Accounts Menu

Balances

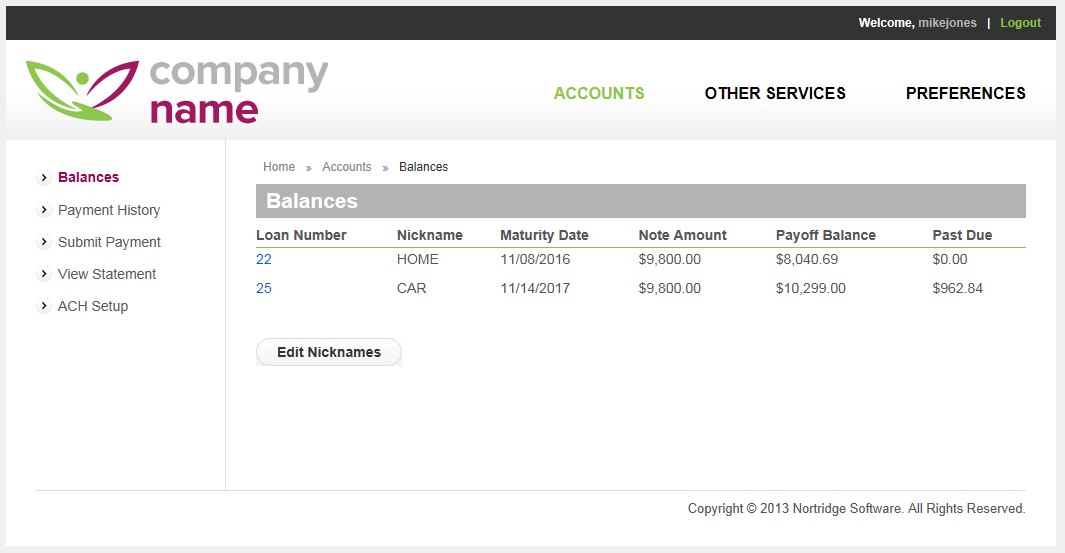

Once your borrower has logged into NLS, they will automatically be taken to their Balances page under the Accounts menu.

