Viewing a Loan

Loans must first be loaded into the search result tree before their data can be viewed. The details of the selected loan in the tree will then be displayed to the right in the main view area with all of its data organized into individual tabs.

Searching for Loans

To initiate a search, click  Get Query. This will load all loans in the database into the tree when no search criteria is specified.

Get Query. This will load all loans in the database into the tree when no search criteria is specified.

To locate a specific loan record, enter a search criteria for the loan in the global search field or enter a value to search for in each individual field and hit Enter or click  Get Query. Only loans that match all of the specified criteria will be loaded into the tree.

Get Query. Only loans that match all of the specified criteria will be loaded into the tree.

For information on increasing the efficiency of your searches using Metacharacters, see Search Criteria Metacharacters.

Click on a loan in the tree to display the details for that particular loan.

To clear the search result, click  Clear Query or hit F5 on the keyboard.

Clear Query or hit F5 on the keyboard.

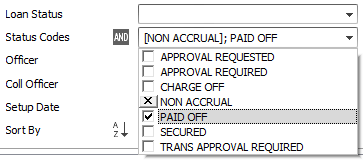

Querying by Status Code

Status codes can be included or excluded in the loan query screen by selecting the status code to be included  or excluded

or excluded  in the Status Codes drop down list. Click the checkbox to toggle between ignore, include, and exclude.

in the Status Codes drop down list. Click the checkbox to toggle between ignore, include, and exclude.

Ignore Ignore |

Status code is not used in the search criteria. |

Include Include |

Loans with the selected status code is specifically included in the search result. |

Exclude Exclude |

Loans with selected status code is specifically excluded from the search result. Excluded status codes are shown within [brackets] in the Status Codes field. |

NLS 5.6 and later

Right click and select Check All to select all status codes, Uncheck All to deselect all status codes, or Exclude All to exclude all status codes.

NLS 5.4 and later

Click the AND/OR button to toggle between matching all (AND) of the selected status code query criteria or any one (OR) of the selected criteria.

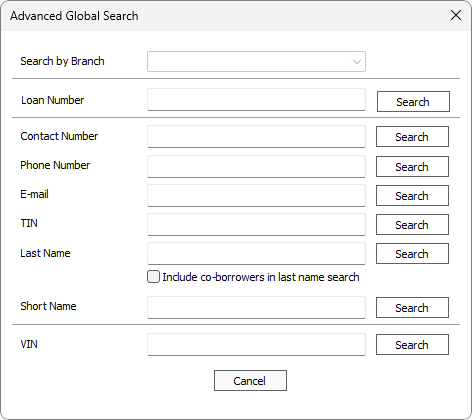

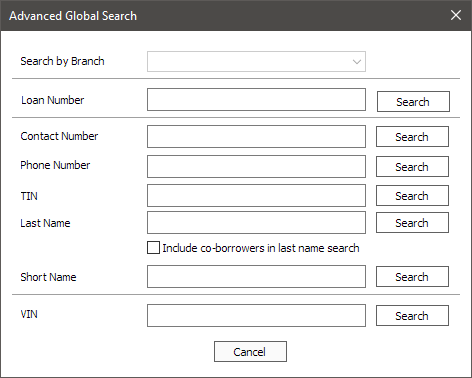

Advanced Global Search

NLS 5.6 and later

Click  Advanced Global Search to open a dialog to search only in one particular field.

Advanced Global Search to open a dialog to search only in one particular field.

Enter a search criteria into one of the fields and click Search to search only in that one particular field.

NLS 5.21 and later

Searches can be restricted to one particular branch by selecting the branch from the Search by Branch drop down list.Select Include co-borrowers in last name search to include co-borrowers when searching by Last Name. This option is only available for loan queries.

Saving Query Criteria

Query criteria can be saved for easy searches in the future. After performing a search, click on the search field and select Save last query criteria or click  . Enter a name for the query criteria in the blank field provided.

. Enter a name for the query criteria in the blank field provided.

Once a query is saved, it will be listed in the search field drop down list. Select the saved query criteria to perform a query based on the saved criteria.

The saved criteria listing order can be rearranged by clicking the arrow icons

shown to the right of each criteria. The criteria can be deleted by clicking

shown to the right of each criteria. The criteria can be deleted by clicking  .

.

Clicking  will prevent the criteria from being seen by other users. These criteria are labeled as being private.

will prevent the criteria from being seen by other users. These criteria are labeled as being private.

Click  to create groups to organize the criteria list. Criteria can be placed in a group by using the arrow icons to move them under the group name. Groups can be collapsed

to create groups to organize the criteria list. Criteria can be placed in a group by using the arrow icons to move them under the group name. Groups can be collapsed  and expanded

and expanded  as needed to hide or show its content.

as needed to hide or show its content.

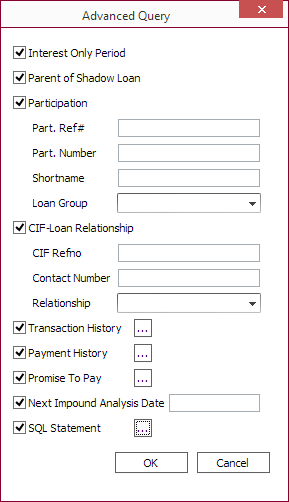

Advanced Query

Advanced Query

Additional search options are available by clicking  Advanced Query ....

Advanced Query ....

| Interest Only Period | Match loan that has the Beginning Interest Only Period option selected. | ||||

| Parent of Shadow Loan | Match loan that is a parent of a shadow loan. | ||||

| Participation |

|

||||

| CIF-Loan Relationship |

|

||||

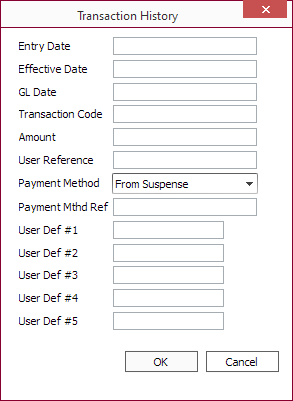

| Transaction History |

Click

|

||||

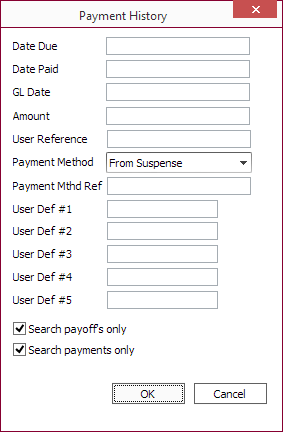

| Payment History |

Click

|

||||

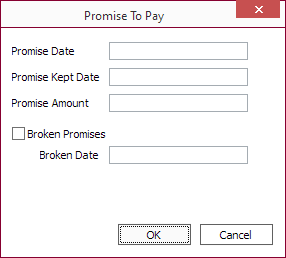

| Promise To Pay |

Click

|

||||

| Next Impound Analysis Date | Match loans with the specified date (MM/dd/yyyy) for its next impound analysis. | ||||

|

SQL Statement5.21+

|

Click Example: Search for loans whose last activity date falls within 12/10/2019 and 12/20/2019 SQL select acctrefno from loanacct where (last_activity_date between '2019-12-10' and '2019-12-20') Example: Search for loans whose ratio of the current loan amount to the current principal balance is 5:1. SQL select acctrefno from loanacct where (current_principal_balance/current_note_amount) < .2 Example: Search for the first 10 loans whose total past due balance is greater than 500. SQL select top 10 acctrefno from loanacct where total_past_due_balance > 500 |

