Active | The loan is open and NLS is actively processing the loan. |

| Cancelled | The loan has been voided. |

| Closed | The loan is paid off and NLS is no longer processing the loan. |

| Draft | The loan is pending approval triggered by the “Execute loan approval” to-do rule. |

| Renewal | The loan has been renewed. |

| Rescission | The loan has been rescinded. |

| Restructured | The loan has been restructured. |

The definitions of these settings cannot be modified. However, you may enter your own custom status codes in the Status Codes sub-category under Loan Setup to perform different functions to a loan. All loans will have one Loan Status, and in addition, may have one or more Status Codes which can also be used to query and filter reports. You will find that a Status Code is an option for most standard reports provided with NLS. As a result, Status Code(s) is an easy way to filter, sort, or group your reports.

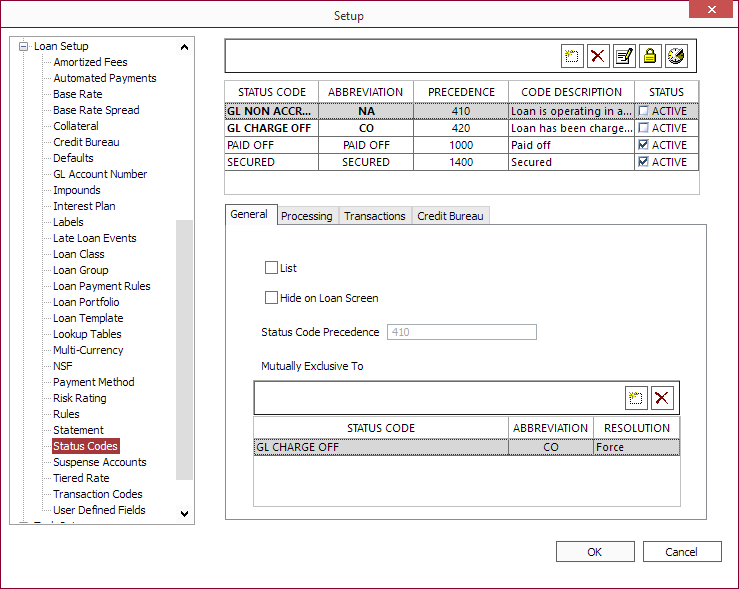

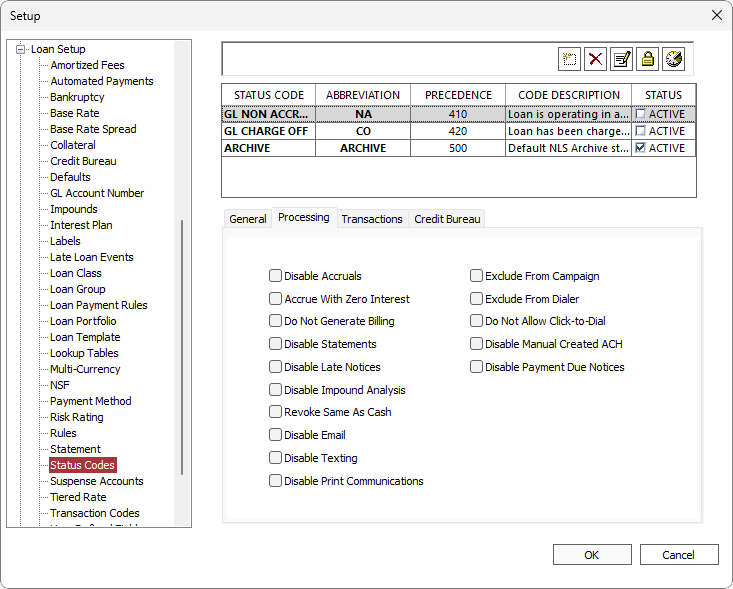

General tab of Status Codes setup window.

