Loan Template

Much of the information required to enter a loan (interest year, statement codes, etc.) may be common among all the loans within certain groups in your portfolio, or even common to all the loans in the portfolio. To save time, and minimize the chance of error during data entry, NLS allows you to configure Loan Templates. These templates contain much of the information that would usually be entered on a loan, and they allow an operator to bypass the entry of that information by simply selecting the appropriate loan template during the loan entry process.

A template can contain any of the following loan information:

- Loan Groups

- Loan Classes

- Interest Accrual Information

- Term Information

- Statement Accrual Cutoff

- Statement Printing Cutoff

- Statement Code

- Late Fee Code

- Amortization Method

- Payment Periods

- Repayment Method

- Percentage of Principal Reduction (if applicable)

- Re-Amortization Information

- Payment Distribution Default

- Pre-payment Penalty

- Interest Rate Information

- Interest Only Period Information

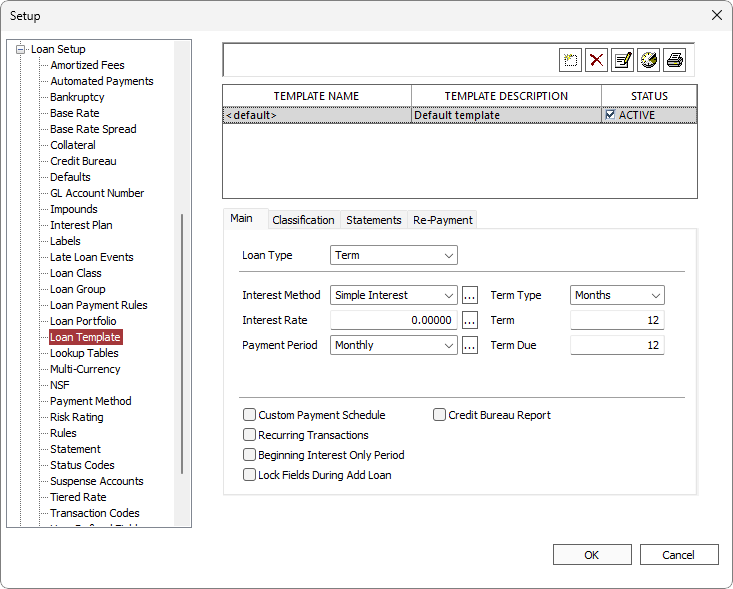

Template setup is configured in Setup > Loan Setup > Loan Template.

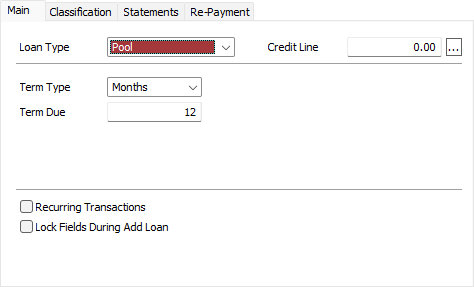

There are four tabs available in the Loan Template category by default: Main, Classification, Statements, and Re-Payment. Additionally, up to five more tabs (depending on the interest method) may be accessed by selecting them at the bottom of the Main tab, these are: Custom Payment Schedule, Recurring Transactions, Beginning Interest Only Period, Lock Fields During Add Loan, and Credit Bureau Report. Custom Payment Schedule and Beginning Interest Only Period are mutually exclusive so only one of these tabs is available in Loan Template setup at any time.

The Loan Template category consists of a toolbar, the template grid (list), and the template setup tabs.

The toolbar allows the user to manage the templates displayed in the template grid.

Loan Template Toolbar

| Button | Description |

|---|---|

Add Add |

Opens the Add Template dialog box. Enter a name for the template in the Template Name field. An optional description for the template may be entered in the Description field. Once the name and description (if any) are entered click OK and the template will be added to the grid. |

Delete Delete |

Deletes the template that is currently selected in the grid. |

Modify Modify |

Opens the Modify Template dialog for the selected template for changing the Template Description of the template. |

Modification History Modification History |

Shows a before and after history of changes to the template setup. |

Print Print |

Prints all rows in the template grid. |

Template Grid

The template grid displays a list of all the templates available in the database as well as basic information about each template. The grid shows the Template Name, Template Description, and Status for each template. Template Name and Template Description are input by the user when the template is first created. Status shows whether the template is Active or Inactive and may be modified directly in the grid by using the checkbox. If a template is set to Inactive it will not be available in the Add Loan dialog, templates are set to Active by default.

When a template is selected in the grid, its settings are automatically loaded into the Template Setup tabs located directly under the grid. These tabs are where the settings that make up the template are entered.

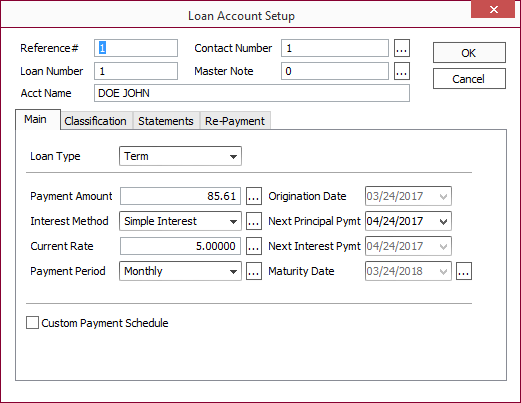

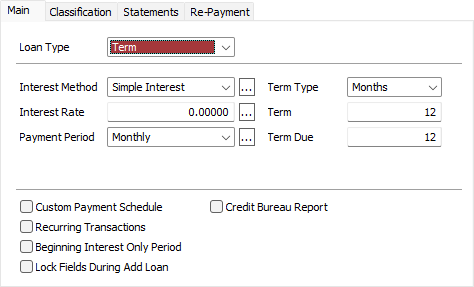

The Main tab contains the most frequently used setup options such as the Loan Type, interest rate settings, payment period settings, and term information. At the bottom of this tab are checkboxes to enable the optional Loan Template setup tabs: Custom Payment Schedule, Recurring Transactions, Beginning Interest Only Period, and Lock Fields During Add Loan.

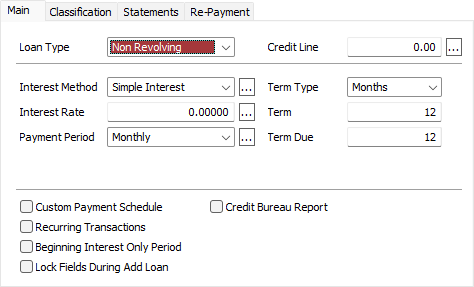

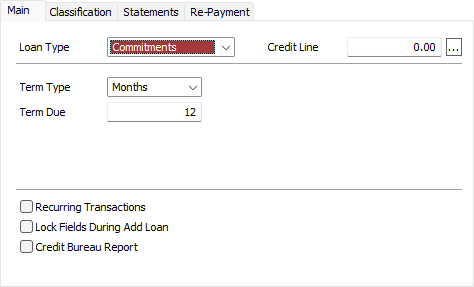

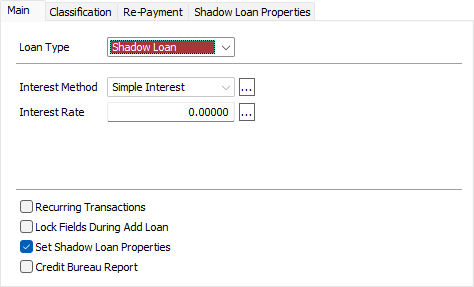

Loan Type

This sets the type of loan to be added and the available settings are: Term, Revolving, Non Revolving, Commitments, and Pool.

| Loan Type | Description |

|---|---|

| Term | The loan has a specifically defined origination and maturity date as well as a defined schedule of payments. |

| Revolving | The loan has a credit line which can be drawn out up to a set limit, and repaid principal may be drawn out again. The term may be indefinite for this type of loan. If the user selects Revolving as the Loan Type, the field Credit Line and an options button for the field will be added to the Main tab. |

| Non Revolving | The loan has a credit line which can be drawn out up to a set limit, but repaid principal cannot be redrawn. The term is limited by the inability of the borrower to keep drawing funds. If the user selects Non Revolving as the Loan Type, the field Credit Line and an options button for the field will be added to the Main tab. |

| Commitments | A Commitment is an agreement by a lender to grant a loan or loans for a specified amount of money at a future date. The holder of the commitment may pay a fee to reserve the funds, but is not required to pay interest on the money unless it is actually borrowed. |

| Shadow Loan | Available with the Multi-book Accounting Module. |

| Pool | A Pool is an aggregation of the loans of different borrowers, which have been combined for a specific purpose, such as to be resold into the secondary market. |

Interest Method

Interest Method sets the procedures that the system follow to calculate daily accruals. The available methods are: Simple Interest, Average Daily Balance, Fixed Amortization, Fixed Amortization (Beginning), Rule of 78s (add-on), and Rule of 78s (simple). It is important to note that certain interest methods may not be available depending on the Loan Type chosen for the template.

