Charge-Off / Non-Accrual

Available in NLS 5.0.1 and later.

When a loan ages and it is apparent that the loan will be uncollectible it is common to stop the loan from accruing income by putting it in a non-accrual state. Then if it is determined that the loan is uncollectible, the loan asset is charged off. Typically a bank will set their loans to a non-accrual state after 60 to 90 days past due and will charge-off the loan when it goes beyond 90 days past due.

When a loan is put in a non-accrual state, any income accrued will be held in separate GL accounts as designated in general ledger controls. This also includes late fees and other fees no longer being recognized as earned income and may no longer accrue income on amortized fees.

When a loan is charged off the accruals are removed from the general ledger that are associated with this particular loan and the principal balance is either removed from the asset account using a write-off account or a loan loss reserve account.

Setting Up NLS

Transaction Codes

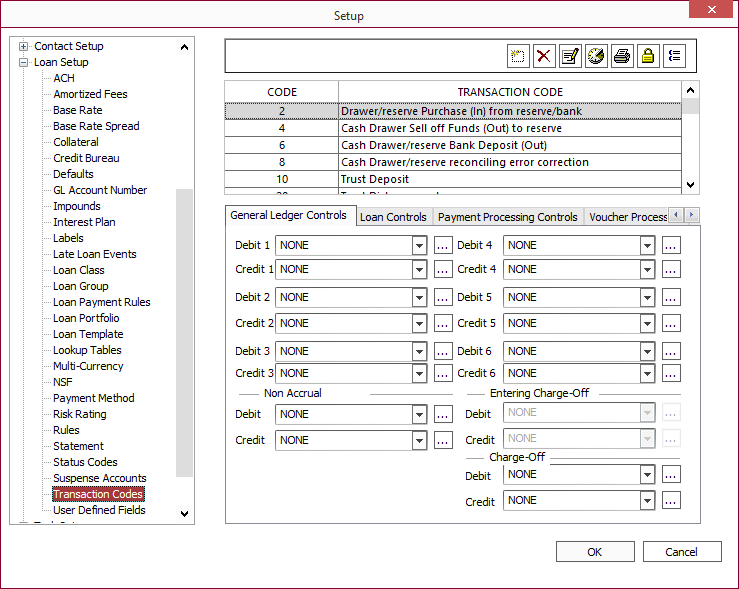

General ledger controls for Non Accrual, Entering Charge-Off, and Charge-Off are located at the bottom of the General Ledger Controls tab in Setup > Loan Setup > Transaction Codes .

For receivables (e.g. Late Fee)

| Code | Transaction Code | Debit | Credit | Description |

|---|---|---|---|---|

| ### | Non-accrual | None | None | Used when the loan is in a non-accrual status. |

| ### | Entering Charge-off | Loan Loss Reserve | Accrued Late Fees | Only active when transaction code is defined as a receivable. Used initially when a loan changes to a charge-off state. |

| ### | Charge-off | None | None | Used when the loan is in a charged-off (written-off) status. A charge-off cannot be backdated past the date of the status change. |

Note

Entering Charge-off and Charge-off are mutually exclusive so if one is active, the other will be inactive.For payments (e.g. Late Fee Payment)

| Code | Transaction Code | Debit | Credit | Description |

|---|---|---|---|---|

| ### | Non-accrual | Cash | Income Account | Used when the loan is in a non-accrual state. |

| ### | Charge-off | Cash | Loan Loss Recovery | Used when the loan is in a charged-off (written-off) state. A charge-off cannot be backdated past the date of the status change. |

Note

Entering Charge-off is disabled as it is used for a receivable type transaction code.Transaction code 490 – Total Charge Off Balance: This is included to be used solely for Metro 2 file. Does not affect any balances or general ledger accounts.

Loan Group

Configured in Setup > Loan Setup > Loan Group.

GL Placeholders Tab

GL Placeholders for non-accrual

| GL Placeholder | Comments |

|---|---|

| Non Accrual Interest | If not being used, set to NONE. Debit this account to track accrued interest. |

| Non Accrual Interest Income | If Non Accrual Interest is not used, set to NONE. Credit this account to track accrued interest. |

| Non Accrual Late Fee | |

| Non Accrual Late Fee Income | |

| Non Accrual Fee | |

| Non Accrual Fee Income |

NLS 5.9 and later

See the section on Loan Group setup for the option of unwinding accrued interest for non-accrual.GL Placeholders for charge-off

| GL Placeholder | Comments |

|---|---|

| Charge-Off Loan Loss | For loan loss account. |

| Charge-Off Loan Loss Recovery | For loan loss recovery account. |

| Charge-Off Principal | |

| Charge-Off Interest | |

| Charge-Off Def Interest | For deferred interest. |

| Charge-Off Late Fee | |

| Charge-Off Other Fee | |

| Charge Off UDB1 – Charge Off UDB10 |

Entering Charge Off Tab

NLS 5.28 and later

The GL control as configured for a transaction code only applies to late fees. To configure the GL controls for principal and interest, see the section on Loan Group setup.