To add a new Status Code, click Add  at the top of the window, enter a name and description for the Status code, and click OK. Then you may select which features are to be disabled for loans which belong to that Status Code.

at the top of the window, enter a name and description for the Status code, and click OK. Then you may select which features are to be disabled for loans which belong to that Status Code.

General Tab

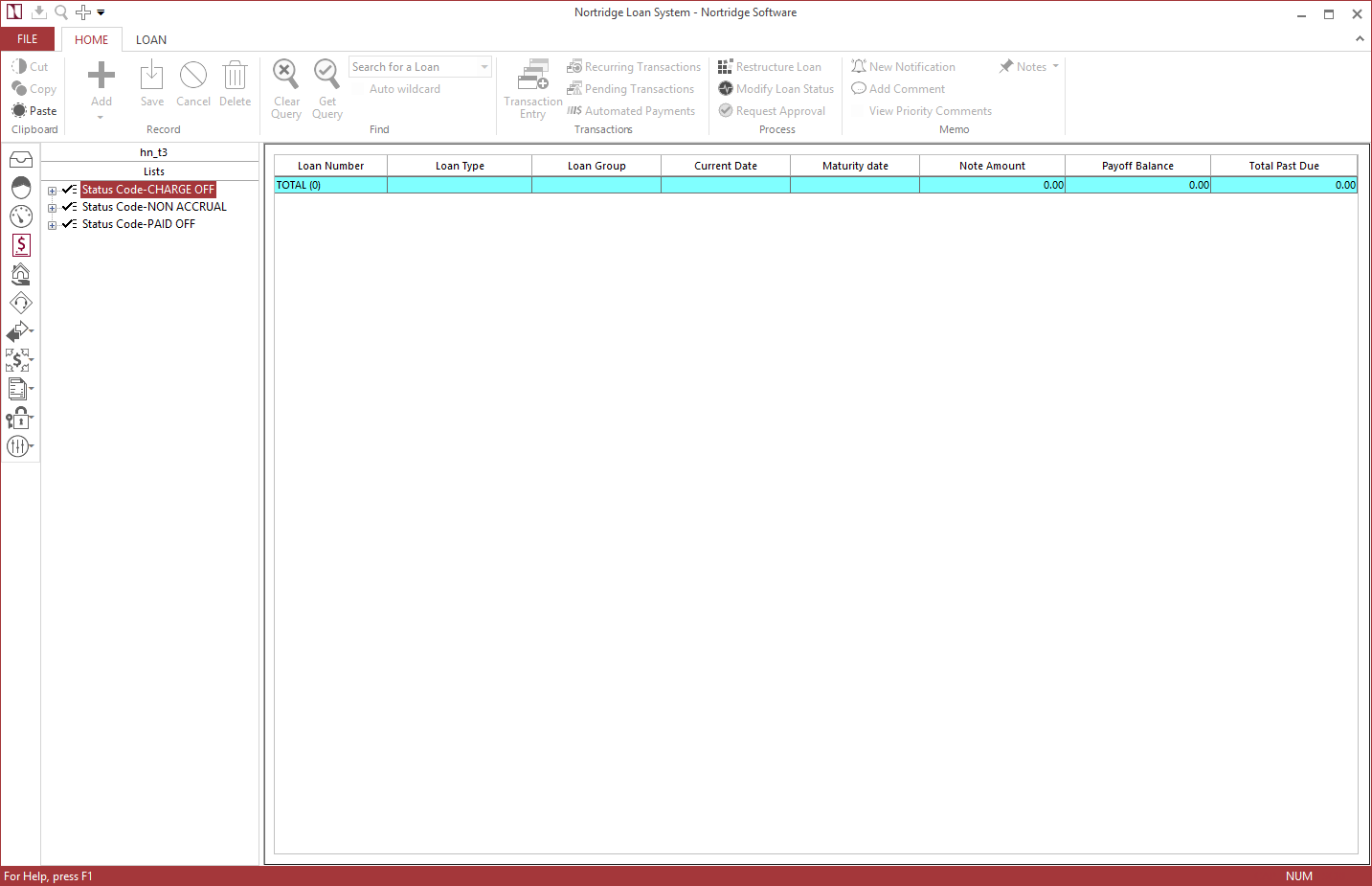

List Option

When selected, the status code will be included in the Lists tree view.