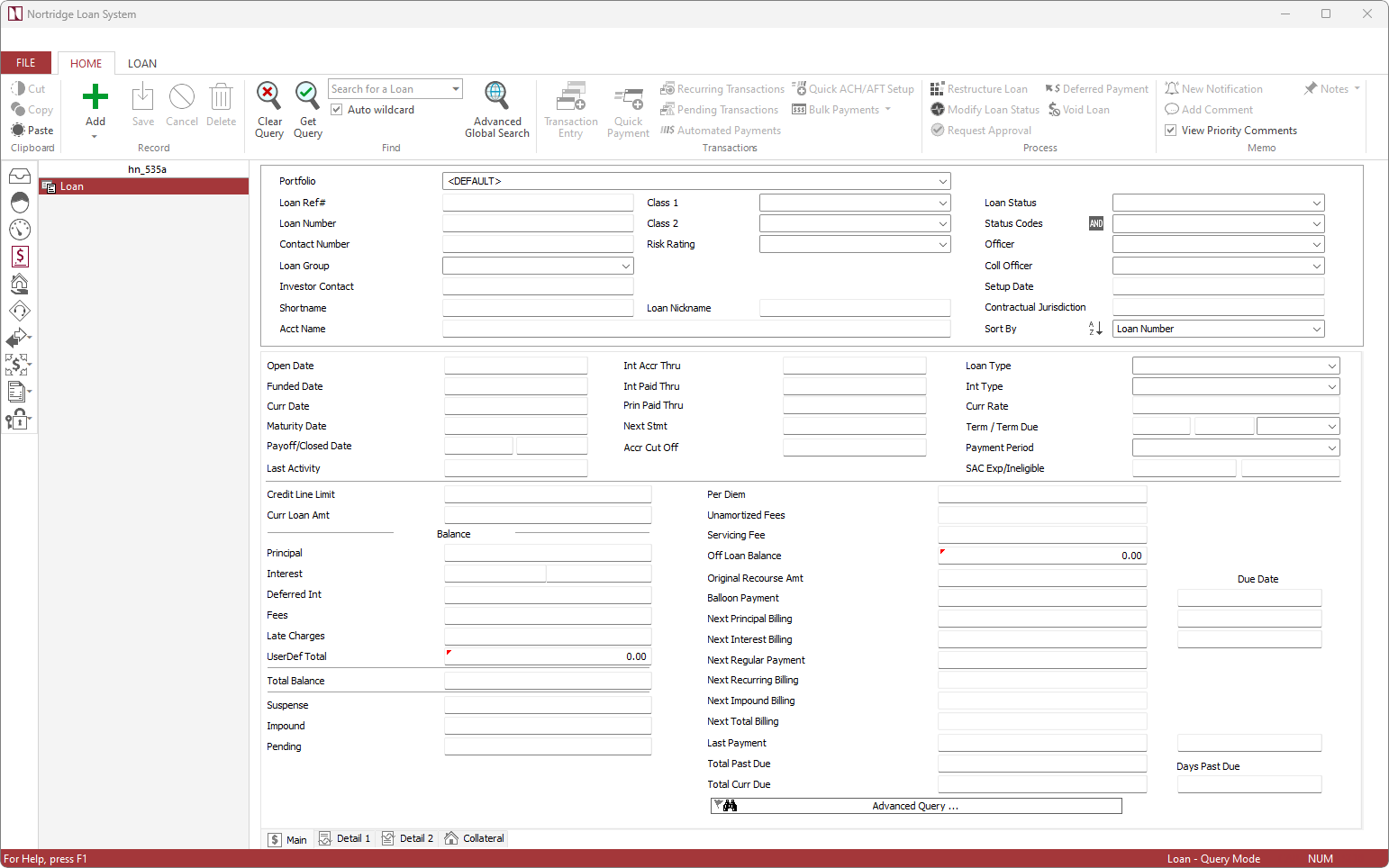

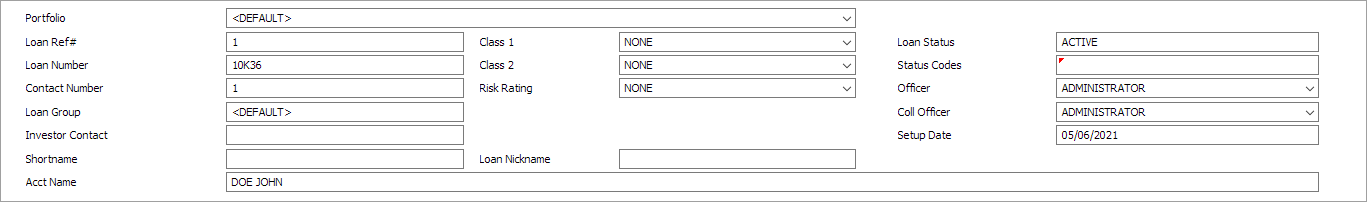

Loan Detail

The top section of the loan view contains the primary details of the loan that was entered when the loan was added to the database. This section is visible at all times and some of the fields can be modified directly. The same fields can also be modified in the Loan Setup dialog.

The Setup Date is a date that was assigned by the system at the time the loan was entered. This field is not user editable.

Loan Status and Status Codes can be edited by selecting  Modify Loan Status.

Modify Loan Status.

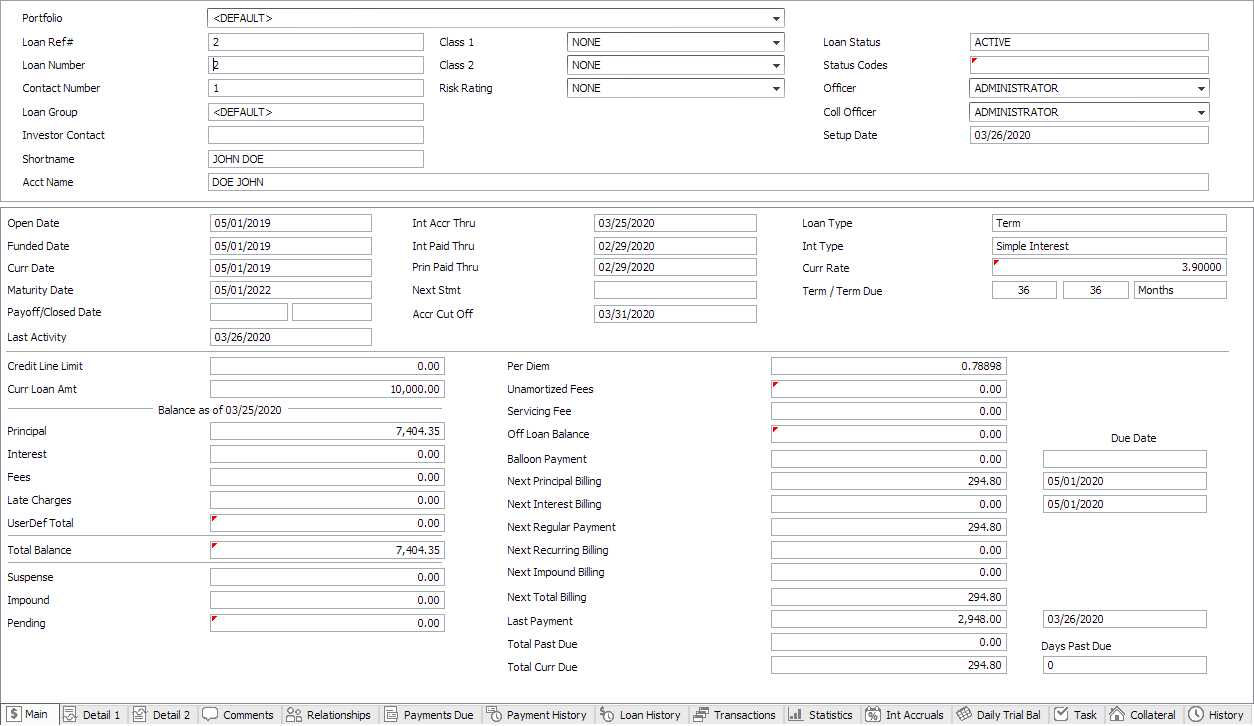

Main Tab

Main Tab

The Main tab of the Loan Query displays all of the relevant dates for the loan setup, as well as current loan balances, projected next billings, and past due amounts.

