Interest Year Calculations

Interest Year determines the calculation method for the per diem interest of the loan and will thus affect the Annual Percentage Yield.

Interest Year in the Nortridge Loan System is defined by a Numerator and a Denominator, both of which can be one of five values: 360, 364, 365, 366, or ACT.

Since the Interest Year is defined as a ratio of two instances from these five values, there are 25 possible interest year definitions:

|

|

N = 360

|

N = 364

|

N = 365

|

N = 366

|

N = ACT

|

|---|---|---|---|---|---|

|

D = 360

|

360 / 360 |

364 / 360 |

365 / 360 |

366 / 360 |

ACT / 360 |

|

D = 364

|

360 / 364 |

364 / 364 |

365 / 364 |

366 / 364 |

ACT / 364 |

|

D = 365

|

360 / 365 |

364 / 365 |

365 / 365 |

366 / 365 |

ACT / 365 |

|

D = 366

|

360 / 366 |

364 / 366 |

365 / 366 |

366 / 366 |

ACT / 366 |

|

D = ACT

|

360 / ACT |

364 / ACT |

365 / ACT |

366 / ACT |

ACT / ACT |

The value: ACT represents the actual number of days in the current year. All Interest Years containing the value of ACT emulate other interest year calculations but may emulate different interest years depending on the leap year status of the current year.

|

Interest Year |

In Non-Leap Year Emulates |

In Leap Year Emulates |

|---|---|---|

|

ACT / 360 |

365 / 360 |

366 / 360 |

|

ACT / 364 |

365 / 364 |

366 / 364 |

|

ACT / 365 |

365 / 365 |

366 / 365 |

|

ACT / 366 |

365 / 366 |

366 / 366 |

|

ACT / ACT |

365 / 365 |

366 / 366 |

|

360 / ACT |

360 / 365 |

360 / 366 |

|

364 / ACT |

364 / 365 |

364 / 366 |

|

365 / ACT |

365 / 365 |

365 / 366 |

|

366 / ACT |

366 / 365 |

366 / 366 |

To calculate the per diem, first multiply the interest rate (r) by the principal (p) to derive the annual interest (i).

To calculate the per diem (daily) interest, use the following equation where:

i = annual interest

z = per diem interest

n = numerator of interest year

d = denominator of interest year

l = number of days in current year (365 if a non-leap year and 366 if a leap year)

The same equation, written in single line format (as a computer equation) would look like this:

The Interest Year 360/360 is a special case. In this case, the per diem interest is the annual interest divided by the number of payments in a year, divided by the number of days in the current payment period. This interest year is inherent in the amortizing equations, and while a Fixed Amortization loan could be done with other interest years, 360/360 is assumed for Fixed Amortization loans because this is the only interest year calculation where the accrual and an amortization schedule built from the amortizing equations will directly synchronize.

For each interest year, you may calculate the Annual Percentage Yield (APY) by multiplying the Annual Percentage Rate (APR) by the factor listed in the table below (not accounting for fees and charges).

