Rules

Rules are actions which are configured to occur on any and all loans in the system if and when those loans meet a certain criteria defined by the setup of the rules.

When setting up a rule, a specific To Do action is defined. The point in time at which that action is to take place is defined by the NLS Event for that action. For some combinations of To Do and Event, a Frequency may be specified. A Condition, which determines if the action should be performed at all on the loan in question, can also be set. Finally, the Rule Setup is completed by giving the rule a name.

Rules need not be assigned to loans, loan groups, or portfolios because all rules are in effect across the entire database. For this reason, it is important that the condition be sufficiently restrictive to make sure that the rule will not execute in any cases where it is not intended.

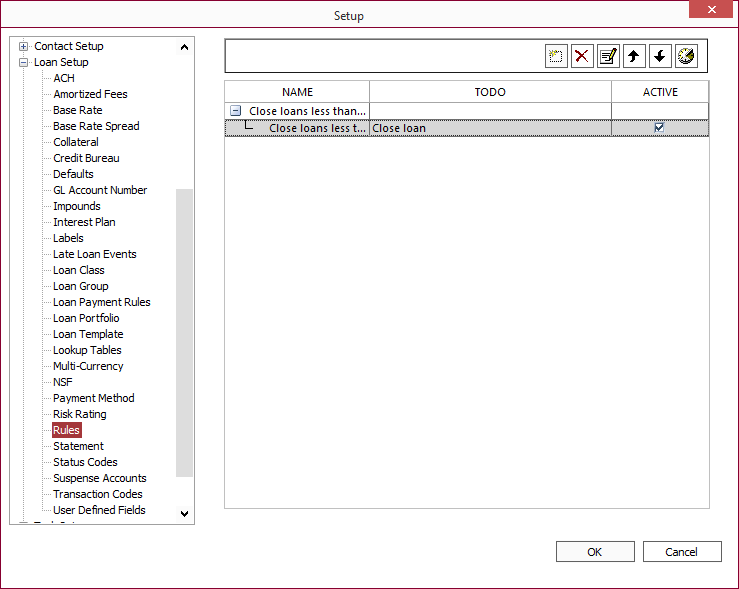

To add a new rule, go to Setup > Loan Setup > Rules. Click Add  to open the Rules wizard.

to open the Rules wizard.

To Do

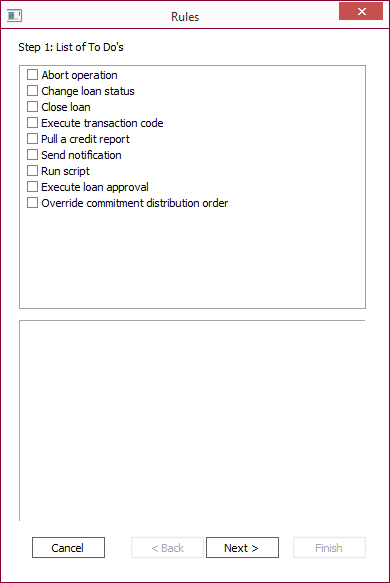

You will first be required to select from a list of To Do items.

| To Do | Description |

|---|---|

| Abort Operation | Click Abort in the lower pane of the Rules window to bring up a dialog for entering the message that will be displayed when the operation is aborted. The operation to be aborted is either the addition of a transaction, a contact, or a loan, and this will be determined by the NLS Event associated with the rule. |

| Change Loan Status | Click loan status in the lower pane of the Rules window to bring up a dialog for selecting which status code to add to the loan. If the Remove Status Code checkbox is selected, the status code in question will be removed from the loan if it is currently on the loan. |

| Close Loan | This To Do operation will close the loan. This will be accomplished by executing a payment for the amount of $0.00 with the payoff flag selected and setting the Loan Status to Closed. Click loan in the lower pane of the Rules window to bring up a dialog for selecting the IRS write off event code.5.35+ |