Interest Method Types

| Interest Method | Description |

|---|---|

| Simple Interest | The loan will always accrue daily on the current principal balance. |

| Average Daily Balance | Interest is accrued daily on the current principal balance to an average daily balance interest balance, then on the billing cycle, the average daily balance interest is moved to the current interest balance. During a billing cycle, the average daily balance interest balance becomes part of the payoff, not the full billing cycle amount. |

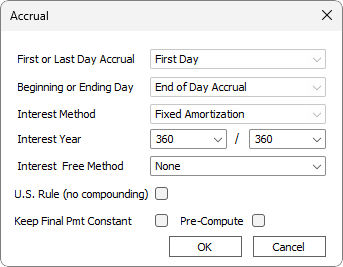

| Fixed Amortization | Interest is accrued daily on the amount of principal specified in the amortization schedule. Early or late payments do not affect the accrual. Principal reduction transactions will cause the schedule to re-amortize. The interest is non compounding and it is usually calculated on a 360/360 interest year. |

| Fixed Amortization (Beginning) | The first payment can be due on the origination date of the loan, and the interest charged in that first payment is that which is expected to accrue in the upcoming period. The loan accrues according to an amortization schedule, but this schedule is based on interest paid in advance of the payment period rather than in arrears. |

| Rule of 78s – Add On | Also referred to as Add-On Interest Method. Please refer to the Appendix for detailed documentation of this interest method. |

| Rule of 78s – Simple | This type of loan accrues as a simple interest loan, however the interest portion of the payment is determined by applying the Rule of 78s to the total projected interest amount for the life of the loan. For more information about the Rule of 78s see the Appendix. |

NLS 5.4 and later

Note

Loans with interest methods of Rule of 78 and Fixed Amortization can be changed to a Simple Interest loan through the Loan Setup dialog. When doing so, a dialog will appear to set the effective date of the change.If the loan has the pre-compute option selected, a transcode 308 "Unearned Addon Interest Reduction" will be recorded to zero out the remaining add-on interest.

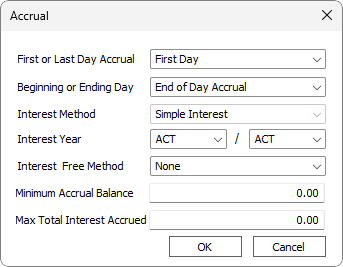

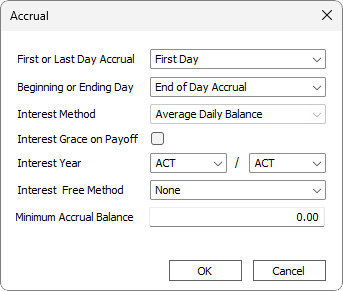

Additional Options

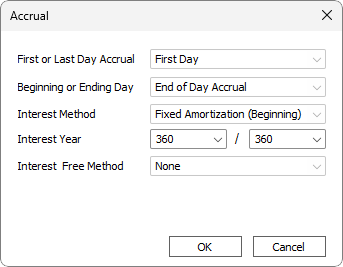

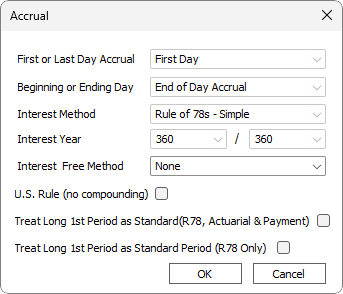

Clicking  located to the right of the Interest Method selector will open up the Accrual dialog which allows the user to set advanced options for interest accruals. Note that some or all of these options are not available when certain Interest Methods are selected.

located to the right of the Interest Method selector will open up the Accrual dialog which allows the user to set advanced options for interest accruals. Note that some or all of these options are not available when certain Interest Methods are selected.

| Option | Description | |||

|---|---|---|---|---|

| First or Last Day Accrual | Controls the behavior of the daily accruals at the beginning and end of the loan.

|

|||

| Beginning or Ending Day | Sets the behavior of accruals with respect to transaction processing.

|

|||

| Interest Method | This is a mirror of the Interest Method field in the Main tab. It is locked in the Accrual dialog and is presented for reference only. Any changes to this field must be made through the Main tab. | |||

| Interest Grace on Payoff | Available for Average Daily Balance. When selected, the ADB interest is not included in the payoff balance. When unselected, the ADB interest is added to the payoff balance. | |||

| Interest Year | Allows the user to set the interest year calculation for interest accruals. See the Appendix for more information. | |||

| Interest Free Method | ||||

| U.S. Rule (no compounding) | When selected, outstanding interest is not included in the interest calculation. | |||

|

Treat Long First Period as Standard Period or Treat Long First Period as Standard (R78, Actuarial & Payment)5.35.21+ |

Available for Rule of 78. When selected, the long first period will be treated as a standard period in its interest calculation. Example If a loan’s origination date is 1/15, first payment on 3/1, and the term is 12 months — first month’s interest calculation will use 12 as the numerator and 78 as the denominator instead of breaking down the first month into multiple parts to derive the numerator and denominator. |

|||

|

Available for Rule of 78. When selected, the long first period will be treated as a standard period in only the rule of 78 interest calculation. Treat Long First Period as Standard (R78, Actuarial & and Payment) and Treat Long First Period as Standard (R78 Only) are mutually exclusive. |

||||

| Minimum Accrual Balance | Sets a minimum principal balance for the purpose of accruing interest. If the principal balance of the loan drops below this value, interest will be accrued on this value as long as the loan remains open and active. | |||

| Available for Simple Interest. Maximum amount of total interest that can be accrued on a loan over the life of the loan. This value is imposed during accruals, backdated payment/reversal, and backdated interest rate change. Interest adjustments are not affected and may exceed this value. 0 denotes no maximum value and interest will continue to accrue accordingly. |

||||

| Keep Final Pmt Constant | Available for Fixed Amortization. Keep final payment constant. The final payment on a Fixed Amortized loan is generally adjusted slightly upward or downward to reflect whatever amount is left at the time that the final payment is due. Selecting this option will result in the final payment being the same amount as all of the other payments. The interest accrual in the final period will be adjusted to achieve this final payment amount. |

|||

|

Pre-Compute5.4+

|

Available for Fixed Amortization. When selected, a transcode 110 is recorded for the pre-computed interest. Add-on Interest and Loan Remaining fields are available in the loan's Main view. Remaining add-on interest is reduced as interest accrues on a loan. When a loan is paid off, a transcode 308 "Unearned Addon Interest Reduction" is recorded to zero out the remaining add-on interest balance. |

