GL Account Number

General Ledger account numbers are automatically generated when Loan groups are defined. If a GL account number is specified on a Loan Group, and that GL account number is unrecognized by the system, you will be prompted to enter a description for that GL account, and it will be added to the list of GL accounts which is maintained by NLS.

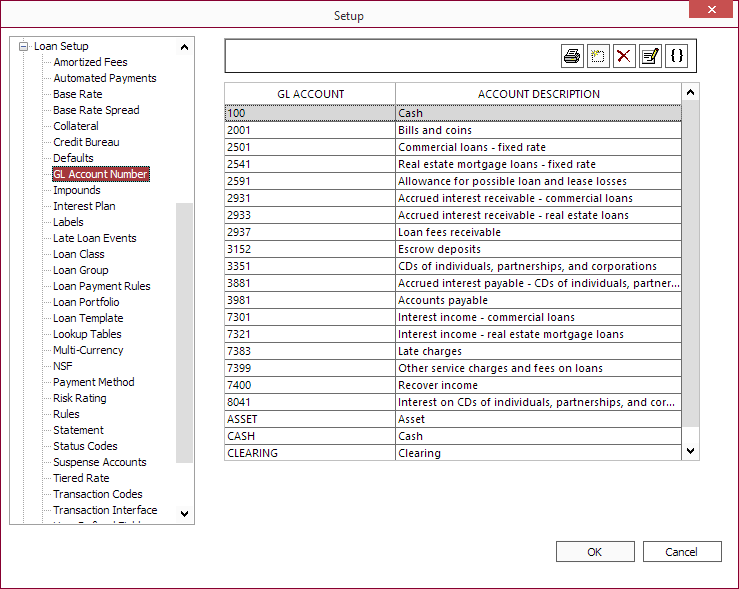

The list of GL accounts may be viewed on the GL Account Number sub-category on the Loan Setup window.

Click  Add to add a new GL account number. Enter your new GL account number and a description of the account in the dialog box and click OK.

Add to add a new GL account number. Enter your new GL account number and a description of the account in the dialog box and click OK.

If the cash drawer feature is enabled, a drop down list will allow for the designation of the GL account as a cash or bank account to be used with a cash drawer. Only GL accounts designated as a cash or bank account can be associated with a cash drawer.

Click  Print to print a list of all of the GL accounts that are configured in NLS.

Print to print a list of all of the GL accounts that are configured in NLS.

Click  Delete to remove a GL account. GL account may only be remove if it is not attached to any existing Loan Group.

Delete to remove a GL account. GL account may only be remove if it is not attached to any existing Loan Group.

Click  Modify to edit the GL account.

Modify to edit the GL account.

Segmented GL Numbers

NLS 5.6 and later

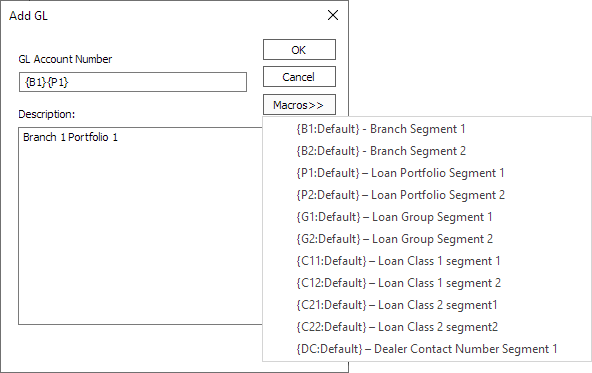

Click Macros>> to insert placeholders to be used within GL numbers to substitute values related to branch, loan portfolio, loan group, and loan class when transactions are entered.

The following placeholders can be used in GL account numbers to insert the corresponding values.

| {B1} and {B2} | Branch segments. Uses the GL Accounting Segment value as configured in Home > Branch Setup. |

| {P1} and {P2} | Loan Portfolio segments. Uses the GL Segment value as configured in Setup > Loan Setup > Loan Portfolio > Options. |

| {G1} and {G2} | Loan Group segments. Uses the GL Segment value as configured in Setup > Loan Setup > Loan Group > GL Segments. |

| {C11} and {C12} | Loan Class 1 segments. Uses the GL Accounting Segment value as configured in Setup > Loan Setup > Loan Class. |

| {C21} and {C22} | Loan Class 2 segments. Uses the GL Accounting Segment value as configured in Setup > Loan Setup > Loan Class. |

| Dealer contact number. |

A default value may be assigned to a placeholder separated by a colon (:). A {B1:0000} placeholder would use 0000 if a {B1} reference is not found.