| Execute Transaction Code | Click transaction code in the lower pane of the Rules window to bring up a dialog with a drop down list for selecting which transaction code to run. A further step in the wizard will allow you to select the amount for which to run that transaction code. |

| Pull a Credit Report | Click credit report in the lower pane of the Rules window to bring up a dialog for selecting which bureau(s) to pull the report(s) from and if an existing report should be used if it has been pulled recently. |

| Send Notification | Click notification in the lower pane of the Rules window to bring up a dialog for entering the message to be sent in the notification, and to which user and or group that notification should be sent. |

| Run Script | Click script in the lower pane of the Rules window for entering a script to be executed. See scripting for more details. |

| Execute Loan Approval | Click loan approval in the lower pane of the Rules window to bring up a dialog for entering the user or group to which to assign this task. The Loan Status will be set to DRAFT until the loan is approved. |

| Override commitment distribution order | Click commitment distribution order in the lower pane of the Rules window to bring up a dialog for configuring the distribution percentage based on the principal balance ratio of the selected loan groups or to use a specific percentage. When specifying a specific ratio, the sum of the ratios must be 100. |

NLS Event

Without exception, after selecting a To Do, the next step in the Rules setup process is to select the NLS Event that determines at which precise point this action is to take place. However, the list of possible Events that are appropriate to each To Do is different (although overlapping). The events themselves are self explanatory. The table below will list which NLS events are applicable to each To Do.

Frequency

Certain combinations of a To Do and an NLS Event involve events (such as the accrual) which occur every day, and it may not be desired that the condition be checked to determine if the To Do should be executed quite this often. Therefore, some combinations allow an optional setting of Frequency. If no Frequency is set, it is assumed to be daily. Frequency options which may be otherwise set are Weekly and Monthly.

If Weekly is selected, clicking Weekly in the lower pane will bring up a dialog box for the selection of a day of the week.

If Monthly is selected, clicking Monthly in the lower pane will bring up a dialog box for the selection of which months the To Do is to be executed. Additionally, a specific day of each month may be selected. Lastly a specific day of the week may be selected along with the Ordinal: First, Second, Third, Fourth, or Last. This allows for the selection of a single day of each month which will be a constant day of the week.

The following table lists all of the combinations of To Do and NLS Event for which a frequency of Weekly or Monthly may be selected.

| To Do | NLS Event |

|---|---|

| Close Loan | Pre-accrual |

| Post-accrual | |

| Execute Transaction Code | Pre-accrual |

| Post-accrual |

Condition

The Condition portion of a rule setup defines the situations under which the rule should or should not execute. The condition may be defined based on values in the contact that the loan is under, values in the loan account itself, or based on an advanced trigger, as defined in the table below.

| Condition Type | Available Conditions |

|---|---|

| Contact | Contact Type is assigned to specific values |

| Entity is assigned to specific values | |

| where setup date is in this date range | |

| where city is located in this location | |

| where state is located in this location | |

| where zip code is in this range | |

| where date of birth(1) is in this date range | |

| where date of birth(2) is in this date range | |

| Loan | where interest method changed |

| where loan portfolio is assigned to specific values | |

| where loan group is assigned to specific values | |

| where loan type is assigned to specific values | |

| 5.7.3+ | where loan class 1 is assigned to specific values |

| 5.7.3+ | where loan class 2 is assigned to specific values |

| where primary loan status (Loan Status) is assigned to specific values | |

| where secondary loan status (Status Codes) is assigned to specific values | |

| 5.38+ | where secondary loan status (Status Code) name is added |

| 5.38+ | where secondary loan status (Status Code) name is removed |

| where setup date is in this date range | |

| where open date is in this date range | |

| where maturity date is in this date range | |

| where current principal balance is in this range | |

| where current interest balance is in this range | |

| where current deferred interest balance is in this range | |

| where current fees balance is in this range | |

| where current late charge balance is in this range | |

| where current UDF(1–10) balance is in this range | |

| where current payoff balance is in this range | |

| where days past due is in this range | |

| 5.20+ | where days past due (adjusted for deferment) is in this range |

| where past due amount is in this range | |

| where current due amount is in this range | |

| where interest-accrued-thru-date is in this date range | |

| Advanced | where SQL statement returns at least 1 row |

| where the Event is triggered by GUI (Graphical User Interface) Triggered by events from within NLS.exe such as XML import, entering transactions, manually running accruals, saving changes to loans, etc… |

