Branch Loan Detail

NLS 5.9 and later

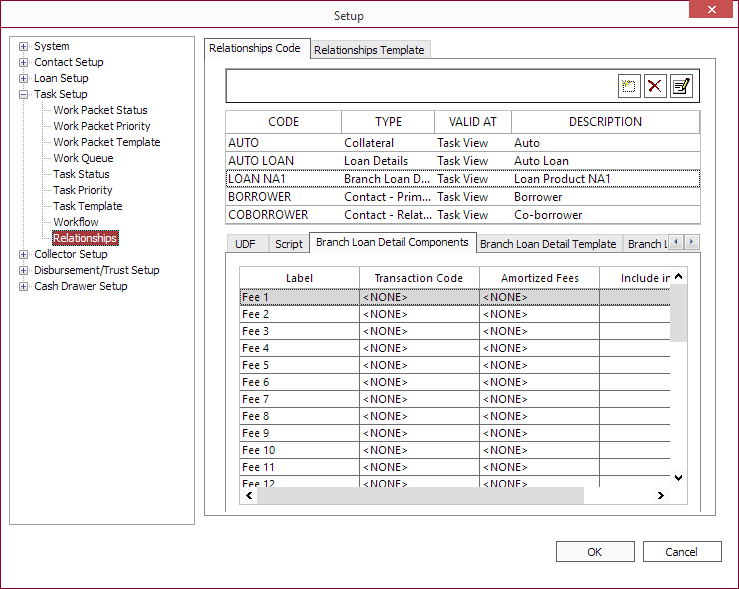

Branch Loan Detail Components

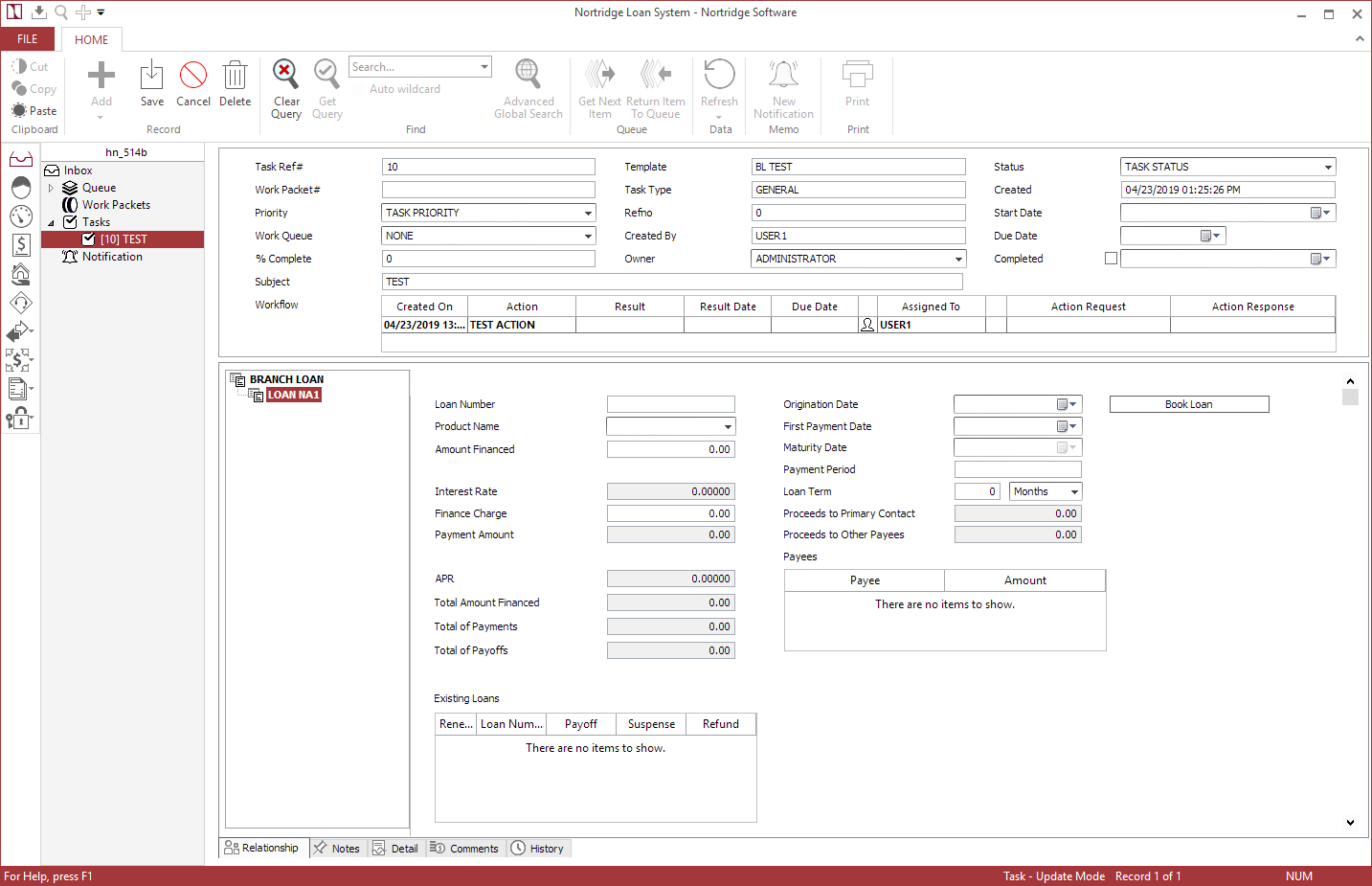

The Branch Loan Detail Components tab contains a list of fields which may be enabled for the loan origination process.

Any fields that are not appropriate to the type of loan that is to be set up by this Branch Loan Detail Task Relationship may be left disabled (by leaving the Enabled checkbox unselected).

For each of these fields, the following options may be set.

| OPTION | DATA TYPE | DEFINITION |

|---|---|---|

| Label | Text | The name of the fee may be entered here. |

| Transaction Code | Drop Down List | Allows selection from the list of available transaction codes and defines which transaction code (if any) should be executed upon loan entry for the amount that has been entered in this field. Transaction Code and Amortized Fees are mutually exclusive—if a transaction code is selected Amortized Fees will become <NONE>. |

| Amortized Fees | Drop Down List | Allows selection from the list of previously configured amortized fee setups and defines which of these fee setups (if any) should be automatically configured upon loan entry for the amount that has been entered in this field. Amortized Fees and Transaction Code are mutually exclusive—if an amortized fees is selected Transaction Code will become <NONE>. |

