Adding a Shadow Loan

To add a shadow loan to an existing loan, first query the loan that will be getting a shadow loan. Click  under

under  in the ribbon bar and select Add Shadow Loan.

in the ribbon bar and select Add Shadow Loan.

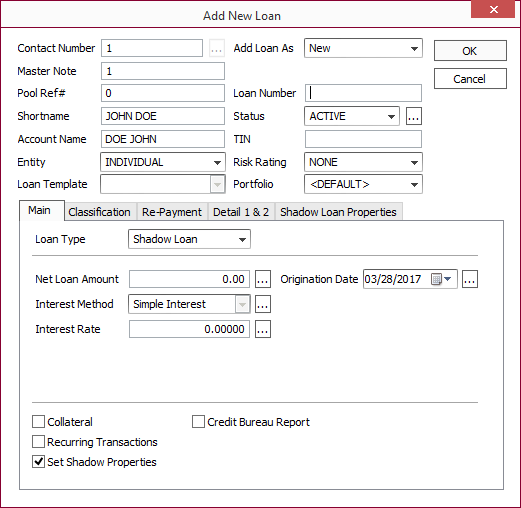

The Add Shadow Loan screen is identical to the Add New Loan screen with the following exceptions: The Statements tab is eliminated (statements are generated from the master loan); the Payment Amount, Payment Method, and Term fields are eliminated; the Custom Payment Schedule and Participation checkboxes are eliminated; and a Set Shadow Properties checkbox is added.

Enter an amount for the shadow loan (it can be different than the amount of the master loan). Enter an interest rate for the shadow loan. The shadow loan can also accrue interest at a different rate than the master loan. On the Re-Payment tab, you can set the payment distribution default order for the shadow loan to be different from the master loan.

Enter Classification items (groups, classes, etc) and user-defined loan detail items just as you would on a regular loan.

Make sure the Set Shadow Properties checkbox is selected to enable the Shadow Loan Properties tab.

Shadow Loan Properties

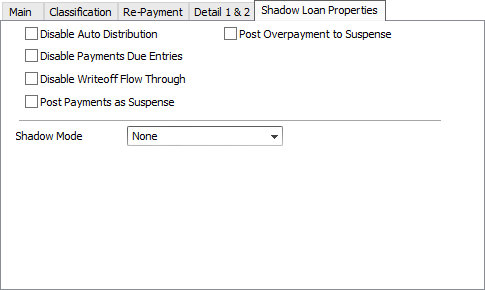

The Shadow Loan Properties tab allows you to set some parameters that control the way that the shadow loan interacts with its master loan.

| Disable Auto Distribution | If this checkbox is selected, a payment made on the master loan will not be duplicated on the shadow loan. |

| Disable Payments Due Entries | If this checkbox is selected, the billings issued on the master loan will not be replicated on the shadow loan. Payments may still be billed on the master loan, and when paid, the transactions will be duplicated on the shadow loan (although they may be duplicated with a different distribution order). |

| Disable Writeoff Flow Through | If this checkbox is selected, writeoff transactions will not be duplicated on the shadow loan. |

| Post Payments as Suspense | If this checkbox is selected, all payments that flow to the shadow loan will post into the suspense bucket. |

| Post Overpayment to Suspense | If this checkbox is selected, all payments which flow to the shadow loan for which there is not a receivable to which they can be applied, will post into the suspense bucket. |

Shadow Modes

| Basis Recovery | Basis recovery. |

| Discount Method | Discount Method, when set, will distribute to income the principal and interest portion of the customer payment multiplied by the discount percentage. The remainder will go to basis recovery. The income will be applied to the shadow loan using transaction code 290 – Earned Income Payment.

If Discount Method is the selected Shadow Mode, two option flags become available. By default, interest and principal on the customer loan will distribute as earned income and basis recovery, respectively, on the shadow loan. |

| Daily Prorated Income Method | Daily Prorated Income Method, when set, will distribute to income the portion of the discount amount based on a straight line, prorated by day from the purchase date to the payment date. Any remaining funds not applied to income are applied to basis recovery. |

LTCG After

For all shadow modes (except NONE) this option becomes available. It is the Long Term Capital Gains After Date, and when populated, it will force all capital gains before this date to use transaction code 294 – Short Term Capital Gain, and all capital gains after this date to use transaction code 296 – Long Term Capital Gain.