Form 1098 – Mortgage Interest Statement

Tax Year field designates the Form 1098 to use for the specified tax year. Years prior to 2015 will use the 2015 Form 1098.

Reporting Points and MIP on 1098 Reports

The 1098 report has fields for the reporting of the dollar value of points paid and of mortgage insurance premiums paid. If you are transactionally tracking these figures, the transaction codes may be configured to update a user-defined statistic (one for each of these two values) and the user-defined statistic may be mapped to the report on the parameter list of the report’s setup.

If you need to backfill this data for a prior period in which you were not tracking these values transactionally, you may set up a custom transaction code that does nothing but increase the value of a user-defined statistic.

To get the value that is present in statistics for the specified date range onto the report, simply set the number of the user-defined statistic in the appropriate field (e.g. Points Paid Stat, Insurance Premiums Stat) in the reports parameter list.

Other Form 1098 Fields

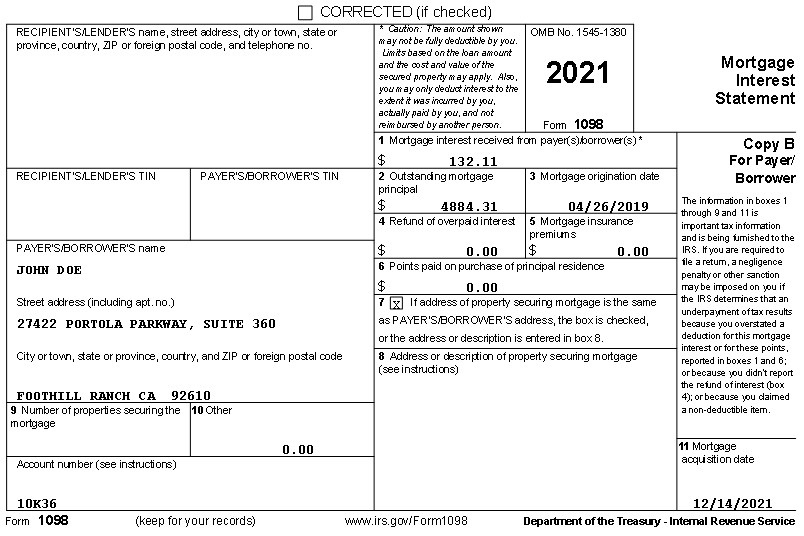

Box 2 – The daily trial balance as of the beginning of the tax year (e.g. for 2021, it is the daily trial balance on 12/31/2020).

Box 3 – The open date of the loan.

Changes for 2021

Box 1 – Mortgage interest received from payer(s)/borrower(s). This is the interest paid plus late charges paid from statistics for the tax year. If this amount is negative, it is reported as a refund of overpaid interest in box 4.

Box 2 – Outstanding mortgage principal. Effective principal balance at the start of the tax year. If the loan was originated during the tax year, then it is the effective principal on the day the loan was originated. If the loan was backdated during the tax year, then it is the effective principal on the day the loan was added in NLS.

Box 3 – Mortgage Origination Date. Open date of the loan. For version 5.20 and higher, this is the funded date of the loan if populated.

Box 4 – Refund of Overpaid Interest. This is the interest paid plus late charges paid from statistics for the year of the tax form if that total is negative.

Box 5 – Mortgage Insurance premiums. Parameter Insurance Premiums Stat is used to get the statistics for the tax year for this item.

Box 6 – Points paid on purchase of principal residence. Parameter Points Paid Stat is used to get the statistics for the tax year for this item.

Box 9 – Number of properties securing the mortgage. Parameter Number of Properties is used to get the user-defined value from Loan Detail Tab 1 or Loan Detail Tab 2 for this item.

Box 11 – Mortgage acquisition date. This is the date the loan was added into the system if it was added during the tax year. Otherwise, this field will be blank.