If the List option is selected for one or more status codes, a Lists tree view will become available.

Hide on Loan Screen

When selected, the status code will not be displayed in the Status Codes field on the loan screen. However, the status code will still appear in the tooltip when the cursor is hovered over the Status Code field and in the status codes dialog.

Status Code Precedence

Every status code is assigned a precedence number. Status codes with lower precedence numbers will overrule status codes with a higher precedence. If a loan has multiple status codes that will have conflicting effects, the loan will ignore the conflicting selection from the status code with the higher precedence.

To modify the precedence of a status code, click  Modify.

Modify.

Mutual Exclusivity

If status codes are setup to be mutually exclusive to other status codes, NLS will prevent both status codes from being applied to a loan at the same time.

The primary status code can have status codes in the Mutually Exclusive To list that can reject or force a selection of the primary status code. The resolution assigned to a mutually exclusive status code is the action taken on the primary status code when a mutually exclusive status code is already set or selected on a loan and an attempt is made to select the primary status code.

| Reject | If the mutually exclusive status code is already selected, the primary status code cannot be selected. |

| Force | If the mutually exclusive status code is already selected, selecting the primary status code will deselect the mutually exclusive status code. |

Example

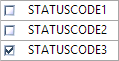

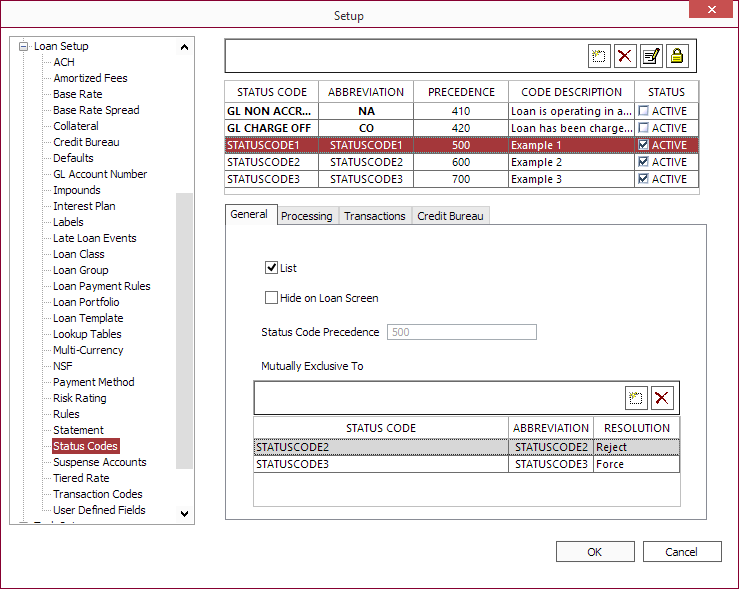

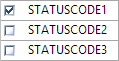

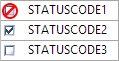

STATUSCODE1 has in its Mutually Exclusive To list, STATUSCODE2 set to Reject and STATUSCODE3 set to Force:

When modifying a loan's status code:

| Current Status | Action | Result |

|---|---|---|

|

|

Select STATUSCODE1 |

|

|

|

Select STATUSCODE1 |

STATUSCODE3 deselected |

|

|

Select STATUSCODE2, STATUSCODE3 |

|

In order to make two status codes mutually exclusive to each other, each status code must have the other status code in its Mutually Exclusive To list and set to Reject or Force.

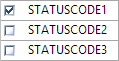

Example

STATUSCODE1 has in its Mutually Exclusive To list, STATUSCODE2 set to Reject and

STATUSCODE2 has in its Mutually Exclusive To list, STATUSCODE1 set to Reject.