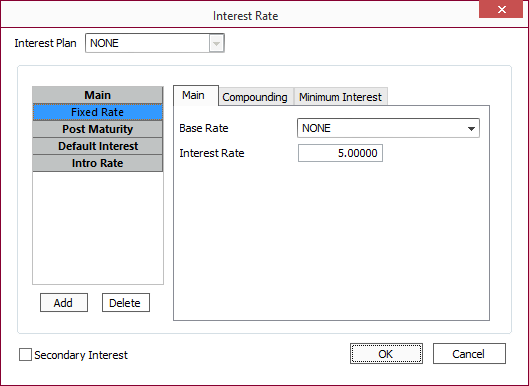

Interest Rate

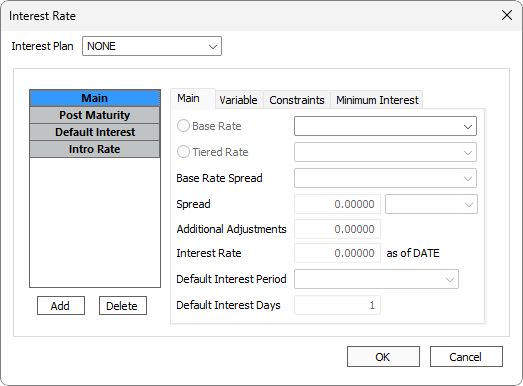

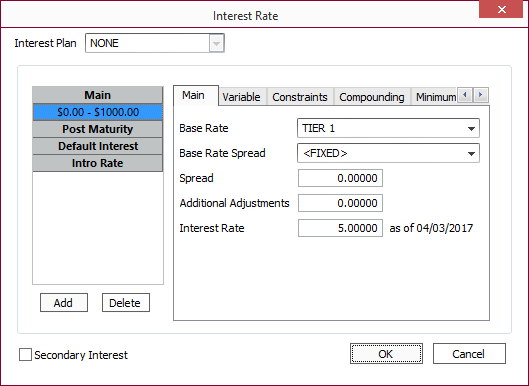

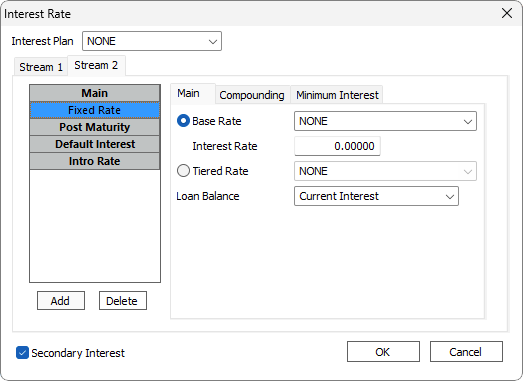

Adding an interest rate via this field will set the loan to a fixed APR equal to the value entered. Clicking  located to the right of the Interest Rate field will open the Interest Rate options dialog where advanced settings for the interest rate of the template may be set.

located to the right of the Interest Rate field will open the Interest Rate options dialog where advanced settings for the interest rate of the template may be set.

The Interest Rate dialog allows the user to input more advanced interest schemes for the template.

The Interest Plan feature is not supported at this time.

The interest structure may be very simple, containing a single fixed rate interest object for the term of the loan. It may be very complex, with multiple variable and fixed interest steps for each condition of the loan. Or it may be anywhere in between. The list is divided into different interest objects; Main, Post Maturity, Default Interest, and Intro Rate. The interest objects in the Main interest group control the standard interest rate for the loan and are in effect, unless overridden by a Post Maturity or Default Interest object. Post Maturity interest objects, if specified, will go into effect on the day of maturity (for first day interest loans) or on the day after maturity (for last day interest loans). Default Interest objects, if specified, are in effect when the loan is considered to be in default.

Main Tab

The Main tab has the most commonly used settings for interest object setups.

| Option | Description |

|---|---|

| Interest Type | Displays the Interest Type set in the Add Step dialog (click Add to open the Add Step dialog). This field is for display only and is not editable. |

| Base Rate or Tiered Rate | Select from any available base or tiered interest rate schemes that have been defined in the Base Rate or Tiered Rate sub-category of the global Loan Setup. If no rate schemes are defined this field is not editable and will default to NONE. If NONE is selected the interest rate will be determined by the value of the Interest Rate field. |

| Base Rate Spread | A spread modifies the base rate for the interest object by summing the value of the base rate and any adjustments. Adjustments may be a positive or negative value. Choose from <FIXED> or a base rate spread as configured in Loan Setup - Base Rate Spread. |

| Spread | This field is not editable when a pre-configured base rate spread is selected. Although a spread amount may be entered when the Base Rate Spread is <FIXED>, it is recommended that the Additional Adjustments field be used instead, leaving the Spread option available if a spread setup is required in the future. |

| Spread Basis | Choose Current Principal, Loan Amount, or Credit Line as the basis for the spread. |

| Additional Adjustments | Enter any ± adjustments to be made to the base interest rate. |

| Interest Rate | Sets the APR for the interest object when no Base Rate is selected. |

| Default Interest Period | Defines when the loan is considered to be in default. This setting is only used when an interest object is set to an Interest Type of Default Interest While in Default or Default Interest Until Maturity. If the Default Interest Period is set to Days, then the loan will be considered to be in default when any payment is past due by the number of days in the Default interest Days field. If a different period, such as months or quarters, is specified then the loan will be considered to be in default when it is past due by that period (e.g. one month of one full quarter). |

| Add-on / Buydown | Available for participants. Add-on interest is used where a lender loans money at an interest rate lower than the interest that is charged to the borrower and interest for the loan servicing agent is added on to the loan. Buydown interest is used where a lender loans money at an interest rate higher than the interest that is charged to the borrower and the loan servicing agent subsidizes the difference. See Subsidized Interest Receivable and Subsidized Interest Payable. |

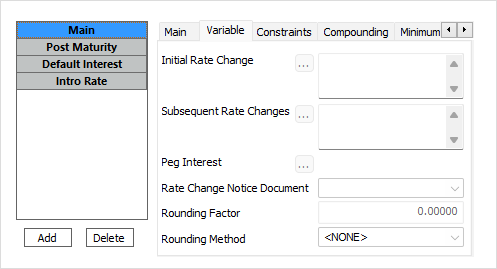

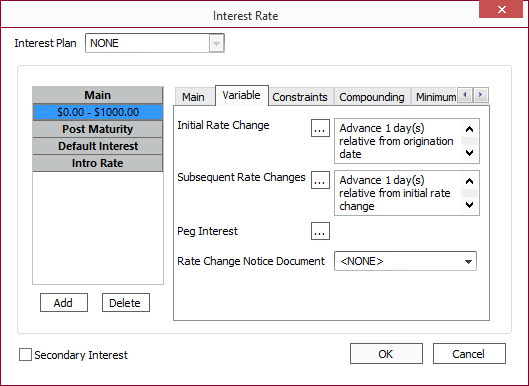

Variable Tab

Variable interest rates in NLS are controlled by a combination of the selected base rate and the rate change information in the Variable tab of the template (or loan). When a rate change event occurs, the system will check the selected base rate index and if a new interest rate is specified, the system will apply the new rate until the next rate change event occurs, at which time the index will again be selected. If the interest rate changes more than once between rate change events, only the latest rate will be applied.

The Variable tab contains the parameters necessary to control rate change events and notifications for a variable interest rate loan. These settings work in conjunction with the selected base rate in the Main tab and are not available unless a base rate is selected. NLS provides for setting two different rate change triggers on templates, an Initial Rate Change, which determines the first date on which the loan will check the base rate index for a rate change, and Subsequent Rate Changes, which determines how the system will derive the dates for all future checks against the base rate index.

Peg Interest is not currently implemented.

Rate Change Notice Document, when selected will generate a Word DOC document during a rate change. The generated document is stored in Document Printing.Notice Cutoff is not currently implemented.

Rounding Factor and Rounding Method

NLS 5.35 and later

The rounding factor and rounding method are used to round the interest rate so that it is divisible by the rounding factor upon any rate change after adding in the adjuster.

Rounding Factor may be a value in the range of 0.00000 to 1.0000.

Rounding Method can be <NONE>, Up, Down, or Nearest Factor (a 5 will round up).

Example

Interest rate is 4.16749 (4.00000 + 0.16749 adjustment):If Rounding Method is <NONE> (or the Rounding Factor is 0.00000) – no rounding occurs.