There are no significant changes to Form 1098 for 2019. However, new Selections options in Reports > Loan Portfolio > Forms > Forms 1098 are available that may affect the value in Box 1.

| Payment Method | Selected payment methods will be included in the total interest paid (Box 1). Leave this blank unless payment methods were specifically created for this purpose. |

| Include Late Charges | When selected, all late charges are included in the total interest paid (Box 1). |

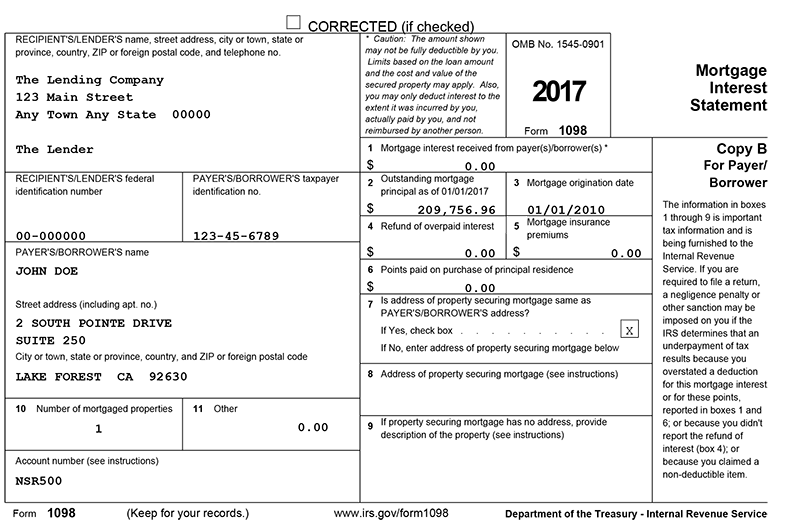

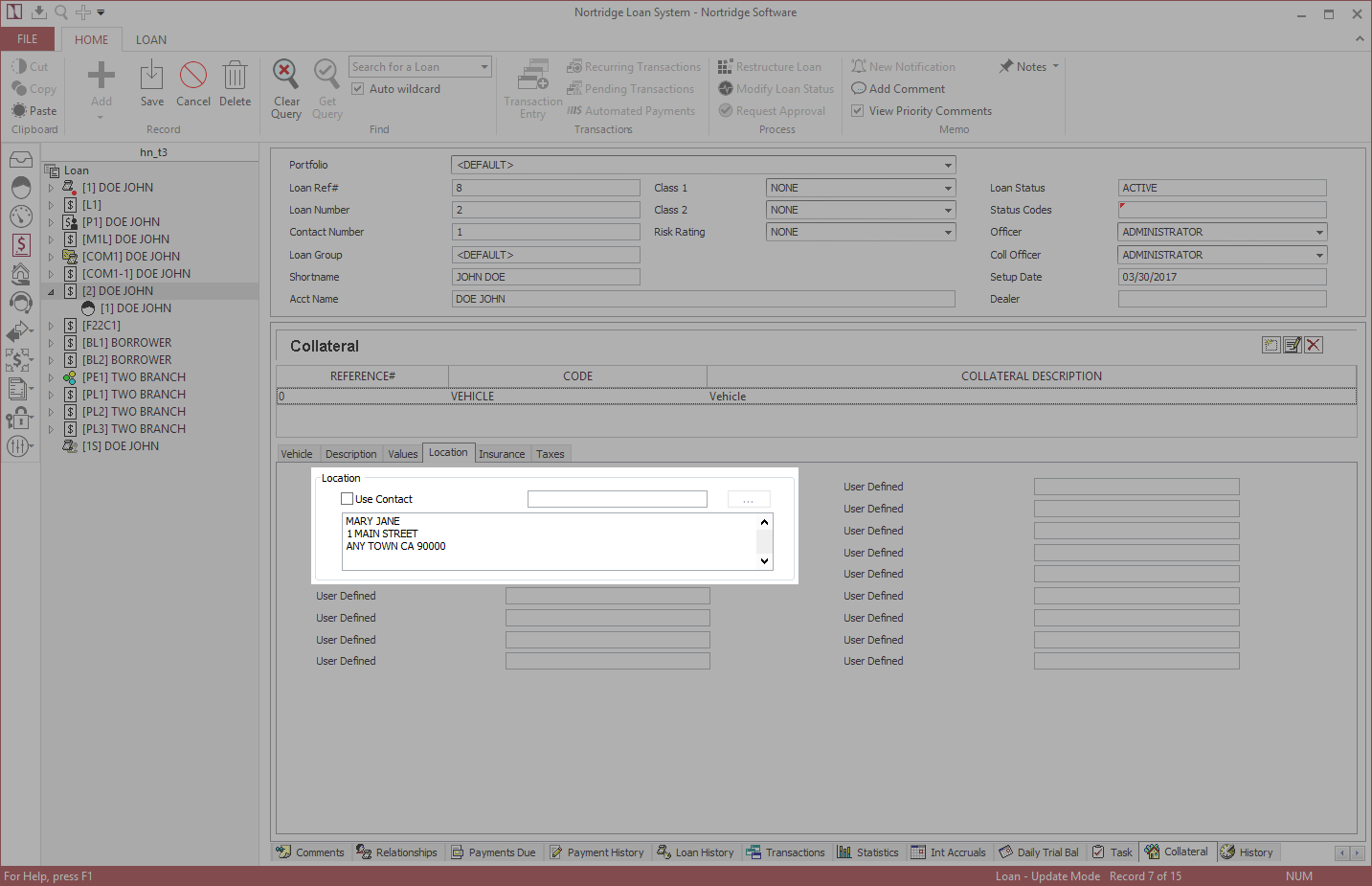

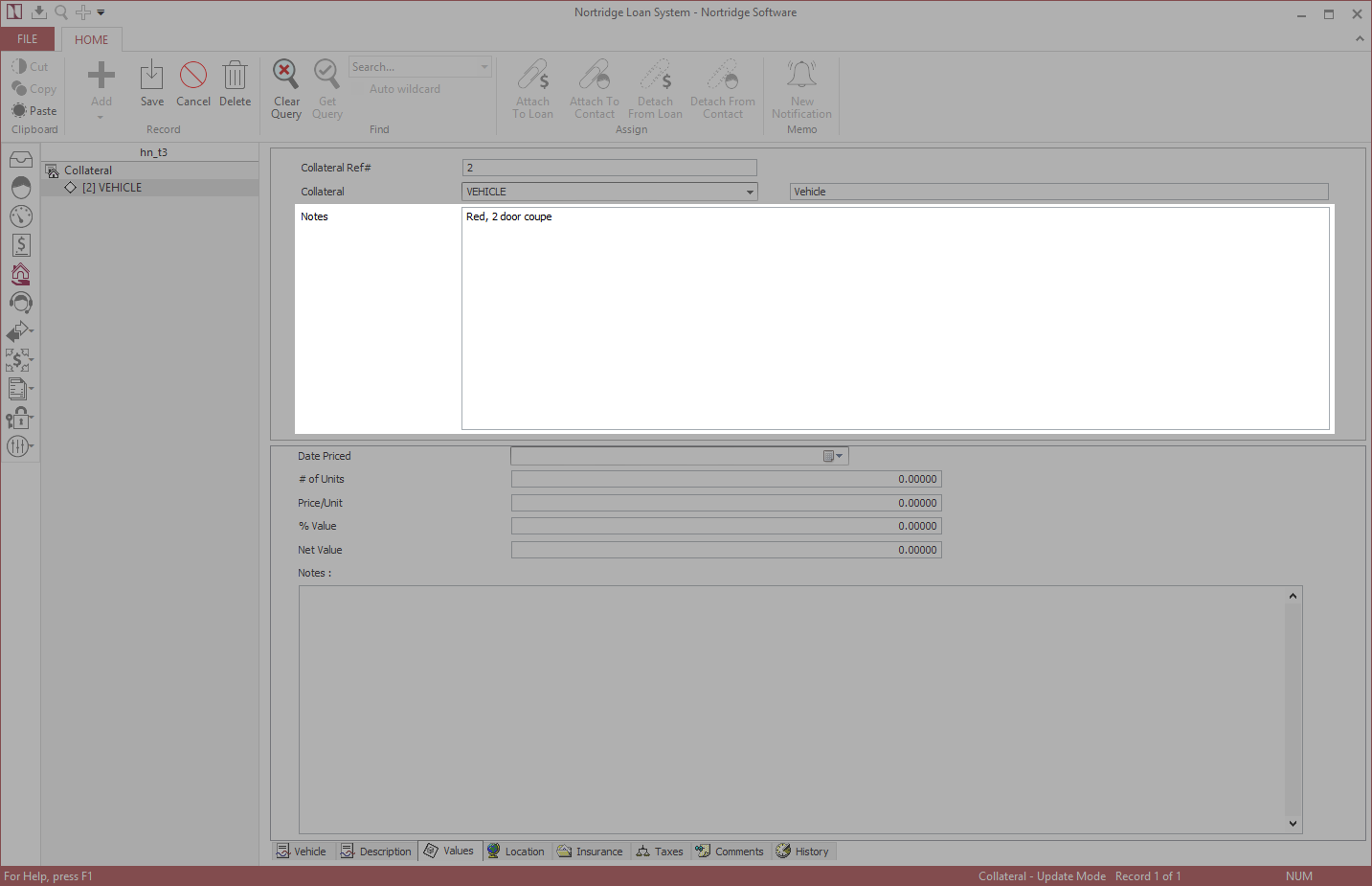

Box 7 – This box is checked if no collateral exists or if a collateral exists and it contains an address that matches the borrower address.

This box is not checked if a collateral exists but does not have an address that matches the borrower address.