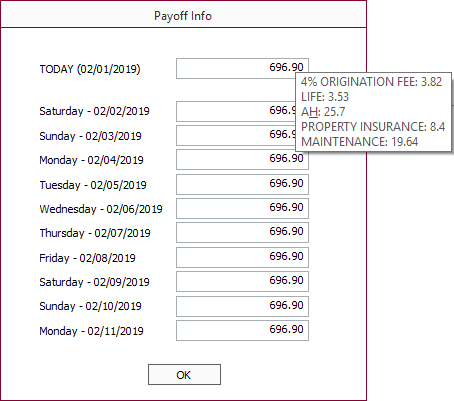

Some fields will display a bubble when moused over to display supplemental information.

A field with a  red triangle in its top left corner can be clicked on to display additional information.

red triangle in its top left corner can be clicked on to display additional information.

Detail 2 Tab

Detail 2 Tab

NLS 5.13 and later

The number of user defined fields have been increased to 75.The Detail 2 tab holds the data for additional user-defined loan fields. To add user-defined information, simply type the information into the appropriate field and click Save  .

.

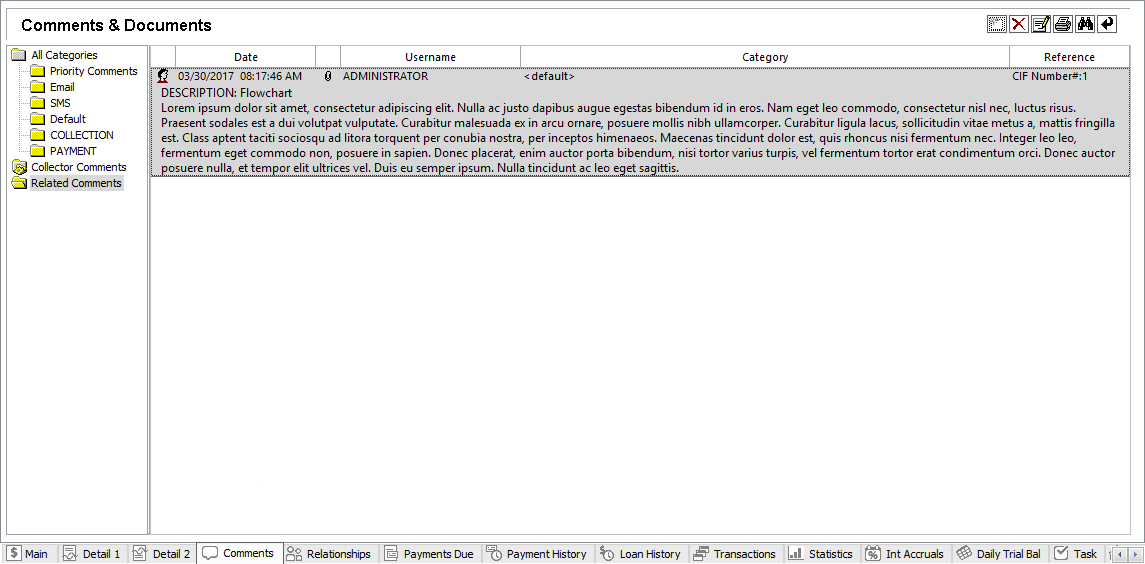

Comments Tab

Comments Tab

The Comments tab allows access to the Loan commenting and document storage system.

The functions of the buttons are:

Add Add |

This button allows you to log a new comment. The comment will be automatically stamped with the date, time, and your User ID number. |

Delete Delete |

This button will remove the highlighted comment if you have the privilege to delete comments. |

Modify Modify |

This button will allow you to edit an existing comment if you have the privilege to modify comments. |

Print Print |

This button will print out all of the existing comments on the currently selected Contact. |

Search Search |

This button allows you to search the database comments for key words. The search may include just the currently selected Contact, or may search the entire table. |

Wrap Text Wrap Text |

Clicking this button will cause the text of the comments to be displayed on multiple lines, allowing all of the comments to be read from the list in their complete form. |

Right-click on a comment to display a popup menu:

| Move to Another Loan | Where applicable, opens a Find Loan dialog where a loan can be queried and the comment will be moved, not copied, to the selected loan. |

| Hide/Show UDF Column | Where applicable, the UDF columns can be toggled to be hidden or shown in the table view. |

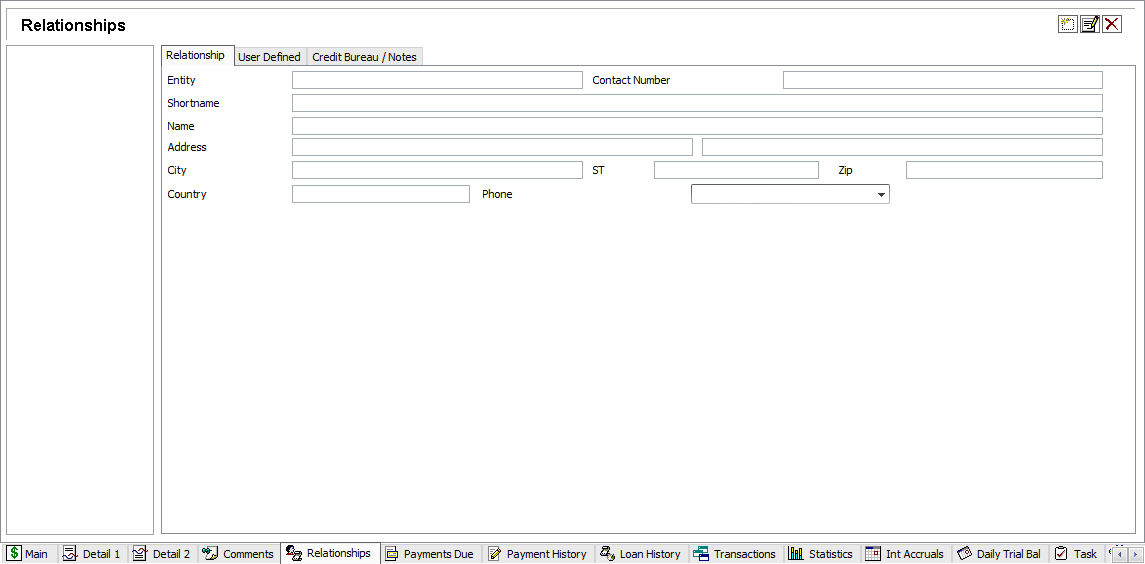

Relationships Tab

Relationships Tab

The Relationships tab of the Loan Query provides access to all of the Contact-Loan relationships for the currently selected loan.

For information on adding relationships, see Contact Manager.

