Multi-Currency

Multi-currency support in NLS allows for entering loans in a different currency and using scripts to convert from one currency to another. The interface provides for a single location where all currencies’ exchange rates can be maintained.

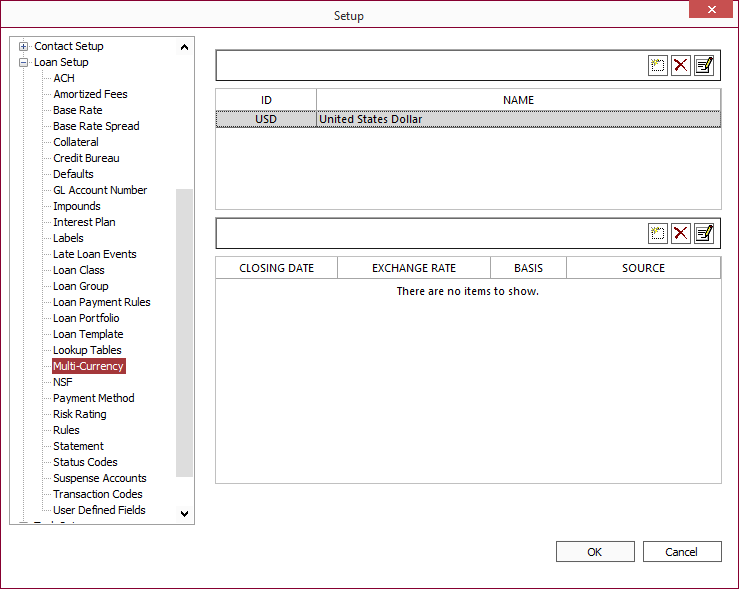

To set up multi-currency, go to File > Setup then expand Loan Setup and select Multi-Currency.

Click Add  at the top of the top pane to add a new currency.

at the top of the top pane to add a new currency.

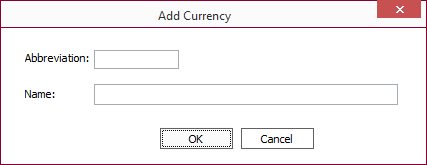

Enter a currency acronym, code, symbol, or anything to help identify the currency into the Abbreviation field and a descriptive name for that currency (e.g. € or EUR for Euros). Click OK.

Click Add  at the top of the lower pane to add a new exchange rate for the selected currency.

at the top of the lower pane to add a new exchange rate for the selected currency.

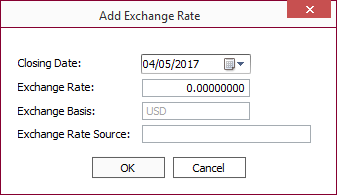

Type in or use the popup calendar to enter the closing date of the currency’s exchange rate from the source of the exchange rate.

Enter a US Dollar value that is equivalent to a single unit of the foreign currency.

Example

If 1 Canadian Dollar is equal to 0.75 US Dollar, enter 0.75 in the Exchange Rate field.Enter the source of the exchange rate in the Exchange Rate Source field for reference (this field may be left blank). Click OK and restart NLS to save the changes.

Using Multi-Currency in Loans

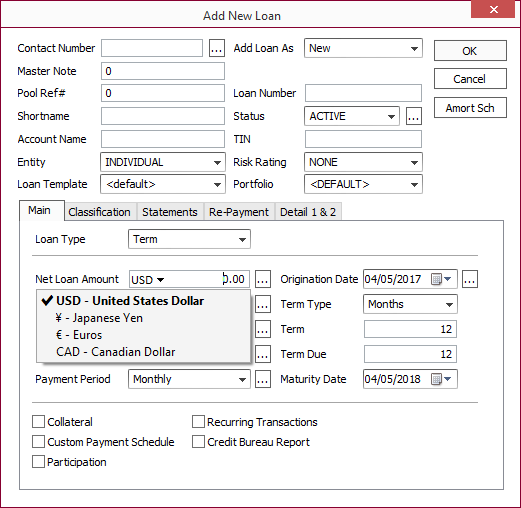

When entering a new loan, the currency for that loan may be chosen if a different currency has been defined in the Multi-Currency setup. A USD label will be shown in the Net Loan Amount field. Click on the USD label and select a different currency from the drop down list. The label will change to reflect the currency chosen for the loan.

Once a loan is created, the currency for the loan cannot be changed. All transactions henceforth for that loan will be in the defined currency. The currency used for the loan will be indicated in the amount field of the transaction entry dialog.

Scripting with Multi-Currency

Multi-currency can be used with scripting in converting currencies for reports and user-defined fields. The following script takes the latest exchange rate for the specified currency of the loan and places the converted USD value of the loan’s principal balance into UDF1.

VBScript

refno = nlsApp.getfield("loan_refno")

curr = nlsApp.sqlselectstatement("select currencyID from loanacct where acctrefno = " + cstr(refno))

if (curr = 0) then

exrate = 1

else

rateid = nlsApp.sqlselectstatement("select max(currencyExchangeratesID) from currencyexchangerates where currencyID = " + cstr(curr))

exrate = nlsApp.sqlselectstatement("select exchangerate from currencyexchangerates where currencyexchangeratesID = " + cstr(rateid))

end if

prin = nlsApp.getfield("loan_currpramt")

prinUSD = cdbl(exrate) * cdbl(prin)

nlsApp.setfield "loan_detail1_UDF1", prinUSD

nlsApp.savescreen()

nlsApp.refreshscreen()

|

refno = nlsApp.getfield("loan_refno") |

Sets variables and gets the loan’s native currency ID. |

|

if (curr = 0) then |

If the loan’s currency is USD (curr = 0) then the exchange rate (exrate) is set to 1. Otherwise the variable exrate is set to the specified currency’s latest exchange rate. |

|

prin = nlsApp.getfield("loan_currpramt") |

Principal of the loan is multiplied by the exrate and assigned to loan_detail1_UDF1. |