Box 8 – The location address entered under the Collateral > Location tab is entered in this box if the address is different than the borrower address.

Box 9 – The data entered in the Notes field under Collateral > Values tab will be used in this box only if no location address is entered in an existing collateral. This box is left blank if a collateral location address exists.

Insurance Premiums Stat parameter is used to obtain the insurance premiums paid.

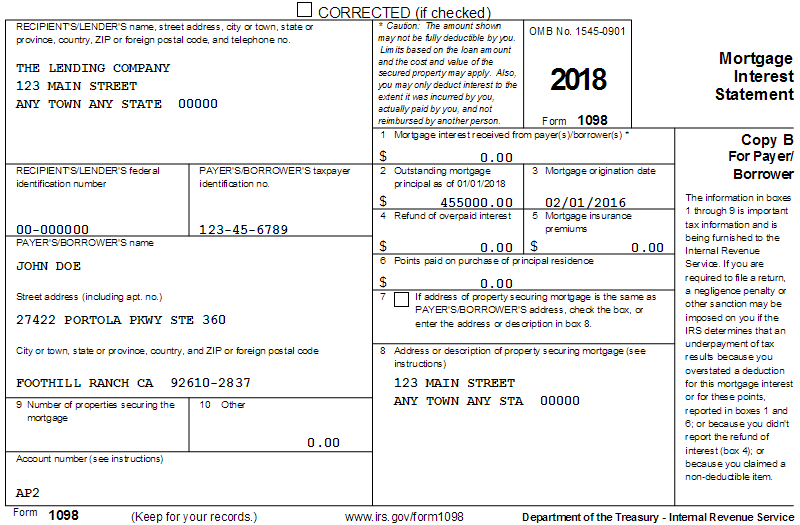

New fields for 2016: mortgage principal, open date, insurance premiums paid, x property, location address, location city state zip, and property description.

Form 1098-E - Student Loan Interest Statement

Changes for 2021

Box 1 – Student loan interest received by lender. This is the interest paid plus late charges paid from statistics for the tax year. If the amount is negative, it is reported as zero. It is likely that this would not be reported since the default minimum is $600.00. If the loan was open after September 1, 2004, capitalized interest is also included. Inclusion of late charges is optional based on a checkbox parameter. Inclusion of capitalized interest is also optional based on a checkbox parameter.

Form 1099-A – Acquisition or Abandonment of Secured Property

Box 1 – Date of lender’s acquisition or knowledge of abandonment. This is the Acquisition Date from the Collateral > Values tab.

Box 2 – Balance of principal outstanding. This the loan's current principal balance.

Box 4 – Fair market value of property. The is the net value from the Collateral > Values tab.

Box 5 – Check if the borrower was personally liable for repayment of the debt. This is the value of the report parameter Personally Liable.

Box 6 – Description of property. Address securing the loan. This is the location address entered in the Collateral > Location tab if the address is different than the borrower’s address.