When modifying a loan's status code:

| Current Status | Action | Result |

|---|---|---|

|

|

Select STATUSCODE2 |

|

|

|

Select STATUSCODE1 |

STATUSCODE1 cannot be selected |

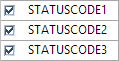

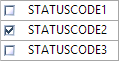

Example

STATUSCODE1 has in its Mutually Exclusive To list, STATUSCODE3 set to Force and

STATUSCODE3 has in its Mutually Exclusive To list, STATUSCODE1 set to Force.

When modifying a loan's status code:

| Current Status | Action | Result |

|---|---|---|

|

|

Select STATUSCODE3 |

|

|

|

Select STATUSCODE1 |

STATUSCODE3 deselected |

Example

STATUSCODE2 has in its Mutually Exclusive To list, STATUSCODE3 set to Force and

STATUSCODE3 has in its Mutually Exclusive To list, STATUSCODE2 set to Reject.

When modifying a loan's status code:

| Current Status | Action | Result |

|---|---|---|

|

|

Select STATUSCODE2 |

STATUSCODE3 deselected |

|

|

Select STATUSCODE3 |

|

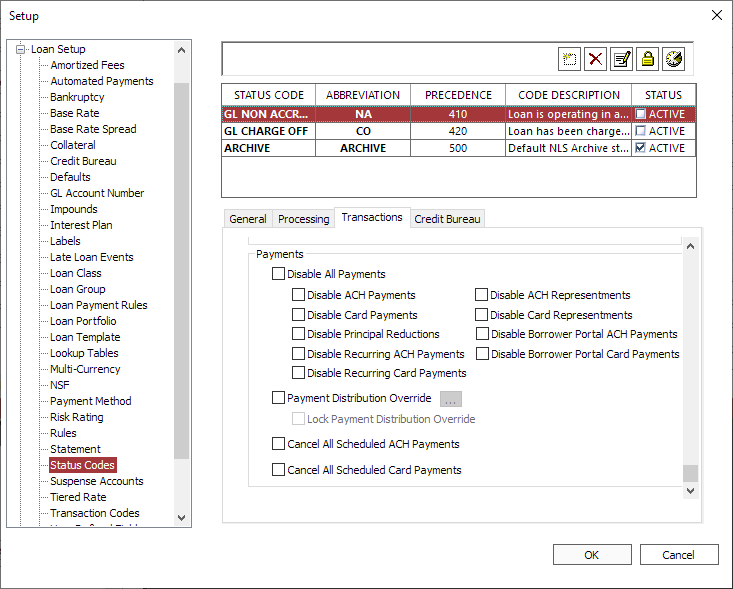

Processing Tab

Processing tab of Status Codes setup window.

| Disable Accruals | All accrual processing will be suspended for any loan that has a status code on which this option is selected. Because any loan is required to have its accruals up to date before any transactions can be processed, this status effectively shuts down all payment processing as well. In addition, no loan that has had accrual processing disabled will appear on any Trial Balance Report, as balances are entered on the Daily Trial Balance table of the database during the accrual processing. |

| Accrue with Zero Interest | Accruals will continue at a zero percent (0%) interest rate on any loan that has a Status Code with this option selected. This option allows the loan to continue accruing instead of suspending accruals completely. |

|

Do Not Generate Billing |

Billings are not generated on any loan that has a Status Code with this option selected. |

| Disable Statements | Statements will not be placed in the print queue for any loan that has a Status Code with this option selected. This will prevent the new generation of statements, but will not stop the printing of statements that were placed in the queue prior to the modification of the loan’s status code. If an unprinted statement is in the queue, and an order is given to NLS to print all unprinted statements, the Status Code will have no effect on which statement is printed. |

| Disable Late Notices | Late Notices will not be placed in the print queue for any loan that has a Status Code with this option selected. This will prevent the new generation of Late Notices, but will not stop the printing of Late Notices that were placed in the queue prior to the modification of the loan’s status code. If an unprinted Late Notice is in the queue, and an order is given to NLS to print all unprinted Late Notices, the Status Code will have no effect on which Late Notice is printed. |