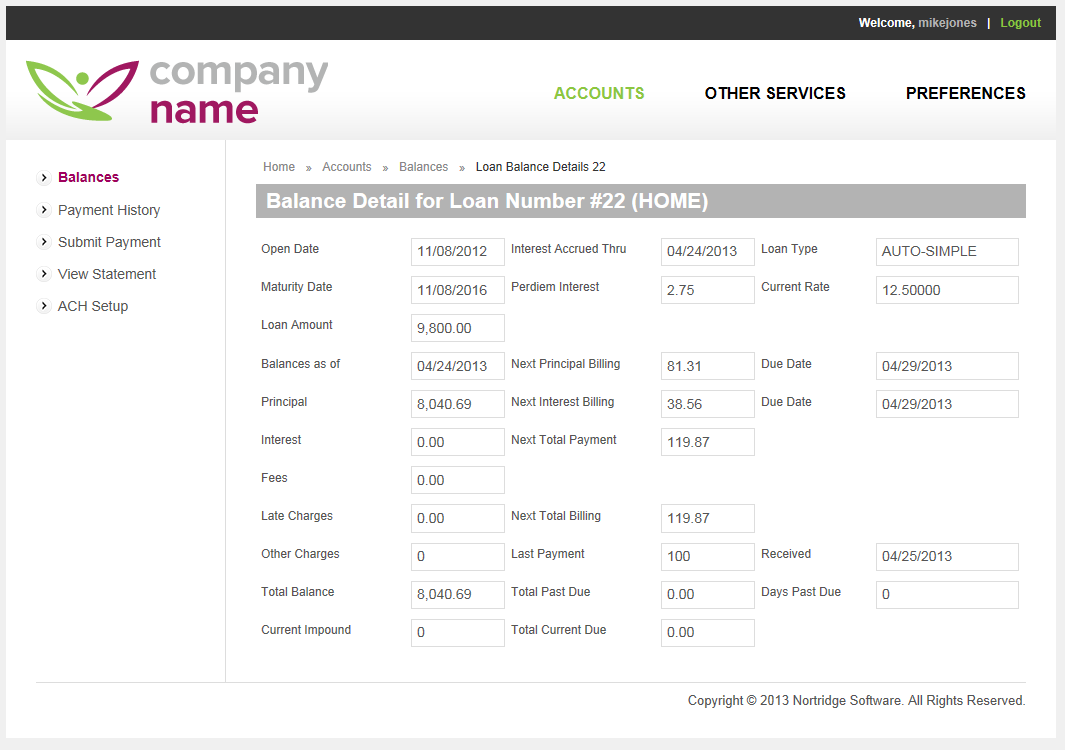

The borrower’s web credentials are matched to their contact account within NLS, and data is returned on all the loans for which they are the borrower. This data is displayed on the balances page. The loan numbers displayed here are hyper links to the balance detail page for each individual loan.

Once a loan has been selected in this way, if the borrower clicks on one of the other tabs, such as Payment History, Submit Payment, View Statement, or ACH Setup, they will be viewing the corresponding data for the selected loan. If they click on one of these tabs without selecting a specific loan, they will be viewing the corresponding data for the first loan on the list.

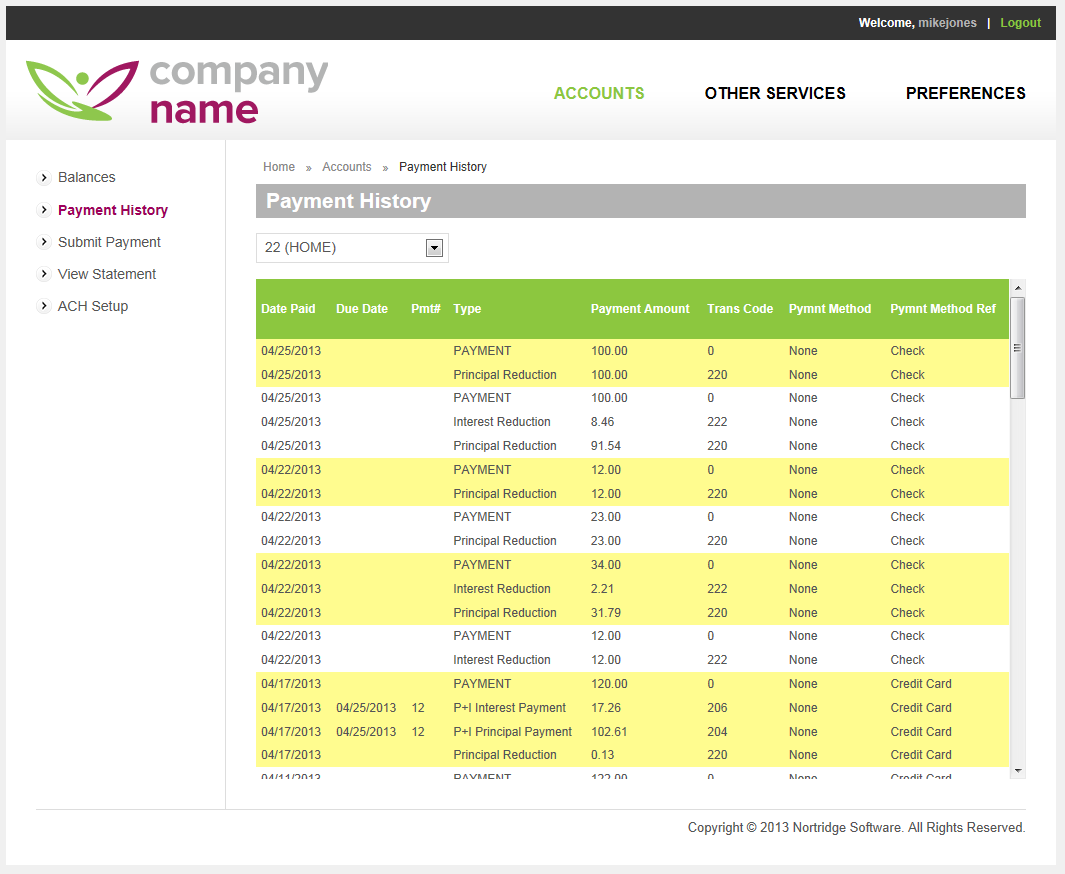

Payment History

Clicking on the Payment History tab after selecting a specific loan on the Balances tab will bring up the payment history for the selected loan. If the borrower has more than one loan, a drop down list will allow selection from the list of available loans.