| Include in PreCompute | Checkbox | Only valid if the transaction code affects the loan amount of principal. When selected, the amount will be included in Transcode 110 - Precomputed Interest. This only applies to rule of 78 and fixed amortization loans. |

|

Include in Amount Financed5.25+

|

Checkbox | When selected, the item is included in the amount financed value during calculation. |

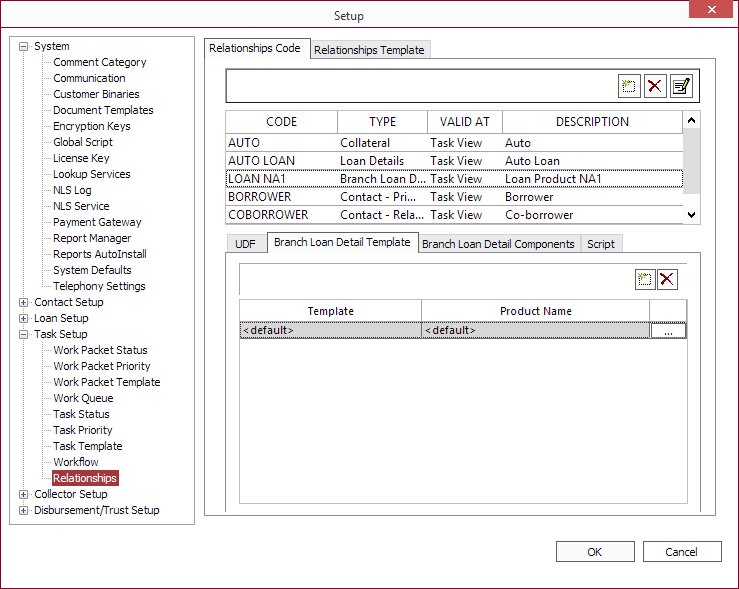

Branch Loan Detail Template

Click  Add on the Branch Loan Detail Template tab to add links to your existing loan templates. These now represent available loan products that may be chosen during the origination process for which this relationship code is to be used. A name designation may be specified for the loan product.

Add on the Branch Loan Detail Template tab to add links to your existing loan templates. These now represent available loan products that may be chosen during the origination process for which this relationship code is to be used. A name designation may be specified for the loan product.

