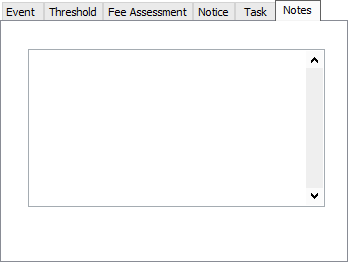

Late Loan Events

Automated late fee and late notice processing is handled in NLS by Late Loan Codes. Each Code consists of one or more events that occur when any payment becomes a specified number of days past due. An event can consist of the assessment of a late fee or the processing of a late notice.

These codes are configured on the Late Loan Events sub-category under Loan Setup.

Adding an Event Schedule

To add a new event schedule, click Add  . A code number for the new late loan schedule will be selected automatically. Enter a description for that schedule, and click OK.

. A code number for the new late loan schedule will be selected automatically. Enter a description for that schedule, and click OK.

Adding an Event Object

To add a new event to an existing schedule, make sure that you have the right schedule selected from the list, then click Add.

On the Add Events window, enter a value in the Number of Days Past Due field. This value will determine when the event will be automatically executed. If a payment on a loan with this late loan schedule reaches the required number of days past due during daily accrual processing, then this event will be executed on that loan.

Enter a description for that event, and click OK.

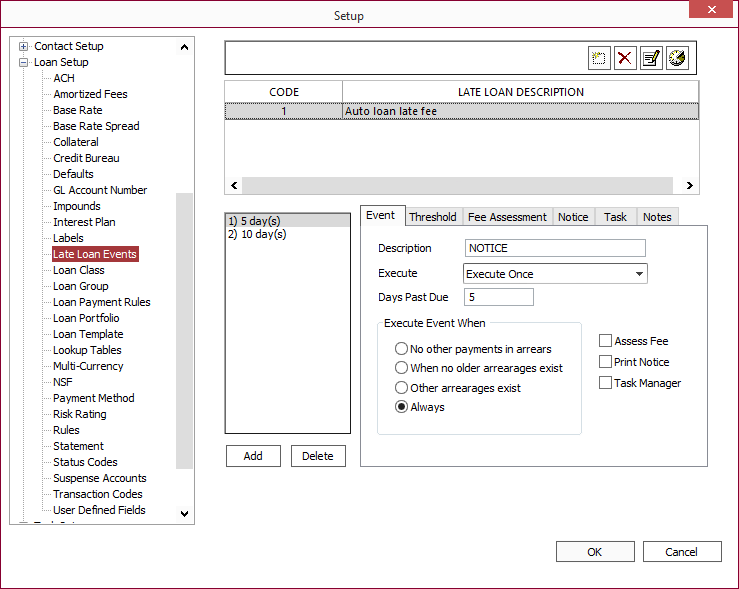

Event Tab

The setup of each event on a late loan schedule is shown on the Event sub-tab.

| Description | This field displays the description for the event as entered on the Add Events window. | ||||

| Execute | If set to Execute Once, the event will occur one time when the past due condition is met. If set to Execute Daily, the event will occur every day until the past due payment is brought current. This may be used for the purpose of assessing a late fee that accrues like extra interest, but be cautioned that this can create a large number of receivable entries on the loan. |

||||

| Days Past Due | When any billing is past due by this number of days, this event will execute. This number was specified on the Add Events window. | ||||

| Execute Event When |

These selections determine how the event will interact with other existing past due receivables.

Example If you have an event that sends a reminder notice when a payment is 10 days late, and another event sends a more sternly worded message when a payment is 30 days late, you will not want your customer to get the reminder notice again when the payment is 40 days late. But, on a monthly loan, a second payment may become 10 days late when the first is reaching 40 days. These selections allow you to instruct the event for the reminder notice to not be executed for the second payment in cases where the sternly worded notice has already been sent on the first payment, and that payment is still past due.

|

||||

| Assess Fee | If this checkbox is selected, the event is a fee assessment event, and the Fee Assessment tab will be activated for this event. | ||||

| Print Notice | If this checkbox is selected, the event is a late notice generating event, and the Notice tab will be activated for this event. | ||||

| Task Manager | If this checkbox is selected, the event will trigger a task as defined in the Task tab. |

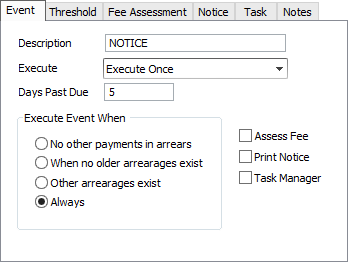

Threshold Tab

When a partial payment has been made, you may not wish to assess a late fee, or send a notice on the remaining unpaid portion of the payment. The threshold feature allows you to set up conditions under which the system will not execute the event if a partial payment meets the conditions of the threshold that you have configured. This feature is configured on the Threshold sub-tab.