| Disable Impound Analysis | Impound analysis will not occur for any loan that has a Status Code with this option selected. |

| Revoke Same As Cash | Same as Cash option is revoked from any loan that has a Status Code with this option selected. |

| No email communication will be sent for any loan that has a Status Code with this option selected. | |

|

Disable Texting5.4+

|

No text messaging will be sent for any loan that has a Status Code with this option selected. |

| Print communications configured for events in Setup > System > Communication > Communication Preferences will not be processed for any loan that has a Status Code with this option selected. | |

| Loans that have a Status Code with this option selected will not appear in a campaign in collector mode. | |

|

Exclude from Dialer5.6+

|

Reserved for dialer file exporting. Loans that have a Status Code with this option selected will not be included in the exported dialer file. |

|

Do Not Allow Click-to-Dial5.6+

|

Loans that have a Status Code with this option selected will prevent the action of double-clicking a phone number to dial out. |

|

Disable Manual Created ACH5.7.3+

|

ACH/AFT automated payments cannot be added to loans that have a Status Code with this option selected. |

| 5.41+ | When selected, will prevent loans with this status code from generating and sending payment due notices. |

Note

A note about Disable Accruals setting: It is strongly recommended that this option is not selected when simply putting a loan on a “non-accrual state.” The accrual process performs 17 different steps, not just the calculation and accrual of interest. If this setting is selected, none of those steps will occur. If you are simply trying to stop the accrual of interest on the loan, it is recommended that you change the interest rate to 0% instead; the loan will continue to accrue (and complete the 17 steps) without adding interest to the loan. Should you decide at a later time that you want to change the interest rate (to start accruing interest again or to go back in time and reinstate the original interest rate), you can do that at any time. And when you do that, it will ask you for an effective date for this change.Transactions Tab

Transactions tab of Status Codes setup window.

| Disable All Transaction Processing | No transactions, standard or manual, may be processed on loans with a Status Code which has this option selected. |

| Disable Principal Advances | The standard Principal Advance transaction (trans code 100) may not be run on loans with a Status Code that has this option selected. This will not prevent the application of a manual transaction code that has been configured to do the same thing. |

|

Disable NSF Fees5.0.1+

|

No NSF fees are added to a loan with a Status Code that has this option selected. |

|

Disable Late Fees5.0.1+

|

No late fees are added to a loan with a Status Code that has this option selected. |

| Disable All Payments | For any loan that has a Status Code with this option selected, all payment type transactions will be disabled. A payment type transaction is defined as any transaction which will pay down an existing receivable item that is on the Payments Due tab. This includes trans codes 200, 202, 204, 206, 208, 210, 250, 252, 254, and any user-defined transaction code for which the Payment option has been selected on the Payment Processing tab. |

| Disable ACH Payments | For any loan that has a Status Code with this option selected, all ACH payments will be disabled. |

| Disable Card Payments | For any loan that has a Status Code with this option selected, all card payments will be disabled. |

| Disable Principal Reductions | The standard Principal Reduction transaction (trans code 220) may not be run on loans with a Status Code that has this option selected. This will not prevent the application of a manual transaction code that has been configured to do the same thing. |

| Payment Distribution Override | Any loan that has a Status Code with this option selected will use the transaction payment distribution priority as defined by clicking the  button. Use the Up and Down buttons to rearrange the payment distribution accordingly with the highest priority item at the top. button. Use the Up and Down buttons to rearrange the payment distribution accordingly with the highest priority item at the top. |

| Lock Payment Distribution Override | Select this option to lock the priority distribution override so that it cannot be changed during transaction entry. |

| For any loan that has a Status Code with this option selected, ACH representments will be disabled. | |

| For any loan that has a Status Code with this option selected, ACH representments will be disabled. | |

|

Disable Card Representments5.24+

|

For any loan that has a Status Code with this option selected, card representments will be disabled. |