Form 1099-C – Cancellation of Debt

Changes for 2021

Box 1 – Date of identifiable event. This is the effective date of the write-off transaction(s) specified in the Transaction Code parameter. If none are specified, this form uses the standard write-off transactions.

Box 2 – Amount of debt discharged. This is the amount of the write-off transaction(s) specified in the Transaction Code parameter. If none are specified, this form uses the standard write-off transactions. Reversals are subtracted from this amount and are determined by the presence of the word “Reversal” in the description. The search is not case-sensitive. Default transaction codes to be included are 440-459 and 470-489.

Box 3 – Interest if included in box 2. This is the amount of the interest write-off transaction(s) specified in the Transaction Code parameter. If none are specified, this form uses the standard write-off transactions. Interest write-off is determined by the presence of the word “Interest” in the transaction description. The search is not case-sensitive.

Box 4 – Debt description. This is the value of the parameter Debt Description or the value of an item identified by the parameter Debt Description From UDF. It will be a user-defined field from Loan Detail Tab 1 or Loan Detail Tab 2.

Box 5 – Personally liable. This is the value of the report parameter Personally Liable.

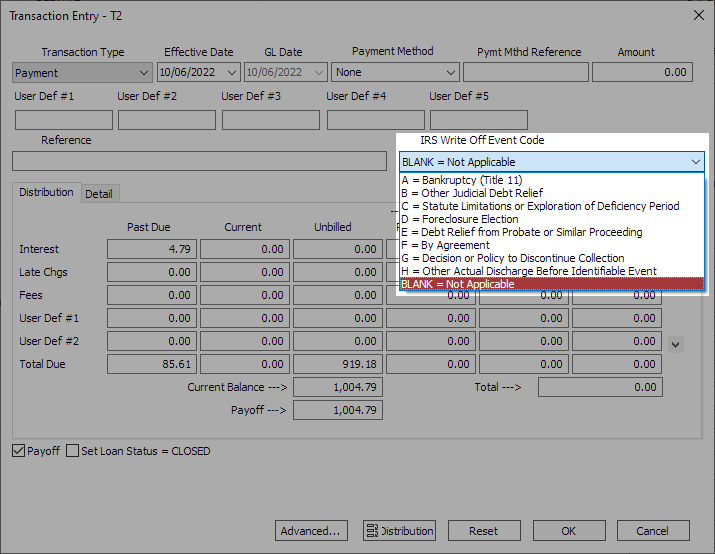

Box 6 – Identifiable event code. This is the user-defined value in the write-off transaction as specified by the report parameter Event Code Location.

Beginning with NLS version 5.20, the event code is selected in a separate IRS Write Off Event Code field in the transaction entry dialog and does not require one to be defined separately as a user-defined field.

Box 7 – Fair Market Value of property. This value is determined from the net value of the collateral attached to the loan. If no amount is in the net value, it searches for the current value of the vehicle record if one exists.

Form 1099-INT – Interest Income

Changes for 2021

Box 1 – Interest income. This form is used for reporting interest and investor received from interest bearing accounts. It is not used for interest paid on loans by borrowers. If you are a lender, do not use this form unless you paid interest to the borrower for money in an interest-bearing account. The parameter Interest Income Stat may be entered to identify the user-defined statistic to be used. Otherwise, this pulls from the Interest Paid statistic.

Form 1099-MISC – Miscellaneous Payments to Vendors

Changes for 2021

Box 3 – Other income. Sum of vouchers paid having a tax form of 1099-MISC in the tax year for non-tax-exempt vendors. See Setup/Disbursement/Vendor Type for the tax-exempt checkbox for vendors. See Setup/Disbursement/Voucher Type for the tax form for vouchers. It must be set to 1099-MISC to generate this form.

Form 1099-NEC – Nonemployee Compensation

Changes for 2021

Box 1 – Nonemployee compensation. Sum of vouchers paid having a tax form of 1099-NEC in the tax year for non-tax-exempt vendors. See Setup/Disbursement/Vendor Type for the tax-exempt checkbox for vendors. See Setup/Disbursement/Voucher Type for the tax form for vouchers. It must be set to 1099-NEC to generate this form.