| Dollar Amount | Depending on the attribute chosen, this is the minimum amount of the past due payment which must remain unpaid in order for the event to execute. | ||||

| Percentage | Depending on the attribute chosen, this is the minimum percentage of the past due payment which must remain unpaid in order for the event to execute. | ||||

| Attribute |

The attribute setting determines if the threshold is defined by the specified dollar amount, the specified percentage, by the greater of the two, or by the lesser of the two.

|

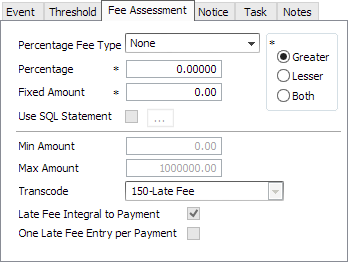

Fee Assessment Tab

If an event is a fee assessment, the type and amount of the late fee will be defined on the Fee Assessment sub-tab.

| Percentage Fee Type |

This drop down list defines if the amount of the fee will be determined by a specified fixed amount, or by a percentage of some balance. If it is a percentage, then what it is a percentage of is specified below.

|

|||||

| Percentage | The specified percentage by which the Total Payment, Unpaid Payment, or Principal will be multiplied to determine the fee. | |||||

| Fixed Amount | The amount of a payment that is not specified by a percentage. Also this amount can be compared to the amount derived from the percentage using the Greater, Lesser, or Both selections below. | |||||

| Greater | The amount of the fee is calculated using the Percentage Fee Type. This fee is then compared to the fixed amount, and the greater of the two is the actual amount assessed. | |||||

| Lesser | The amount of the fee is calculated using the Percentage Fee Type. This fee is then compared to the fixed amount, and the lesser of the two is the actual amount assessed. | |||||

| Both | The total fee is the sum of the amount computed with the Percentage Fee Type and the specified Fixed Amount. | |||||

To determine a fee using a SQL statement, select Use SQL Statement and click  . . |

||||||

| Min Amount | If the total fee is less than the Min Amount, then the Min Amount becomes the amount of the fee. | |||||

| Max Amount | If the total fee exceeds this amount, then the assessment is lowered to the Max Amount. | |||||

| Transcode | This drop down list contains all available fee receivable transaction codes. The standard transaction code for late fees is: 150 – Late Fee. Using this menu, you may select one of your own manual transaction codes for the fee. | |||||

| Late Fee Integral to Payment | The late payment that triggered the late fee could have had more than one part, such as principal and interest. All payments also have a Total Payment record which is the sum of the parts that are lumped together to make up that payment. If a late fee is assessed that is integral to the payment, it becomes a part of that payment, and the Total Payment record is increased to include it. | |||||

| One Late Fee Entry Per Payment | If the event is set to Execute Daily, and this checkbox is selected, then each day, instead of creating a new receivable for that day’s late fee assessment, the existing receivable will simply be increased by the appropriate amount. |

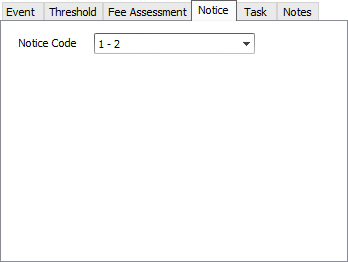

Notice Tab

If an event is a late notice printing event, the statement code for the late notice is specified on the Notice sub-tab.

All valid Late Notice Codes will appear in this drop down menu. The late notice code selected will determine the format of the late notice. NLS ships with one Late Notice Code: STANDARD LATE NOTICE, but others can be custom programmed. Once installed on the system, the new late notice must be configured in statement setup. After that, its late notice code will appear here in the drop down list.

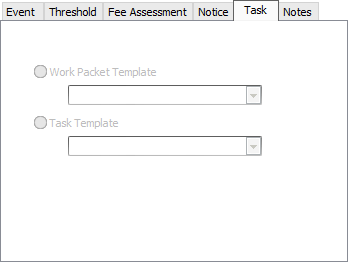

A late loan event can cause a Task to be initiated. To configure a Task to be triggered by the late loan event, select the Task Manager checkbox on the Event tab. Then choose a Task Template on the Task tab.

Notes Tab

Comments on this particular event may be placed on the Notes sub-tab.