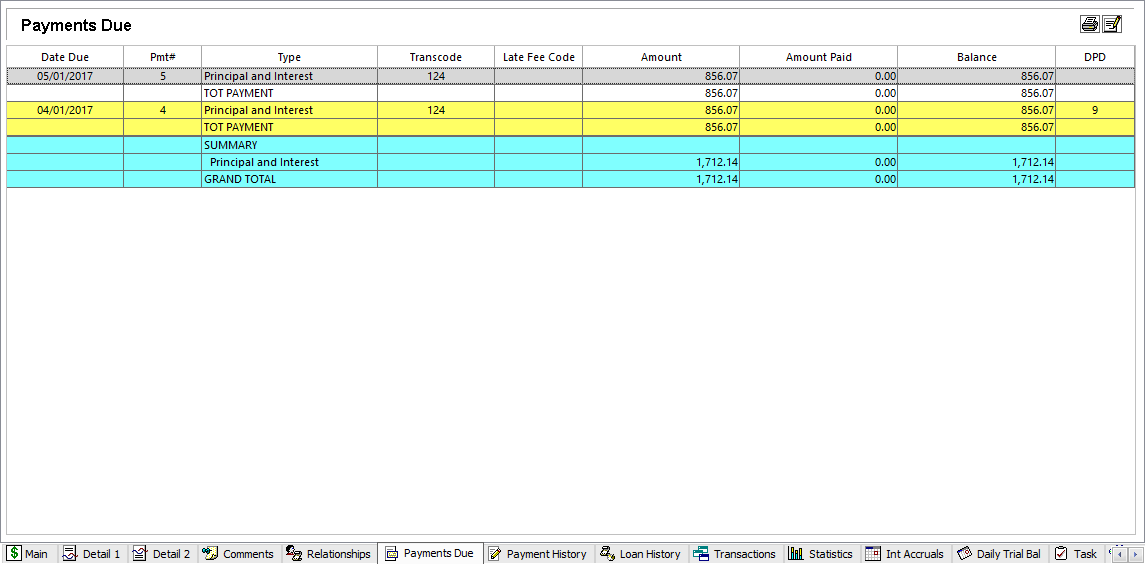

Payments Due Tab

Payments Due Tab

The Payments Due tab of Loan Query provides access to a list of all currently outstanding receivables on the loan.

Print Print |

This button will print out the full list of outstanding payments. |

Modify Modify |

This button will allow you to edit existing receivables. If the amount of the receivable is reduced so that the Amount Remaining is equal to zero, the receivable will be deleted. |

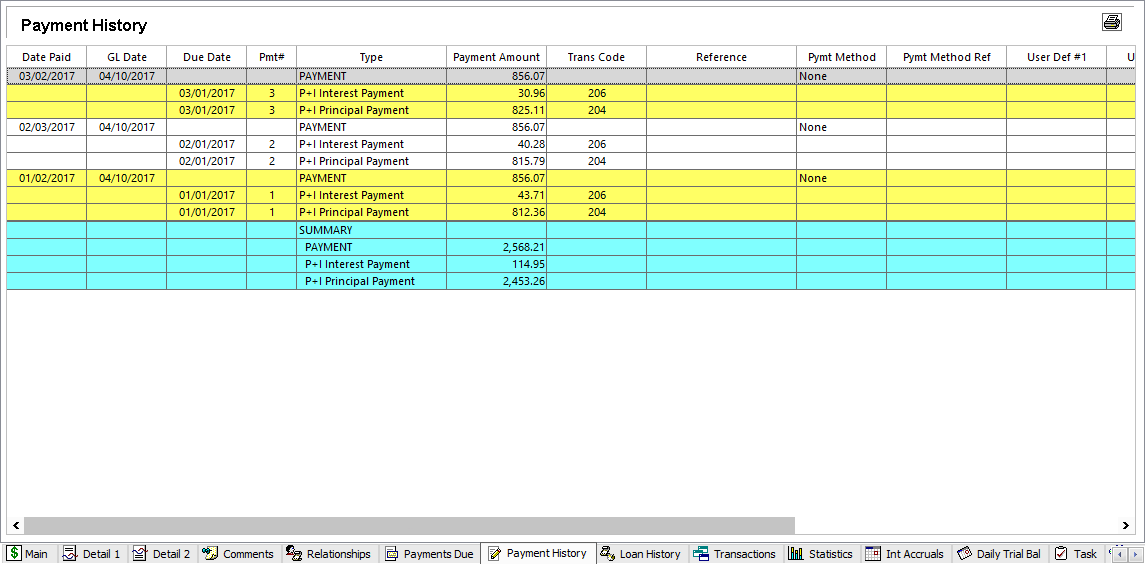

Payment History Tab

Payment History Tab

The Payment History tab displays a record of all payments that have been made on this loan account. Only payment transactions are shown here, and if a payment is reversed, the payment record is removed from the list.

The functions of the buttons are:

Print Print |

This button will print out the full list of the payment history. |

Right-click on a payment history to display a popup menu:

| Add Payment History | Manually enter a payment history. |

| Modify Payment History | Edit the selected payment history. This option is only available for manually entered payment history. |

| Delete Payment History | Delete the selected payment history. This option is only available for manually entered payment history. |

| Removes the NSF entry from the payment history and will reverse the associated unpaid NSF fee. NSF fee that has been partially or fully paid will need to be reversed manually. This option is only available for NSF payments. |

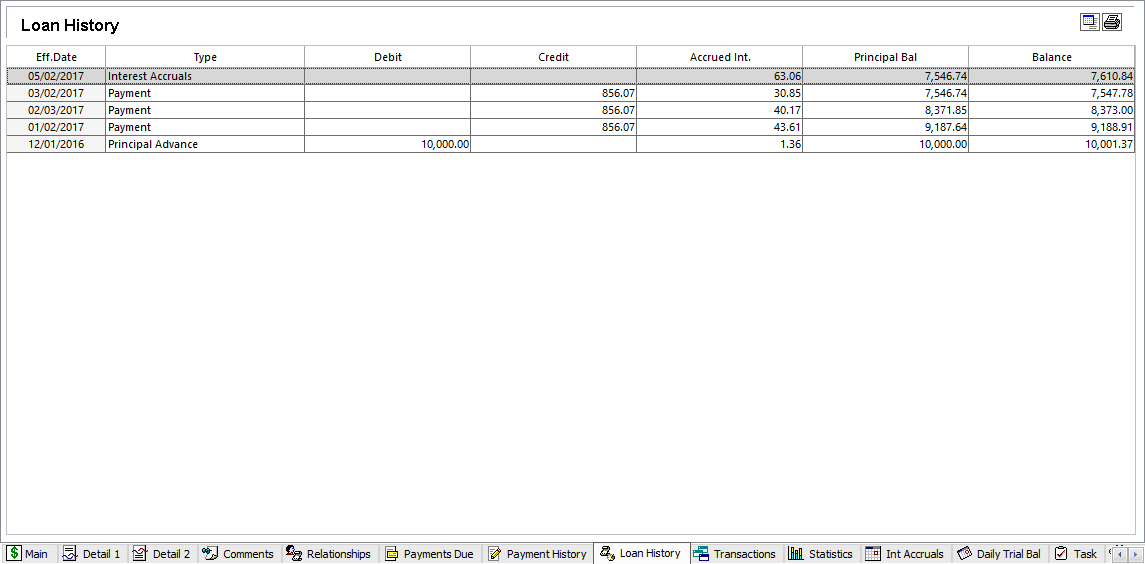

Loan History Tab

Loan History Tab

The Loan History is a running list of transactions and balances by effective date. It is designed to give a picture of the transaction history of the loan from the borrowers point of view, showing the principal balance at all times, and the transaction history that justifies those balances.