Note

To include a space between the GL accounting segments, the space must be included at the end of the GL accounting segment name.Segmented GL Macro

NLS 5.7.2 and later

A macro can be used to derive segmented GL numbers dynamically based on conditions. Macros are written in XML using nested conditions to derive a GL segment.

Macros can be edited by clicking  Macro.

Macro.

Sample XML

<GLMACRO>

<MACRO NAME="{AB1:000000}">

<!--if Payment Method number is 100 then GL= 1012470-->

<CONDITION RESULT="1012470">

<PAYMENTMETHODNO>100</PAYMENTMETHODNO>

</CONDITION>

<!--if Loan Class 1 number is 10 and-->

<CONDITION>

<CLASS1NO>10</CLASS1NO>

<!--if Transaction Type is Advance then GL= 1002850-->

<CONDITION RESULT="1002850">

<TRANSACTIONTYPE>Advance</TRANSACTIONTYPE>

</CONDITION>

<!--if Transaction Type is Payment then GL= 1002462-->

<CONDITION RESULT="1002462">

<TRANSACTIONTYPE>Payment</TRANSACTIONTYPE>

</CONDITION>

<!--if Status Code number is 5 or Status Code number is 6 then GL= 1002400-->

<CONDITION COMPARISON="OR" RESULT="1002400">

<STATUSCODENO>5</STATUSCODENO>

<STATUSCODENO>6</STATUSCODENO>

</CONDITION>

</CONDITION>

<!--ELSE -->

<CONDITION>

<!--if Branch number is 20 then GL = 1002888-->

<CONDITION RESULT="1002888">

<BRANCHNO>20</BRANCHNO>

</CONDITION>

<!--else if Branch number is 21 then GL = 1002362-->

<CONDITION RESULT="1002362">

<BRANCHNO>21</BRANCHNO>

</CONDITION>

<!--ELSE -->

<CONDITION>

<!--if Transaction Type is Advance and-->

<CONDITION>

<TRANSACTIONTYPE>Advance</TRANSACTIONTYPE>

<!--if Disbursement Account number is 30 THEN GL = 1012478-->

<CONDITION RESULT="1012478">

<DISBURSEMENTACCOUNTNO>30</DISBURSEMENTACCOUNTNO>

</CONDITION>

<!--else GL = 1002306-->

<CONDITION RESULT="1002306">

</CONDITION>

</CONDITION>

<!--else if Transaction Type is Payment then GL=1002801-->

<CONDITION RESULT="1002801">

<TRANSACTIONTYPE>Payment</TRANSACTIONTYPE>

</CONDITION>

<!--else if Status Code number is 5 or Status Code number is 6 then GL=1002323-->

<CONDITION COMPARISON="OR" RESULT="1002323">

<STATUSCODENO>5</STATUSCODENO>

<STATUSCODENO>6</STATUSCODENO>

</CONDITION>

</CONDITION>

</CONDITION>

</MACRO>

</GLMACRO>

<GLMACRO> or <MACROS>

| Attribute | Required | Comments |

|---|---|---|

| No attribute |

<MACRO> - Sub element of <GLMACRO> or <MACROS>

| Attribute | Required | Comments |

|---|---|---|

NAME

|

Yes | Name of the macro. Default value may be declared separated by a colon. Formatted as NAME="AB1:00000" |

<CONDITION> - Sub element of <MACRO>

<BRANCHNO> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Branch number. Database column BranchDivisionID. |

<PORTFOLIOCODENO> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Loan portfolio ID. Mouse over name in Setup > Loan Setup > Loan Portfolio to see ID. |

<LOANGROUPNO> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Loan group number. Mouse over group in Setup > Loan Setup > Loan Group to see number. |

<CLASS1NO> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Loan class 1 number. Mouse over code in Setup > Loan Setup > Loan Class to see number. |

<CLASS2NO> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Loan class 2 number. Mouse over code in Setup > Loan Setup > Loan Class to see number. |

<DISBURSEMENTACCOUNTNO> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Disbursement account number. Database column disbursement_account_id. |

<PAYMENTMETHODNO> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Payment method number. Database column payment_method_no. |

<TRANSACTIONTYPE> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Valid values are:NoneAdvanceBillingPaymentLate ChargeFeeWrite OffAmortized FeeDebitCreditImpoundServicing Fee |

<STATUSCODENO> - Sub element of <CONDITION>

| Attribute | Required | Comments |

|---|---|---|

| Undefined | No | Status code number. More than one value is allowed within a single <CONDITION>. |