Account Reconciliation

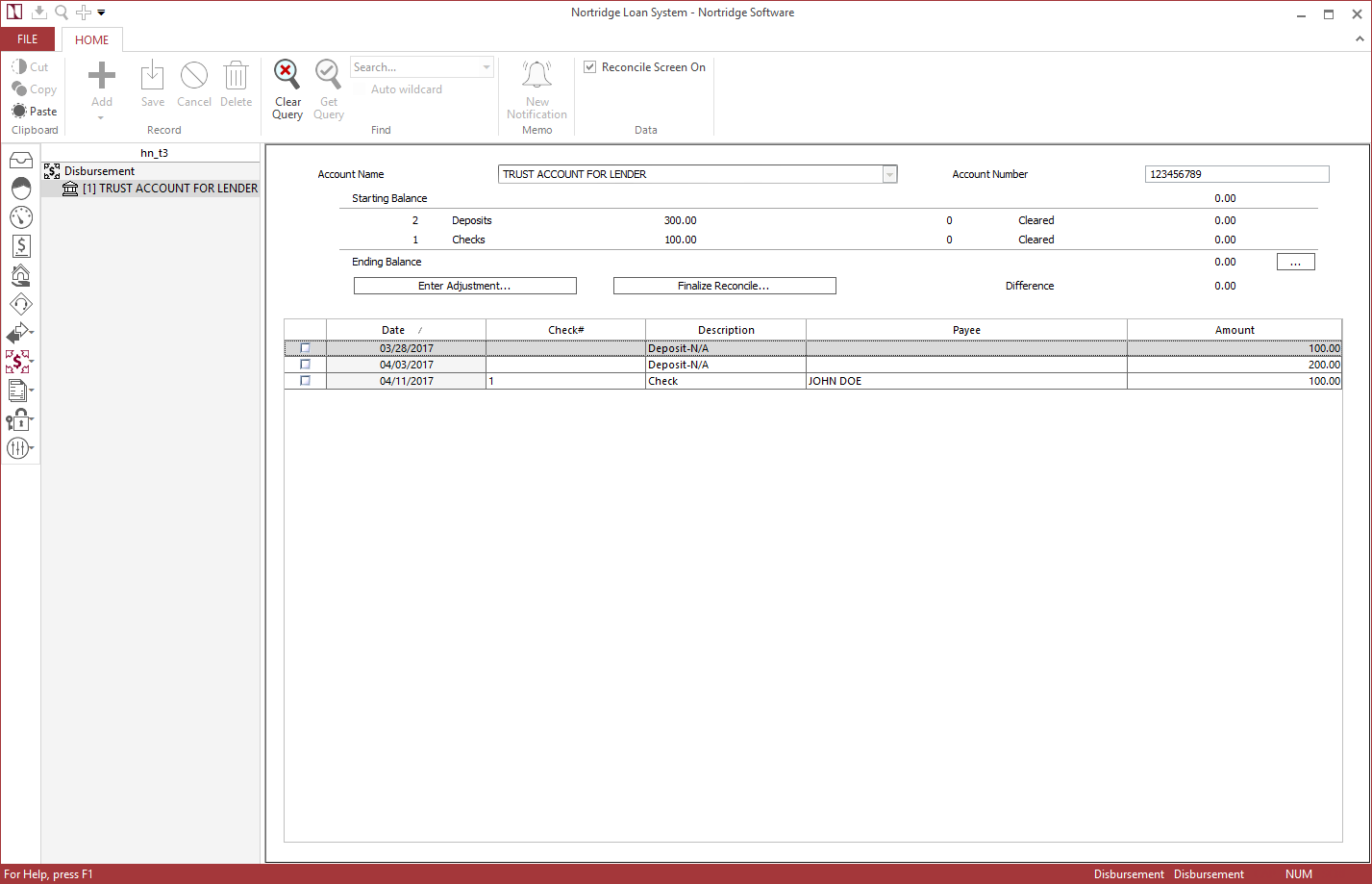

Account Reconciliation is used to balance the checking accounts that are represented by disbursement accounts within NLS.

To reconcile an account select Disbursement  from the Disbursement

from the Disbursement  shortcut and query the disbursement account. Select Reconcile Screen On on the ribbon bar.

shortcut and query the disbursement account. Select Reconcile Screen On on the ribbon bar.

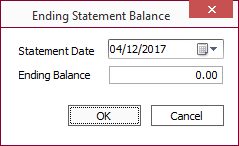

Begin by entering the ending balance shown on your bank statement. Click  next to Ending Balance.

next to Ending Balance.

Enter the statement date and the ending balance then click OK.

Next, go down the list of outstanding checks and check off any that appear as paid on the bank statement.

Once this is done, you will be ready to enter adjustments.

Enter Adjustments

All items on the bank statement, other than vouchers and checks that are represented in NLS must be entered as Adjustments. Additionally, the first time the Disbursement features of NLS are used to reconcile, an adjustment should be entered to establish the starting balance (unless the bank account did not exist prior to the use of NLS, in which case the starting balance would be $0.00). In all subsequent months, the starting balance will automatically be set to the ending balance of the previous month.

Enter the date, type, and amount of the adjustment along with any reference text that you desire. The available adjustment types are:

- Deposit - N/A

- Deposit - Check

- Deposit - Wire

- Deposit - Cashier’s Check

- Deposit - Cash

- Bank Fee

- Misc Adjustment

- Interest Earned

Once you have entered all of the adjustments that appear on the bank statement, you are ready to Finalize the Reconciliation.

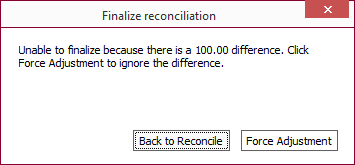

Finalize Reconciliation

Once the account is balanced, click Finalize Reconcile… to complete the process. If the account had been balanced when this button is clicked the Reconciliation will be finalized and recorded. If the account is out of balance, you will receive a warning.

Click Back to Reconcile to continue entering adjustments, or click Force Adjustment to make a correcting entry in the bank account to force balancing.