|

Interest Year |

APY factor (Non-Leap) |

APY factor (Leap Year) |

|---|---|---|

|

360 / 360 |

1 |

1 |

|

364 / 360 |

1.01111 |

1.01111 |

|

365 / 360 |

1.01389 |

1.01389 |

|

366 / 360 |

1.01667 |

1.01667 |

|

ACT / 360 |

1.01389 |

1.01667 |

|

360 / 364 |

0.98901 |

0.98901 |

|

364 / 364 |

1 |

1 |

|

365 / 364 |

1.00275 |

1.00275 |

|

366 / 364 |

1.00549 |

1.00549 |

|

ACT / 364 |

1.00275 |

1.00549 |

|

360 / 365 |

0.98630 |

0.98630 |

|

364 / 365 |

0.99726 |

0.99726 |

|

365 / 365 |

1 |

1 |

|

366 / 365 |

1.00274 |

1.00274 |

|

ACT / 365 |

1 |

1.00274 |

|

360 / 366 |

0.98361 |

0.98361 |

|

364 / 366 |

0.99454 |

0.99454 |

|

365 / 366 |

0.99727 |

0.99727 |

|

366 / 366 |

1 |

1 |

|

ACT / 366 |

0.99727 |

1 |

|

360 / ACT |

0.98630 |

0.98361 |

|

364 / ACT |

0.99726 |

0.99454 |

|

365 / ACT |

1 |

0.99727 |

|

366 / ACT |

1.00274 |

1 |

|

ACT / ACT |

1 |

1 |

Example:

A 10% APR loan with an Interest Year of ACT/360 (the Interest Year with the highest possible yield) will have an APY of 10.1389% in non-leap years and 10.1667% in leap years.Over the life of a 30 year loan with a starting principal of $100,000, this would result in an additional $2,183 in accrued interest.

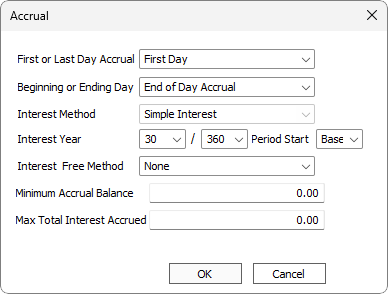

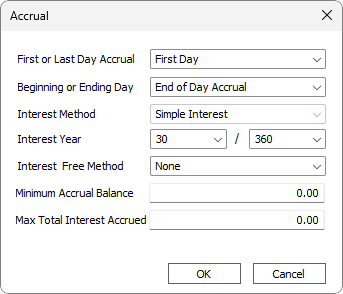

30 / 360

30 / 360 can be selected for simple interest and fixed amortization loans.

Only First Day and End of Day Accrual are available for 30 / 360.

Interest accruals will be skipped or added based on the number of days that are in the monthly period. If a monthly period contains 31 days, the accrual on the 31st day will be 0.00. If a monthly period contains 28 days, additional two days of accruals will be added.

NLS 5.29 – 5.42

Only the following payment periods are allowed for 30 / 360:

-

Monthly = 30 days per month for all 12 months of the year

-

Bi-Monthly = 60 days for each of the 6 bi-monthly periods of the year

-

Quarterly = 90 days per quarter for all 4 quarters of the year

-

Semi-Annual = 180 days per semi-annual period, twice a year

-

Annual = 360 days for the whole year

The value specified by the Period Start field will be used to determine the start and end dates of the “month” period.

Example

If the “interest calculation period start date” is set to 5:| December 5 – January 4 | 31 day period | Accrue zero on January 4 |

| January 5 – February 4 | 31 day period | Accrue zero on February 4 |

| February 5 – March 4 | 28 day period | Accrued 3x on March 4 |

| March 5 – April 4 | 31 day period | Accrue zero on April 4 |

| April 5 – May 4 | 30 day period | Accrue normally |

| May 5 – June 4 | 31 day period | Accrue zero on June 4 |

| June 5 – July 4 | 30 day period | Accrue normally |

| July 5 – August 4 | 31 day period | Accrue zero on August 4 |

| August 5 – September 4 | 31 day period | Accrue zero on September 4 |

| September 5 – October 4 | 30 day period | Accrue normally |

| October 5 – November 4 | 31 day period | Accrue zero November 4 |

| November 5 – December 4 | 30 day period | Accrue normally |

Example

If the next principal period is extended from 4/1 to 7/15, the interest accrual will be:4/1~4/30 = principal * rate / 12 / 30

5/1~5/30 = principal * rate / 12 / 30

5/31 = 0

6/1~6/30 = principal * rate / 12 / 30

7/1~7/14= principal * rate / 12 / 30

If the next principal period is shortened from 4/1 to 3/25, all the days within that period will have an interest of 1 day per diem:

3/1~3/24 = principal * rate / 12 / 30