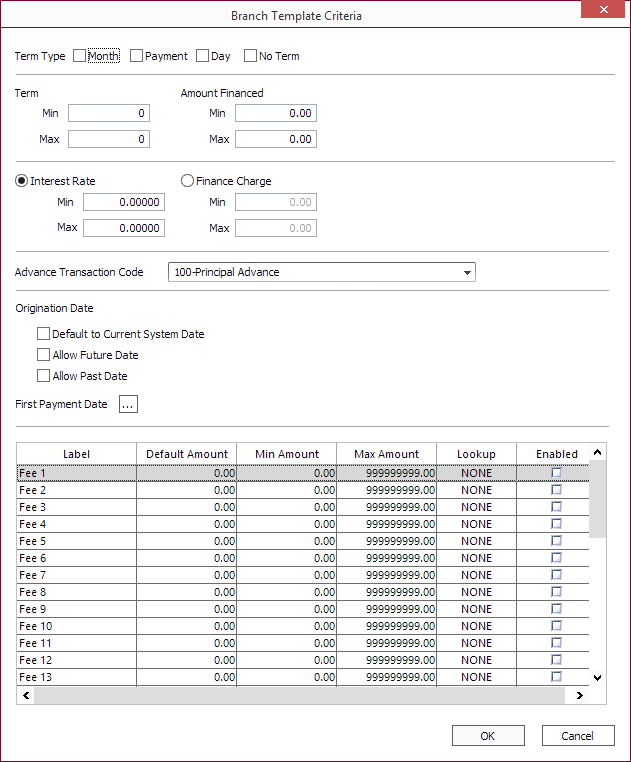

Click  to the right of the template to bring up the Branch Template Criteria dialog. Here, you may define the term type, term, amount financed, and a minimum and maximum interest rate or finance charge for the loan product.

to the right of the template to bring up the Branch Template Criteria dialog. Here, you may define the term type, term, amount financed, and a minimum and maximum interest rate or finance charge for the loan product.

| Term Type | Defines how the length of the loan’s term is measured. | ||||||||||

| Term | Defines the length of the term type. | ||||||||||

| Amount Financed | Defines the range of amount financed on the loan. This is the loan’s loan amount (principal balance). | ||||||||||

| Interest Rate Finance Charge |

Interest Rate and Finance Charge are mutually exclusive. Defines the range of interest rate or finance charge on the loan. |

||||||||||

| Advance Transaction Code | The transaction code to use for advances made on the loan. | ||||||||||

| Origination Date |

|

||||||||||

| First Payment Date | Click  to display a dialog for configuring the first payment date for the loan. to display a dialog for configuring the first payment date for the loan. |

||||||||||

| Fee 1 to Fee 35 |

|

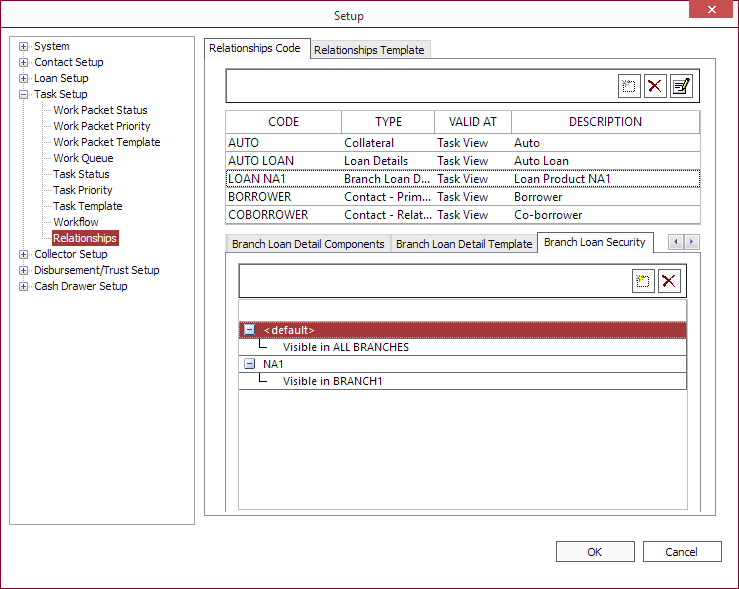

Branch Loan Security

NLS 5.14 and later

The availability of templates to specified branches can be configured in the Branch Loan Security tab. A security entry is automatically created for each template under its product name.

Click  to associate a branch with the selected template. Only branches listed under each template will have access to the respective template.

to associate a branch with the selected template. Only branches listed under each template will have access to the respective template.