| For any loan that has a Status Code with this option selected, all recurring and billing ACH payments will be disabled. | |

| For any loan that has a Status Code with this option selected, all recurring card payments will be disabled. One-time payments are allowed. | |

| Only applies to the Borrower Portal. For any loan that has a Status Code with this option selected, ACH payments cannot be created through the Borrower Portal. |

|

| Only applies to the Borrower Portal. For any loan that has a Status Code with this option selected, card payments will be disabled. |

|

| For any loan that has a Status Code with this option selected, all scheduled ACH payments will be canceled. Removal of this status code at a future date will not reinstate the automated processing of the canceled ACH payments. | |

|

Cancel All Scheduled Card Payments5.24+

|

For any loan that has a Status Code with this option selected, all scheduled card payments will be canceled. Removal of this status code at a future date will not reinstate the automated processing of the canceled card payments. |

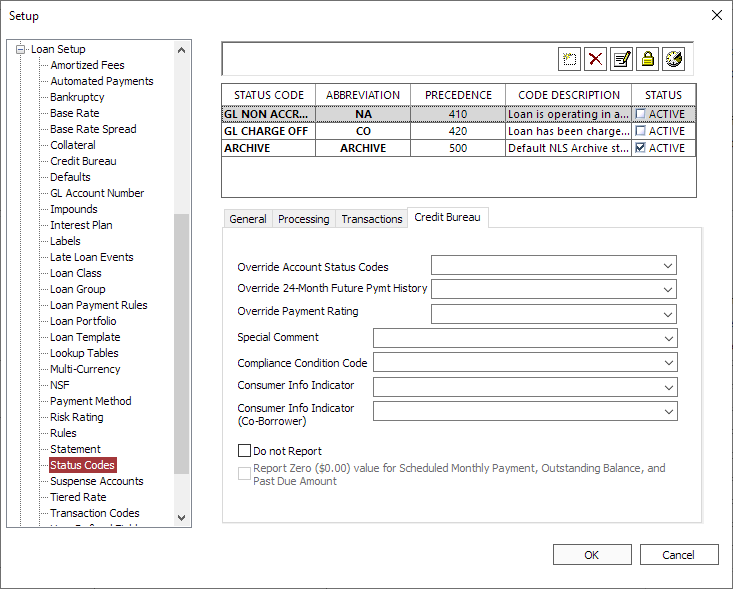

Credit Bureau Tab

Credit Bureau tab of Status Codes setup window.

| Override Account Status Codes | If needed the account status code can be overridden by choosing the appropriate item from the drop down list. |

| Override 24-Month Future Pymt History | If needed the 24 month future payment history data can be overridden by choosing the appropriate item from the drop down list. Only applies to this status code and does not affect the credit bureau setup.5.21+ |

| Override Payment Rating | If needed the payment rating can be overridden by choosing the appropriate item from the drop down list. |

| Special Comment | Special Comment may be used in conjunction with the Account Status to further define the account. |

| Compliance Condition Code | Allows the reporting of a condition that is required for legal compliance (e.g., according to the Fair Credit Reporting Act (FCRA) or Fair Credit Billing Act (FCBA)). |

| Consumer Info Indicator | Contains a value that indicates a special condition of the account that applies to the primary consumer. This special condition may be that a bankruptcy was filed, discharged, dismissed, or withdrawn; a debt was reaffirmed; or the consumer cannot be located or is now located. The indicator should be reported one time and will be deleted only when the condition no longer exists. Note When set to Blank, the consumer info indicator from the previous period will continue to be reported. |

| Contains a value that indicates a special condition of the account that applies to the co-borrower. | |

| Do not Report | When selected, the loan will be excluded from the credit bureau report. |

|

Only applicable to Bankruptcy CII Code A through H or Z. When selected, the Scheduled Monthly Payment, Outstanding Balance, and Past Due Amount on a loan’s Metro 2 will be reported as zero (0.00) value. |

Delete

Delete Trustee

Trustee

View

View Show Differences

Show Differences