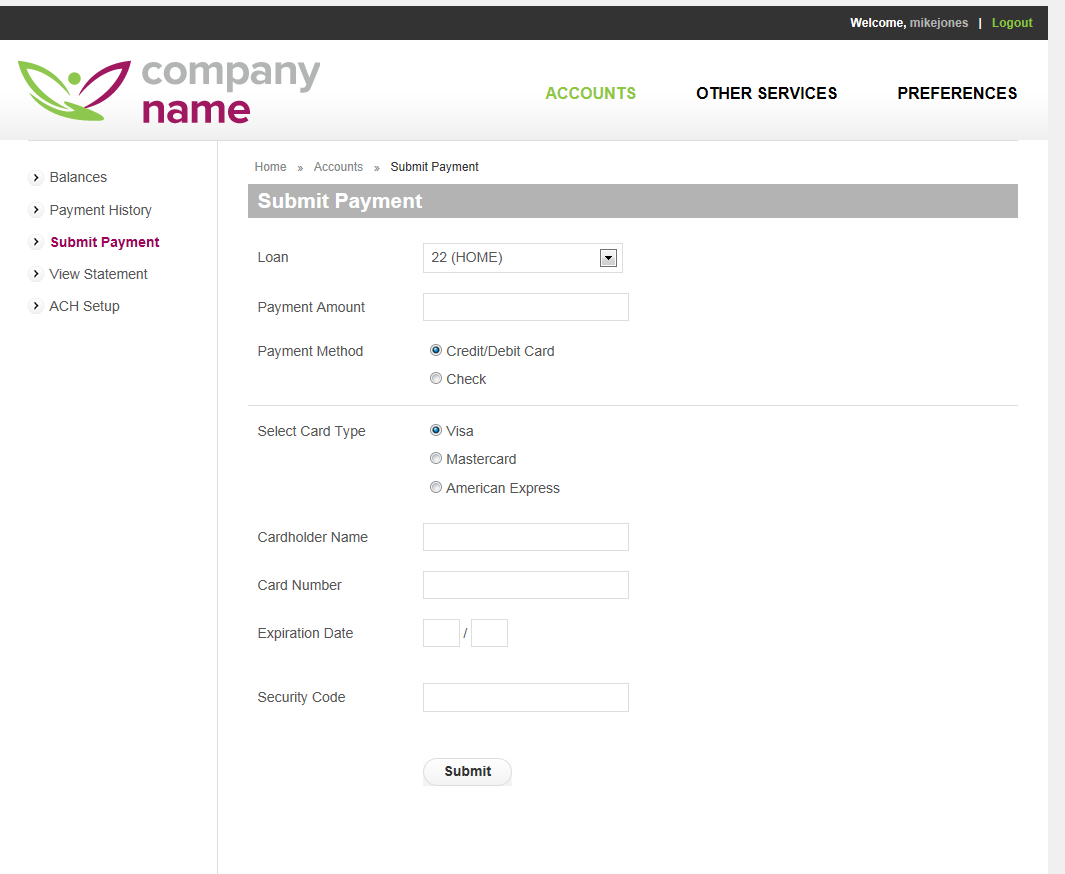

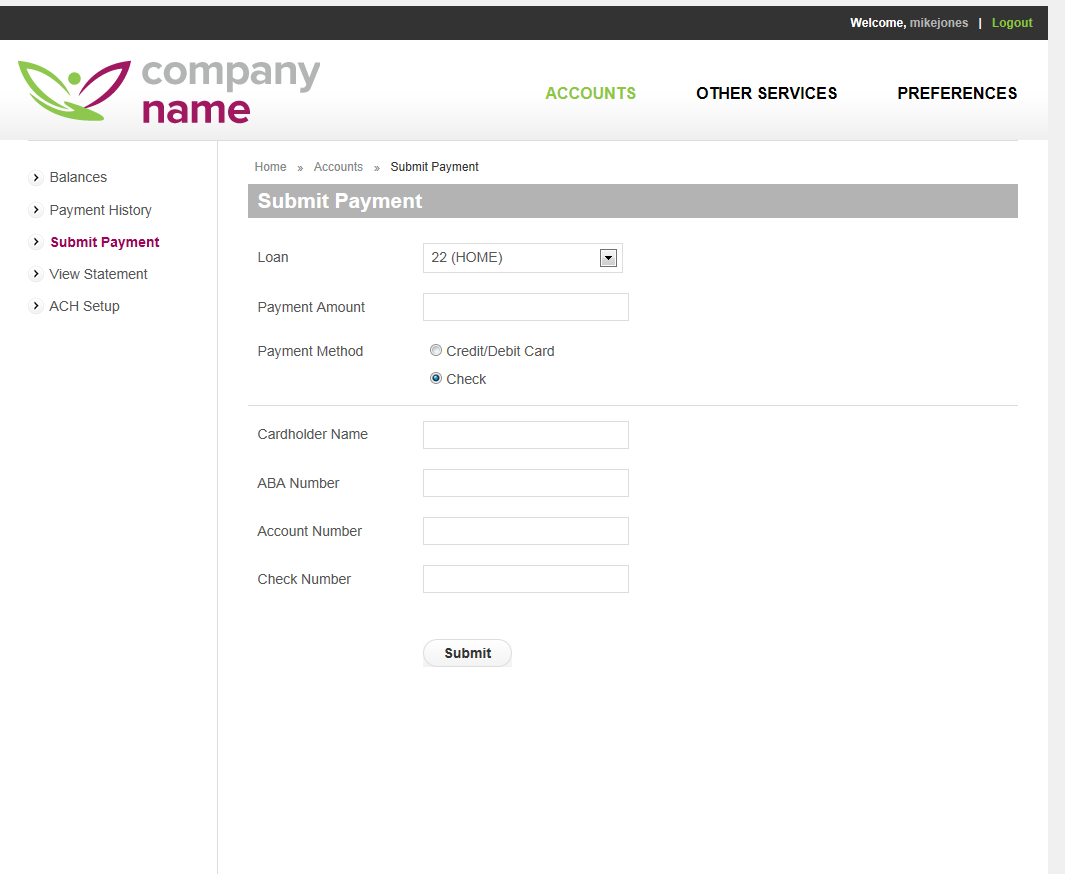

Submit Payment

The submit payment tab will allow the borrower to enter the information necessary to process a payment through an automatic payment gateway. In addition to using the Web Portals, you must have the automatic payment gateways configured.

Payments may be submitted via Credit/Debit Card or Electronic Check.

The information submitted will be passed to the automatic payment gateway and processed through that feature.