Renewing Loans

NLS 5.10 and later

Loans belonging to the same borrower or applicant tied to the loan application task may be renewed by selecting the loan from the Existing Loans list.

When the loan is renewed, all remaining balances of the old loan will be added to the Amount Financed (Principal) of the new loan. The Amount Financed value cannot be changed and other outstanding balances will be moved to the new loan accordingly:

- Interests, fees, late charges, and user defined total will be reversed in the old loan using corresponding restructure transcodes then moved to the new loan’s principal balance.

- Suspense will be reversed in the old loan then moved to the new loan by subtracting the amount from the new loan’s principal balance.

- Pending will be reversed in the old loan then moved to the pending bucket in the new loan.

- Outstanding balances of impound, off loan balance, and servicing fee—if any of these exists on the old loan—must be satisfied on the old loan before the loan can be renewed.

- Amortized fee will be canceled using the cancellation type as defined in the amortized fees cancellation setup. If the cancellation type is set to None, it must first be set to a different cancellation type before the loan can be renewed.

Update Loan

NLS 5.15.1 and later

When Update Loan is clicked, a wizard driven interface will step through the process of updating the loan.

Payees

NLS 5.14 and Later

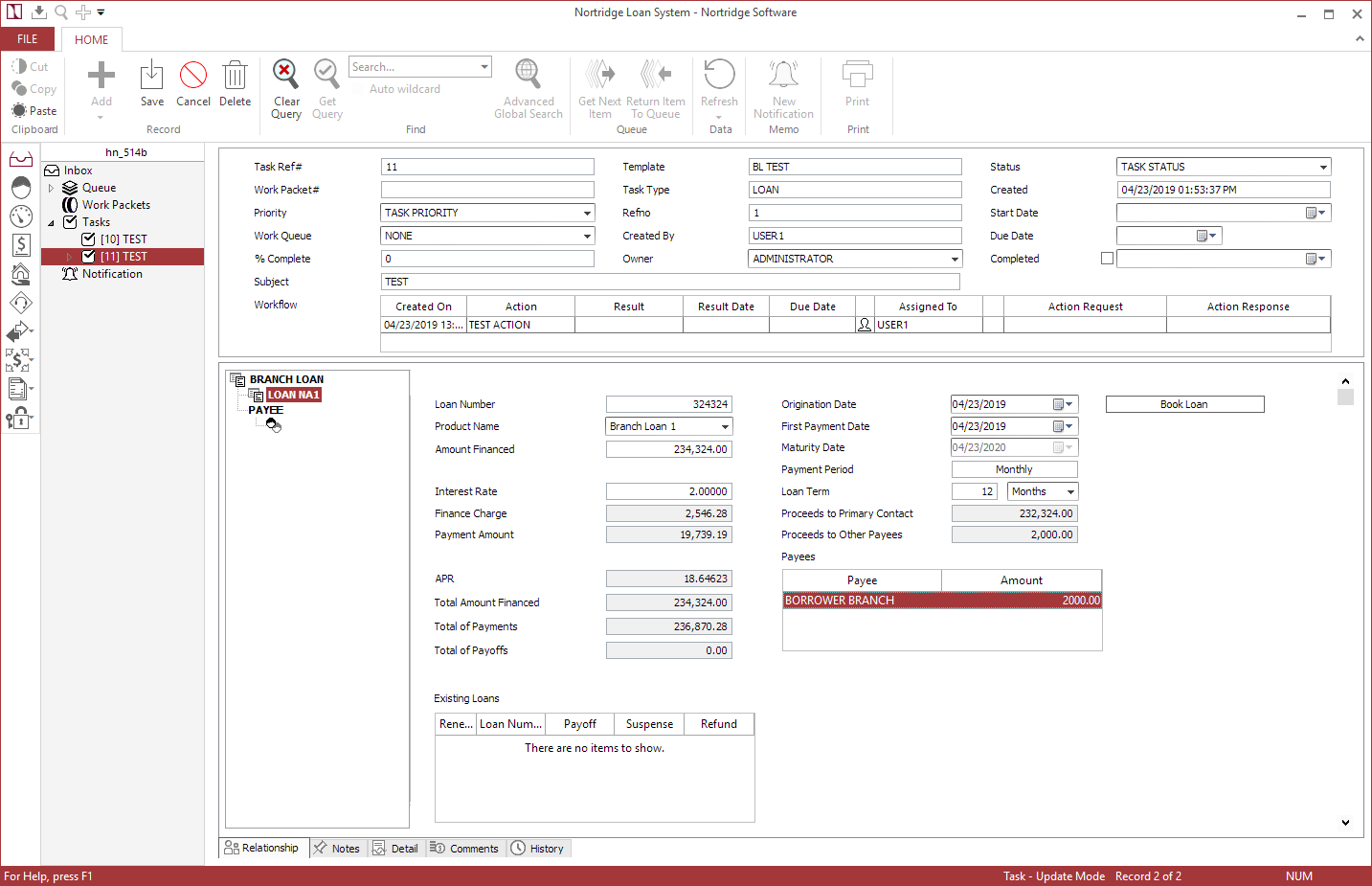

Additional payees may be added to receive portion of the proceeds with each resulting in a 100 - Principal Advance transaction with a voucher tied to the payee.

NLS 5.15.1 and later

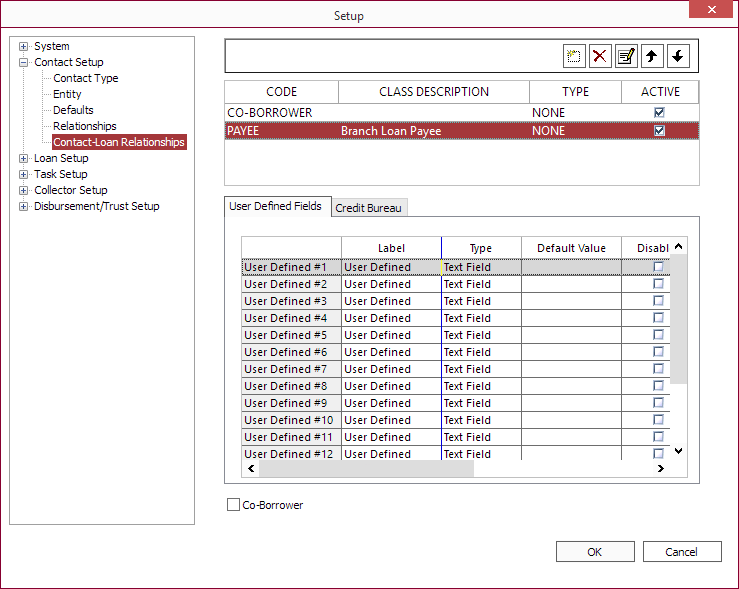

In Setup > Contact Setup > Contact Type, a contact type may be designated as a Payee to classify a contact as a payee.To designate additional payees, a unique contact-loan relationship should be created for this purpose in Setup > Contact Setup > Contact-Loan Relationships.

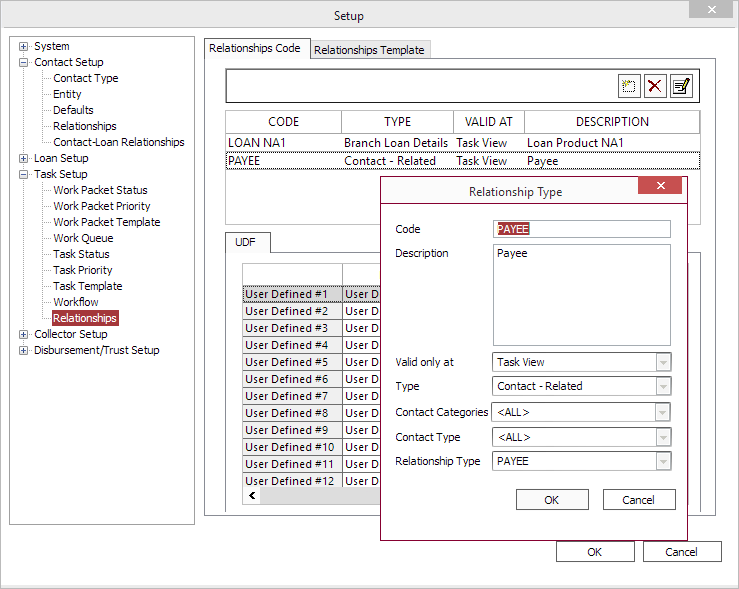

Then a task relationship code will need to be created in Setup > Task Setup > Relationships using the relationship type created above.

Once the relationships code has been created, the payee can be added to a branch loan by right-clicking in the branch loan relationship tree and selecting PAYEE. Click on <add new item> or right-click on PAYEE and select Add Contact to add payees to the loan.

Click on the Amount column in the Payees list to enter the amount to be distributed to that payee. The Proceeds to Primary Contact and Proceeds to Other Payees values will reflect the changes.