Tiered Rate

Available in NLS 5.4 and later

A tiered rate structure can be used to associate a fixed interest rate for a range of principal balances on a loan. An unlimited number of tiers can be created for a single tiered rate structure.

Tiered rate can be applied to simple interest and fixed amortization interest methods and once a tiered rate structure is associated with a loan, it cannot be modified.

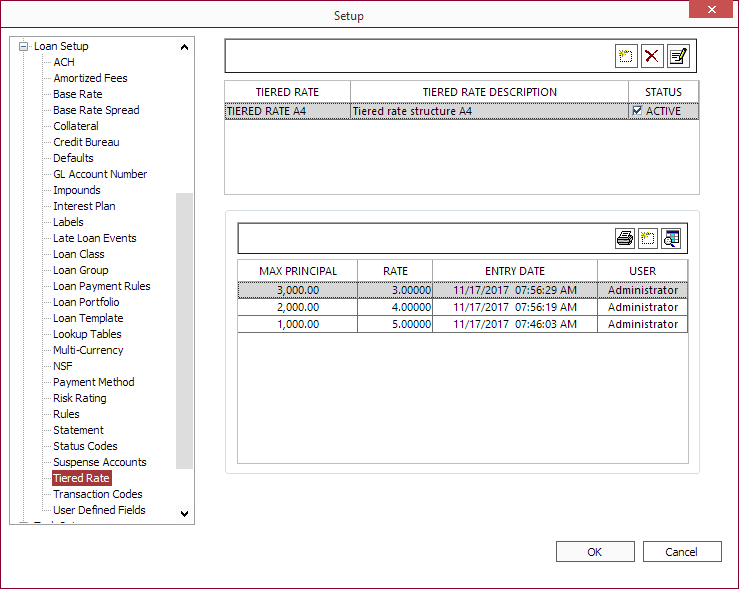

Tiered rates can be configured in Setup > Loan Setup > Tiered Rate.

The buttons on the upper portion of the Tiered Rate window:

Add Add |

Creates a new tiered rate structure. Enter a name and description for the tiered rate, and click OK. The system will automatically prompt a Tiered Rate Correction to force you to set an initial rate for this tiered rate structure. Enter a max principal amount for which this rate tier will take effect. Enter the interest rate in the Tiered Rate field and enter a comment about this rate if one is desired. Click OK. |

Delete Delete |

Deletes the highlighted tiered rate schedule. A tiered rate that is currently referenced on any existing loan account cannot be deleted. |

Modify Modify |

Opens the Modify Tiered Rate dialog. Enter a new description and click OK. |

Tiered Rate Corrections

The lower half of the tiered rate window shows the list of tiered rate corrections for the currently selected tiered rate structure.

This pane shows the maximum principal of each tiered rate correction, the rates that will be in effect up to the maximum principal, the day and time the rate was entered, and which NLS user entered it.

The buttons on the lower half of the Tiered Rate window:

Print Print |

Click this button to send the list of tiered rate corrections to the printer. This printout will give you the entire structure for the selected tiered rate. |

Add Add |

Creates a new Tiered Rate Correction entry. Tiered rate corrections set the interest rate for the loan based on its principal balance. Enter a new maximum principal balance for the new rate tier. Enter the new rate, and a comment if one is required. Click OK. |

Show/Hide Correction Show/Hide Correction |

When Show/Hide Corrections is set to “Show,” a check mark will indicate which old rate entries have been superseded by the new rate change. When the display is set to hide corrections, the check marked entries will be removed so that you can easily see the structure as it is currently in effect. |

Adding a Tiered Rate Structure to a Loan

To add a Tiered Rate structure to a simple interest or fixed amortization loan, click  next to Interest Rate in the Add New Loan dialog or Restructure Loan dialog.

next to Interest Rate in the Add New Loan dialog or Restructure Loan dialog.

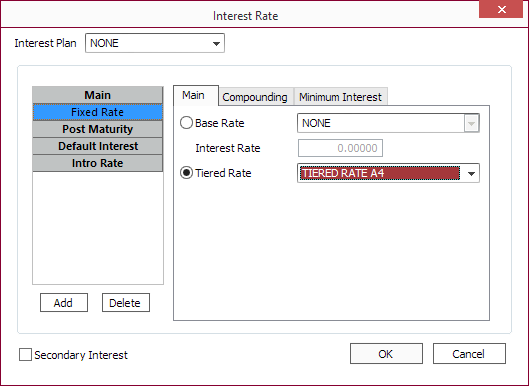

Then in the Interest Rate dialog, click Tiered Rate and select the tiered rate structure created in Tiered Rate Setup from the drop down list.

Once a loan is associated with a tiered rate, the loan's Curr Rate field in the Main loan view will display Tiered Rate.

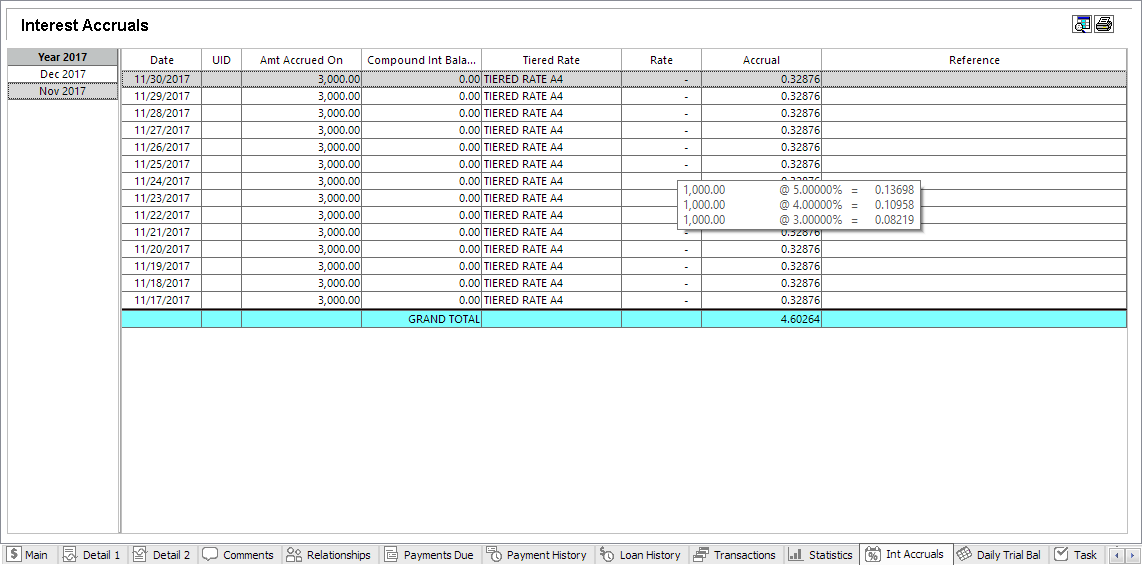

To see how the tiered rates applied to a loan in its accruals, click the  Int Accruals tab and place the cursor over the Rate column. A tooltip will show the breakdown of the tiered rates as it applied to the principal balance.

Int Accruals tab and place the cursor over the Rate column. A tooltip will show the breakdown of the tiered rates as it applied to the principal balance.