If Rounding Method is Up – interest rate will be 4.25000.

If Rounding Method is Down – interest rate will be 4.12500.

If Rounding Method is Nearest Factor – interest rate will be 4.12500.

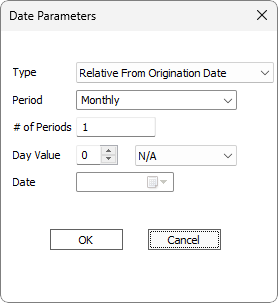

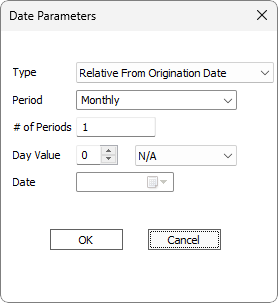

Clicking on  for either Initial Rate Change or Subsequent Rate Changes will open the Date Parameters dialog. This dialog sets all of the parameters necessary to define when a rate change event occurs. Because these parameters are date dependent and a template should be set up so that it can be used at any time a loan is added, it is often ineffective to set the rate change date parameters on the template. In that case, they must be set on a loan-by-loan basis when each variable rate loan is added.

for either Initial Rate Change or Subsequent Rate Changes will open the Date Parameters dialog. This dialog sets all of the parameters necessary to define when a rate change event occurs. Because these parameters are date dependent and a template should be set up so that it can be used at any time a loan is added, it is often ineffective to set the rate change date parameters on the template. In that case, they must be set on a loan-by-loan basis when each variable rate loan is added.

Type defines the method by which the date of a rate change is determined.

Not Applicable disables the rate change event and all other fields in the Date Parameters dialog. If the Initial Rate Change is set to Not Applicable, Subsequent Rate Changes will be disabled, and the interest rate will be set to the current value of the selected base rate as of the origination date of the loan when it is added.

If type is set to Relative From Origination Date, the rate change event will occur when the duration defined by the Period and # of Periods fields has elapsed since the origination date of the loan. Relative From Origination Date is intended for use with the Initial Rate Change, and although it is possible to select this type for Subsequent Rate Changes, we do not recommend doing so, because it will only trigger a rate change event once. If a periodic rate change is required, Subsequent Rate Changes should be set to a type of Relative to Initial Rate Change. This type is only available for Subsequent Rate Changes and functions in the same manner as Relative From Origination Date, except that the period is relative from the last rate change.

The last type, Fixed Date, is possible to use on a loan template, however we recommend against this practice because a loan may be added at any time using the template, even after a fixed date would become invalid. As mentioned in the section above, if the rate changes are to be defined with a fixed date, then they must be defined as each loan is entered, not on the template.

When type is set to Relative From Origination Date or Relative to Initial Rate Change, the total time between rate change events is defined by the Period and # of Periods fields. # of Periods sets the number of cycles, as defined by the Period field, between rate change events.

Example

If Period is set to Monthly, # of Periods is set to 3, and Type is set to Relative From Origination Date for the Initial Rate Change, then the first possible rate change for the loan would be 3 months from the origination date of the loan.Day Value allows the loan to force a rate change to a specific day of the month. N/A ignores the setting of day value, allowing the rate change to occur as defined by Period and # of Periods. Force Negative will cause the rate change to roll back to the date selected.

Example

If Day Value is set to 5/Force Negative and the rate change is scheduled to occur on June 2, the rate change will actually occur on May 5.Force Positive will make the rate change jump forward to the selected day value. Force Neutral will force the rate change to the selected day in the current month.

Example

If Day Value is set to 15/Neutral, a rate change will occur on the 15th of June regardless of whether the change was scheduled to happen on the 1st or the 31st of June.Note

The day value is only functional with a relative rate change type and will not be available when type is set to Fixed Date.Date sets an absolute date for the rate change when Type is set to Fixed Date. While this setting is functional with loan templates, it is not recommended because of possible conflicts when the date selected on the template becomes earlier than the origination date of a loan added with the template. For loans that require a fixed date for a rate change we recommend entering the date information at loan input time instead of in the template.

When the date parameters are set for a rate change the box to the right of  will display a description of when the rate change will occur in plain English.

will display a description of when the rate change will occur in plain English.

Example

If the Initial Rate Change was set to:Type – Relative From Origination Date

Period – Monthly

# of Periods – 3

Day Value – 1/Force Negative

the description would display “Advance 3 month(s) relative from origination date, Force backward to 1st day of the month.”

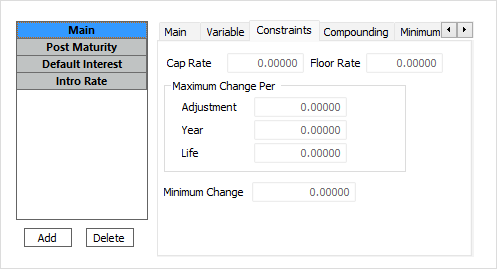

Constraints Tab

The Constraints tab contains the settings for interest limits when a variable interest rate is used.

| Option | Description |

|---|---|

| Cap Rate | Defines the maximum interest rate for the loan. |

| Floor Rate | Sets the minimum interest rate for the loan. |

| Maximum Change Per Adjustment | Sets the maximum rate change for each single rate change event. |

| Maximum Change Per Year | Limits the total amount by which the rate can be adjusted in one calendar year (January 1st through December 31st). |

| Maximum Change Per Life | Limits the total amount by which the rate can be adjusted, effectively creating another cap and floor rate for that loan which are based on the initial rate. |

| Minimum Change | Sets the minimum amount by which the rate can change at one time. |

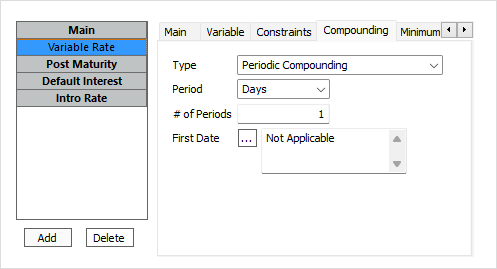

Compounding Tab

The Compounding tab contains the controls for setting up compound interest on a loan.

| Option | Description |

|---|---|

| Type | The compounding types available are: None, Periodic Compounding, and Compounding When Past Due.

None: There is no compounding of interest on the loan. Periodic Compounding: Each day’s interest is accrued on the sum of the principal balance plus whatever portion of the interest was accrued as of the last compounding date. Compounding When Past Due: All interest is compounded whenever the loan is past due. |

| Period | Only available for Periodic Compounding. Defines the compounding period. |

| # of Periods | Only available for Periodic Compounding. Used with Period to determine the compounding period. Example If a loan is to compound interest every five days, the period could be set to days and the number of periods set to 5. |

| First Date | Defines the first date on which the loan is to be compounded. The Period and # of Periods then determine the subsequent dates from that point. |

Minimum Interest Tab

This feature is not yet enabled in NLS.

Variable Rate Example

Example

This is an example on how to set up a loan with a base rate to use a variable rate interest based on the loan’s outstanding principal amount.

Query the loan and select Loan >  Loan Setup from the ribbon bar.

Loan Setup from the ribbon bar.

Click  next to Current Rate to open the Interest Rate dialog.

next to Current Rate to open the Interest Rate dialog.

Delete the current interest rate by selecting it in the left pane and click Delete.

Click Add to add a new interest rate.

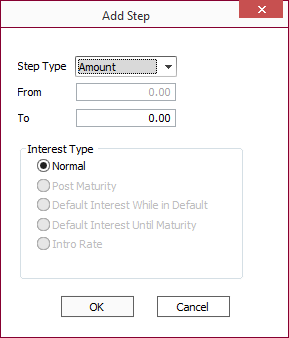

Set Step Type to Amount and enter the maximum amount of principal in the To field for which to apply this interest rate. The minimum amount, From field, is set to 0 and cannot be changed for the initial step. Click OK.

Select the base rate or tiered rate to be used from the drop down list and enter a spread or additional adjustment as needed.