|

| where the Event is NOT triggered by GUI (Graphical User Interface) Triggered by events from external applications and services such as NLS Service. |

|

| 5.21+ | do not execute on a weekend, advance to next business day |

| 5.21+ | do not execute on a US Holiday |

| 5.31+ | do not execute on a US Federal Reserve Holiday |

| 5.21+ | do not execute on a NYSE Holiday |

| 5.21+ | do not execute on a UK Holiday |

| 5.21+ | do not execute on a Mexico Holiday |

| 5.21+ | do not execute on a Canada Holiday |

| 5.21+ | do not execute on an Alberta Holiday |

| 5.21+ | do not execute on a British Columbia Holiday |

| 5.21+ | do not execute on a Manitoba Holiday |

| 5.21+ | do not execute on a New Brunswick Holiday |

| 5.21+ | do not execute on a New Foundland & Labrador Holiday |

| 5.21+ | do not execute on a Northwest Territories Holiday |

| 5.21+ | do not execute on a Nova Scotia Holiday |

| 5.21+ | do not execute on a Nunavut Holiday |

| 5.21+ | do not execute on an Ontario Holiday |

| 5.21+ | do not execute on a Prince Edward Island Holiday |

| 5.21+ | do not execute on a Quebec Holiday |

| 5.21+ | do not execute on a Saskatchewan Holiday |

| 5.21+ | do not execute on a Yukon Holiday |

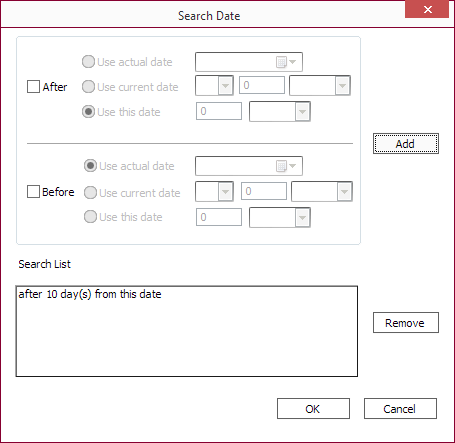

Conditions specifying a date range is configured by clicking on the in this date range link.

Conditions can be set to match either before of after the specified date.

| Condition | Description |

|---|---|

| Use actual date | The exact date as specified. |

| Use current date | Delta from the date of the rule’s creation. Example If the date is January 15th, +2 days will use January 17th as the criteria, -2 days will use January 13th as the criteria. |

| Use this date | Delta from the date on which the rule is applied. |

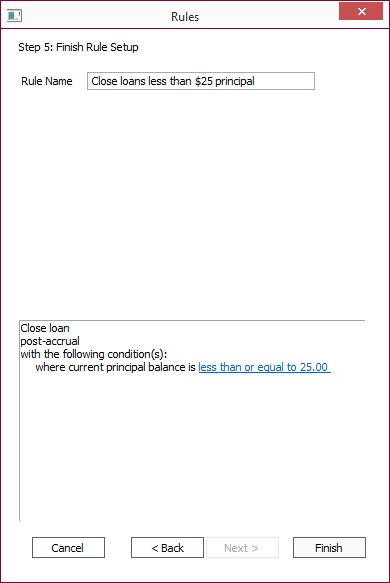

Finish Rule Setup

When the event, frequency, and condition have been defined, and any required parameters for the condition have been configured, click Next> to finalize the rule setup. The rule will be defined on the interface, and to finish the configuration, the only remaining requirement is to give the rule a name.

Click Finish to complete the rule setup.