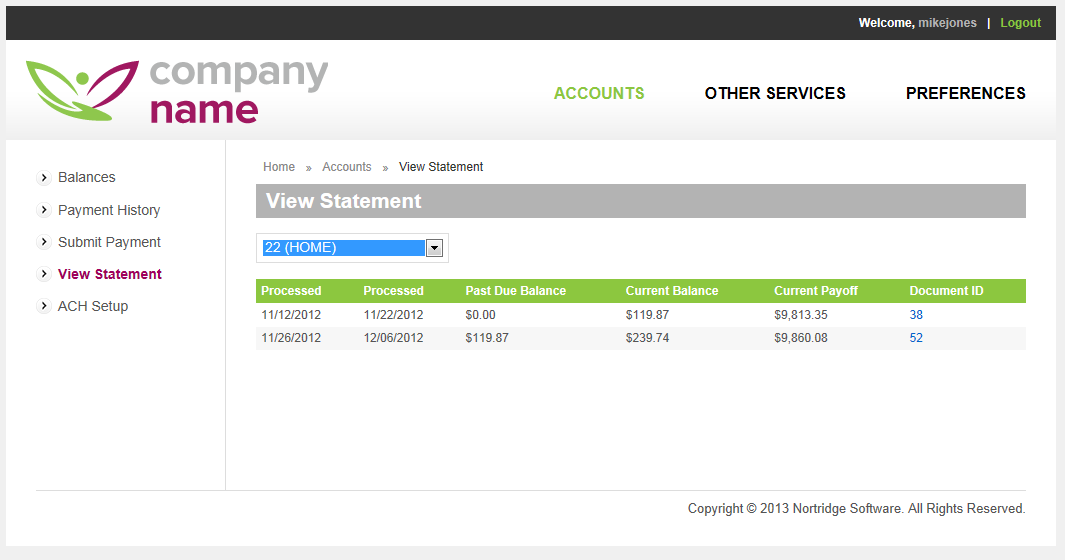

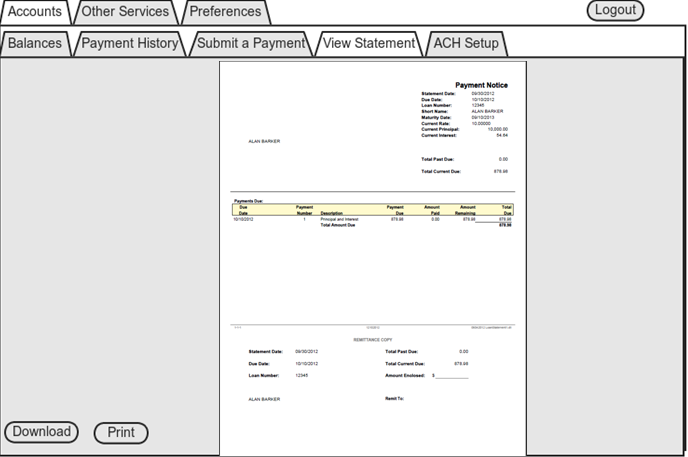

View Statement

Clicking on the View Statement tab will bring up a list of the statements stored in the comments and documents for the selected loan. If the borrower has multiple loans, a drop down list will allow selection from the available loans.

Clicking the document ID next to any specific statement will download the PDF file for that particular statement and display it for the borrower.

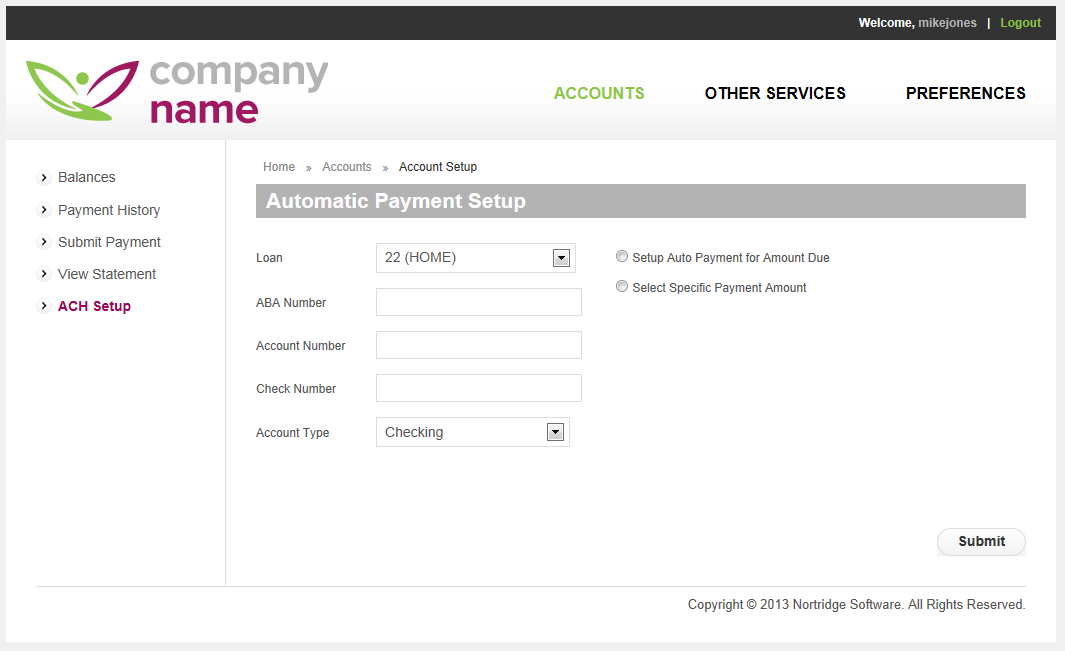

ACH Setup

If you allow the processing of payments on your loans via ACH, you can enable the ACH setup screen of the web portal and let your borrowers submit and modify their bank information to you via your website.

The borrower will enter their bank information and specify the amount to be drawn, the frequency of draws (which can be tied to the billings), and the date of the first draw that they are authorizing. When the borrower submits the information, it will automatically be imported onto the setup for the borrower’s loan.