Click the Variable tab then click  to set the date the loan is to be eligible for the initial rate change and do the same for subsequent rate changes.

to set the date the loan is to be eligible for the initial rate change and do the same for subsequent rate changes.

Click Add to add additional rate change steps for different principal amounts and interest rates as needed and click OK when finished.

Note

When adding additional steps, the From field will automatically be populated but can be edited. If the amount in either the From or To field overlap an existing entry, the values on the existing entries will be adjusted accordingly.Adding an Interest Object

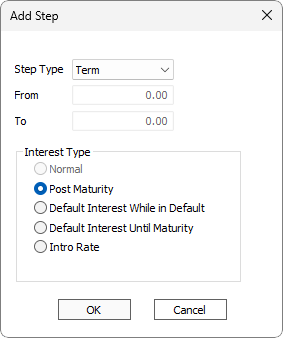

The Add button will open the Add Step dialog which sets the basic parameters for an interest object; the Interest Type and Step Type (including the step values if applicable).

Step Type

Step Type allows the user to set the step interest behavior of the interest object. Step Type may be set to Term, Days, or Amount.

| Option | Description |

|---|---|

| Term | The interest object does not step and will be in effect as set by the object’s Interest Type |

| Days | Allows the loan to have multiple interest objects for each group that are in effect for a specific range of days with respect to the group. For example, the first interest object with a Default Interest While in Default interest type could be set to one to 15 days with a fixed interest rate of 15%. The next default interest object could be set to 15 to 30 days with an interest rate of 16%, etc. |

| Amount | Allows stepping the interest based on the current principal balance of the loan. |

Step From and To set the day or amount parameters for an interest object when the Step Type is set to Days or Amount. From sets the low end of the range for the object and To set the high end of the range.

Once these parameters are set, clicking OK will add the object to the appropriate group. Click Cancel to exit the dialog without making any changes to the interest setup.

An interest object’s settings are controlled in the Main, Variable, Constraints, Compounding, and Minimum Interest tabs to the right of the interest object display.

Interest Type

Interest Type determines which group the interest object will be added in, and under which conditions an interest object will be in effect. Depending on what (if any) interest objects already exist for the template, the available options may be locked or restricted. Also a template may only have one interest object per group if the Step Type is set to Term.

A Normal interest type will be added to the Main group and will be in effect for the regular, non-default, term of the loan. The interest type will automatically be set to Normal when the first interest object is added to the template.

Post Maturity interest is used after the regular term of the loan has expired and is added in the Post Maturity group.

Default Interest While in Default type interest objects are in effect whenever the default condition has been met. If payments bring the loan current, the loan will be considered to be out of default and will revert to the current Normal interest type object. This interest type is shown under the Default Interest group.

Default Interest Until Maturity objects will be in effect if the default conditions have been met. Unlike Default Interest While in Default, once the default condition has been triggered, the Default Interest Until Maturity object will be in effect until the loan reaches maturity. This type of loan is also added under the Default Interest group.

Intro Rate interest objects are in effect from the start of the loan until the expiration date is reached. They may be configured as variable rate by assigning a base rate, and if that is done, they may be tied to a base rate spread to define the adjuster over the base rate. An additional flat positive or negative adjustment may be added.

Secondary Interest Stream

A loan can be configured to accrue a secondary stream of interest. This functionality is useful for payment in kind and other situations where two separate accrual rates are necessary.

To activate the secondary interest stream, select the Secondary Interest checkbox on the Interest Rate screen in either the loan template or in loan setup. The interest rate screen will be divided into two tabs: Stream 1 and Stream 2.

The secondary interest stream has identical setup parameters to the primary, except for the addition of one drop down list: Loan Balance. This allows you to determine if the secondary interest stream shall be combined with the primary in the Current Interest Accrued loan balance, or shall be recorded in a separate loan balance called Deferred Interest.

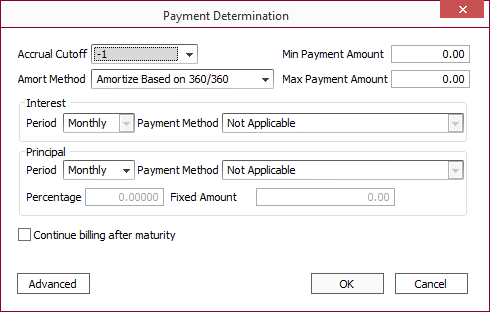

Payment Period

Payment Period sets the length of the payment cycle and its options are: Days, Weekly, Bi-Weekly, Semi-Monthly, Semi-Monthly (14 day), 28 Day, Monthly, Bi-Monthly, Quarterly, Semi-Annually, Annually, and Maturity. Click  to open the Payment Determination dialog.

to open the Payment Determination dialog.

The Payment Determination dialog sets advanced options for payments such as minimum and maximum payment amounts, the amortization method used to determine payment amounts, and other options.

| Option | Description | |||||||

|---|---|---|---|---|---|---|---|---|

| Accrual Cutoff | This value is added to the Next Interest Due Date to determine the date through which interest will be billed. example If the next interest payment is due on September 1st, and the Accrual Cutoff is -1, the September 1st payment will include all interest through August 31st. |

|||||||

| Min Payment Amount | Sets the minimum payment for the loan. If the total balance of the loan is greater than the Min Payment Amount, the program will always bill at least the amount set in this field, no matter what the calculated payment is. If the balance of the loan is less than the minimum, the remaining balance will be billed. | |||||||

| Max Payment Amount | Sets the maximum amount the loan will bill for. If the calculated payment is more than the maximum, the payment will be lowered to the maximum amount. | |||||||

| Amort Method | Determines how the payments are calculated.

|

|||||||

| Interest | Used when amortization method is set to Not Applicable to calculate the interest receivable on a payment.

|

|||||||

| Principal |

Used when the amortization method is set to Not Applicable, Total Payment Combined, or Total Payment Separated to determine the principal billing.

|

|||||||

| Continue Billing After Maturity | If selected, the regular payment will continue to bill every period until the loan is paid off. | |||||||

| Do not Bill Principal Balloon | This option is only available if Continue Billing After Maturity is selected. If selected, no balloon payment will bill and the loan will continue to bill its regular monthly payment until paid off. In effect, the term of the loan is governed by the payments. |

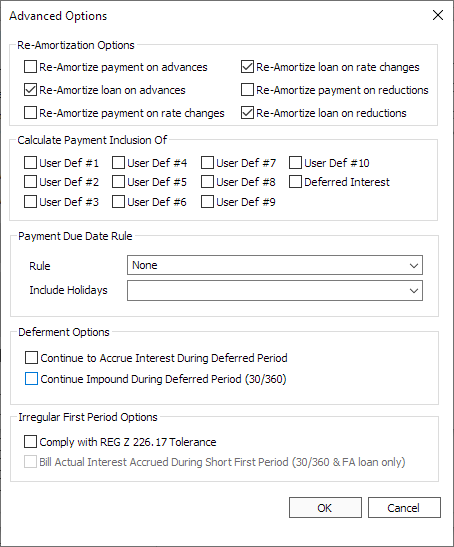

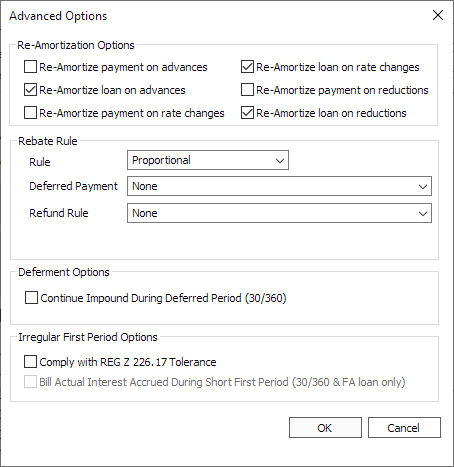

Advanced Options

| Option | Description | |||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Re-Amortization Options | Re-Amortize payment… - The payment amount is recalculated using the amortization equations, with the current principal, interest rate, and remaining term.

