To enter a loan as a participation loan, begin as you normally would by querying the contact that the loan is to be entered on.

Click  under

under  in the ribbon bar and select Add New Loan.

in the ribbon bar and select Add New Loan.

Select the Participation checkbox at the bottom of the loan entry screen. This will make a new Participation tab available on the loan entry screen. If your NLS license does not contain the Participation Module, the Participation checkbox will not appear on your loan entry screen.

Enter the rest of the parameters for the loan as you normally would for that loan type. For examples of entering different types of loans, see Loan Input Examples.

Click the Participation tab. Here you will enter the various participants that will exist on the loan. When a loan is created and the Participation checkbox selected, a participant called PRIMARY is automatically created. This participant has two functions: a) to hold all of the principal balance of the loan until you have had a chance to create the other participants and assign the money to them, and b) to catch any differences between the accruals of the entire loan and the sum of the accruals of all of the participants, and thus keeping the loan account in balance.

Differences between the accruals on the loan and the sum of the accruals of the participant parts of the loan may occur simply from rounding (it is not unusual to have one cent per day flowing to the PRIMARY participant), or they may be due to the fact that you are not required to make the interest rates of the participants add up to the total interest rate of the loan.

Example

ABC Lending Company books a loan to a customer at an interest rate of 10%. They sell off participations in the loan for the full amount of the loan at 8%. ABC Lending Company now owns none of the principal on the loan, but they are getting a 2% interest rate for administering the loan. They set up the loan at 10%, with a participant set up at 8% owning the entire principal amount of the loan. Then they make sure that the loan group of this participant is set up so that the interest accrued for the participant goes to the participant’s accrued interest and income accounts, while the loan group for the PRIMARY participant on the loan will credit ABC Lending Company’s own income accounts. Every day when this loan accrues interest, it will accrue at a rate of 10% on the full loan balance. The participant’s account will accrue at 8% on the full loan balance. The difference will automatically flow to the PRIMARY participant, and because the Loan Group for the PRIMARY participant is set to credit ABC Lending Company’s own income account, they will realize their 2% interest in the loan, even though they own none of the principal.To add participants to the loan, click Add  on the Participation tab.

on the Participation tab.

Enter a Participant Number, Name, select a Loan Group for the participant, and enter the principal amount and interest rate for that participant. If you are not using unique loan groups for each participant, link the participant to a vendor account. Click OK. The participant will be set up as a sub-loan for the amount designated, and that amount will be deducted from the PRIMARY participant so that the total sum of the principal for all participants equals the principal of the loan.

To add subsequent participants, click Add  again and repeat the process. You can continue adding participants, as long as there are funds remaining—that have yet to be assigned—in the PRIMARY participant .

again and repeat the process. You can continue adding participants, as long as there are funds remaining—that have yet to be assigned—in the PRIMARY participant .

Note

Preferably, the PRIMARY participant should have a zero balance after all other participants have been added. All pieces of the loan—including the portion retained by the servicer or lender—need to be added as additional pieces. This allows for any overages to be stored separately in the PRIMARY participant.Example

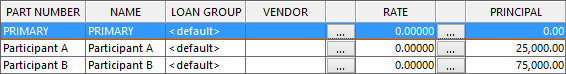

For a loan of $100,000.00, the preferred method is:0.00 PRIMARY

25,000.00 retained as Participant A (the servicer)

75,000.00 participated to Participant B

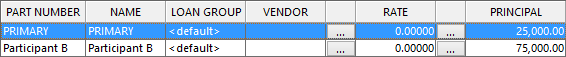

Alternatively, if overages do not need to be kept separate, the money owned by the servicer may be left in the Primary participant. However, this may lead to problems if compounding is required in the future.

Example

For a loan of $100,000.00:25,000.00 retained as PRIMARY (the servicer)

75,000.00 participated to Participant B

The vendor field in the configuration of the participant allows you to link the participation to the vendor account on a contact that represents the source of funds. This is useful for handling settlement of the funds, either by check or ACH. The presence of this disbursement account will cause the generation of a voucher to the participant when a payment is received. If the participant’s Loan Group has a disbursement account specified in its Servicing Options, then it is not necessary to link a disbursement account here.

Participant Interest

On a participation loan, an interest rate is specified for the loan as a whole, but different interest rates may be defined for each participant. This can result in a difference between the interest accrued on the loan account, and the sum of the interest accrued on the various participant sub-loans. This difference is always automatically assigned to the PRIMARY participant’s sub-loan.

Example

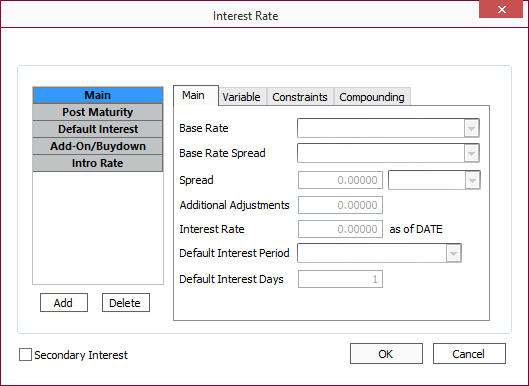

Assume a loan with a principal balance of $100,000 participated evenly between the lending company and a participating bank. The note rate is 10%, but the participating bank is lending the money at 9%. Since the loan is participated evenly, the lending company can charge 11% on the funds it is lending, and the borrower will end up paying a net of 10% interest on the entire loan. Any discrepancies between the note rate (10%) and the sum of the participant rates (½ of 9% + ½ of 11%) would be no more than small rounding errors.The interest setup on a participant may be modified by querying the loan and then selecting the participant on the query tree. Once the participant is selected, select Loan >  Interest Setup. This will bring up a setup screen similar to the one that exists in the standard loan setup, but this applies to only the sub-loan of the single selected participant.

Interest Setup. This will bring up a setup screen similar to the one that exists in the standard loan setup, but this applies to only the sub-loan of the single selected participant.

Adding Participant to Existing Loans

Participants can be added to an existing loan by first querying the loan to which to add a participant.

Click  under

under  in the ribbon bar and select Add Participant then click Add

in the ribbon bar and select Add Participant then click Add  to add a new participant.

to add a new participant.