The functions of the buttons are:

Show Show |

|

|||

Print Print |

This button will print out the full list of the loan history. |

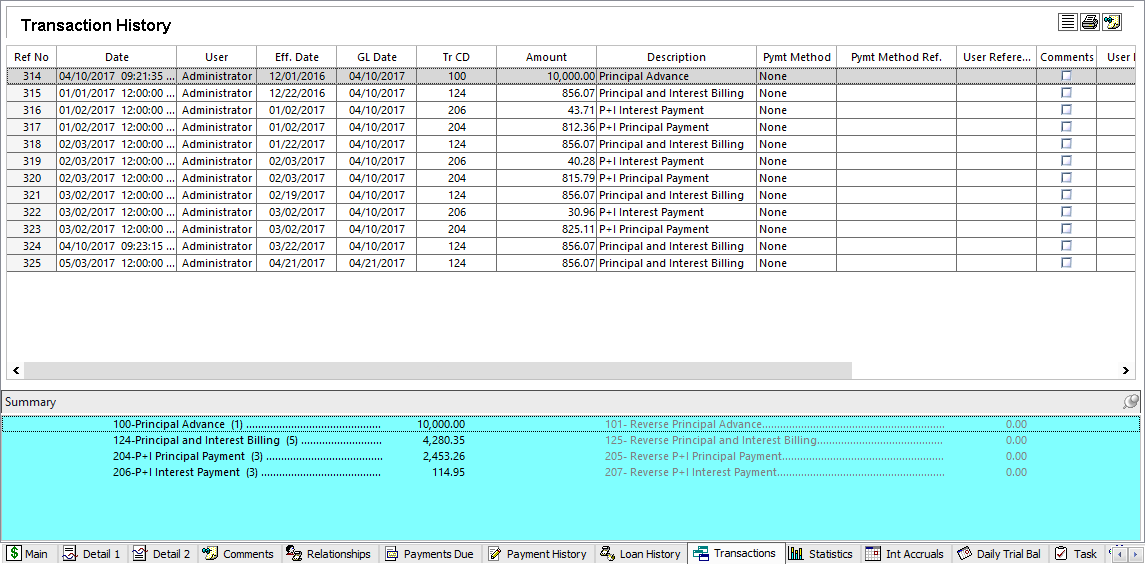

Transactions Tab

Transactions Tab

All transactions are listed in the transaction history. The date and time of the actual moment of transaction entry are recorded along with the user ID. The effective date is the date entered by the user at the time of transaction entry.

When a transaction is reversed, it is not taken off of transaction history, but a reversing transaction is added. The transaction history, therefore; will show a complete history of every event that has happened on the loan except for interest accruals, rate changes, and modifications to the loan setup.

The functions of the buttons are:

Show/Hide Reversed Transactions Show/Hide Reversed Transactions |

Button toggles the list to hide or show reversed transactions. The initial state can be configured in Loan Setup > Loan Defaults > Miscellaneous.5.18+ |

Print Print |

This button will print out the full list of the transaction history. |

Comments Comments |

Clicking this button brings up a comments window which will allow you to add comments that are linked directly to individual transactions. |

Right-click on a transaction to display a popup menu:

| Add Transaction History | Manually enter a transaction history item. |

| Modify User Defined Fields | Modify the user-defined fields of the selected transaction history item. |

| Delete Transaction History | Delete the selected transaction history. This option is available only on manually entered transaction history item. |

|

Move the transaction from one loan to another. Enter the loan number to which to transfer the transaction and click Transfer. The transaction, including the transaction code, will be moved to the specified loan and any balances affected will be updated.

Only available on transactions codes that creates a voucher and a check (or ACH) to a vendor. Must first be enabled in default, user, or group privilege under Loan > Transaction Entry > Other > Allow check/ACH transfer between loans. |

Right click on the header row of the table to display a popup menu to choose what and how the data is displayed and organized.

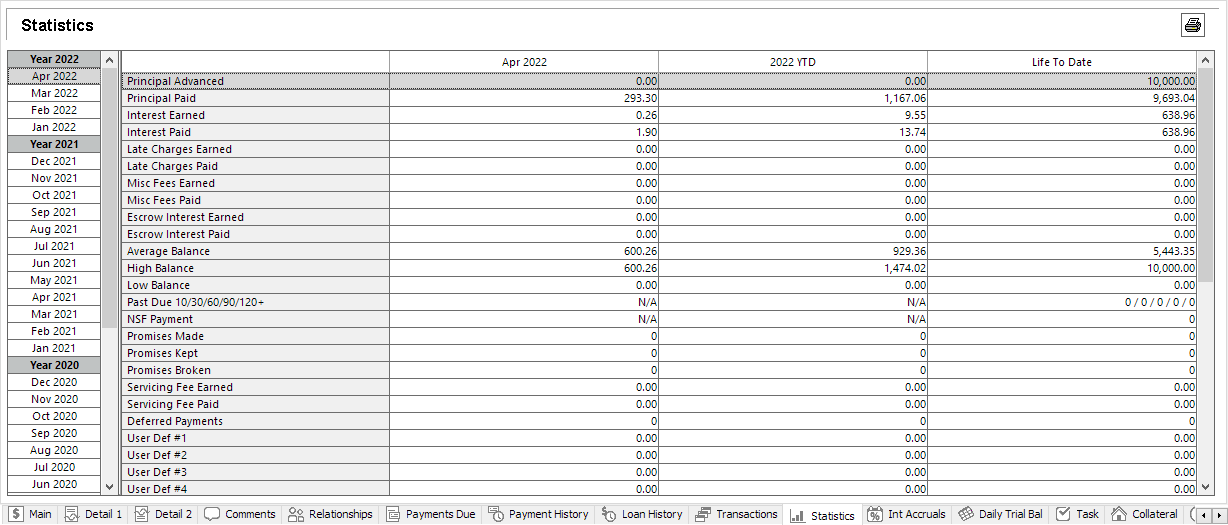

Statistics Tab

Statistics Tab

Complete statistical data for each loan is available through the Statistics tab.

The statistics are shown for the loan's life to date, for each calendar year of the loan’s existence, and for each month of the loan’s existence.

| Principal Advanced | The sum of all Principal Advance Transactions made during the statistical period. |

| Principal Paid | The sum of all principal payments made during the statistical period. |

| Interest Earned | The sum of all interest accruals and interest adjustments during the statistical period. As interest adjustments may be positive or negative, any negative interest adjustments during the statistical period will reduce the total Interest Earned. |

| Interest Paid | The sum of all Interest Payments made during the statistical period. |

| Late Charges Earned | The sum of all late charges assessed during the statistical period. |

| Late Charges Paid | The sum of all late fee payments made during the statistical period. |

| Misc Fees Earned | The sum of all fees (other than late fees) assessed during the statistical period. |

| Misc Fees Paid | The sum of all fee payments (other than late fees) made during the statistical period. |

| Escrow Interest Earned | This statistic is not currently in use. |

| Escrow Interest Paid | This statistic is not currently in use. |

| Average Balance | The sum of all daily balances during the statistical period, divided by the number of days in the period. |

| High Balance | The greatest single daily balance for the loan in the statistical period. |

| Low Balance | The lowest single daily balance for the loan in the statistical period. |

| Past Due 10/30/60/90/120+ |

A counter of the number of distinct billings that have gone past due, categorized by the number of days past due. Days past due is the loan's accrued through date minus the payment's due date. Once a payment is past due by 10 days, the 10 days past due counter is set and until the payment is paid in full, it will remain there until it is 30 days past due at which point the count is moved to the 30 days past due counter. The sum of these counts should not exceed the total number of payments that have ever been past due. The life to date past due counter can be changed by right-clicking on the life to date value and selecting Modify Past Due Counters. |

| NSF Payment | A counter of all distinct NSF payments. |

| Promises Made | The number of times that a Promise to Pay was logged in through the collections module. |

| Promises Kept | The number of times that a Promise to Pay was logged in through the collections module, and an amount equal to or exceeding the amount of the promise was entered as a payment prior to the expiration of the promise. |

| Promises Broken | The number of times that the expiration date of a Promise to Pay was reached before payments in amounts equal to or exceeding the amount of the promise were made. |

| The number of deferred payments made. Partial payments and future deferments are included in the count. | |

| User Def # 1–25 | These statistics are defined by the system administrator, and may be updated by user-defined transactions. |