Re-Amortize loan… - On Fixed Amortized Loans only: the amount accrued on is re-indexed in the amortization schedule, resulting in the accrual and the interest to principal breakdown of future payments being adjusted to reflect the previous principal advances and reductions. The payment and the loan (accrual) may be re-amortized independently. |

|||||||||||||||||||||||||||||||||

| Calculate Payment Inclusion Of | For those loans where the payment is a fixed amount and the distribution is defined at the moment of payment (interest first / remainder to principal), any of the loan balances selected here will be included along with the interest for the purpose of determining, after the interest and these balances have been paid, how much of the required payment remains to be applied to principal. | |||||||||||||||||||||||||||||||||

| Payment Due Date Rule | Only available for certain loan types. Allows a payment which will be due on a weekend or holiday to be shifted to the previous or next business day. If the rule for holidays is invoked, you may select from a List of Holidays. NLS 5.13 and later Canadian holidays are classified by province. |

|||||||||||||||||||||||||||||||||

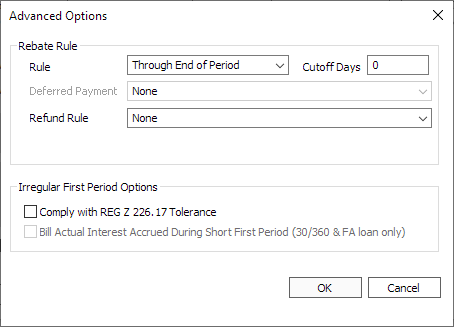

| Rebate Rule | This functionality is supported under both Rule of 78 (Sum of digits) and fixed amortized loans. Rule - When set to Proportional, the interest is not rebated and is proportionally charged to the payoff date in the period. This is the default for fixed amortized loans. When set to Through End of Period an additional option—Cutoff Days— will become available. Setting cutoff days to 15 will result in no interest earned in the period if the payoff is prior to the 15th of the period and will earn the entire period of interest after the 15th day of the period. NLS 5.13 and later When set to Through End of Period from Origination Date the refund is calculated from the origination date instead of just the current payment due date period. This can be used for loans with a long first payment period.When set to Nearest to Payment Date, no interest is charged if the payment date falls within the first half of the month. Full interest is charged if the payment date falls within the second half of the month. Refund RuleNone

Refund of Interest; Prepayment in Full Before First Installment Due Date (Texas Rule 83.756)Select this option to apply the Texas Rule §83.756 Refund of Precomputed Interest for Subchapter F Loans; Prepayment in Full Before the First Installment Due Date. When a loan is paid off prior to its first due date, any residual amount over 1/30th of the interest that is scheduled to accrue for the entire first period for each day after the origination date is refunded back to the borrower. If this amount is less than what has accrued on the loan, the lender is entitled to accrue additional interest up to this amount resulting in the refund of capitalized interest to the borrower being less.

Example Loan amount of $1,480 at 44.756% interest with 12 payments using Rule of 78 - Addon interest:

Refund of All Interest on Payoff Before First Installment Due DateNLS 5.11 and later Select this option to refund 100% of the interest if the loan is paid in full prior to the first due date.

Straight Line Interest

South Carolina Minimum Interest Refund ($15 on Renewal; $1 on Payoff)NLS 5.15 and later Rebate is fixed at $15 on renewal and $1 on payoff. Georgia Industrial Loan Act (GILA)NLS 5.18 and later Available for rule of 78 loan only. Tennessee Indirect Interest RefundNLS 5.20 and later Available for rule of 78 loan only. Louisiana Prepayment Charge |

|||||||||||||||||||||||||||||||||

|

Deferment Options5.14+

|

|

|||||||||||||||||||||||||||||||||

|

|

Term

The term of the loan is defined by the Term Type, Term, and Term Due fields on the main tab.

Term Type defines how the length of the term is measured.

| Term Type | Description |

|---|---|

| Days | The term of the loan is equal to the number of days specified in the Term field. The maturity date of the loan will be calculated by adding the appropriate number of days to the Origination Date. |

| Months | Defines the term of the loan as a specific number of months equal to the setting in the Term field. |

| Payments | Sets the length of the loan equal to a number of payments determined by Term. The actual length of the payment period is determined by the Payment Period and Payment Determination settings. |

| No Term | Used for revolving credit loans with an indefinite term, this type of loan will have no maturity date. |

On Amortized Loans, the Amortization Term of the loan may be different from the actual term which defines the maturity date. One example of this would be a 30 year amortized loan where the loan must be repaid or re-amortized within five years. When the Term Due field contains a different value than the Term field, Term defines the amortization term of the loan, while Term Due defines the maturity date.

Checkboxes

The checkboxes at the bottom of the tab allow access to additional tabs used to set up advanced features. Selecting a checkbox will turn on its corresponding tab. Note that the Custom Payment Schedule and Beginning Interest Only Period tabs cannot be used at the same time.

Use Implicit Interest Rate

When selected, NLS will calculate the interest rate based on the configured custom payment schedule. The Interest Rate field cannot be edited.

This option only appears in the Add Loan dialog and is not configurable in Loan Template.

Only applies to fixed amortization interest method and when the Custom Payment Schedule option is selected.

The classification tab of the template contains default settings for loans that are to be added using that template for the following fields:

See the respective topics on these fields for further information.

The Statements tab of the template contains default settings for loans that are to be added using that template for the following fields:

| Option | Description |

|---|---|

| Billing Cutoff | The number of days prior to the due date of the next payment on which that payment will bill and a receivable will be created in the payments due tab. The billing date (which is also the next statement date if the loan uses a billing statement) is calculated by adding the Billing Cutoff (a negative number) to the due date. |

| Statement 1 | Allows you to select a statement code to be assigned to the loans. This can be a billing statement code or a periodic statement. |

| Statement 2 | Allows you to select a second statement code to be assigned to the loans. This is optional. It should be used for a loan that, for example, has a monthly billing statement and a quarterly periodic custom statement. If the same statement code is selected in both fields, you will get the same statement twice. |

| Late Fee Code | Allows you to select a late fee code for the loans that will be entered using this template. The late fee code defines the various late loan events (fees and notices). |

|

Skip final pymt5.16+

|

When selected, a late fee will not be assessed on the final billing. This option will not prevent recurring transactions from billing late fees. |

| Make Timely | This functionality will test prior to assessing a late fee to see if the customer has made a whole payment during the current payment cycle that has been distributed to a previous period’s receivable. If Make Timely is enabled and the customer has made a full payment, no late fee will be assessed. This option can be set where the loan’s late fee is set up. |

| Req exact pymt | The Require Exact Payment option is only available when Make Timely is selected. When selected, the payment amount must be equal to the amount due for the make timely rule to take effect. |

| NSF Code | Allows for the selection of an NSF code for the loans that will be entered using this template. The NSF code defines any automatic NSF fee to be applied if a payment is reversed because of insufficient funds. |

The Re-Payment tab contains the settings that control how the loan system processes payments. This includes re-amortization settings, payment distribution order, and pre-payment penalties.

Amortization Repayment Type controls what portion of a payment is applied to interest vs. principal. This field may be locked or restricted depending on the Interest Method selected in the Main tab. If the loan does not use an amortization schedule to determine the payment amount, Not Applicable is the proper setting. Repay Using Fixed Amortization Schedule determines the interest/principal breakdown using the amortization schedule, and is unaffected by the interest balance on the date that the payment is received. Repay Using Interest First Remainder to Principal applies funds to cover all of the outstanding interest on the loan at the time the payment is received, with the remainder of the payment being applied to principal. This results in more of the payment being applied to principal if the payment is received early, and less if the payment is received late.

Principal and Interest Recalc is not currently implemented.

Pre Payment Penalty Type is not currently implemented.

Payment Distribution

When a payment is made on a loan and if the user does not manually specify to which balances the payment is to be applied, the system will apply the funds in the order specified in the loan’s Payment Distribution setting.

