Restructuring a Loan

The Restructure Loan feature is used for modifications to loans for which the complexity of the modification goes beyond what can be done through a simple modification of a parameter in loan setup. It is not required for such things as modifications to the interest rate setup, modifications to the next payment due date, un-billing of outstanding billed payments (in effect tacking them on to the end of the loan), or modification to the fixed payment amount. It is required any time a fixed amortized loan needs to be changed to any other type of loan, any time a non-fixed amortized loan is to be changed into a fixed amortized loan, a temporary cessation of payments or interest only period is to be imposed in the middle of a loan, or any time that two or more loans are to be combined and rewritten as one loan.

Note

Beginning with NLS 5.4, a fixed amortized loan does not need to be restructured when converting to a simple interest loan.The following loan is an example of a case where a loan might be restructured:

A home buyer borrowed $250,000 at 4% on a 30 year mortgage five years ago. All payments on the loan were made on time until six months ago, at which time the homeowner became unemployed. Payments were continued to be made on time for the next three months, but was unable to make any further payments, and at this time the loan is 96 days past due. Now having secured new employment, in order to bring the loan current, three months of past due payments must be made, one full payment for the current month, and pay $179.04 in late charges for a total of $4,953.20. The borrower, now employed, is capable of making the monthly payment, but is not capable of bringing the loan current. The bank is eager to avoid foreclosing on a borrower who is capable of making a monthly payment, but is not willing to take a loss on the past due interest and late charges which have already been accounted for as income. The bank agrees to a modification of the loan under the following terms:

- Outstanding interest and late charges shall be financed into the modified loan as principal.

- The term shall be extended to 30 years from the time of the modification.

- The first six months of the modified loan shall be interest only.

- The amortized payment amount shall be modified so as to pay off the loan in the 30 years from the date of modification. Taking the interest only period into account, the balance is being amortized over 29.5 years. If the interest and late fees being capitalized exceed the amount of principal that has been paid down over the last five years, this could result in a slight increase in the monthly payment amount.

- The interest rate of the loan is unchanged.

The servicer clicks  Restructure Loan.

Restructure Loan.

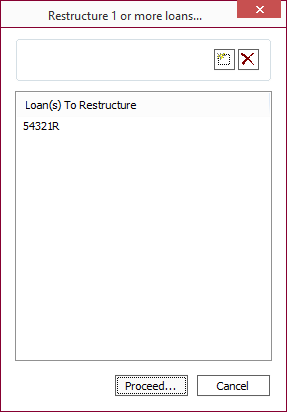

The servicer now has the option of adding additional loans that are to be combined in the restructure. In this case, the servicer is restructuring one loan only.

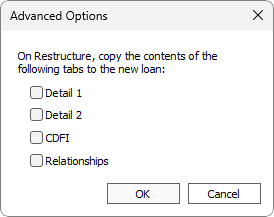

NLS 5.39 and later

Click Advanced… to transfer the contents of select tabs. This option is only available when restructuring a single loan.

The Servicer clicks Proceed…

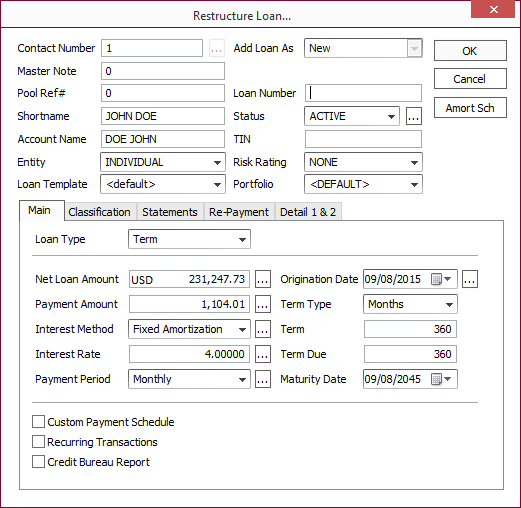

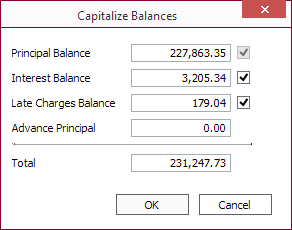

The loan number is entered. Clicking  next to Net Loan Amount shows that the amount of the restructured loan is composed of a combination of the outstanding principal, outstanding interest, and outstanding late charges. It appears that this does not exceed the original amount of the loan and it is likely that the extension of the term will actually result in a reduction of the monthly payment amount.

next to Net Loan Amount shows that the amount of the restructured loan is composed of a combination of the outstanding principal, outstanding interest, and outstanding late charges. It appears that this does not exceed the original amount of the loan and it is likely that the extension of the term will actually result in a reduction of the monthly payment amount.

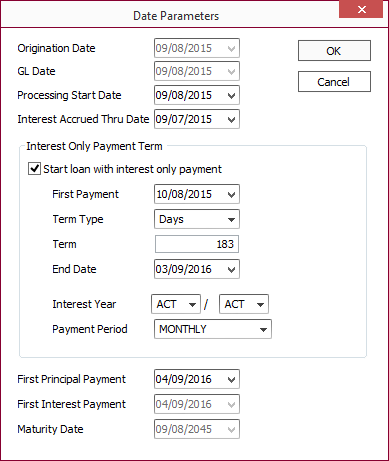

The interest only period is entered in the date parameters by clicking  next to Origination Date.

next to Origination Date.

The rest of the loan parameters are filled in as usual and the loan entered.

The borrower now has the benefit of six months with monthly payments of approximately $750 (about $330 less than the former monthly payment), followed by a remaining term with a payment of approximately $80 less than what was formerly being paid. In return for this benefit, the loan will be extended for an additional five years.

Restructuring a Participation Loan

Conditions to note when restructuring participation loans:

- Additional principal advance may not be added.

- Money cannot be moved among participants.

- Only one participated loan can be restructured.

The original value of participants cannot be preserved and any delta will be absorbed by the primary participant.

Example

Participated Loan Principal = $1,000; Interest = $1.53425

PRIMARY Principal = $500; Interest = $1.03562

Participant A Principal = $200; Interest $0.15342

Participant B Principal $300; Interest = $0.34521

Since only two decimal places can be moved, a delta of $0.01 will occur:

$1.03 + 0.15 + 0.34 = $1.52

The new loan needs to be $1,001.53 so the delta of $0.01 will be absorbed by the PRIMARY participant:

$1.04 + 0.15 + 0.34 = $1.53