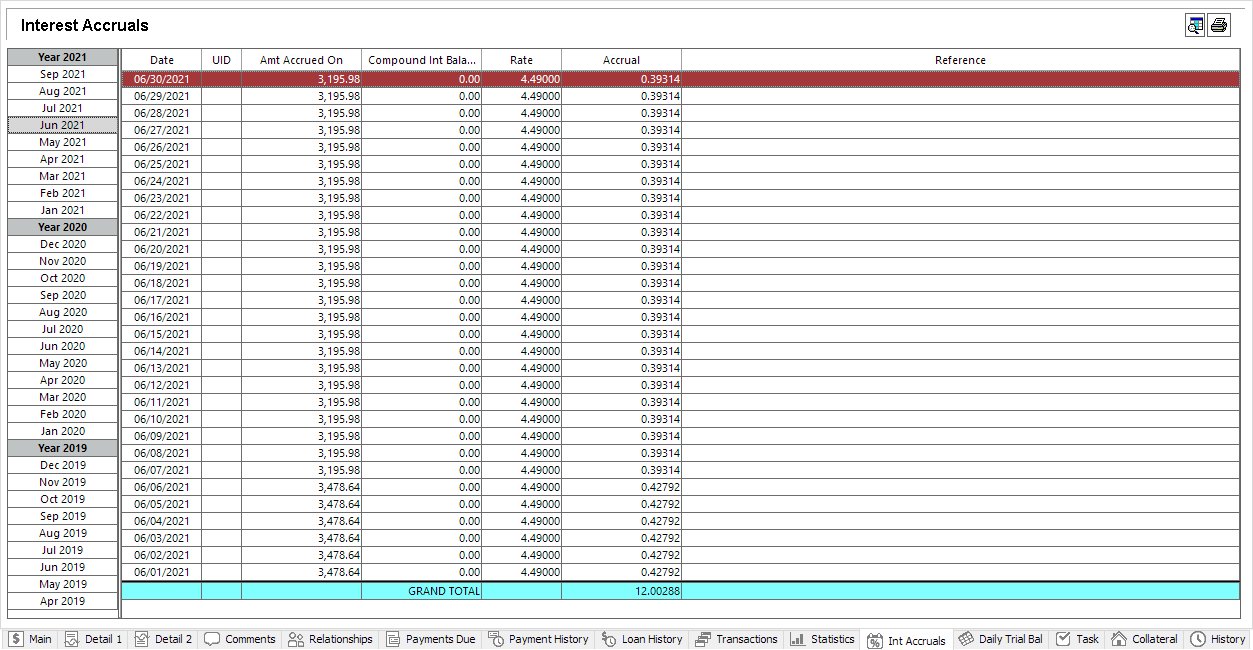

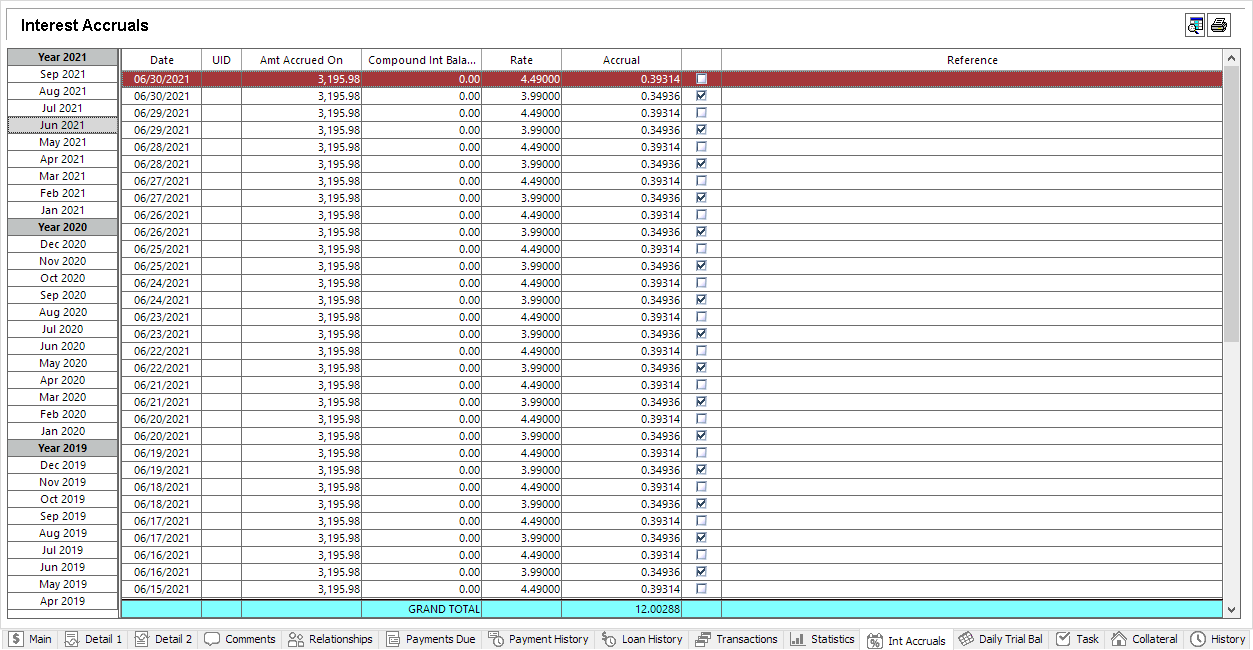

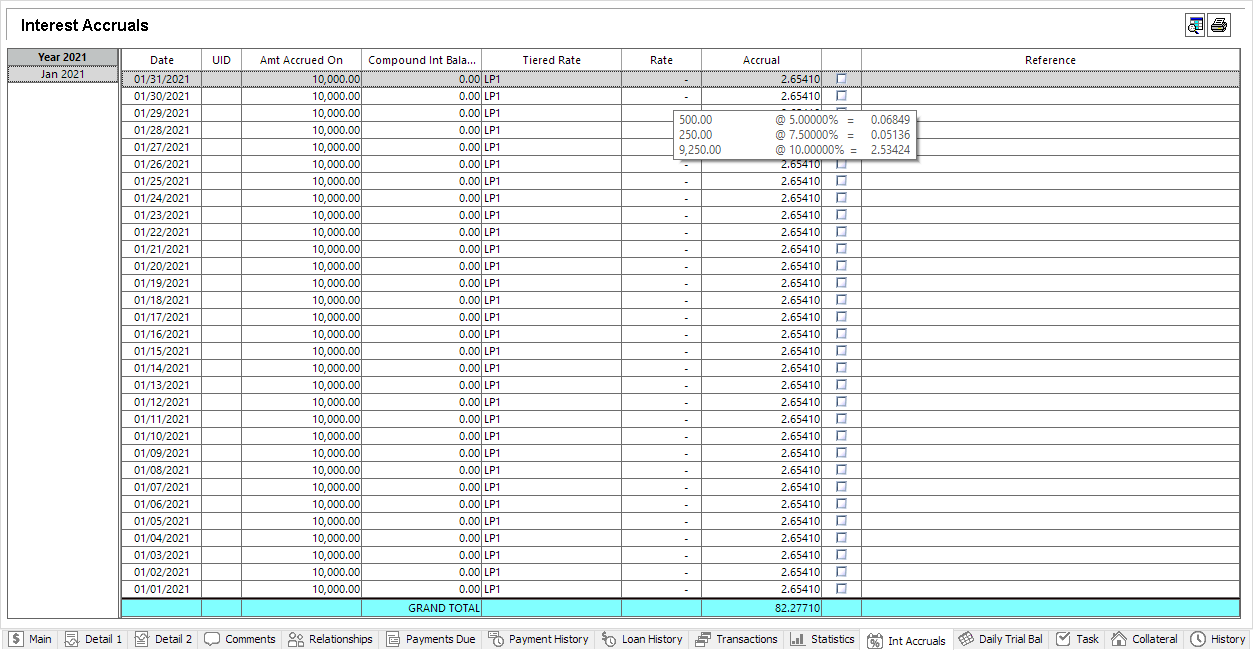

Interest Accruals Tab

Interest Accruals Tab

The Int Accruals tab provides access to all of the daily accruals that have been earned on the loan.