To change the payment distribution order for the template, click  located to the right of Payment Distribution to open the Payment Distribution dialog.

located to the right of Payment Distribution to open the Payment Distribution dialog.

To change the default distribution order, click on a distribution Item in the list, and use the Up and Down buttons to set the order desired. Clicking the Reset button will set the distribution back to the system default.

NLS allows the user to set up complex or arbitrary payment options via the Custom Payment tab. In order to access the tab, the Custom Payment Schedule checkbox must be selected in the Main tab. Selecting custom payments will disable Payment Period and the field will be removed from Main tab.

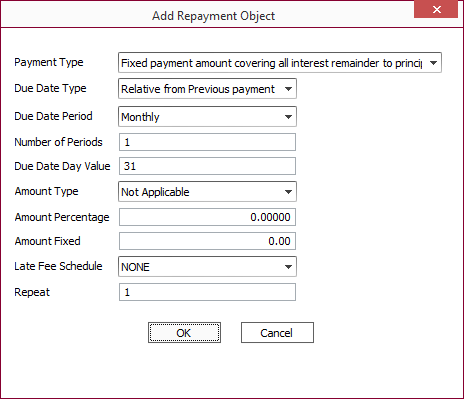

The Custom Payment tab contains a toolbar and the Custom Payment Schedule grid. Click Add  to open the Add Repayment Object dialog to create a new repayment object. Click Delete

to open the Add Repayment Object dialog to create a new repayment object. Click Delete  to delete the repayment object that is currently selected in the grid. Click Modify

to delete the repayment object that is currently selected in the grid. Click Modify  to open the Modify Payment dialog which mirrors the options in the Add Repayment Object dialog, except that the Repeat field is not present.

to open the Modify Payment dialog which mirrors the options in the Add Repayment Object dialog, except that the Repeat field is not present.

The grid displays the payment number, due date type, due date period, number of periods, day value, amount type, amount percent, fixed amount, and late fee schedule for each repayment object.

Add Repayment Object

The Add Repayment Object dialog contains all of the parameters necessary to create a new repayment object for the template.

Care should be taken when setting the parameters of a repayment object, as some settings are logically incompatible with each other and may produce unexpected results.

Payment Type

Payment Type determines what type(s) of receivable the custom payment object will generate.

| Option | Description |

|---|---|

| Interest Only Payment | The repayment object will generate an interest receivable based on the Amount Type, Amount Percentage, and Amount Fixed settings. |

| Interest Only Payment Less Outstanding Billed Interest | Creates an interest receivable based on the Amount Type, Amount Percentage, and Amount Fixed settings, however all calculations for the amount of the receivable are carried out after any outstanding billed interest is deducted from the current interest amount of the loan. |

| Principal Only Payment | Creates a principal receivable based on the Amount Type, Amount Percentage, and Amount Fixed settings |

| Principal Only Payment Less Outstanding Billed Principal | Creates a principal receivable based on the Amount Type, Amount Percentage, and Amount Fixed settings, however all calculations for the amount of the receivable are carried out after any outstanding billed principal is deducted from the current principal amount of the loan. |

| Fixed Principal Payment Plus Accrued Interest | Creates a principal receivable based upon the setting of the Amount Fixed field and creates an interest receivable in the amount of the currently accrued interest at the time the receivable is generated. |

| Fixed payment amount covering all interest remainder to principal | Creates a single receivable in the amount of the Amount Fixed field, applying the payment to interest first then applying any remaining amount to principal. |

| Bill all interest due | Creates an interest receivable for all outstanding interest at the time of billing. |

| Bill all principal due | Creates a principal receivable for all outstanding principal at the time of billing. |

| Bill entire loan amount | Creates an interest receivable for all outstanding interest and a principal receivable for all outstanding principal for the loan at the time of billing. |

Due Date Type

Due Date Type controls how the system calculates the due date of the repayment object. Relative from previous payment calculates the date starting from the billing date of the last payment, or the origination date if no previous payment exists. Relative from Origination Date calculates the date starting from the origination date of the loan.

The billing date is determined by stepping forward from the date determined by Due Date Type a number of periods (specified by Number of Periods) of length set by Due Date Period.

Example

A payment object set to: Due Date Type – Relative from Origination date, Due Date Period – Months, and Number of Periods – 3, would set the date 3 months forward from the origination date of the loan.Due Date Day Value

Due Date Day Value will force the due date of the repayment object to the day specified in the field within the current month.

Example

If the calculated date for the repayment object was the 15th of June but Due Date Day Value was set to 1, the actual due date would shift to the 1st of June.Amount Type

Amount Type specifies the method by which the amount of the receivable is calculated.

| Option | Description |

|---|---|

| Not Applicable | Will result in no payment being generated, unless Payment Type has a specific method for calculating the payment amount. Example Fixed Principal Payment Plus Accrued Interest will use the amount set in the Amount Fixed field for the principal portion of the billing and the current interest amount for the interest billing, regardless of the setting of Amount Type. |

| % of Original Principal | Calculates the payment amount based on a percentage (set in the Amount Percentage field) of the original principal amount of the loan. |

| % of Current Principal | Calculates the payment amount based on a percentage (set in the Amount Percentage field) of the current principal amount of the loan. |

| % of Current Interest | Calculates the payment amount based on a percentage (set in the Amount Percentage field) of the current interest amount of the loan. |

| Fixed Amount | Bills the amount specified in the Amount Fixed field. |

| Percentage of Total Payment’s Base | Calculates the percentage (base x rate) of the base given the total amount and rate. Total Amount = Base + Percentage. |

Amount Percentage

Amount Percentage specifies the percentage to be used to calculate the payment mount, where applicable.

Amount Fixed

Amount Fixed specifies the payment amount for Payment Types and Amount Types that use a fixed payment amount.

Late Fee Schedule

Late Fee Schedule allows the payment object to utilize any of the Late Loan Codes set up in the Late Loan Events tab of Loan Setup.

Repeat

Repeat allows the user to create multiple copies of the same repayment object for the purpose of easily setting up a custom periodic billing cycle. When the user clicks the OK button to add the repayment object, a number of copies equal to Repeat will be created. This setting should only be used when Due Date Type is set to Relative From Previous Payment.

Recurring Transactions allows the user to add custom transactions which re-executed at specified time to the template. The Recurring Transactions tab consists of the toolbar, the transaction list, and the settings tabs.

The toolbar has buttons (from left to right) to Add  a new transaction, Delete

a new transaction, Delete  a transaction, Move Up

a transaction, Move Up  a transaction on the list, and Move Down

a transaction on the list, and Move Down  a transaction on the list.

a transaction on the list.

The transaction list displays a list of all the recurring transactions for the template. When a transaction is selected, its settings will load into the Event, Transaction, and Notes tabs to the right of the transaction list.

Event Tab

The Event tab holds the basic settings that determine when the transaction will occur and for how long it will repeat.

| Option | Description |

|---|---|

| Description | Sets the name of the transaction in the transaction list. |

| Event |

Controls whether the transaction is a Scheduled, Periodic, Billing, Daily Accrual, On Post Payment, or On Pre Payment transaction.

Scheduled transaction is a single time event and will only occur once. Only a Start Date and a Statement Cutoff may be specified for a scheduled event. Periodic event may be run repeatedly until the Expire Date parameters are satisfied or until it has run for the length specified in #of Periods. Billing event will occur each time the loan bills a payment through its automated payment cycle. Daily Accrual event will execute every day, and be adjusted if the balance it is accrued on has a backdated change. On Post Payment event will occur whenever a payment is entered on the loan. |

| Max Repeat | Sets the maximum number of times the event may run. This setting supersedes the settings for Expire Date and # of Periods. |

| Start Date | Determines when the transaction will first run. Clicking  will open the Date Parameters dialog which contains the settings necessary to define the start date. will open the Date Parameters dialog which contains the settings necessary to define the start date. |

| Expire Date | Determines when the transaction will end. Clicking  will open the Date Parameters dialog which contains the settings necessary to define the expire date. will open the Date Parameters dialog which contains the settings necessary to define the expire date. |

| Period | For Periodic transactions, the length of time between transactions is specified as a # of Periods of length determined by the Period field. |

| Due Date Day | Will force the due date of the recurring transaction to the date specified within the current month. Example If the calculated date for the transaction was the 15th of June but Due Date Day value was set to 1 the actual due date would shift to the 1st of June. |

| Statement Cutoff |

For recurring transactions that will use a trans code that is NOT a receivable, the statement cutoff should be set to zero. The transaction will actually execute on the transaction due date plus the Statement Cutoff.