Status Codes

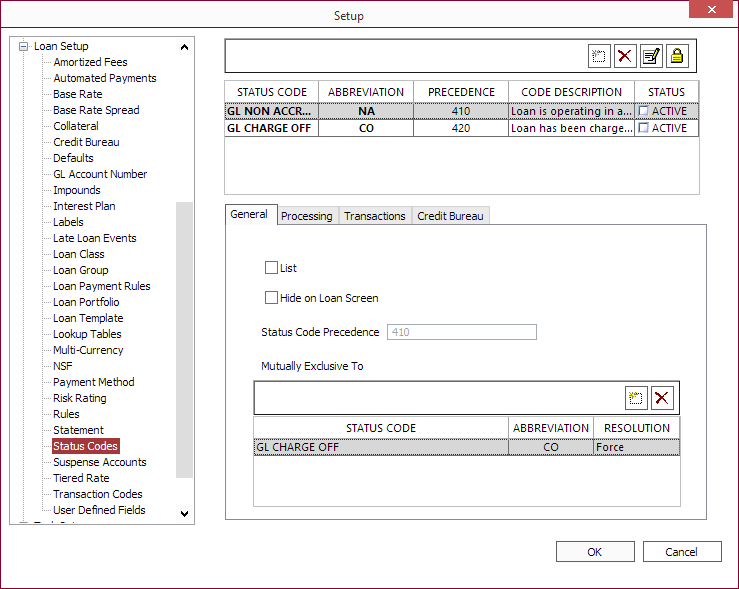

Configured in Setup > Loan Setup > Status Codes.

There are two predefined status codes used for placing loans in a non-accrual and charge-off states; GL NON ACCRUAL and GL CHARGE OFF. These status codes cannot be deleted but can be disabled by turning off its active status.

| Status Code | Comments |

|---|---|

| GL Non Accrual | Set when the loan is to be in a non-accrual state. |

| GL Charge Off | Set when the loan is in a charge-off state. |

Status codes will be listed at the top of the list if the Hide on Loan Screen option is not selected.

Changing a Loan’s Status

To change a loan’s status, query the loan and select  Modify Loan . Select a non-accrual or charge-off status for the loan and click OK.

Modify Loan . Select a non-accrual or charge-off status for the loan and click OK.

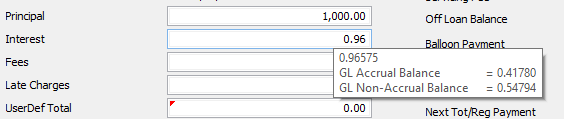

When viewing a loan in a non-accrual status, moving the cursor over the Interest, Fees, and Late Charges fields on the Main tab will display a tooltip showing the field’s balance breakdown.

Backdating a charged off loan

NLS 5.4.3 and later

When a charged off loan is backdated, the effective date of the 490 transaction code created will inherit the effective date of the charge off status code. All transactions from the effective date will be unwound and re-applied. Any cash recovery transactions that are re-applied will add the 490 transaction code in the negative amount of the cash payment.

Examples

The following examples show how GL accounts are affected as a loan enters and exits non-accrual and charge-off states.

Enter non-accrual – receive cash – exit non-accrual

- Originate a loan of 1,000.00

- Accrue interest daily - 5.00

- Accrue interest daily - 5.00

- Loan enters non-accrual state

- Accrue interest daily - 5.00

- Accrue interest daily - 5.00

- Cash payment of 10.00 (payment is applied to the interest that was accrued prior to the loan changing to a non-acrrual state).

- Cash payment of 8.00

- Loan is changed from non-accrual state to accrual. Remaining 2.00 from non-accrual interest is moved to accrued interest.

Line numbers above correspond to row numbers below

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Enter non-accrual for fees and exit non-accrual

- Originate a loan of 1,000.00

- Assess 10.00 late fee

- Loan enters non-accrual state

- Assess 8.00 late fee

- Payment of 10.00 for late fee

- Payment of 5.00 for late fee

- Loan is changed from non-accrual state to accrual

Line numbers above correspond to row numbers below

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Charge-off loan (without going through non-accrual state)

- Originate a loan of 1,000.00

- Accrue interest daily - 5.00

- Accrue interest daily - 5.00

- Accrue late fee 10.00

- Write off 1,000.00 principal

- Write off 10.00 interest

- Write off 10.00 late fee

- Receive a payment for 50.00 (46.00 principal and 4.00 interest)

Line numbers above correspond to row numbers below

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Charge off loan from non-accrual state

- Originate a loan of 1,000.00

- Accrue interest daily - 5.00

- Accrue interest daily - 5.00

- Loan enters non-accrual state

- Accrue interest daily - 5.00

- Accrue interest daily - 5.00

- Change status to charge-off – write off 1,000.00 principal

- Charge off 10.00 accrued interest

- Unwind non-accrual interest

- Receive a 50.00 payment (46.00 principal and 4.00 interest)

Line numbers above correspond to row numbers below

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Reverse charge-off back to non-accrual

- Originate a loan of 1,000.00

- Accrue interest daily - 10.00

- Loan enters non-accrual state

- Accrue interest daily - 10.00

- Change to charge-off state – write off 1,000.00 principal

- Charge off 10.00 accrued interest and non-accrual accounts

- Receive a 50.00 payment (46.00 principal and 4.00 interest)

- Change loan from charge-off state to non-accrual state – unwind principal of 1,000.00 less 46.00 received payment

- Unwind the charge-off interest of 10.00 less 4.00 received payment

- Place 10.00 of non-accrual interest to interest income

Line numbers above correspond to row numbers below

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Reverse charge-off back to normal loan

- Originate a loan of 1,000.00

- Accrue interest daily - 10.00

- Accrue late fee - 10.00

- Write off 1,000.00 principal

- Write off 10.00 interest

- Write off 10.00 late fee

- Receive payment for 50.00 (46.00 principal and 4.00 interest)

- Change loan status from charge-off to normal loan - unwind principal of 1,000.00 less 46.00 received payment

- Unwind charge off of interest of 10.00 less 4.00 received payment

- Unwind late fee of 10.00

Line numbers above correspond to row numbers below

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||