The functions of the buttons are:

Show/Hide Corrections Show/Hide Corrections |

This button is only available if the list is expanded to daily accruals. It adds daily accruals that have been superseded by correcting entries back into the list. |

Print Print |

This button will print out the full list of the accrual history, either the monthly aggregates or the daily accruals for the selected month. |

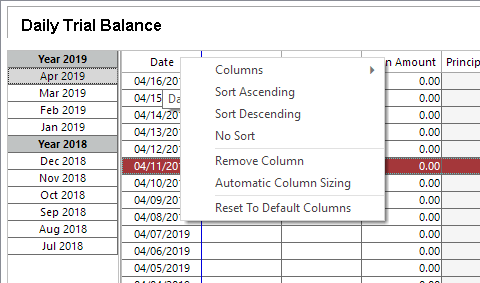

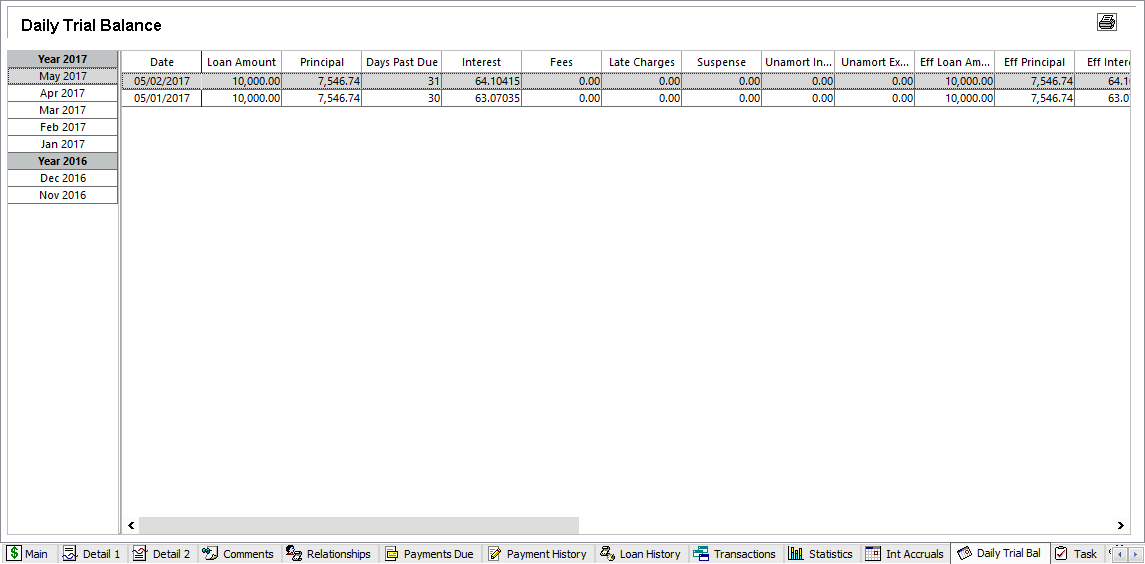

Daily Trial Balance Tab

Daily Trial Balance Tab

The Daily Trial Balance tab provides access to the Actual Trial Balance Entries (what the balance on the loan was on any given day) and the Effective Trial Balance Entries (balance adjusted to take backdated transactions into account so as to show what the balance would have been if those transactions had actually been entered on those days). In addition, a third set of balances, the GL Balances is identical to the effective balances, but uses the GL date of the transactions instead of the effective date for determining the adjustments.

The function of the buttons are:

| Show/Hide User Defined Fields | This button is only available if the list is expanded to daily trial balance entries. It adds the user-defined loan balance entries to the trial balance view. |

Print Print |

This button will print out the full list of the trial balance history for the selected month. |

Right click on the header row to display a menu for configuring the sorting and display of columns.

| Columns | Select which column to display. |

| Sort Ascending | Sorts the rows in ascending order based on the selected column. |

| Sort Descending | Sorts the rows in descending order based on the selected column. |

| No Sort | Removes the highlighting from the currently sorted column. Does not affect the current sorting. |

| Remove Column | Hides the selected column. The hidden column can be shown again by selecting it in the Columns menu. |

| Automatic Column Sizing | When selected, all the columns are automatically sized to fit within the visible area. |

| Reset to Default Columns | Resets the table to display the default set of columns. This cannot be undone. |

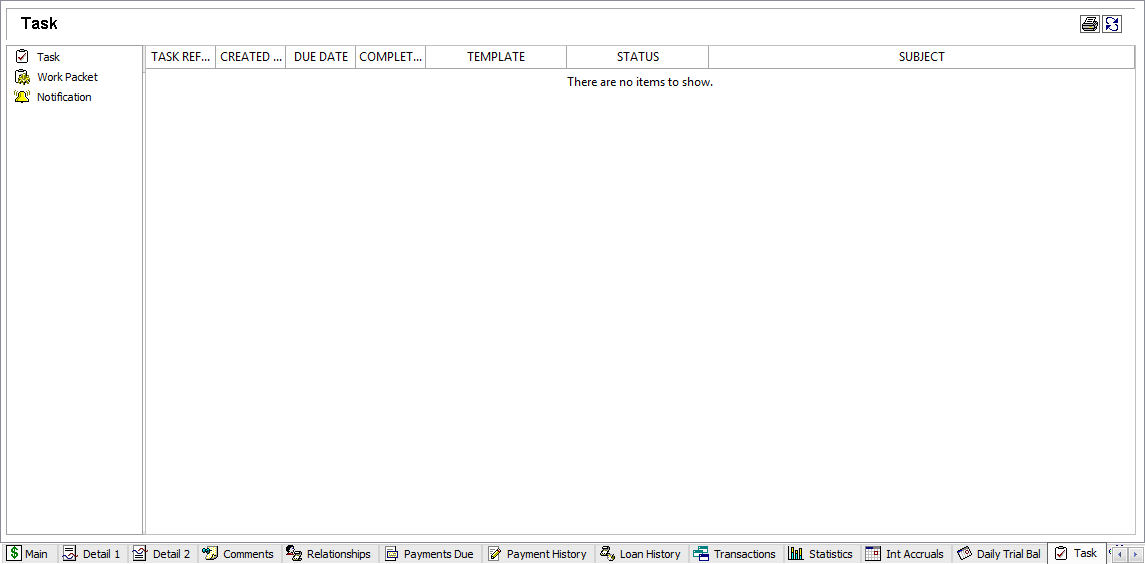

Task Tab

Task Tab

The Task tab of Loan Query lists any Tasks, Work Packets, or Notifications that are associated with this loan.