Note The Statement Cutoff is a negative number so the transaction will execute a number of days before the due date. |

| Execute Post Accrual | If this checkbox is selected, the recurring transaction will occur at the end of the accrual process, after the day’s interest has been accrued. Otherwise, it will occur earlier in the process, before the interest accrual. This can be critical if the transaction is set to execute for an amount equal to a percentage of the current interest balance. |

| Execute Beginning of Day | If this option is selected, the recurring transaction will occur at the beginning of the day. This option is mutually exclusive and cannot be selected along with the Execute Post Accrual option. |

| Execute Only During Payoff | Only available when event type is On Pre Payment. When selected, the recurring transaction will only execute if a payoff is triggered. |

Date Parameters

The Date Parameters dialog is accessed by clicking  in the Start Date and Expire Date fields.

in the Start Date and Expire Date fields.

Type defines the method by which the date of a recurring transaction is determined. If type is set to Relative From Origination Date, the transaction will occur when the duration defined by the Period and # of Periods fields has elapsed since the origination date of the loan. Relative From 1st Principal Payment will cause the transaction to occur when the duration defined by the Period and # of Periods fields has elapsed since the first principal payment becomes due. Relative From 1st Interest Payment will cause the transaction to occur when the duration defined by the Period and # of Periods fields has elapsed since the first interest payment becomes due. Although it is possible to set the Type to Fixed Date, doing so is not recommended for templates.

Day Value allows the loan to force a recurring transaction to a specific day of the month. N/A ignores the setting of day value, allowing the transaction to occur as defined by Period and # of Periods. Force Negative will cause the transaction to roll back to the date selected.

Example

If Day Value is set to 5/Force Negative and the transaction will normally occur on June 2, the transaction will actually occur on May 5.Force Positive will make the transaction jump forward to the selected day value.

Force Neutral will force the transaction to the selected day in the current month.

Example

If Day Value is set to 15/Neutral, a transaction will occur on the 15th of June regardless of whether the transaction was scheduled to happen on the 1st or the 31st of June.CAUTION

When entering a new loan, make sure the Day Value is equal to or greater than the current date when using Force Neutral. A Day Value less than the current date will cause the initial transaction of a new loan to occur prior to the loan’s origination date.

Note

The day value is only functional with a relative rate change type and will not be available when type is set to Fixed Date.Date sets an absolute date for the transaction when Type is set to Fixed Date. While this setting is functional with loan templates, it is not recommended because of possible conflicts when the date selected on the template becomes earlier than the origination date of a loan added with the template. For loans that require a fixed date for a recurring transaction, we recommend entering the date information at loan input time instead of in the template.

Transaction Tab

The Transaction tab holds the settings that define the transaction.

Transaction Type

| Option | Description |

|---|---|

| Transaction Code | The transaction code to be executed is selected from the Transaction Code drop down list. |

| Principal Due | In place of this selection, use Transaction Code, and set the Transaction Code number to 120. |

| Interest Due | In place of this selection, use Transaction Code, and set the Transaction Code number to 122. |

| Payment | The recurring transaction will automatically post a payment of the amount specified, according to the default distribution settings on the loan. |

| Servicing Fee | The transaction is a servicing fee, which can be defined as a fixed amount, a percentage, or a lookup table. A vendor may be specified for the receipt of the servicing fee, and the reconciliation of that fee can be by any one of the following three methods: Net from Cash - By Payment, Net from Cash - Total Outstanding, or Bill Lender. |

| Calculates the percentage, based on the selected numerator and denominator, to be applied to the transaction. | |

| Subsidization Settlement | This recurring transaction type is only available if the transaction is on a participant. The transaction will automatically create a voucher to allow for the billing of subsidized interest to the subsidizing participant. |

Transaction Code

Select the transaction code to be executed by the recurring transaction.

Late Fee Schedule

If the transaction code selected is a receivable, a late fee schedule can be assigned to the receivable so that a late fee will automatically post if the receivable is not paid before the expiration of the grace period.

Amount Type

This allows you to select a Fixed Amount for the transaction or to define the transaction amount as a percentage of any loan balance.

Amount Percentage

If the transaction is to be for a fixed amount, enter that fixed amount here. If it is a percentage of a loan balance, enter the percentage here.

Amount Min

If the amount is a percentage and that calculated percentage is less than the amount entered in this field, the transaction will execute for the amount in this field.

Amount Max

If the amount is a percentage and that calculated percentage exceeds the amount entered in this field, the transaction will execute for the amount in this field. A value of zero in this field indicates no maximum (not a maximum of zero).

NLS 5.31 and later

Only available when Transaction Type is Transaction Code or Payment. The payment method to use for the recurring transaction.

Payment Method Reference

NLS 5.31 and later

Only available when Transaction Type is Transaction Code or Payment. Any reference information to associate with the payment method.

Notes Tab

The Notes tab allows the user to input notes about any recurring transactions included in the template.

This tab is visible only when the loan type is Shadow Loan. See Adding a Shadow Loan.

The Interest Only Term tab allows the user to set up a period in the beginning of the loan that only bills the interest accrued. The fields function in a similar manner to those in the Main tab, but apply only to the interest only term.

Term Type defines how the length of the interest only term is measured. When set to Days the interest only term is equal to the number of days specified in the Term field. Setting Term Type to Months defines the interest only term as a specific number of months equal to the setting in the Term field. A Term Type of Payments sets the length of the interest only term equal to a number of payments determined by Term. The actual length of the payment period is determined by the Period field.

It is possible for the interest only term to have a different interest year than the regular term of the loan which is set in the Interest Year field.

Lock Fields tab allows the template to prevent the user from changing certain settings while the loan is being added. When a user chooses the template in the add loan dialog, any of the areas that are selected will not be able to be changed.

| Option | Description |

|---|---|

| Loan Setup | Will lock fields in the Main, Classification, Setup, and Re-Payment tabs. Exceptions are Net Loan Amount, Payment Amount, Interest Rate, and Origination Date in the Main tab, and Loan Officer and Collection Officer in the Setup tab. |

| Interest Rate | Will lock the interest rate and options for the loan, if applicable. |

| Recurring Transactions | Will lock all fields in the Recurring Transactions tab. |

| Credit Line | Will lock all changes to the Credit Line field and its options, if applicable. |

| Option | Description |

|---|---|

| Credit Bureau Header | Select from the Credit Bureau Headers that you have configured in the Credit Bureau section of Loan Setup. |

| Portfolio Type | Select the portfolio type to be reported (as defined by the credit bureau reporting agencies) which is to be used with the loans that are added with this template. |

| Account Type | Select the account type to be reported (as defined by the credit bureau reporting agencies) which is to be used with the loans that are added with this template. |

| Primary ECOA Code | Select the ECOA code to be reported (as defined by the credit bureau reporting agencies) which is to be used with the loans that are added with this template. |

When selected, the Credit Bureau ID as defined for the branch (in the contact’s  Branch Setup dialog) will be used for the loan. In the Branch Setup dialog, Enable Branch must be selected and a valid Credit Bureau ID must be selected. Branch Setup dialog) will be used for the loan. In the Branch Setup dialog, Enable Branch must be selected and a valid Credit Bureau ID must be selected.The Credit Bureau Header drop down will be disabled and must be set to NONE prior to selecting this option. |

|

| Do not report | Loans with this option selected are not included in credit bureau reports. |

loan template setup add-on addon buydown buy-down

Payment Information dialog.

Payment Information dialog.