Loan Payment Rules

Loan Payment Rules may be used to count a short payment as satisfied in full if the amount of the payment exceeds a certain required threshold. In the event that this occurs, the billing amount is automatically modified so that the amount billed is equal to the amount paid. The adjustment will be shown as a payment threshold rule applied transaction type in the transaction history of the loan. This does not cause any additional change to the balances of the loan which could result in a balloon payment.

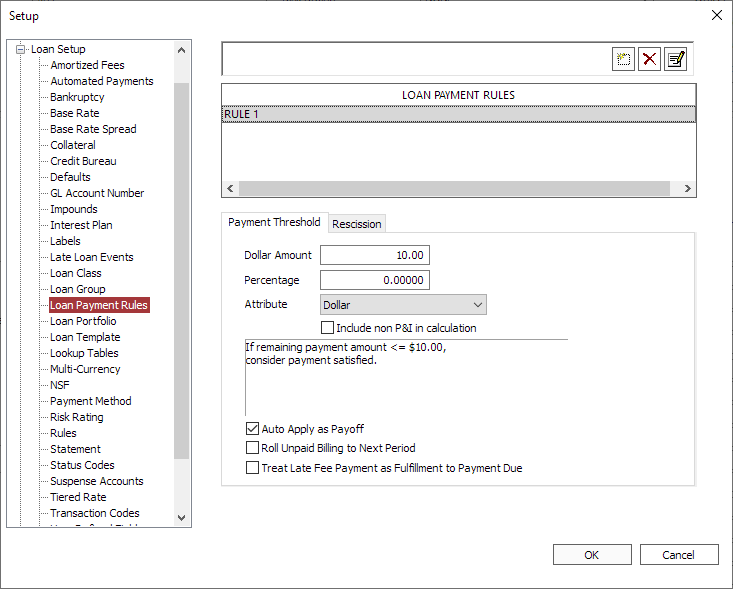

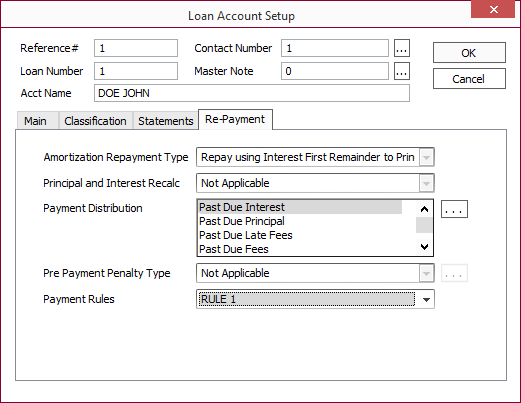

The rules are set up in the Loan Payment Rules section of Loan Setup (fig. a), and assigned to a specific loan with the Payment Rules drop down list on the Re-payment tab of that loan (fig. b).

Figure a – Loan Payment Rules section of Loan Setup

Figure b – Loan Account Setup Re-Payment tab of a loan.

To specify a set of rules, go to Loan Setup > Loan Payment Rules, and click  .

.

Give the rule a name and click OK.

Specify a dollar amount and/or a percentage, and one of the following attributes:

| Both Dollar and Percentage | For the payment to be Satisfied, the amount remaining must be less than the specified dollar amount and also must be less than the specified percentage of the payment. |

| Either Dollar or Percentage | For the payment to be Satisfied, the amount remaining must be either less than the specified dollar amount or less than the specified percentage of the payment. |

| Dollar | For the payment to be Satisfied, the amount remaining must be less than the specified dollar amount. |

| Percentage | For the payment to be Satisfied, the amount remaining must be less than the specified percentage of the payment. |

Include non P&I in calculation/Include fees and other balances in calculation: If selected, any fees and other balances attached to the billing will be used in the calculation of the payment including those used to determine payment rules.

Example

A loan billing with a P&I of $100 and a late fee of $5 has a loan payment rule applied to it with a $2 payment threshold. If the Include non P&I in calculation/Include fees and other balances in calculation option is selected, a payment of $99 will not satisfy the loan payment rule but a payment of $104 will. Although the payment is considered satisfied, $1 will remain on the late fee as non P&I fees are not reversed.Auto Apply As Payoff: If selected, any payment that is sufficient to payoff the loan will cause the payment to automatically act as if the payoff checkbox was selected on the payment and activate all associated payoff functionality. Note, that this is separate from the threshold for payment. Auto payoff requires payment in full. For automating a short payoff, see Rules.

NLS 5.14 and later

Roll Unpaid Billing to Next Period: when selected, any remaining P&I will be rolled over to the next billing if the payment made on the current billing is deemed satisfied.

If a payment made to an unbilled balance satisfies a billing, the billing will roll.5.22+

NLS 5.19 and later

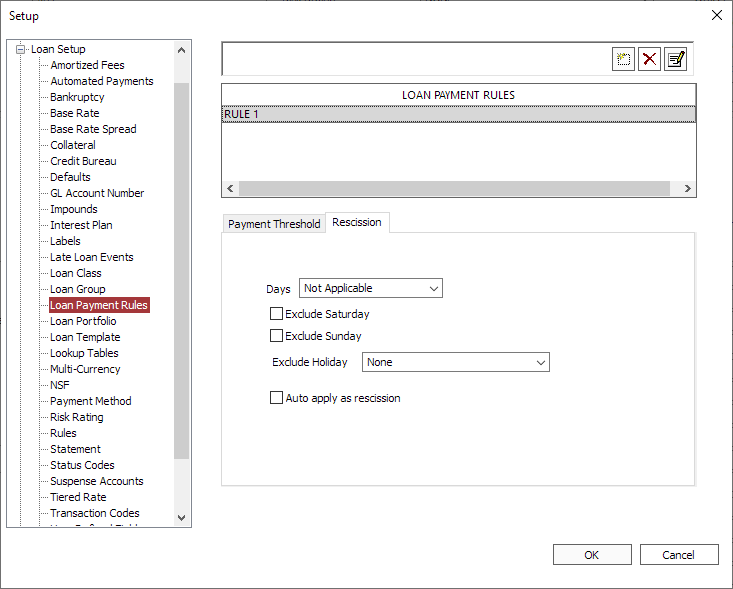

Treat Late Fee Payment as Fulfillment to Payment Due: when selected, any portion of a payment that is applied to late fees will be treated as a fulfillment to the remaining P+I balance.Rescission Tab

NLS 5.7.4 and later

Rules can be used to rescind a loan when a loan’s full amount of principal is paid off within a specified period of days. When a loan is rescinded, the borrower owes no fees or interest on the loan, all transactions are reversed and not written off, and the status code of Rescission will be set on the loan.

| Days | The number of days from the loan’s origination from which the loan can be rescinded when paid in full. |

| Exclude Saturday | Select to exclude Saturdays from the Days count. |

| Exclude Sunday | Select to exclude Sundays from the Days count. |

| Exclude Holiday | Choose a holiday schedule to exclude holidays from the Days count. |

| Auto apply as rescission | Select to automatically rescind a loan when the rules are satisfied. If this option is not selected, Payoff option must be selected in the Transaction Entry dialog or the Auto Apply as Payoff is set for the rule. |

The following conditions must be satisfied for a loan to be rescinded:

- Payment is equal to the principal balance

- Payment amount is greater than zero

- Payment must be made within the specified number of days

- No previous partial payments have been made on the loan

- The sum of all advances is equal to the current principal balance