The functions of the buttons are:

Print Print |

Clicking this button sends the displayed list of tasks, work packets, or notifications to the printer. |

Refresh Record Refresh Record |

Clicking this button reloads the selected list so that it will include any tasks or work packets that have been added or modified by other users. |

Right-click to display a popup menu:

| Show/Hide Completed Object | Toggle between showing and hiding completed items. |

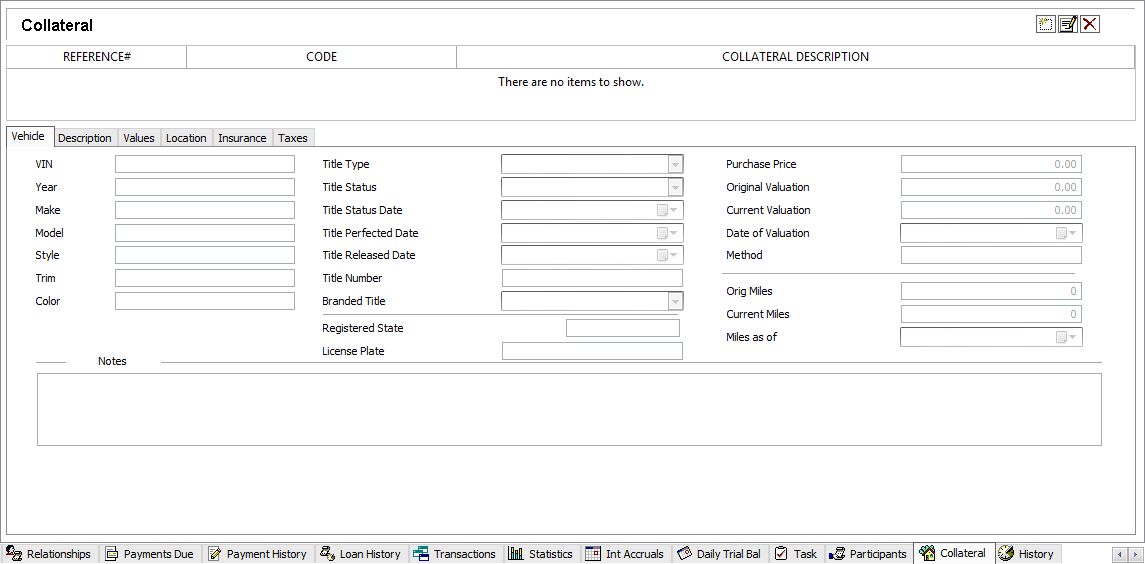

Collateral Tab

Collateral Tab

The Collateral tab provides access to any collateral items that have been added to the loan.

For information of the configuration and use of Collateral Codes, see Loan Setup.

The functions of the buttons are:

Add Add |

Allows you to add a new collateral item to the loan. |

Modify Modify |

Allows you to switch an existing piece of collateral from one Collateral Code to another. You must be sure to check the information on your collateral user-defined fields to be sure it is still valid, as the fields may have different data types on the new code. |

Delete Delete |

Removes the selected collateral item. |

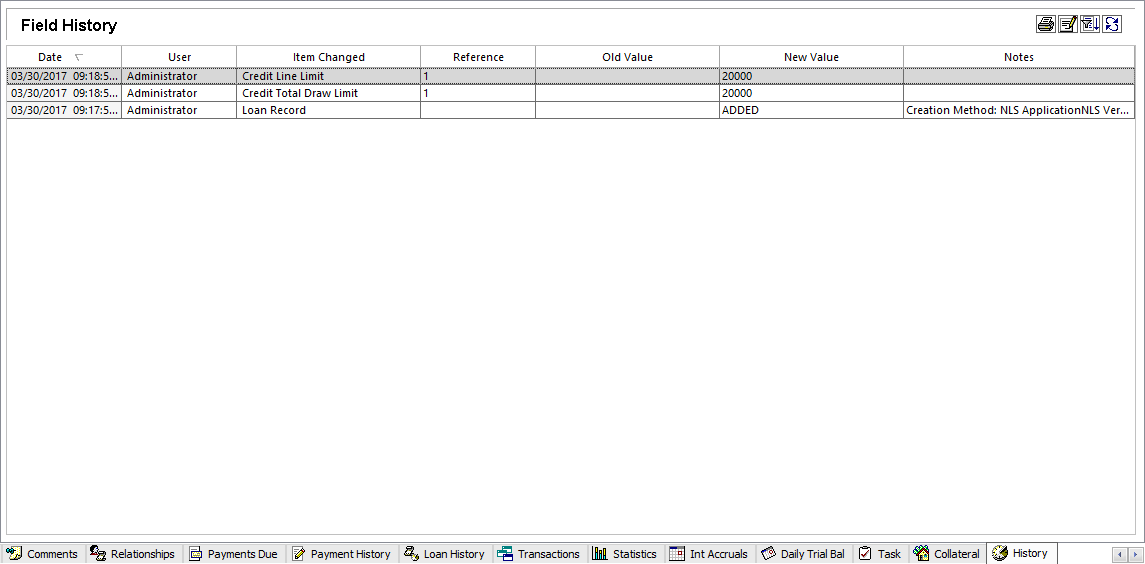

History Tab

History Tab

The History tab provides access to the history of all modifications that have been made to the loan setup.

The functions of the buttons are:

Print Print |

This button will print out the full list of the modification history. |

Modify Modify |

This button allows you to add or modify notes about the currently selected Loan Setup Modification History item. |

Filter Query Filter Query |

By default, the field history shows the complete list of modifications for the currently selected loan. By clicking this button, you can run a search on all of the modification history in the database. |

Refresh Record Refresh Record |

Clicking this button will reload the modification history for the current loan. This will allow you to view any modifications that you have just made to the loan, or any modifications that have been made to this loan by other users since you originally queried the loan. |

to specify search criteria pertaining to the past transactions made on the loan.

to specify search criteria pertaining to the past transactions made on the loan.

Detail 1 Tab

Detail 1 Tab

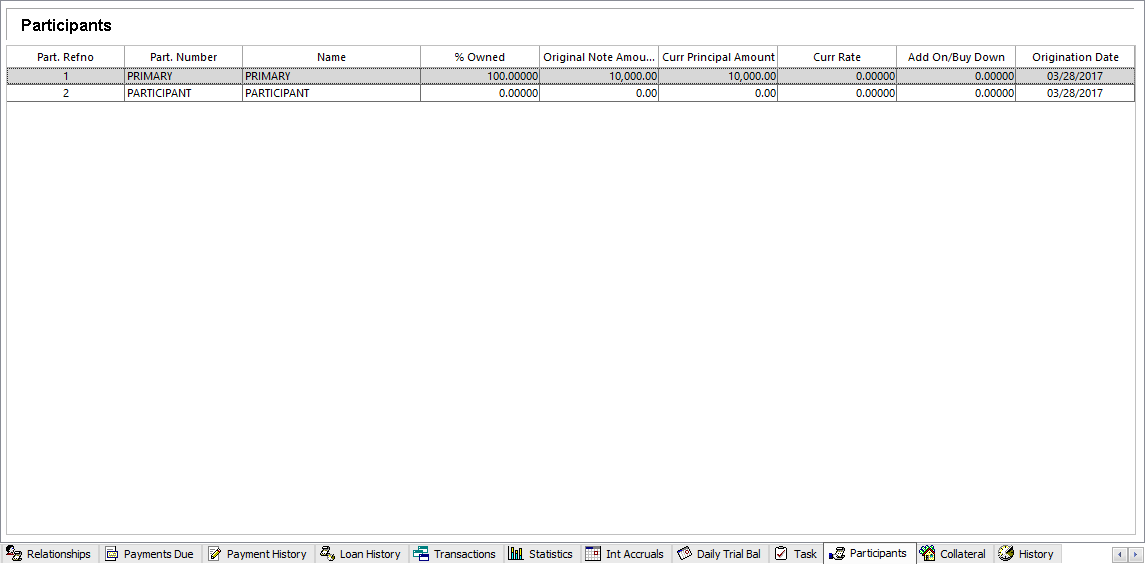

Participants Tab

Participants Tab